Official Transfer-on-Death Deed Form for Kansas

The Kansas Transfer-on-Death Deed form is a valuable tool for property owners looking to streamline the transfer of their real estate upon their passing. This legal document allows individuals to designate a beneficiary who will receive their property without the need for probate, simplifying the process for loved ones during a difficult time. By completing this form, property owners can maintain control over their assets while ensuring that their wishes are honored after they are gone. The form requires specific information, including the names of the property owner and the designated beneficiary, as well as a legal description of the property. It must be properly signed, notarized, and recorded with the appropriate county office to be effective. Understanding the nuances of the Transfer-on-Death Deed can help individuals make informed decisions about their estate planning and provide peace of mind regarding the future of their property.

Dos and Don'ts

When filling out the Kansas Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are some things you should and shouldn't do:

- Do provide accurate information about the property, including the legal description.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in front of a notary public.

- Do file the completed deed with the appropriate county office.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't forget to check for any local regulations that may apply.

- Don't use vague terms when describing the property or beneficiaries.

- Don't attempt to make changes after the deed has been signed and notarized.

How to Use Kansas Transfer-on-Death Deed

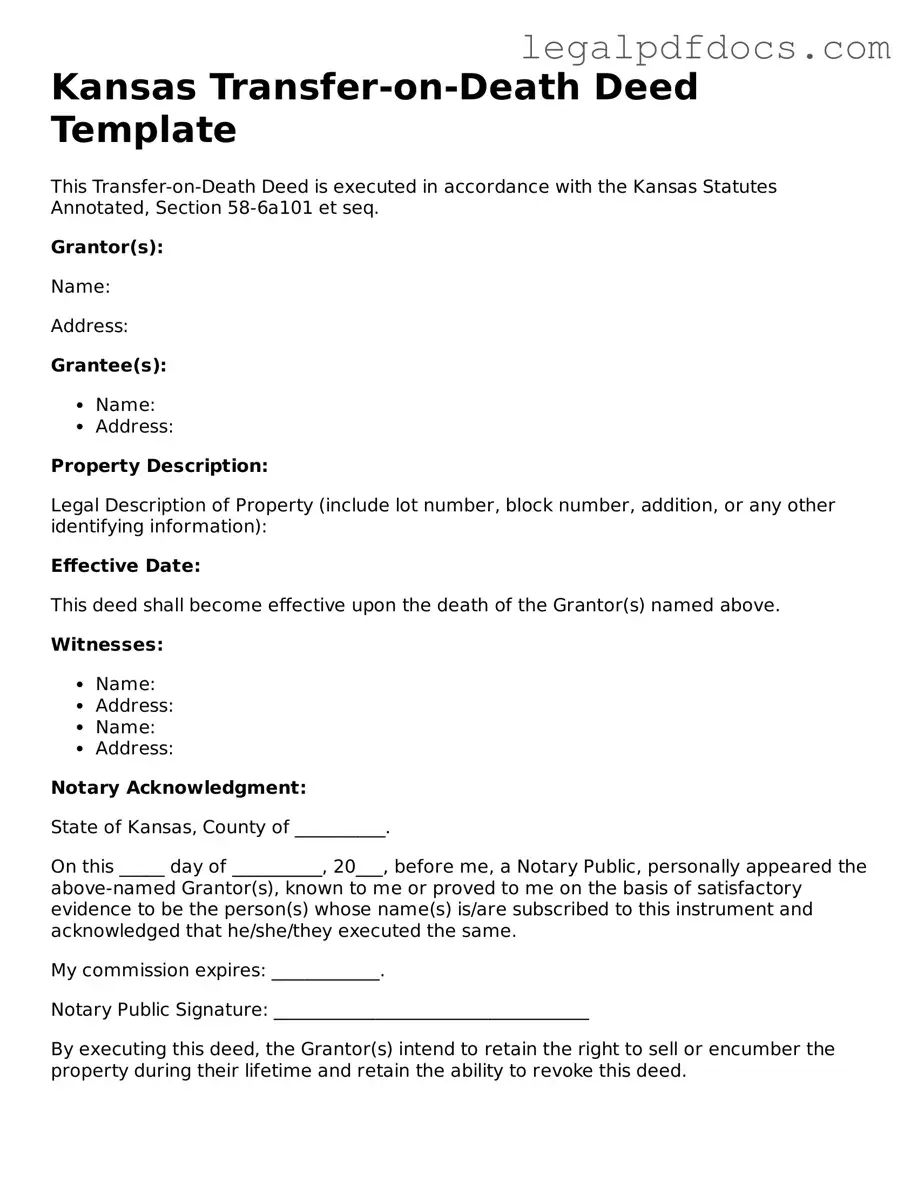

Once you have obtained the Kansas Transfer-on-Death Deed form, it is important to fill it out accurately to ensure that your intentions are clearly expressed. The following steps will guide you through the process of completing the form correctly.

- Begin by entering the name of the owner(s) of the property in the designated space at the top of the form.

- Provide the address of the property that is being transferred. This should include the street address, city, and zip code.

- Include a legal description of the property. This can usually be found on the property’s deed or tax documents. Ensure that this description is accurate and complete.

- Identify the beneficiary or beneficiaries who will receive the property upon the owner’s death. Include their full names and addresses.

- If there are multiple beneficiaries, specify how the property will be divided among them. This may involve stating percentages or designating specific portions of the property.

- Sign and date the form in the presence of a notary public. The notary will need to verify your identity and witness your signature.

- Once the form is signed and notarized, it must be filed with the appropriate county office where the property is located. Check local regulations for any specific filing requirements.

After completing these steps, ensure that you keep a copy of the filed deed for your records. It is advisable to inform the beneficiaries about the deed to facilitate a smooth transfer in the future.

Find Popular Transfer-on-Death Deed Forms for US States

Tod Deed California - You can designate different beneficiaries for different properties if you own multiple parcels.

Does a Transfer on Death Deed Supersede a Will - It provides a clear mechanism for property distribution, which can alleviate uncertainty for surviving family members.

Transfer on Death Deed Florida Form - Beneficiaries do not have any ownership rights until the property owner passes away.

Illinois Transfer on Death Instrument - This deed helps avoid probate, making the transfer of property smoother and faster for heirs.

Documents used along the form

The Kansas Transfer-on-Death Deed form allows property owners to designate a beneficiary to receive their property upon death without the need for probate. This deed is a useful tool for estate planning, but it often works in conjunction with other important documents. Below is a list of forms and documents that are commonly used alongside the Kansas Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death, including any specific bequests and the appointment of an executor.

- Durable Power of Attorney: This allows an individual to designate someone to manage their financial affairs if they become incapacitated.

- Living Will: This document specifies a person's wishes regarding medical treatment and life support in case of a terminal illness or incapacity.

- Revocable Living Trust: A trust that can be altered or revoked during the grantor's lifetime, allowing for easier management of assets and avoiding probate.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for accounts like life insurance policies, retirement accounts, and bank accounts, ensuring they transfer outside of probate.

- Property Deed: This legal document conveys ownership of real estate. It may need to be updated or referenced when creating a Transfer-on-Death Deed.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person, especially when there is no will, aiding in the transfer of property.

- Estate Tax Return: If applicable, this form is filed to report the estate's value and any taxes owed, ensuring compliance with federal and state tax laws.

Utilizing these documents in conjunction with the Kansas Transfer-on-Death Deed can streamline the process of transferring property and ensure that your wishes are honored. Proper estate planning provides peace of mind for you and your loved ones.

Misconceptions

Understanding the Kansas Transfer-on-Death Deed can be challenging. Here are nine common misconceptions about this form:

- It only applies to real estate. While the Transfer-on-Death Deed is primarily used for real estate, it does not cover personal property or financial accounts.

- It is the same as a will. A Transfer-on-Death Deed functions differently than a will. It allows for the direct transfer of property upon death, bypassing probate.

- It can be revoked at any time without formalities. Although a Transfer-on-Death Deed can be revoked, it must be done through a formal process, such as filing a revocation deed.

- All heirs must agree to the transfer. The designated beneficiary can receive the property without needing consent from other heirs, as long as the deed is valid.

- It requires the beneficiary to pay taxes immediately. Beneficiaries typically do not have to pay taxes on the property until they sell it or it generates income.

- It is only for married couples. Anyone can use a Transfer-on-Death Deed to designate a beneficiary, regardless of their marital status.

- It guarantees that the property will be transferred as intended. While the deed is a legal document, it may still be contested in court under certain circumstances, such as claims of undue influence.

- Once filed, the deed cannot be changed. A Transfer-on-Death Deed can be amended or revoked, allowing property owners to adjust their plans as needed.

- It is only useful for large estates. This deed can be beneficial for any property owner, regardless of the estate's size, as it simplifies the transfer process.

Understanding these misconceptions can help individuals make informed decisions about their estate planning in Kansas.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Kansas Transfer-on-Death Deed is governed by K.S.A. 59-3501 to 59-3508. |

| Eligibility | Any individual who owns real estate in Kansas can use this deed to designate a beneficiary. |

| Revocation | The deed can be revoked at any time before the owner's death by recording a new deed or a revocation form. |

| Beneficiary Rights | Beneficiaries do not have rights to the property until the owner's death. |

| Execution Requirements | The deed must be signed by the owner and notarized. It must also be recorded with the county register of deeds. |

| Tax Implications | Transfer-on-Death Deeds do not affect the owner's tax obligations during their lifetime. |

Key takeaways

When considering the Kansas Transfer-on-Death Deed form, there are several important points to keep in mind. This deed allows property owners to transfer their property to beneficiaries without going through probate. Here are some key takeaways:

- Eligibility: Only individuals who own real property in Kansas can use this form. Ensure that you meet the criteria before proceeding.

- Beneficiary Designation: Clearly name the beneficiaries. You can designate multiple beneficiaries, but be specific about their shares.

- Execution Requirements: The deed must be signed by the property owner in the presence of a notary public. This step is crucial for the deed to be valid.

- Filing the Deed: After completing the form, file it with the appropriate county register of deeds. This filing must occur during the owner’s lifetime.

- Revocation: The property owner can revoke the deed at any time before their death. A formal revocation must be filed to ensure clarity.

Understanding these points can help ensure a smooth transfer of property when the time comes.