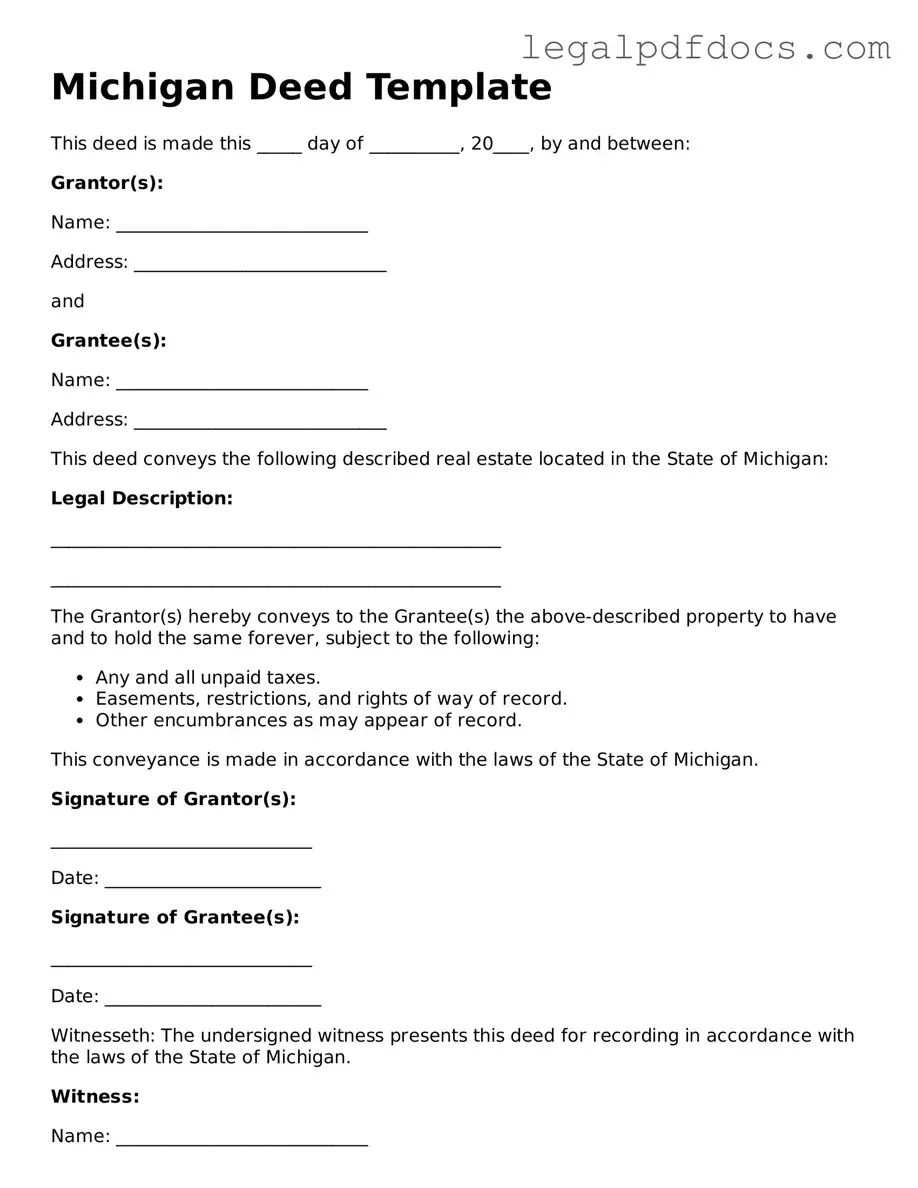

Official Deed Form for Michigan

When it comes to transferring property ownership in Michigan, understanding the Michigan Deed form is essential. This legal document serves as a formal record of the transfer of real estate from one party to another, ensuring that the transaction is recognized by the state. The form includes vital information such as the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), as well as a detailed description of the property itself. Additionally, the deed must be signed and notarized to be valid, providing an extra layer of security for both parties involved. Different types of deeds, such as warranty deeds and quitclaim deeds, cater to various needs and circumstances, making it important for property owners to choose the right one for their situation. Understanding these aspects can help ensure a smooth and legally sound property transfer process, allowing individuals to navigate the complexities of real estate transactions with confidence.

Dos and Don'ts

When filling out the Michigan Deed form, it is essential to approach the task with care. A well-completed deed ensures that property transfers are valid and recognized by law. Here are some important dos and don'ts to consider:

- Do verify the legal description of the property. Ensure that it accurately reflects the property boundaries.

- Do include the names of all parties involved. This includes both the grantor (seller) and the grantee (buyer).

- Do sign the deed in the presence of a notary public. This step is crucial for the deed's validity.

- Do ensure that the deed is dated. The date of signing is important for legal purposes.

- Don't leave any blank spaces on the form. All sections must be completed to avoid confusion.

- Don't forget to check for errors before submission. Mistakes can lead to delays or complications.

- Don't neglect to record the deed with the county register of deeds. This step is necessary to make the transfer official.

How to Use Michigan Deed

After obtaining the Michigan Deed form, you will need to provide specific information to complete it. This form requires details about the property, the parties involved, and the nature of the transaction. Once filled out, the form will need to be signed and may require notarization before it is filed with the appropriate county office.

- Begin by entering the name of the grantor, the person transferring the property. Make sure to include their full legal name.

- Next, fill in the name of the grantee, the person receiving the property. Again, use the full legal name.

- Provide the address of the property being transferred. Include the street address, city, state, and zip code.

- Describe the property in detail. Include any relevant parcel numbers or legal descriptions that identify the property.

- Indicate the type of deed being used. This could be a warranty deed, quitclaim deed, or another type.

- Fill in the date of the transaction. This is typically the date when the deed is signed.

- Sign the form where indicated. The grantor must sign the deed to validate the transfer.

- If required, have the deed notarized. A notary public will verify the identities of the signers and witness the signing.

- Finally, submit the completed deed to the appropriate county office for recording. Check with your local office for any specific filing requirements or fees.

Find Popular Deed Forms for US States

How Does House Title Look Like - Used to convey real estate from one party to another.

How to Transfer a Deed in Kansas - Title insurance is often associated with deeds, protecting against issues related to the title of the property.

Warranty Deed Form Idaho - Property deeds are commonly required in real estate closings.

Documents used along the form

When transferring property in Michigan, several documents may accompany the Michigan Deed form to ensure a smooth and legally sound transaction. Each of these documents serves a specific purpose and helps clarify the details surrounding the property transfer. Below are some commonly used forms and documents.

- Property Transfer Affidavit: This document provides information about the property being transferred, including its value and any exemptions that may apply. It is typically required by the local assessor's office to update property records.

- Seller's Disclosure Statement: This form informs potential buyers about the condition of the property. It outlines any known issues or defects, helping to protect both the seller and the buyer by ensuring transparency.

- Title Insurance Policy: This document protects the buyer from potential disputes over property ownership. It ensures that the title is clear and free from liens or other encumbrances, providing peace of mind for the new owner.

- Closing Statement: Also known as a HUD-1 statement, this document details all the financial aspects of the transaction. It includes costs such as closing fees, taxes, and any adjustments, allowing both parties to understand their financial obligations.

These forms and documents work together to facilitate a clear and organized property transfer process. Having them prepared and completed can help avoid potential legal complications and provide reassurance to all parties involved.

Misconceptions

Understanding the Michigan Deed form is essential for property transactions. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

-

All deeds are the same.

Not all deeds serve the same purpose. Michigan recognizes various types of deeds, such as warranty deeds and quitclaim deeds, each with different legal implications.

-

A deed must be notarized to be valid.

While notarization is common and recommended, a deed can still be valid without it, provided it meets other legal requirements.

-

Once a deed is signed, it cannot be changed.

Deeds can be amended or revoked, but the process requires specific legal steps to ensure validity.

-

Only a lawyer can prepare a deed.

While hiring a lawyer is advisable for complex transactions, individuals can prepare their own deeds, provided they follow the legal guidelines.

-

Deeds do not need to be recorded.

Recording a deed is crucial for establishing public notice of ownership. Failure to record can lead to disputes over property rights.

-

All deeds transfer ownership equally.

Different deeds convey different levels of ownership rights. A warranty deed offers more protection than a quitclaim deed.

-

Only the seller needs to sign the deed.

In many cases, both the seller and the buyer must sign the deed to ensure a valid transfer of ownership.

-

A deed is the same as a title.

A deed is a legal document that transfers ownership, while a title represents legal ownership of the property. They are not interchangeable.

-

Once a deed is recorded, it cannot be contested.

Recording a deed does not prevent challenges. Parties may contest the validity of a deed in court under certain circumstances.

By understanding these misconceptions, individuals can navigate property transactions in Michigan more effectively.

PDF Specifications

| Fact Name | Details |

|---|---|

| Type of Deed | In Michigan, the most common types of deeds are warranty deeds and quitclaim deeds. |

| Governing Laws | The Michigan Deed form is governed by the Michigan Compiled Laws, specifically MCL 565.201. |

| Signature Requirement | The deed must be signed by the grantor in front of a notary public. |

| Recording | To be effective against third parties, the deed should be recorded with the county clerk's office. |

| Consideration | While a deed may be executed without consideration, it is advisable to include a nominal amount. |

| Legal Description | The property must be described accurately in the deed, using a legal description. |

Key takeaways

When filling out and using the Michigan Deed form, several important considerations can help ensure the process is smooth and legally sound. Here are key takeaways to keep in mind:

- Accurate Information: Ensure that all names, addresses, and legal descriptions of the property are filled out correctly. Any inaccuracies can lead to complications in the transfer of ownership.

- Signature Requirements: The deed must be signed by the grantor, the person transferring the property. In Michigan, signatures need to be notarized to be valid.

- Consideration Amount: The deed should state the consideration, or the amount paid for the property. This amount can affect tax implications and should be accurately reported.

- Recording the Deed: After completing the deed, it should be recorded with the local county clerk’s office. This step is essential for protecting the new owner’s rights against future claims.

- Legal Advice: Consulting with a legal professional can provide clarity on the process and ensure compliance with local laws and regulations.