Fill Out a Valid Louisiana act of donation Template

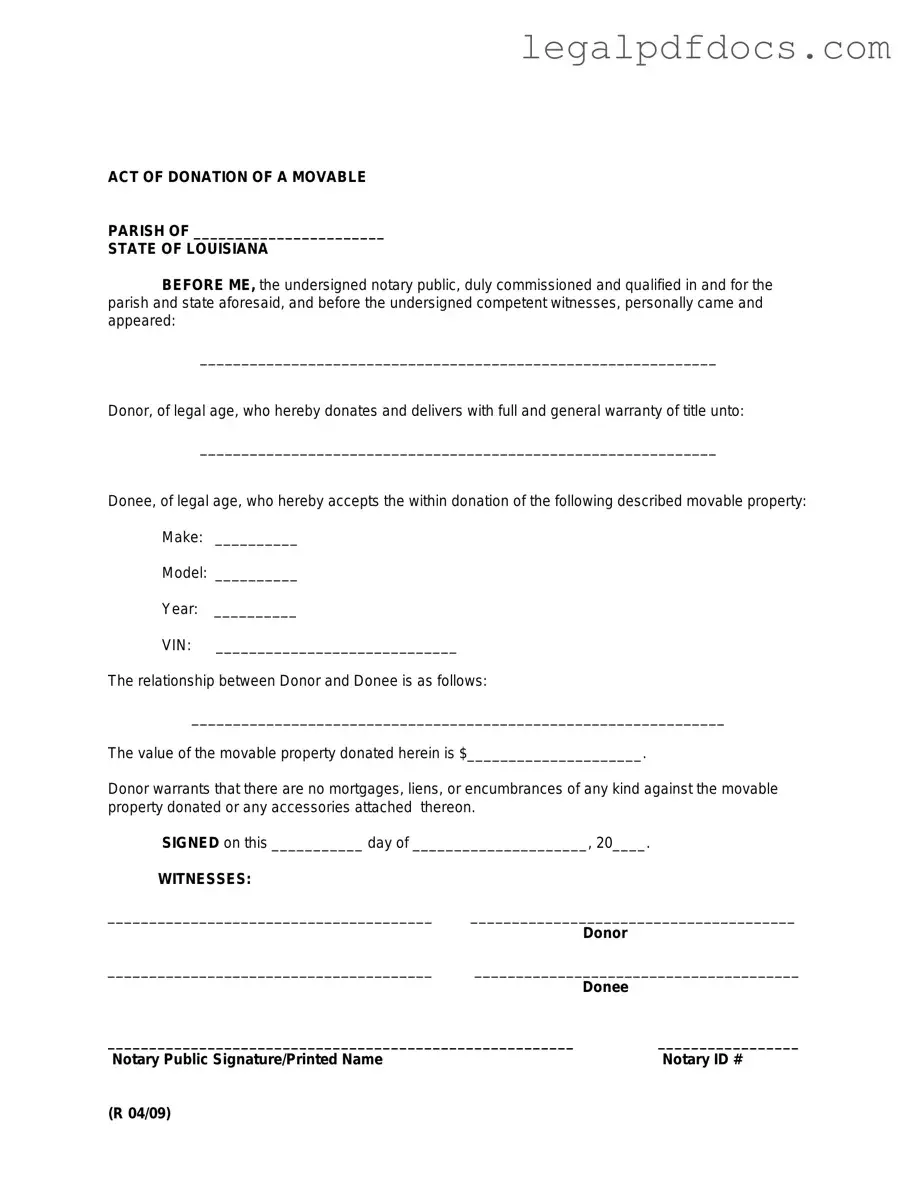

The Louisiana Act of Donation form serves as a crucial legal instrument for individuals wishing to transfer ownership of property without the exchange of money. This form is particularly significant in the state of Louisiana, where civil law principles govern property transfers. It outlines the specific details of the donation, including the identity of the donor and the recipient, as well as a precise description of the property being donated. Essential elements such as the donor's intent, the acceptance of the donation by the recipient, and any conditions or restrictions associated with the transfer are clearly articulated within the document. Additionally, the form may require notarization or witnesses to validate the transaction, ensuring that the donor's wishes are legally recognized and enforceable. Understanding the nuances of this form is vital for anyone considering a property donation in Louisiana, as it not only safeguards the interests of both parties but also complies with state laws governing such transfers.

Dos and Don'ts

When filling out the Louisiana act of donation form, there are several important dos and don’ts to keep in mind. This will help ensure that the process goes smoothly and that your intentions are clearly documented.

- Do read the instructions carefully before starting.

- Do provide accurate information about the donor and the recipient.

- Do describe the property being donated in detail.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections of the form blank unless instructed.

- Don’t use vague language when describing the donation.

- Don’t forget to have the form notarized if required.

- Don’t submit the form without reviewing it for errors.

How to Use Louisiana act of donation

Filling out the Louisiana Act of Donation form is an important step in transferring ownership of property or assets. After completing the form, it will need to be submitted to the appropriate authorities to ensure that the donation is legally recognized.

- Obtain the Louisiana Act of Donation form. This can usually be found online or at a local courthouse.

- Begin by entering the date at the top of the form. Make sure to use the correct format.

- Fill in the full names and addresses of both the donor (the person giving the property) and the donee (the person receiving the property).

- Clearly describe the property or assets being donated. Include any relevant details, such as location or identification numbers.

- Specify any conditions or restrictions related to the donation, if applicable.

- Both the donor and the donee should sign the form. Make sure that signatures are dated.

- Have the form notarized to ensure its validity. This step may require both parties to be present.

- Make copies of the completed form for both the donor and donee’s records.

- Submit the original form to the appropriate local government office or authority for processing.

More PDF Templates

Who Can Write an Esa Letter - Having a support animal documented can foster community support and awareness.

Ucc 1-308 Explained - Individuals using this form can assert their status under UCC 1-308/1-207.

Documents used along the form

The Louisiana Act of Donation form is a crucial document used for transferring property from one individual to another without any exchange of money. However, several other forms and documents often accompany this act to ensure a smooth and legally binding transaction. Below is a list of these documents, each serving a specific purpose in the donation process.

- Donation Agreement: This document outlines the terms of the donation, including details about the property being transferred and any conditions attached to the gift.

- Property Deed: A deed serves as the official record of property ownership. It is essential for documenting the transfer of real estate from the donor to the recipient.

- Affidavit of Identity: This sworn statement verifies the identities of the parties involved in the donation. It helps prevent fraud and ensures that all parties are who they claim to be.

- Tax Forms: Donors may need to complete specific tax forms, such as the IRS Form 709, to report the gift for tax purposes. This is especially important if the value exceeds the annual exclusion limit.

- Title Insurance Policy: This document protects the new owner against any future claims or disputes regarding the property title. It provides peace of mind for the recipient of the donation.

- Notice of Donation: In some cases, a formal notice may be filed with local authorities to inform them of the property transfer. This helps maintain public records and ensures transparency.

- Power of Attorney: If the donor cannot complete the donation process personally, a power of attorney allows another individual to act on their behalf, ensuring the transaction proceeds smoothly.

- Gift Letter: A simple letter confirming the donor's intent to gift the property can be helpful. This letter may outline any specific terms or conditions related to the donation.

- Beneficiary Designation Forms: If the property includes financial accounts or insurance policies, these forms ensure that the intended recipient is recognized as the beneficiary after the donation.

Each of these documents plays a vital role in the donation process, helping to clarify intentions and protect the rights of all parties involved. By ensuring that these forms are properly completed and filed, individuals can navigate the complexities of property donation with greater confidence.

Misconceptions

The Louisiana Act of Donation form is an important legal document, but there are several misconceptions surrounding it. Here are four common misunderstandings:

- It only applies to property transfers between family members. Many people think that the Act of Donation is limited to family transactions. In reality, it can be used for any voluntary transfer of property, whether between relatives or friends.

- It requires a notary public to be valid. While having a notary public can add an extra layer of authenticity, the Act of Donation can still be valid without one. However, having a notary can help prevent future disputes.

- It cannot be revoked once signed. Some believe that once the Act of Donation is executed, it is permanent. In fact, under certain circumstances, the donor can revoke the donation, particularly if it was made under duress or if the donor becomes incapacitated.

- It is only for real estate transactions. Many assume that the Act of Donation is exclusively for real estate. However, it can also be used for personal property, such as vehicles, jewelry, or artwork.

Understanding these misconceptions can help individuals navigate the process more effectively and make informed decisions regarding property transfers in Louisiana.

File Specs

| Fact Name | Description |

|---|---|

| Definition | The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 through 1490. |

| Parties Involved | The form typically involves a donor (the person giving the gift) and a donee (the person receiving the gift). |

| Property Types | Real estate, personal property, and movable property can be donated using this form. |

| Notarization Requirement | The Act of Donation must be notarized to be legally binding in Louisiana. |

| Tax Implications | Donations may have tax consequences, and both parties should consult a tax professional. |

| Revocation | Once executed, the donation can be revoked only under specific circumstances outlined in the law. |

| Witnesses | In some cases, having witnesses present during the signing may be beneficial, although not always required. |

| Filing | While not required, filing the Act of Donation with the local property records office can help establish proof of transfer. |

Key takeaways

The Louisiana Act of Donation form is an important legal document used for transferring property without consideration. Here are some key takeaways to keep in mind when filling out and using this form:

- Understand the Purpose: This form is specifically designed for individuals who wish to donate property, such as real estate or personal belongings, to another person without expecting anything in return.

- Identify the Parties: Clearly state the names and addresses of both the donor (the person giving the property) and the donee (the person receiving the property). Accurate identification is crucial for the legality of the donation.

- Detail the Property: Provide a thorough description of the property being donated. This includes not just the physical address for real estate but also any relevant details about the items for personal property.

- Consider Legal Requirements: Certain formalities must be observed, such as notarization or witnessing, depending on the type of property being donated. Ensure that you meet all state requirements to validate the donation.

- Consult a Professional: If you have any doubts or questions about the process, seeking advice from a legal expert can help clarify your obligations and rights. This is especially important for larger or more complex donations.