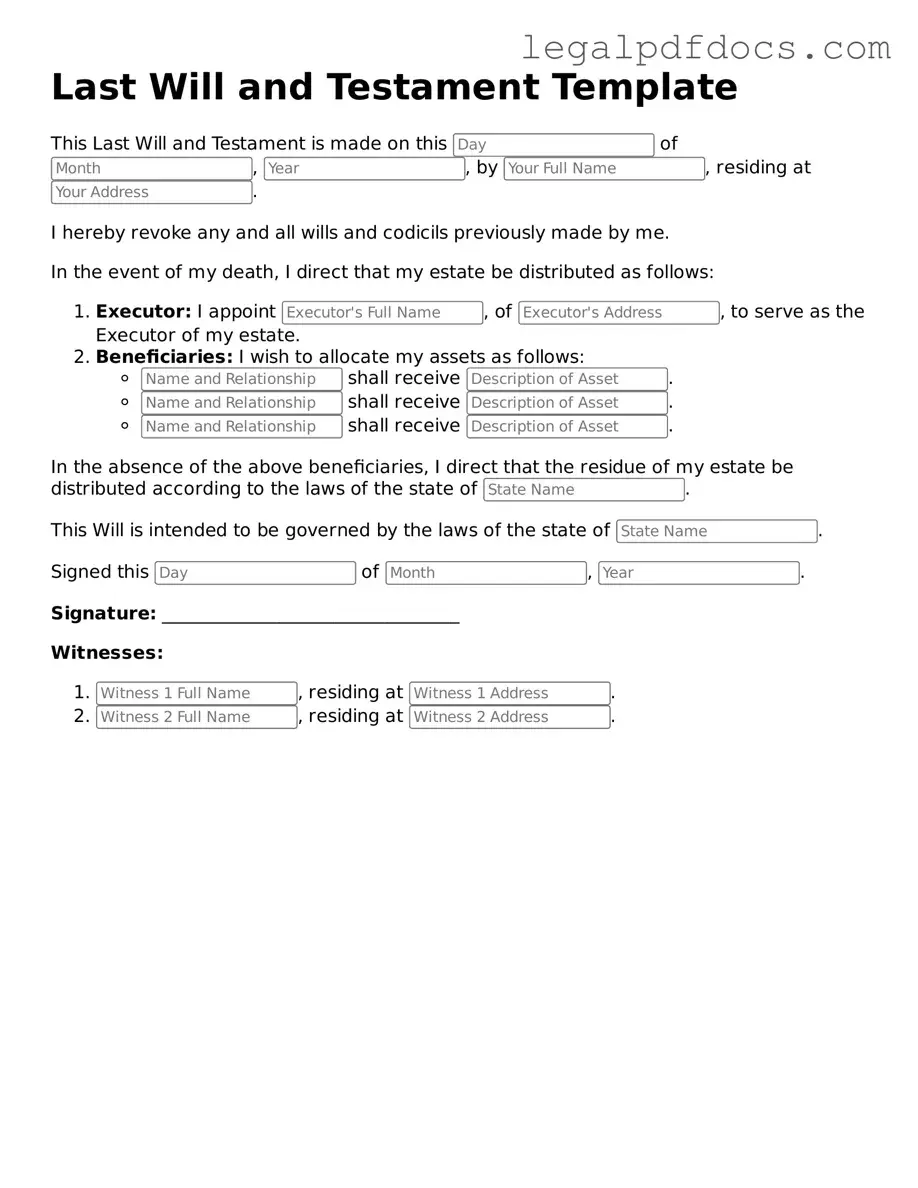

Last Will and Testament Template

The Last Will and Testament form is a crucial legal document that allows individuals to outline their wishes regarding the distribution of their assets after their death. This form serves multiple purposes, including the appointment of an executor, who will be responsible for managing the estate and ensuring that the decedent's wishes are carried out. Additionally, the will can designate guardians for minor children, providing peace of mind for parents concerned about their children's future. It also allows individuals to specify particular bequests, ensuring that sentimental items or specific assets go to designated beneficiaries. Furthermore, a well-crafted will can help minimize disputes among family members and streamline the probate process, making it easier for loved ones to navigate the complexities of estate administration. Understanding the components of this form, including the necessary signatures and witnessing requirements, is essential for anyone looking to create a legally binding document that reflects their final wishes.

Last Will and Testament Document Categories

Dos and Don'ts

When filling out a Last Will and Testament form, it's important to approach the task with care. Here are some key dos and don'ts to consider:

- Do ensure that you are of sound mind and legal age when creating your will.

- Do clearly identify yourself and provide your full name and address.

- Do specify your beneficiaries and what they will receive.

- Do appoint an executor who will manage your estate after your passing.

- Don't use vague language that may lead to confusion about your intentions.

- Don't forget to sign and date the document in the presence of witnesses, if required by your state.

- Don't overlook the need to review and update your will periodically, especially after major life events.

How to Use Last Will and Testament

Completing your Last Will and Testament is an important step in planning for the future. Once you have filled out the form, you will need to sign it in the presence of witnesses to ensure it is legally valid. Follow these steps to accurately fill out the form.

- Title the document: At the top of the page, write "Last Will and Testament."

- Identify yourself: Clearly state your full name, address, and date of birth.

- Declare your intent: Include a statement that you are of sound mind and that this document reflects your wishes.

- Appoint an executor: Choose a trusted individual to carry out the terms of your will. Provide their full name and contact information.

- List your beneficiaries: Clearly identify who will receive your assets. Include their names, addresses, and relationship to you.

- Detail your assets: Describe the property, money, and possessions you wish to distribute. Be specific to avoid confusion.

- Include special instructions: If there are any specific wishes regarding your assets or dependents, outline them clearly.

- Sign the document: At the bottom of the form, sign your name to validate the will.

- Witnesses: Have at least two witnesses sign the document, confirming they saw you sign it. Include their names and addresses.

After completing the form, store it in a safe place and consider discussing your wishes with your loved ones. This will help ensure everyone understands your intentions.

More Forms:

Partial Lien Release Form - Used in various real estate settings to manage lien interests.

Broward County Animal Care - The form includes sections for owner and animal information.

Gift Card Template Free - Create lasting memories with a gift open to interpretation.

Documents used along the form

A Last Will and Testament is a crucial document for expressing your wishes regarding the distribution of your assets after your death. However, several other forms and documents often accompany it to ensure that your estate is managed according to your intentions. Below is a list of common documents that may be used alongside a Last Will and Testament.

- Living Will: This document outlines your preferences for medical treatment in case you become unable to communicate your wishes. It guides healthcare providers about your choices regarding life-sustaining treatments.

- Durable Power of Attorney: This form allows you to designate someone to make financial or legal decisions on your behalf if you become incapacitated. It remains effective even if you lose the ability to make decisions yourself.

- Healthcare Proxy: Similar to a durable power of attorney, this document specifically appoints someone to make medical decisions for you if you cannot do so. It ensures your healthcare preferences are respected.

- Trust Documents: A trust can hold your assets for the benefit of your beneficiaries. Trust documents outline how the assets will be managed and distributed, often avoiding probate and providing privacy.

- Beneficiary Designations: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts. They often override instructions in a will, making them critical to estate planning.

- Letter of Intent: While not legally binding, this letter provides guidance to your executor and beneficiaries about your wishes, including funeral arrangements and personal messages.

- Inventory of Assets: This document lists all your assets and their values. It helps your executor manage your estate and ensures that nothing is overlooked during the distribution process.

- Funeral Instructions: This document specifies your wishes regarding funeral arrangements, including burial or cremation preferences, and any specific requests you may have.

- Tax Documents: These forms are necessary for filing any estate taxes. They ensure that your estate complies with tax obligations and helps in the smooth transfer of assets.

Each of these documents plays a vital role in comprehensive estate planning. They work together to ensure your wishes are honored, your loved ones are taken care of, and your estate is managed efficiently. Properly preparing these documents can save your family time, money, and emotional stress during a difficult period.

Misconceptions

Understanding a Last Will and Testament is essential for anyone planning their estate. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

-

A will only takes effect after death.

While it’s true that a will is executed upon death, the planning and creation of a will can significantly impact your affairs while you are still alive, especially in terms of guardianship for minor children.

-

Only wealthy individuals need a will.

Everyone, regardless of their financial status, can benefit from having a will. It ensures that your wishes are followed and can help avoid disputes among family members.

-

A handwritten will is not valid.

In many states, a handwritten will, also known as a holographic will, can be valid as long as it meets specific requirements. However, it’s advisable to consult legal guidance to ensure its enforceability.

-

A will can cover all aspects of estate planning.

A will primarily addresses the distribution of assets and guardianship. It does not cover matters like joint ownership or beneficiary designations on life insurance policies and retirement accounts.

-

Once a will is made, it cannot be changed.

A will can be amended or revoked at any time while the person is alive. Regular updates are recommended to reflect changes in circumstances or wishes.

-

Having a will avoids probate.

While a will does not avoid probate, it does provide clear instructions for the probate process. Some assets may still need to go through probate even if a will exists.

-

All assets must be included in a will.

Some assets, like those held in a living trust or joint accounts, do not need to be included in a will since they pass directly to the designated beneficiaries.

-

Wills are only for the elderly.

It’s never too early to create a will. Life is unpredictable, and having a plan in place can provide peace of mind at any age.

-

Once you have a will, you don’t need to think about it again.

Life changes, such as marriage, divorce, or the birth of a child, may require updates to your will. Regular reviews ensure that your wishes remain current.

Being aware of these misconceptions can help individuals make informed decisions about their estate planning. It is always beneficial to seek professional advice tailored to personal circumstances.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. |

| State-Specific Forms | Each state has its own requirements for a valid will. For example, California's governing law is the California Probate Code. |

| Witness Requirement | Most states require at least two witnesses to sign the will, ensuring that it is executed properly and reflects the testator's wishes. |

| Revocation | A will can be revoked or modified at any time, as long as the person is mentally competent. This is often done by creating a new will. |

| Probate Process | After a person passes away, their will typically goes through probate, a legal process that validates the will and oversees the distribution of assets. |

Key takeaways

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after you pass away. Here are some key takeaways to keep in mind when filling out and using this important document:

- Understand the Purpose: A Last Will and Testament outlines how you want your assets distributed, who will care for your minor children, and who will execute your estate.

- Choose Your Executor Wisely: The executor is responsible for managing your estate, paying debts, and distributing assets. Select someone trustworthy and capable.

- Be Clear and Specific: Clearly outline your wishes regarding asset distribution. Ambiguities can lead to disputes among heirs.

- Consider State Laws: Each state has specific laws regarding wills. Familiarize yourself with these regulations to ensure your will is valid.

- Sign and Witness: Most states require that your will be signed in the presence of witnesses. Ensure you follow the legal requirements to avoid challenges later.

- Review Regularly: Life changes, such as marriage, divorce, or the birth of children, may necessitate updates to your will. Regular reviews help keep it current.

- Store Safely: Keep your will in a safe but accessible location. Inform your executor and loved ones about where it is stored to avoid confusion.

By following these key points, you can create a Last Will and Testament that reflects your wishes and provides peace of mind for you and your loved ones.