Loan Agreement Template

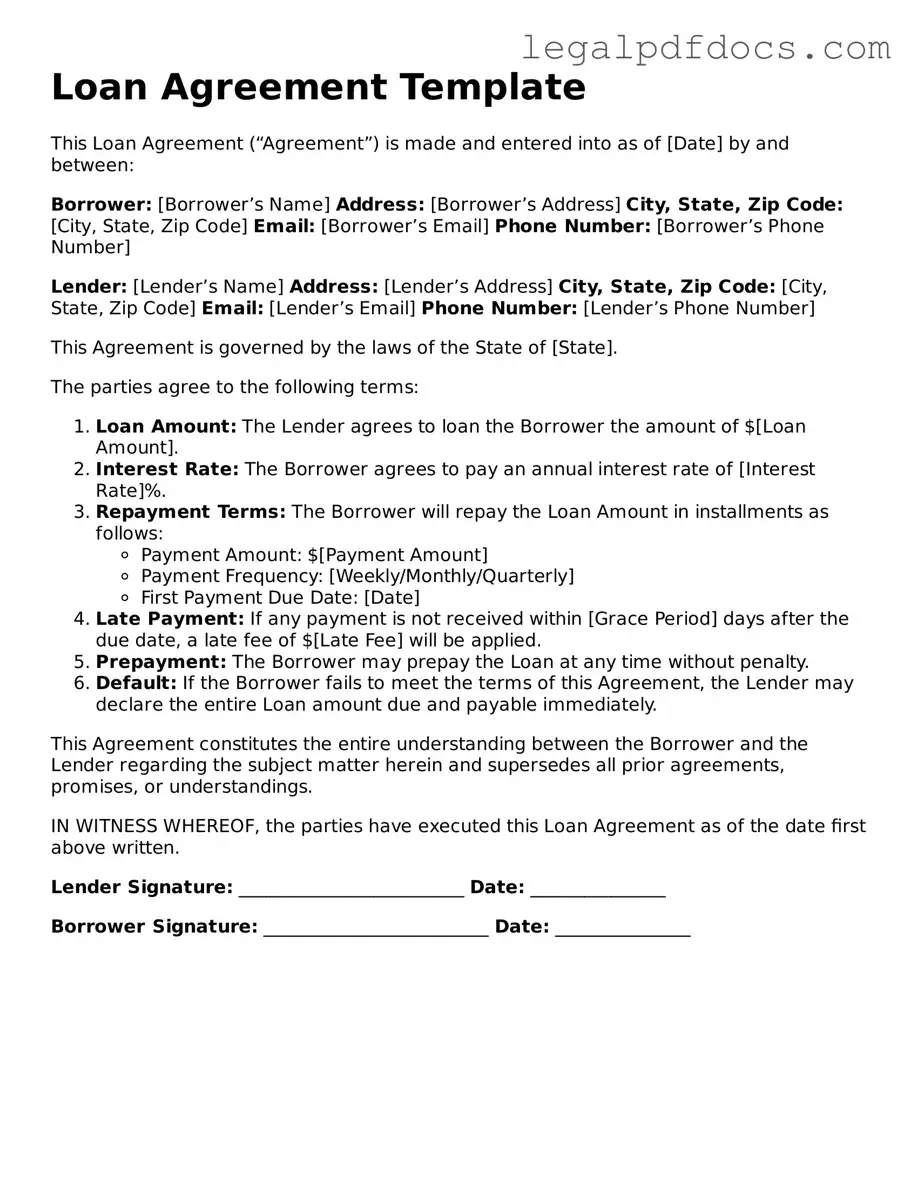

A Loan Agreement form is an essential document that outlines the terms and conditions of a loan between a lender and a borrower. This form serves as a legally binding contract, ensuring that both parties understand their rights and obligations. Key aspects of the form include the loan amount, interest rate, repayment schedule, and any collateral required. Additionally, it often details the consequences of defaulting on the loan and any fees associated with late payments. By clearly defining these elements, the Loan Agreement helps to prevent misunderstandings and disputes down the line. Whether you’re borrowing money for personal needs, business expansion, or any other purpose, having a well-drafted Loan Agreement is crucial for protecting your interests and ensuring a smooth financial transaction.

State-specific Guidelines for Loan Agreement Documents

Loan Agreement Document Categories

Dos and Don'ts

When filling out a Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and completeness. Below are some dos and don'ts to consider.

- Do read the entire Loan Agreement form carefully before starting.

- Do provide accurate and truthful information.

- Do double-check all numbers and figures for correctness.

- Do sign and date the form where required.

- Don't leave any sections blank unless instructed to do so.

- Don't use abbreviations or slang in your responses.

- Don't rush through the form; take your time to ensure clarity.

- Don't forget to keep a copy of the completed form for your records.

How to Use Loan Agreement

Completing the Loan Agreement form is straightforward. Follow these steps to ensure all necessary information is accurately provided. This will help facilitate the processing of your loan.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Fill in your contact number and email address for communication purposes.

- Specify the loan amount you are requesting.

- Indicate the purpose of the loan in the provided section.

- Include your employment information, such as employer name and position.

- State your annual income clearly.

- Review the terms of the loan agreement carefully.

- Sign and date the form at the bottom to confirm your agreement.

After completing the form, ensure you keep a copy for your records. Submit the signed document as instructed to proceed with the loan application process.

More Forms:

Goodwill Donation Form - Your contributions enhance the lives of many individuals.

Snowmobile Bill of Sale - This form is beneficial for those selling a snowmobile privately or through a dealership.

Documents used along the form

When entering into a loan agreement, several other forms and documents may accompany the primary agreement to ensure clarity and protection for all parties involved. Each of these documents serves a specific purpose, contributing to the overall understanding and enforcement of the loan terms.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, including details such as the interest rate, repayment schedule, and any penalties for late payments. It serves as a legal acknowledgment of the debt.

- Loan Application: This form is typically completed by the borrower to provide the lender with necessary information regarding their financial status, credit history, and purpose for the loan. It helps the lender assess the borrower's creditworthiness.

- Collateral Agreement: If the loan is secured, this document details the assets that the borrower pledges as collateral. It specifies what will happen to the collateral in the event of default, offering the lender additional security.

- Personal Guarantee: This is a document where an individual agrees to be responsible for the loan if the primary borrower defaults. It can provide the lender with an extra layer of assurance, particularly when dealing with businesses.

- Disclosure Statement: This document outlines the terms and conditions of the loan, including any fees, interest rates, and the total cost of borrowing. It ensures that the borrower is fully informed before signing the loan agreement.

Understanding these accompanying documents is crucial for both lenders and borrowers. They collectively create a comprehensive framework that governs the loan transaction, helping to prevent misunderstandings and disputes down the line.

Misconceptions

Loan agreements are essential documents that outline the terms of a loan between a borrower and a lender. However, several misconceptions surround them. Below is a list of common misunderstandings regarding loan agreements.

- All loan agreements are the same. Loan agreements can vary significantly based on the type of loan, the lender, and the specific terms negotiated. Each agreement is tailored to the circumstances of the transaction.

- You can ignore the fine print. The fine print often contains crucial details about fees, interest rates, and repayment terms. Ignoring it can lead to unexpected costs or obligations.

- Loan agreements are only for large sums of money. Even small loans can require a formal agreement. It's important to document any loan, regardless of the amount, to protect both parties.

- Signing a loan agreement means you can't negotiate. Many terms in a loan agreement are negotiable. Borrowers should feel empowered to discuss and modify terms before signing.

- Once signed, you cannot change a loan agreement. While modifications can be challenging, they are possible. Both parties can agree to amend the terms if necessary.

- Loan agreements are only needed for personal loans. Business loans, mortgages, and other types of financing also require loan agreements. They are a standard practice in various lending scenarios.

- Verbal agreements are sufficient. A verbal agreement may not hold up in court. Written agreements provide a clear record of the terms and conditions, which is vital for legal protection.

Understanding these misconceptions can help borrowers and lenders navigate their agreements more effectively and avoid potential pitfalls.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. It serves to protect the interests of both parties by clearly stating repayment terms, interest rates, and any collateral involved. |

| Essential Elements | Key components of a Loan Agreement include the loan amount, interest rate, repayment schedule, and any fees associated with the loan. Both parties must agree to these terms for the agreement to be valid. |

| State-Specific Requirements | Loan Agreements may vary by state. For example, in California, the agreement must comply with the California Civil Code regarding interest rates and disclosure requirements. |

| Governing Law | The governing law for a Loan Agreement is typically specified within the document. For instance, if the loan is executed in New York, the laws of New York will govern any disputes arising from the agreement. |

| Enforceability | For a Loan Agreement to be enforceable, it must be in writing and signed by both parties. Oral agreements may not hold up in court, especially for larger loan amounts. |

Key takeaways

When filling out and using a Loan Agreement form, it is essential to understand several key aspects to ensure clarity and legal validity. Below are the takeaways that can guide you through the process.

- Clearly identify all parties involved. This includes the lender and the borrower, along with their contact information.

- Specify the loan amount. Clearly state how much money is being borrowed to avoid any misunderstandings.

- Outline the interest rate. Make sure to include whether it is fixed or variable, and how it will be calculated.

- Define the repayment terms. Include the payment schedule, due dates, and any grace periods.

- Include any collateral. If the loan is secured, specify what assets are being used as collateral.

- Address default conditions. Clearly outline what constitutes a default and the consequences that follow.

- Ensure compliance with state laws. Different states have varying regulations regarding loan agreements, so it’s crucial to adhere to these.

- Both parties should sign the agreement. This signifies that both the lender and borrower understand and agree to the terms outlined in the document.