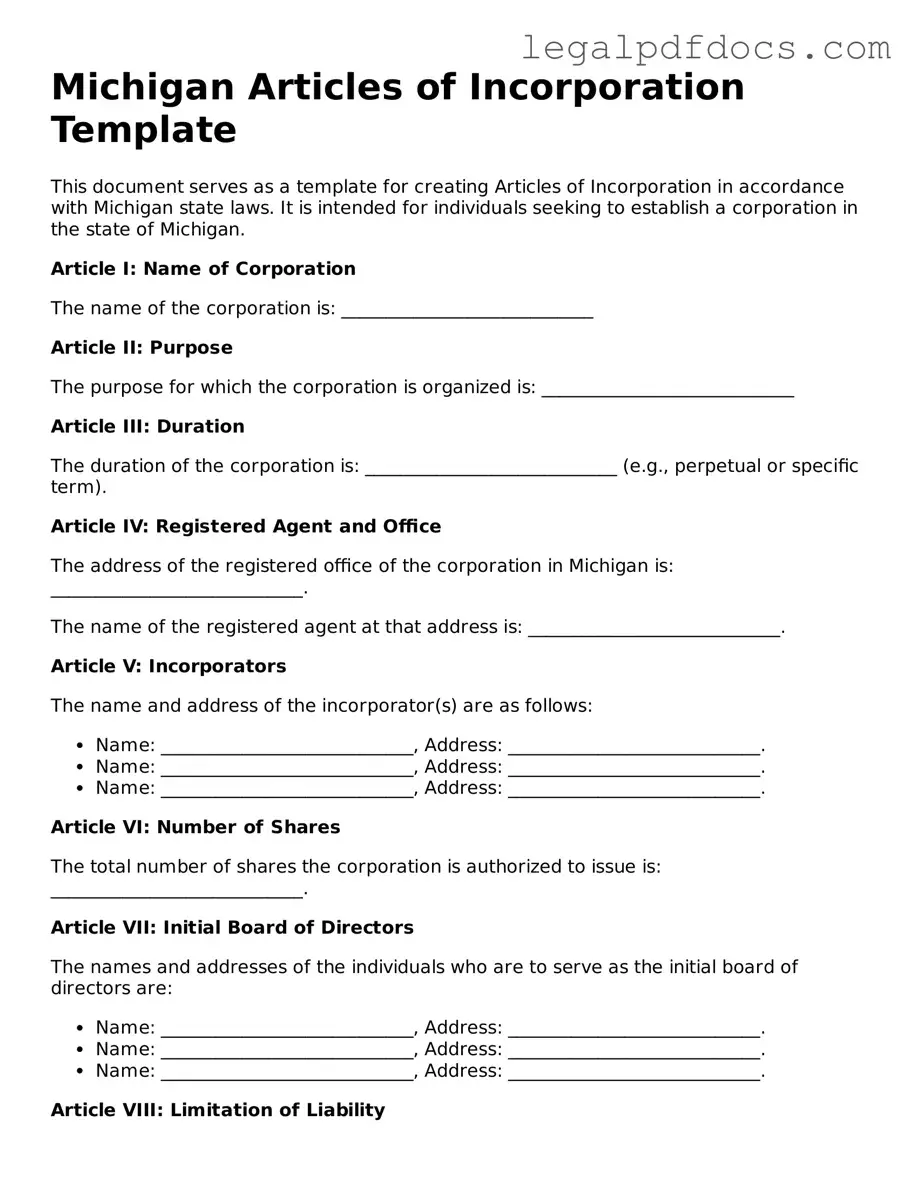

Official Articles of Incorporation Form for Michigan

When starting a business in Michigan, one of the first crucial steps is filing the Articles of Incorporation. This essential document serves as the foundation for your corporation, outlining key details that define its existence and structure. The form requires you to provide important information such as the corporation's name, which must be unique and comply with state naming regulations. Additionally, you will need to specify the purpose of your corporation, whether it's for profit or nonprofit activities. The Articles also call for the inclusion of the registered agent's name and address, ensuring there is a reliable point of contact for legal correspondence. Furthermore, you must outline the number of shares the corporation is authorized to issue, which is vital for understanding ownership distribution. Other aspects include the duration of the corporation, which can be perpetual or for a specified term, and the names and addresses of the incorporators. By carefully completing this form, you take a significant step toward establishing a legal entity that can operate within Michigan’s business landscape.

Dos and Don'ts

When filling out the Michigan Articles of Incorporation form, it’s important to follow certain guidelines to ensure a smooth process. Here are six things you should and shouldn't do:

- Do provide accurate information.

- Don't leave any required fields blank.

- Do double-check for spelling and numerical errors.

- Don't use abbreviations unless specified.

- Do include the correct filing fee with your submission.

- Don't forget to sign the document before sending it in.

By following these tips, you can help ensure that your Articles of Incorporation are processed efficiently and correctly. Taking the time to review your submission can save you from delays and additional paperwork.

How to Use Michigan Articles of Incorporation

After completing the Michigan Articles of Incorporation form, you will need to submit it to the Michigan Department of Licensing and Regulatory Affairs (LARA). This is a crucial step in officially establishing your corporation. Ensure that you have all required information and documents ready for submission.

- Begin by downloading the Michigan Articles of Incorporation form from the LARA website or obtain a physical copy.

- Fill in the name of your corporation. Ensure that the name complies with Michigan naming requirements and is unique.

- Provide the purpose of your corporation. Be clear and concise about what your business will do.

- List the duration of your corporation. Most corporations are set up to exist indefinitely unless specified otherwise.

- Enter the address of your corporation's registered office. This must be a physical address in Michigan.

- Identify the registered agent. This can be an individual or business entity authorized to receive legal documents on behalf of the corporation.

- Include the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. Ensure that all incorporators sign where required.

- Prepare the filing fee. Check the current fee amount on the LARA website to ensure you include the correct payment.

- Submit the completed form along with the filing fee to LARA. You can do this online or via mail, depending on your preference.

Find Popular Articles of Incorporation Forms for US States

How Much Does a Llc Cost in Texas - It identifies the incorporators, who are the individuals establishing the corporation.

Idaho Llc Registration - Incorporation may enhance credibility with customers and suppliers.

Georgia Secretary of State Forms - Corporate bylaws may also be referenced in the articles.

Documents used along the form

When forming a corporation in Michigan, several additional documents may be required or beneficial to complete the incorporation process. These documents help establish the structure, governance, and compliance of the corporation. Below is a list of common forms and documents often used alongside the Michigan Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It includes details about the board of directors, meetings, and voting procedures.

- Initial Board of Directors Resolution: This document records the decisions made by the initial board of directors, including the appointment of officers and approval of bylaws.

- Employer Identification Number (EIN) Application: This form is submitted to the IRS to obtain a unique identification number for tax purposes. It is essential for opening a bank account and hiring employees.

- Business License Application: Depending on the type of business and location, this application may be required to operate legally within the municipality.

- Certificate of Good Standing: This document verifies that the corporation is compliant with state regulations and has fulfilled all necessary requirements, often needed for certain business transactions.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders, including how shares can be transferred and how disputes will be resolved.

- Registered Agent Appointment Form: This form designates a registered agent to receive legal documents on behalf of the corporation, ensuring compliance with state law.

- Annual Report: Corporations in Michigan are required to file this report annually to update the state on business activities and maintain good standing.

- Operating Agreement (for LLCs): If the corporation is an LLC, this document outlines the management structure and operational procedures.

These documents play a crucial role in establishing a corporation's framework and ensuring compliance with legal requirements. Properly preparing and filing these forms can help avoid potential issues and facilitate smooth business operations.

Misconceptions

When it comes to the Michigan Articles of Incorporation form, several misconceptions often arise. Understanding these can help ensure a smoother incorporation process. Here are seven common misconceptions:

-

Filing the Articles is the only step to forming a corporation.

Many believe that submitting the Articles of Incorporation is all that is needed. In reality, additional steps, such as obtaining necessary licenses and permits, are often required.

-

Anyone can file the Articles of Incorporation.

While it is true that anyone can fill out the form, it is essential to have a clear understanding of the corporation's structure and purpose. Misunderstandings can lead to errors that may delay the process.

-

Once filed, the Articles cannot be changed.

This is not true. Amendments can be made to the Articles of Incorporation after they are filed, although the process may require additional paperwork and fees.

-

All corporations must have a board of directors.

While most corporations do have a board, certain types of corporations, such as single-member LLCs, may not require one. Understanding the specific requirements for your business type is crucial.

-

The Articles of Incorporation guarantee business success.

Filing the Articles is merely a legal step. It does not ensure that the business will be successful. Success depends on various factors, including market demand and effective management.

-

Filing fees are the only costs involved.

Incorporation involves more than just filing fees. There may be costs for legal advice, obtaining licenses, and ongoing compliance requirements that need to be factored in.

-

Once incorporated, the business is free from personal liability.

Incorporation does provide some protection from personal liability, but it is not absolute. Personal guarantees and certain actions can still expose owners to liability.

By debunking these misconceptions, individuals can approach the incorporation process with greater clarity and confidence.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Articles of Incorporation form is used to officially establish a corporation in the state of Michigan. |

| Governing Law | This form is governed by the Michigan Business Corporation Act, specifically MCL 450.1201 et seq. |

| Filing Requirements | To file the Articles of Incorporation, one must provide specific information, including the corporation's name, purpose, and registered agent. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies depending on the type of corporation being formed. |

| Processing Time | The processing time for the Articles of Incorporation can vary, but it typically takes several business days to complete. |

Key takeaways

Filling out the Michigan Articles of Incorporation form is a critical step in establishing a corporation in the state. Here are some key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation, outlining its basic structure and purpose.

- Choose an Appropriate Name: Ensure that the name of your corporation is unique and complies with Michigan’s naming requirements. It must include a corporate designator such as "Corporation," "Incorporated," or an abbreviation.

- Designate a Registered Agent: Appoint a registered agent who will be responsible for receiving legal documents on behalf of the corporation. This agent must have a physical address in Michigan.

- Specify the Business Purpose: Clearly articulate the purpose of your corporation. This can be a general statement or a specific description of the business activities.

- Include Share Information: Provide details about the shares your corporation will issue, including the total number of shares and their par value, if applicable.

- File with the State: After completing the form, submit it to the Michigan Department of Licensing and Regulatory Affairs along with the required filing fee. Ensure that you keep a copy for your records.

By following these guidelines, you can navigate the process of incorporating in Michigan with greater confidence and clarity.