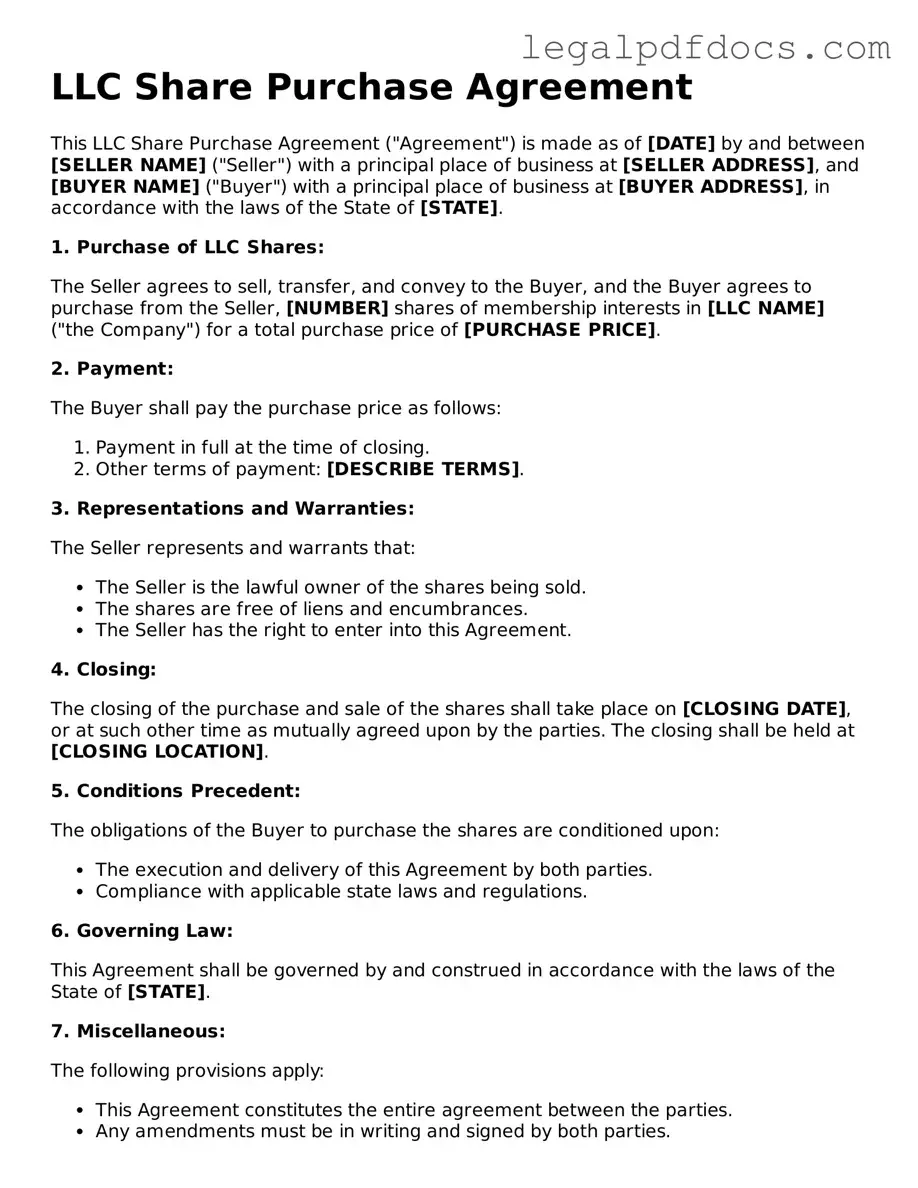

LLC Share Purchase Agreement Template

When it comes to buying or selling shares in a Limited Liability Company (LLC), having a solid agreement in place is crucial for both parties involved. The LLC Share Purchase Agreement serves as the foundation for this transaction, outlining the terms and conditions under which shares will be transferred. This important document typically includes details such as the purchase price, payment terms, and the number of shares being sold. It also addresses any warranties or representations made by the seller, ensuring that the buyer is fully informed about what they are acquiring. Additionally, the agreement may stipulate any conditions that must be met before the sale can be finalized, along with provisions for handling disputes should they arise. By clearly defining the rights and responsibilities of each party, the LLC Share Purchase Agreement helps to minimize misunderstandings and protect the interests of everyone involved in the transaction.

Dos and Don'ts

When filling out an LLC Share Purchase Agreement form, it's essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do: Read the entire agreement carefully before filling it out.

- Do: Provide accurate and complete information about the parties involved.

- Do: Include the correct number of shares being purchased.

- Do: Specify the purchase price clearly.

- Don’t: Rush through the form; take your time to avoid mistakes.

- Don’t: Leave any required fields blank.

- Don’t: Use vague language; be as specific as possible.

- Don’t: Forget to review the agreement with all parties involved before signing.

How to Use LLC Share Purchase Agreement

Filling out the LLC Share Purchase Agreement form is a straightforward process that requires attention to detail. This document is essential for formalizing the transfer of ownership interests in a limited liability company. As you proceed, ensure that all information is accurate and complete to avoid potential disputes in the future.

- Begin by entering the date of the agreement at the top of the form.

- Identify the parties involved. Clearly state the names and addresses of both the seller and the buyer.

- Specify the name of the LLC and its principal place of business.

- Detail the number of shares being sold and the purchase price per share. Ensure that the total purchase price is calculated accurately.

- Include any representations and warranties made by the seller regarding the shares and the LLC.

- Outline any conditions that must be met before the sale is finalized, such as obtaining necessary approvals or consents.

- Provide information regarding the closing date and the method of payment.

- Ensure that both parties sign and date the agreement at the bottom of the form.

After completing these steps, review the document thoroughly to confirm that all information is correct. It may be beneficial to have a legal professional review the agreement before finalizing it to ensure compliance with applicable laws and regulations.

More Forms:

Furniture Purchase Agreement Template - Serves as a formal acknowledgment of sale terms.

Farm Equipment Bill of Sale - Standardizes the sales process for easier understanding.

Dating Application Form Funny - Never too late to search for that special someone.

Documents used along the form

When engaging in a transaction involving the purchase of shares in a Limited Liability Company (LLC), several other forms and documents may accompany the LLC Share Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth transaction and protecting the interests of all parties involved. Here’s a list of some common forms you might encounter:

- Operating Agreement: This document outlines the management structure and operational procedures of the LLC. It defines the roles and responsibilities of members, including how profits and losses are distributed.

- Membership Interest Transfer Agreement: This agreement formalizes the transfer of ownership interests from one member to another. It specifies the terms and conditions under which the transfer occurs.

- Due Diligence Checklist: A tool used to ensure that all necessary information about the LLC is reviewed before the purchase. It typically includes financial statements, contracts, and any potential liabilities.

- Confidentiality Agreement (NDA): This document protects sensitive information shared during the negotiation process. It ensures that both parties keep proprietary information private.

- Bill of Sale: A simple document that serves as proof of the transfer of ownership of shares. It provides a record of the transaction for both the buyer and seller.

- Resolution of Members: A formal document where the members of the LLC approve the sale of shares. This resolution is often required to confirm that the transaction has been authorized by the LLC.

- Escrow Agreement: This agreement involves a third party holding funds or documents until certain conditions are met. It provides security for both the buyer and seller during the transaction.

- Tax Clearance Certificate: This certificate verifies that the LLC has paid all applicable taxes. It can be essential for the buyer to ensure there are no outstanding tax liabilities associated with the LLC.

- Indemnification Agreement: This document protects one party from potential losses or liabilities that may arise from the transaction. It outlines the responsibilities of each party regarding any claims made after the sale.

Understanding these accompanying documents can greatly enhance your ability to navigate the complexities of an LLC share purchase. Each form serves a specific purpose, ensuring that both the buyer and seller are protected and informed throughout the process. Being well-prepared with these documents can lead to a smoother transaction and foster a positive relationship between the parties involved.

Misconceptions

When it comes to the LLC Share Purchase Agreement, several misconceptions often arise. Understanding these can help clarify the purpose and function of this important document. Here are four common misconceptions:

-

Misconception 1: An LLC Share Purchase Agreement is only necessary for large transactions.

This is not true. Regardless of the size of the transaction, an LLC Share Purchase Agreement is crucial for outlining the terms of the purchase. Even smaller transactions benefit from having clear documentation to avoid misunderstandings later on.

-

Misconception 2: The agreement is only relevant to the buyer.

In reality, the agreement is important for both the buyer and the seller. It protects the interests of both parties by detailing the rights and obligations involved in the transaction. This ensures that everyone is on the same page and reduces the risk of disputes.

-

Misconception 3: Once signed, the agreement cannot be changed.

This is misleading. While the agreement is a binding document, it can be amended if both parties agree to the changes. Flexibility can be important, especially if circumstances change or new information comes to light.

-

Misconception 4: The agreement is a one-size-fits-all document.

In fact, each LLC Share Purchase Agreement should be tailored to fit the specific needs of the transaction and the parties involved. Customizing the agreement helps address unique circumstances and ensures that all relevant details are covered.

By dispelling these misconceptions, individuals can approach the LLC Share Purchase Agreement with a clearer understanding of its importance and functionality.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement outlines the terms under which shares of an LLC are bought and sold. |

| Parties Involved | The agreement typically involves the seller (current owner of the shares) and the buyer (new owner). |

| Governing Law | The agreement is often governed by the laws of the state where the LLC is formed. For example, if the LLC is in California, California law applies. |

| Purchase Price | The agreement specifies the purchase price for the shares, which can be a fixed amount or based on a valuation method. |

| Conditions Precedent | There may be conditions that must be met before the sale can be completed, such as approvals from other members. |

| Confidentiality Clause | Many agreements include a confidentiality clause to protect sensitive information shared during the transaction. |

Key takeaways

When filling out and using the LLC Share Purchase Agreement form, there are several important points to consider. These takeaways can help ensure clarity and legality in the transaction.

- Understand the purpose of the agreement: This document outlines the terms under which one party will purchase shares from another party in an LLC.

- Clearly identify the parties involved: Include the full names and addresses of both the seller and the buyer to avoid any confusion.

- Specify the number of shares being sold: Detail the exact quantity of shares being transferred to ensure both parties are in agreement.

- Include the purchase price: Clearly state the total amount the buyer will pay for the shares, including any payment terms or conditions.

- Outline representations and warranties: Both parties should agree on the representations regarding the shares and the LLC to protect their interests.

- Consider including conditions precedent: These are requirements that must be met before the transaction can be completed, such as obtaining necessary approvals.

- Address confidentiality: If sensitive information is shared during negotiations, include clauses to protect that information from disclosure.

- Specify the governing law: Indicate which state’s laws will govern the agreement, as this can affect interpretation and enforcement.

- Ensure signatures are included: Both parties must sign the agreement to make it legally binding. Consider having it witnessed or notarized for added security.

By keeping these key points in mind, individuals can navigate the complexities of an LLC Share Purchase Agreement more effectively.