Lady Bird Deed Template

The Lady Bird Deed, also known as an enhanced life estate deed, offers a unique way for property owners to manage their real estate while providing for their heirs. This type of deed allows individuals to retain full control over their property during their lifetime, including the right to sell, mortgage, or alter the property as they see fit. Upon the owner's passing, the property automatically transfers to designated beneficiaries without the need for probate, simplifying the transfer process and potentially saving time and money. Additionally, the Lady Bird Deed can help protect the property from being counted as an asset for Medicaid eligibility, which is a significant consideration for many individuals planning for long-term care. Understanding the key elements of this deed, including its advantages and limitations, can empower property owners to make informed decisions about their estate planning strategies.

Dos and Don'ts

When filling out the Lady Bird Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are five important dos and don'ts to consider:

- Do verify the legal description of the property.

- Do include the names of all grantors and grantees clearly.

- Do ensure that the form is signed and dated by all parties involved.

- Don't leave any sections of the form blank, as this may lead to complications.

- Don't use outdated forms; always use the most current version available.

How to Use Lady Bird Deed

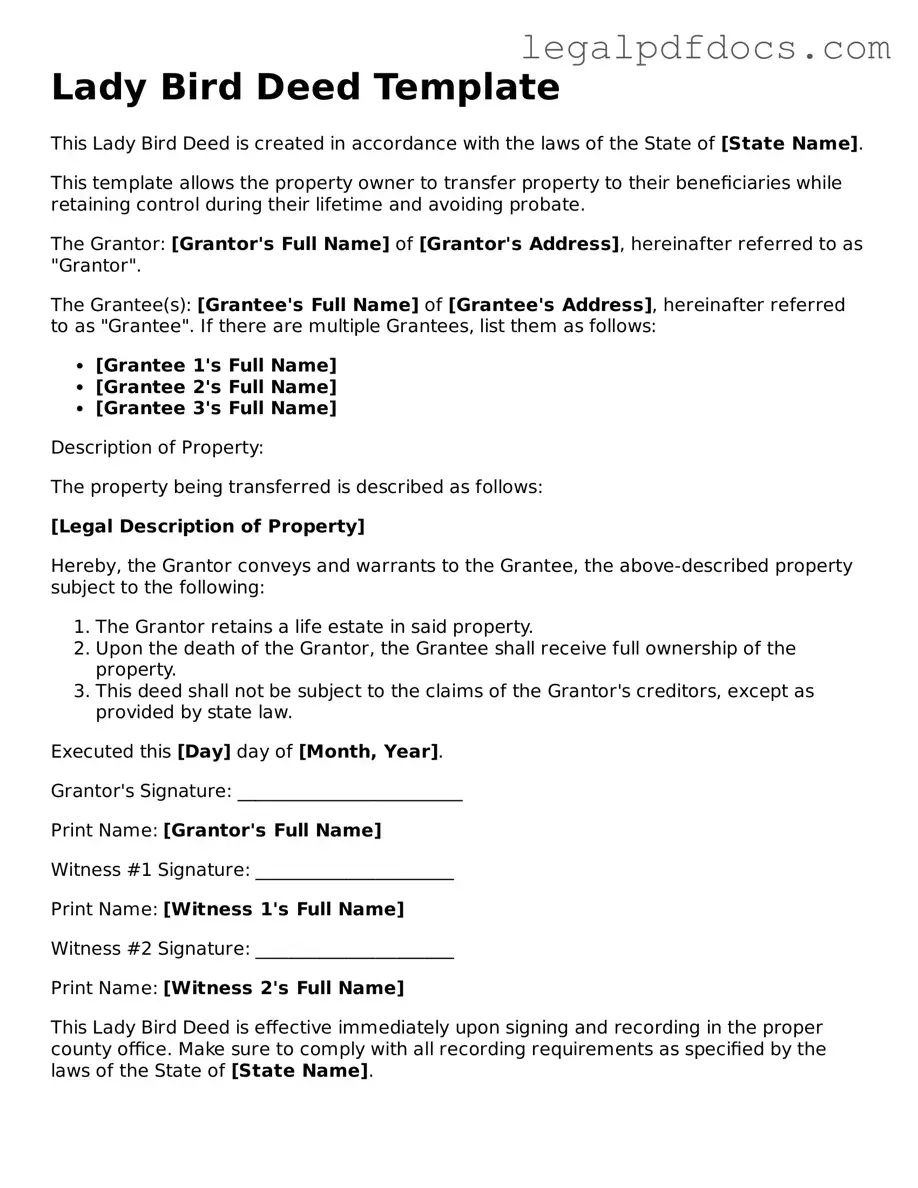

After obtaining the Lady Bird Deed form, it's essential to fill it out accurately to ensure proper transfer of property rights. Follow these steps carefully to complete the form correctly. Once filled out, the form will need to be signed and notarized before being filed with the appropriate local office.

- Identify the Property: Write the full legal description of the property being transferred. This includes the address and any specific identifiers, such as parcel numbers.

- List the Grantor: Fill in the name of the current property owner(s). Ensure that all names are spelled correctly and match official documents.

- List the Grantee: Enter the name(s) of the person(s) who will receive the property. Again, confirm that the names are accurate and complete.

- Include Additional Provisions: If there are any specific conditions or instructions related to the property transfer, include them in this section.

- Sign the Form: The grantor(s) must sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Notarization: Have the notary public complete their section of the form, confirming the identities of the signers and witnessing the signatures.

- File the Deed: Submit the completed and notarized form to the appropriate local office, such as the county clerk or recorder's office, for official recording.

Check out Popular Types of Lady Bird Deed Templates

What Is a Deed in Lieu of Foreclosure - Understanding local laws surrounding Deeds in Lieu is a key step.

How to File a Quitclaim Deed in California - A Quitclaim Deed is a simple way to convey property rights.

What Is a Gift Deed in Real Estate - The document formalizes the act of giving to enhance its importance.

Documents used along the form

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. When preparing a Lady Bird Deed, there are several other forms and documents that may be necessary to ensure a smooth process. Below is a list of commonly associated documents that can complement the Lady Bird Deed, each serving a specific purpose in the estate planning and property transfer process.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can provide clarity and prevent disputes among heirs.

- Durable Power of Attorney: This document allows an individual to designate someone to make financial or legal decisions on their behalf if they become incapacitated.

- Health Care Proxy: A form that appoints someone to make medical decisions for an individual if they are unable to do so themselves.

- Living Trust: A legal arrangement that places assets into a trust for the benefit of the individual during their lifetime and for designated beneficiaries after their death, potentially avoiding probate.

- Transfer on Death Deed (TOD): Similar to a Lady Bird Deed, this document allows property to transfer directly to a beneficiary upon the owner's death without going through probate.

- Affidavit of Heirship: A sworn statement that establishes the heirs of a deceased person, often used when there is no will to clarify property ownership.

- Quitclaim Deed: A legal document used to transfer interest in real property without guaranteeing that the title is clear, often used between family members.

- Property Tax Exemption Application: A form that may need to be filed to maintain tax benefits associated with a property, particularly after a transfer of ownership.

- Notice of Intent to Transfer: A document that informs interested parties of the impending transfer of property, which can help prevent disputes and clarify intentions.

Understanding these associated documents is crucial for anyone considering a Lady Bird Deed. Each plays a role in ensuring that the transfer of property is executed smoothly and in accordance with the individual's wishes. By being informed, individuals can better navigate the complexities of estate planning and secure peace of mind for themselves and their loved ones.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a useful estate planning tool. However, several misconceptions surround this legal document. Understanding these myths can help individuals make informed decisions about their property and estate planning.

- Misconception 1: A Lady Bird Deed avoids probate entirely.

- Misconception 2: The property cannot be sold after a Lady Bird Deed is executed.

- Misconception 3: A Lady Bird Deed protects the property from creditors.

- Misconception 4: Only married couples can use a Lady Bird Deed.

- Misconception 5: A Lady Bird Deed is the same as a regular life estate deed.

While a Lady Bird Deed can help transfer property outside of probate, it does not eliminate all probate issues. If there are other assets in the estate, those may still go through the probate process.

This is false. The property owner retains the right to sell, mortgage, or otherwise manage the property as they see fit, even after creating the deed.

This is not entirely accurate. While the deed can provide some protections, it does not guarantee that creditors cannot claim the property if the owner has outstanding debts.

Anyone can utilize a Lady Bird Deed, regardless of marital status. It is a flexible option for individuals and families looking to manage their estate.

While they share similarities, a Lady Bird Deed includes specific provisions that allow the property owner to retain more control over the property during their lifetime. This distinction is crucial for effective estate planning.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Lady Bird Deed is a type of property deed that allows a property owner to transfer their property to a beneficiary while retaining control during their lifetime. |

| Governing Law | In the United States, Lady Bird Deeds are primarily recognized in Florida, Texas, and Michigan, governed by state property laws. |

| Benefits | This deed helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Tax Implications | Property transferred via a Lady Bird Deed generally does not trigger gift taxes, as the transfer occurs at death rather than during the owner's lifetime. |

| Revocability | The property owner can revoke or change the deed at any time before their death, maintaining flexibility in estate planning. |

| Limitations | Lady Bird Deeds are not available in all states and may not be suitable for all types of property, such as commercial real estate. |

Key takeaways

Here are some important points to consider when filling out and using the Lady Bird Deed form:

- Purpose: The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- Retain Rights: You can continue to live in and use the property, even after the deed is executed.

- Avoid Probate: The property will pass directly to the beneficiaries upon your death, avoiding the lengthy probate process.

- Tax Benefits: The property can maintain its current tax basis, which can be beneficial for your heirs.

- Revocable: You can change or revoke the deed at any time before your death.

- Beneficiary Designation: Clearly name your beneficiaries to ensure your wishes are followed.

- State-Specific Rules: Be aware that laws regarding Lady Bird Deeds can vary by state, so check local regulations.

- Consultation Recommended: Consider consulting an attorney to ensure the deed meets your needs and complies with the law.

- Record the Deed: After filling it out, the deed must be recorded in the county where the property is located to be valid.

Taking these points into account can help ensure that the process goes smoothly and aligns with your intentions for your property.