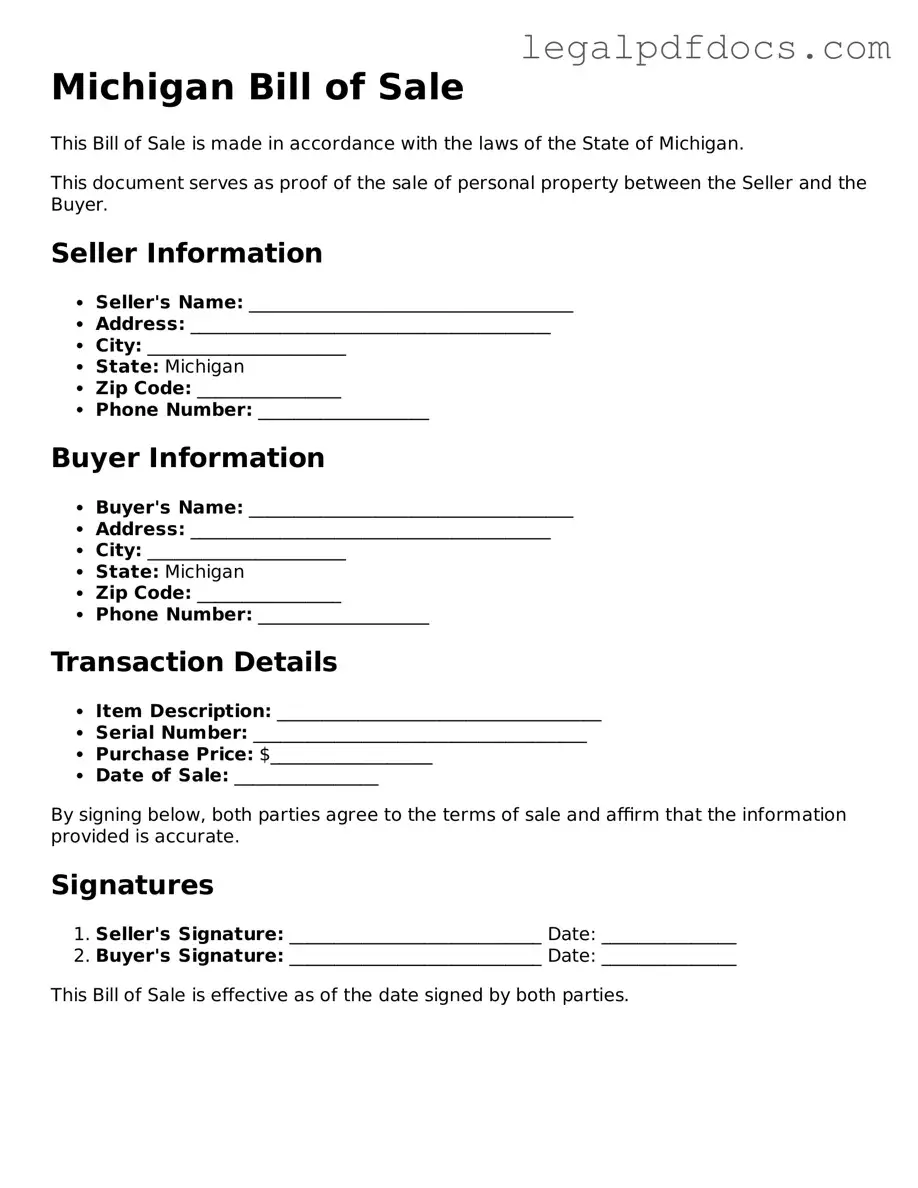

Official Bill of Sale Form for Michigan

The Michigan Bill of Sale form serves as a crucial document in the transfer of ownership for various types of personal property, including vehicles, boats, and other tangible items. This form provides essential information, such as the names and addresses of both the seller and the buyer, a detailed description of the item being sold, and the sale price. By documenting the transaction, the Bill of Sale protects both parties by establishing clear evidence of the sale, which can be vital in resolving any disputes that may arise in the future. Additionally, the form may include information regarding warranties or guarantees, if applicable, further clarifying the terms of the sale. Understanding the importance of this document can help individuals navigate the complexities of property transactions in Michigan, ensuring a smooth and legally sound transfer of ownership.

Dos and Don'ts

When filling out the Michigan Bill of Sale form, it is essential to be thorough and accurate. Here are some important dos and don'ts to keep in mind:

- Do provide clear and accurate information about the item being sold, including make, model, year, and VIN for vehicles.

- Do include the full names and addresses of both the buyer and the seller to avoid any future disputes.

- Don't leave any sections blank; incomplete forms can lead to complications during the transfer of ownership.

- Don't forget to sign and date the form; without signatures, the Bill of Sale is not valid.

How to Use Michigan Bill of Sale

Once you have gathered the necessary information, you can begin filling out the Michigan Bill of Sale form. This document will serve as a record of the transaction between the buyer and seller. Follow these steps carefully to ensure that all required information is accurately provided.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Make sure to include the street address, city, state, and zip code.

- Next, fill in the buyer's full name and address, ensuring that all details are complete and correct.

- In the designated section, describe the item being sold. Include important details such as the make, model, year, and Vehicle Identification Number (VIN) if applicable.

- Indicate the sale price clearly. Write the amount in both numeric and written form to avoid any confusion.

- Both the seller and buyer should sign and date the form at the bottom. This signature confirms that both parties agree to the terms of the sale.

- If applicable, include any additional terms or conditions regarding the sale in the space provided.

After completing the form, keep a copy for your records. It is advisable for both parties to retain a signed copy to reference in the future, should any questions arise regarding the sale.

Find Popular Bill of Sale Forms for US States

Handwritten Bill of Sale - A Bill of Sale helps establish the date of transfer and purchase price.

State of Georgia Bill of Sale - A Bill of Sale can establish the timeline of ownership transfer for legal purposes.

Dmv Bill of Sale California - Having this document can simplify the transfer process at the Department of Motor Vehicles.

Vehicle Bill of Sale Free Pdf - A Bill of Sale can be crucial for registering vehicles with the Department of Motor Vehicles.

Documents used along the form

When buying or selling a vehicle or personal property in Michigan, the Bill of Sale is an essential document. However, there are several other forms and documents that can complement the Bill of Sale, ensuring a smooth transaction. Here’s a list of common documents that are often used alongside the Michigan Bill of Sale.

- Title Transfer Form: This form is crucial for transferring ownership of a vehicle. It includes information about the buyer, seller, and the vehicle itself, ensuring that the new owner is officially recognized.

- Vehicle Registration Application: After purchasing a vehicle, the new owner must register it with the state. This application provides the necessary details to update the vehicle’s registration in the buyer's name.

- Odometer Disclosure Statement: This document is required for most vehicle sales and confirms the vehicle's mileage at the time of sale. It helps prevent fraud by ensuring accurate reporting of mileage.

- Affidavit of Ownership: If the seller does not have the title or if the vehicle is a gift, this affidavit can help establish ownership and provide a legal basis for the sale.

- Purchase Agreement: This document outlines the terms of the sale, including price, payment method, and any warranties or conditions. It serves as a written record of the agreement between buyer and seller.

- Sales Tax Form: In Michigan, buyers must pay sales tax on vehicle purchases. This form helps calculate the tax owed and ensures compliance with state regulations.

- Insurance Verification: Before registering a vehicle, buyers must provide proof of insurance. This document verifies that the vehicle is insured, meeting Michigan's legal requirements.

Having these documents in hand can streamline the process of buying or selling property in Michigan. Each form plays a unique role in ensuring that the transaction is legal, transparent, and efficient. Being prepared with the right paperwork can make all the difference in your experience.

Misconceptions

The Michigan Bill of Sale form is an important document for transferring ownership of personal property. However, there are several misconceptions surrounding its use and requirements. Below are five common misconceptions, along with clarifications to help individuals understand the true nature of this form.

-

Misconception 1: A Bill of Sale is only necessary for vehicle transactions.

This is not true. While many people associate Bills of Sale with vehicles, they are also applicable for other personal property transactions, such as boats, trailers, and even valuable items like jewelry or artwork.

-

Misconception 2: A Bill of Sale does not need to be notarized.

In Michigan, notarization is not a requirement for all Bills of Sale. However, having the document notarized can provide an extra layer of authenticity and may be beneficial in certain situations, especially for high-value items.

-

Misconception 3: The Bill of Sale serves as proof of ownership.

While a Bill of Sale is a record of the transaction, it does not automatically serve as proof of ownership. Ownership is typically established through the title or registration documents, particularly for vehicles.

-

Misconception 4: The seller is responsible for all liabilities after the sale.

This misconception can lead to confusion. Generally, once the sale is complete and the Bill of Sale is signed, the seller is no longer responsible for the item. However, it is wise for buyers to conduct thorough inspections before completing the transaction.

-

Misconception 5: A Bill of Sale is only needed for sales between strangers.

Even transactions between friends or family members benefit from a Bill of Sale. This document can help prevent misunderstandings and provide a clear record of the agreement.

Understanding these misconceptions can help individuals navigate the process of buying and selling personal property in Michigan more effectively. Always consider seeking guidance when in doubt about legal documents and their implications.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Bill of Sale form is used to document the sale of personal property between a buyer and a seller. |

| Governing Law | This form is governed by Michigan law, specifically the Michigan Compiled Laws (MCL) 440.2101 et seq. |

| Property Types | The form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required, it is recommended to add an extra layer of authenticity. |

| Seller Information | The form must include the seller's full name and address to ensure proper identification. |

| Buyer Information | It is essential to provide the buyer's full name and address for record-keeping purposes. |

| Sale Price | The sale price of the property must be clearly stated in the form. |

| Condition of Property | The seller should disclose the condition of the property to avoid future disputes. |

| Signature Requirement | Both the buyer and seller must sign the form to validate the transaction. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed Bill of Sale for their records. |

Key takeaways

When filling out and using the Michigan Bill of Sale form, there are several important points to keep in mind. This document serves as a record of the transaction between a buyer and a seller, ensuring clarity and protection for both parties involved.

- Accurate Information: Always provide accurate details about the buyer, seller, and the item being sold. This includes names, addresses, and a thorough description of the item.

- Consider the Item's Condition: Clearly state the condition of the item. Whether it’s new, used, or sold "as-is," this information can prevent future disputes.

- Include Sale Price: Document the sale price prominently. This figure is crucial for both parties and can be important for tax purposes.

- Signatures Matter: Ensure that both the buyer and seller sign the document. Without signatures, the Bill of Sale may not hold up as a legal record.

- Keep Copies: After completing the form, both parties should retain copies. This provides proof of the transaction and can be useful for future reference.

- Understand Local Regulations: Familiarize yourself with any local laws or regulations regarding vehicle sales or other transactions that may require additional documentation.

By paying attention to these key elements, individuals can navigate the process of using the Michigan Bill of Sale form more effectively, ensuring a smooth transaction experience.