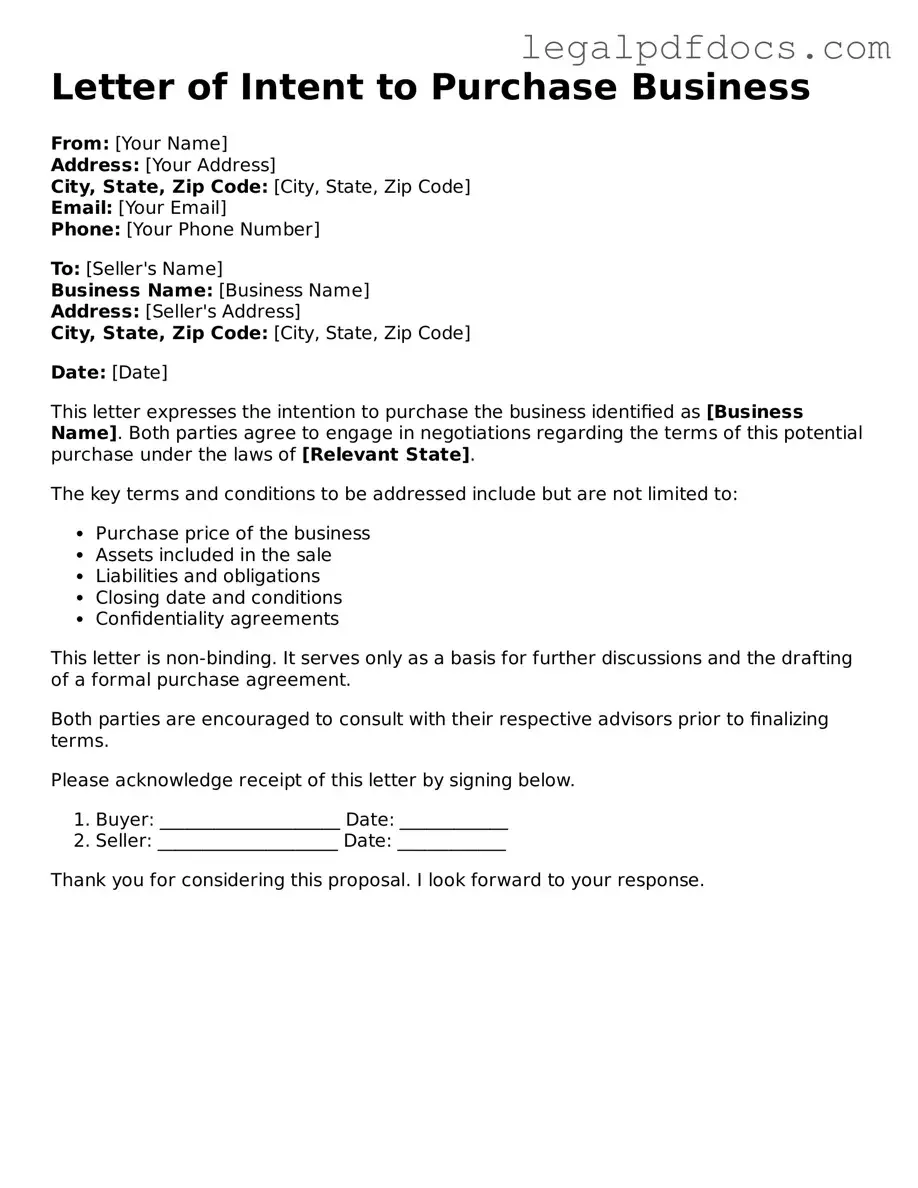

Letter of Intent to Purchase Business Template

The Letter of Intent to Purchase Business form serves as a crucial preliminary document in the process of acquiring a business. This form outlines the basic terms and conditions that both the buyer and seller agree upon before entering into a formal purchase agreement. Key aspects include the purchase price, payment terms, and any contingencies that may affect the transaction. Additionally, it often addresses timelines for due diligence and closing, ensuring that both parties are aligned on expectations. By clearly delineating the intentions of both the buyer and seller, this letter fosters open communication and sets the stage for a smoother negotiation process. It is essential for both parties to understand that while this document is not legally binding, it reflects a serious commitment to move forward with the transaction, thus highlighting the importance of careful consideration and clarity in its drafting.

Dos and Don'ts

When filling out a Letter of Intent to Purchase Business form, it’s important to be thorough and accurate. Here are some guidelines to follow:

- Do clearly state your intention to purchase the business.

- Do provide accurate contact information for both parties.

- Do outline the proposed purchase price and payment terms.

- Do include any conditions that must be met before the sale can proceed.

- Do specify a timeline for the transaction.

- Don’t use vague language that can lead to misunderstandings.

- Don’t omit any important details about the business or the sale.

- Don’t forget to have both parties sign and date the document.

- Don’t rush through the process; take your time to ensure accuracy.

Following these tips can help ensure that your Letter of Intent is clear and effective.

How to Use Letter of Intent to Purchase Business

Completing the Letter of Intent to Purchase Business form is an important step in the process of acquiring a business. After filling out this form, parties typically move forward with negotiations and due diligence. It is crucial to ensure that all information is accurate and clearly presented.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of both the buyer and the seller. Ensure that all names are spelled correctly and addresses are complete.

- Clearly state the name of the business being purchased. Include any relevant identifiers, such as the business's legal structure or registration number.

- Outline the proposed purchase price. Be specific about the amount and the currency.

- Include any terms and conditions that are relevant to the purchase. This could involve payment methods, financing arrangements, or contingencies.

- Indicate the timeline for the transaction. Specify key dates, such as when the offer will expire or when due diligence should be completed.

- Provide a section for signatures. Ensure that both parties sign and date the document to validate the agreement.

Check out Popular Types of Letter of Intent to Purchase Business Templates

Sample Letter of Intent to Purchase Property - It helps in establishing the framework for negotiating further terms.

Homeschool Notice of Intent - Fulfilling this requirement can help foster a positive relationship with local school officials.

Letter of Intent Investment - It may include conditions that need to be met before the investment moves forward.

Documents used along the form

When considering the purchase of a business, a Letter of Intent (LOI) is just the starting point. Several other forms and documents are often needed to ensure a smooth transaction. Each of these documents serves a specific purpose and helps clarify the terms and conditions of the sale. Below is a list of common documents that accompany the LOI.

- Purchase Agreement: This is the main contract that outlines the terms of the sale, including price, payment terms, and responsibilities of both parties.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document protects sensitive information shared during negotiations.

- Due Diligence Checklist: This list helps the buyer gather all necessary information about the business, including financial records, contracts, and legal obligations.

- Asset List: A detailed inventory of all assets being sold, such as equipment, inventory, and intellectual property, is essential for clarity.

- Financial Statements: Recent financial statements provide insight into the business's performance and help the buyer assess its value.

- Transition Plan: This document outlines how the business will transition to the new owner, including training and support needed during the changeover.

- Escrow Agreement: If part of the purchase price is held in escrow, this agreement details the conditions under which funds will be released.

- Closing Statement: This final document summarizes the financial aspects of the transaction, including adjustments and the final purchase price.

Understanding these documents is crucial for both buyers and sellers. Each plays a vital role in ensuring that the purchase process is transparent and efficient. Being well-prepared can lead to a successful transaction and a smooth transition of ownership.

Misconceptions

When considering a Letter of Intent (LOI) to purchase a business, many individuals and organizations harbor certain misconceptions. Understanding these misconceptions can help clarify the purpose and implications of an LOI.

- An LOI is a legally binding contract. While an LOI outlines the intentions of the parties involved and may include certain binding provisions, it is primarily a preliminary document. Most LOIs are meant to express interest and set the stage for negotiations, rather than to create enforceable obligations.

- An LOI guarantees the sale of the business. A common misunderstanding is that an LOI signifies that the sale will definitely occur. In reality, it is merely a step in the negotiation process. Both parties can still walk away from the deal after the LOI is signed, especially if due diligence uncovers issues.

- All terms must be finalized in the LOI. Some believe that an LOI should include every detail of the transaction. However, it is often more beneficial for an LOI to focus on key terms and conditions. This allows for flexibility and further discussion as negotiations progress.

- An LOI eliminates the need for further negotiation. Another misconception is that once an LOI is signed, the parties can no longer negotiate. In fact, the LOI serves as a starting point for discussions. It can be modified or adjusted as both parties work towards a final agreement.

By addressing these misconceptions, parties can approach the process of purchasing a business with a clearer understanding of the role and function of a Letter of Intent.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Letter of Intent (LOI) outlines the preliminary agreement between parties interested in a business transaction, such as the purchase of a business. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that it expresses an intention to negotiate but does not create a legal obligation to complete the transaction. |

| Key Components | An LOI usually includes details like the purchase price, payment terms, and any contingencies that must be met before finalizing the sale. |

| State-Specific Forms | Different states may have specific requirements for LOIs. For instance, in California, the governing law includes the California Commercial Code. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information exchanged during negotiations. |

| Due Diligence | The LOI often sets the stage for due diligence, allowing the buyer to investigate the business's financial and operational aspects before finalizing the purchase. |

| Expiration Date | LOIs often include an expiration date, after which the terms are no longer valid, encouraging timely negotiations. |

| Legal Review | It is advisable to have a legal professional review the LOI to ensure that it accurately reflects the intentions of both parties and complies with relevant laws. |

Key takeaways

When filling out and using the Letter of Intent to Purchase Business form, consider the following key takeaways:

- Clarity is Crucial: Clearly outline the terms of the proposed purchase. This includes the purchase price, payment terms, and any conditions that must be met before the sale can proceed.

- Intent Matters: The letter serves as a formal declaration of your intent to buy the business. It sets the stage for negotiations and demonstrates your seriousness to the seller.

- Confidentiality Considerations: Often, these letters include a confidentiality clause. This protects sensitive information about the business being sold, ensuring that both parties maintain privacy throughout the process.

- Non-Binding Nature: Understand that a Letter of Intent is generally non-binding. It outlines the intentions but does not create a legal obligation to complete the purchase unless a formal agreement is signed later.

- Professional Tone: Use a professional tone throughout the letter. This reflects your seriousness and can help build a positive relationship with the seller.