Official Tractor Bill of Sale Form for Kansas

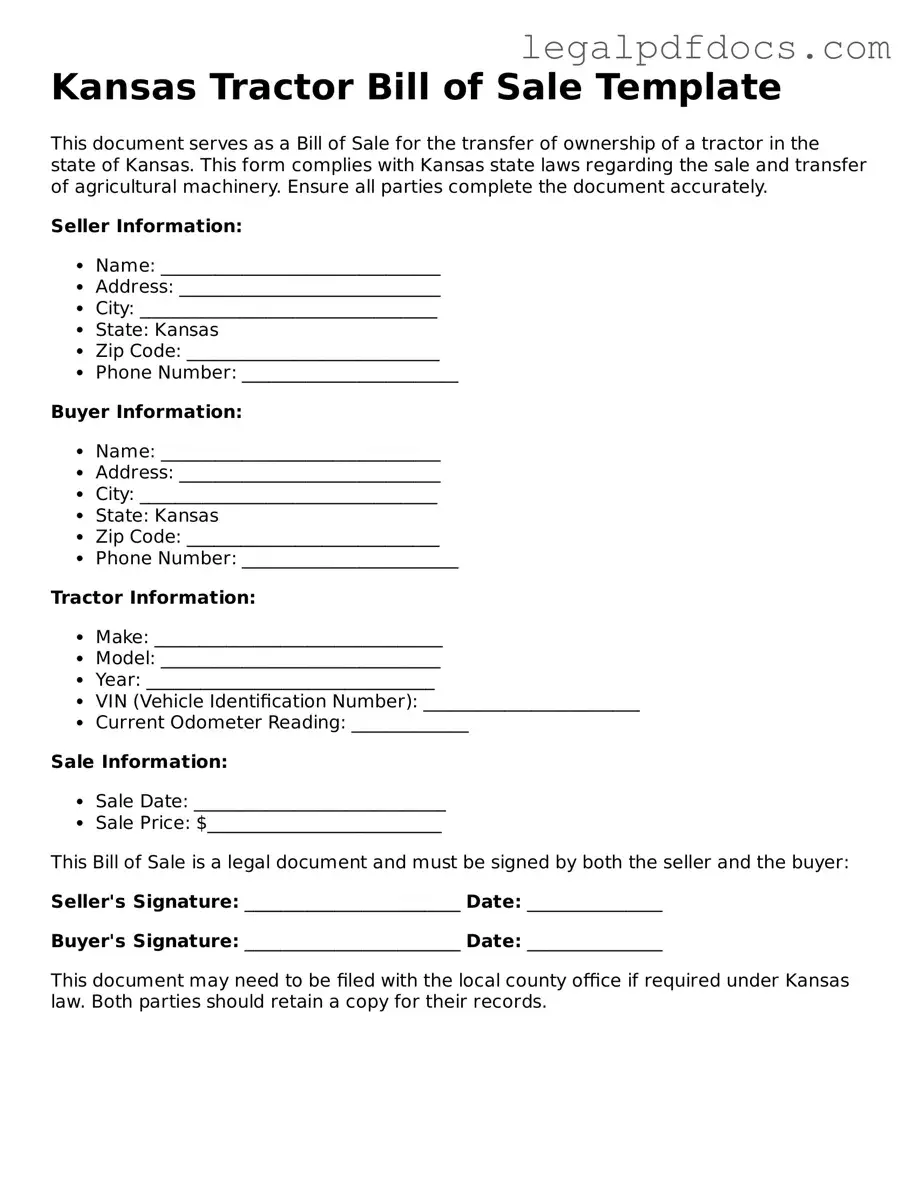

When buying or selling a tractor in Kansas, having a proper bill of sale is essential for both parties involved. The Kansas Tractor Bill of Sale form serves as a crucial document that outlines the transaction details, ensuring clarity and legal protection. This form typically includes important information such as the names and addresses of the buyer and seller, a description of the tractor being sold—including its make, model, year, and Vehicle Identification Number (VIN)—as well as the sale price. Additionally, it often contains spaces for signatures, which signify that both parties agree to the terms laid out in the document. By using this form, individuals can help prevent misunderstandings and disputes that may arise after the sale, making it a vital part of the buying and selling process. Understanding the key components of the Kansas Tractor Bill of Sale can empower both buyers and sellers, ensuring a smooth and transparent transaction.

Dos and Don'ts

When filling out the Kansas Tractor Bill of Sale form, it’s important to approach the process with care. Here are some essential do's and don'ts to consider:

- Do ensure all information is accurate and complete.

- Do include the full names and addresses of both the buyer and seller.

- Do provide a detailed description of the tractor, including make, model, year, and VIN.

- Do sign and date the form to validate the sale.

- Do keep a copy of the completed bill of sale for your records.

- Don't leave any sections blank unless specifically instructed.

- Don't use nicknames or abbreviations for names.

- Don't falsify any information regarding the tractor's condition or history.

- Don't forget to check for any local requirements or additional paperwork needed.

By following these guidelines, you can ensure that the transaction is handled properly and legally. This will protect both the buyer and seller in the process.

How to Use Kansas Tractor Bill of Sale

Once you have the Kansas Tractor Bill of Sale form ready, it's important to fill it out accurately. This document will help you transfer ownership of the tractor legally. Follow the steps below to ensure all necessary information is included.

- Obtain the form: Download or print the Kansas Tractor Bill of Sale form from a reliable source.

- Fill in the seller's information: Enter the full name, address, and contact details of the seller.

- Enter the buyer's information: Provide the full name, address, and contact details of the buyer.

- Describe the tractor: Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price: Clearly state the amount for which the tractor is being sold.

- Include the date of sale: Write the date when the transaction is taking place.

- Sign the form: Both the seller and buyer must sign the document to validate the sale.

- Make copies: Keep a copy for both the seller and buyer for their records.

Find Popular Tractor Bill of Sale Forms for US States

Farm Tractor Bill of Sale - Having a Tractor Bill of Sale can simplify the registration process with local authorities.

Tractor Bill of Sale Form - The Tractor Bill of Sale is a document used to record the sale of a tractor between a buyer and a seller.

Tractor Bill of Sale - Can be adapted for different types of tractors and attachments.

Documents used along the form

When purchasing or selling a tractor in Kansas, it's important to have the right documentation in place. The Kansas Tractor Bill of Sale form is essential for recording the transaction, but there are several other forms and documents that can accompany it to ensure a smooth process. Below is a list of these important documents.

- Title Transfer Document: This document officially transfers ownership of the tractor from the seller to the buyer. It must be completed and submitted to the appropriate state agency to update the vehicle registration records.

- Vehicle Identification Number (VIN) Verification: This form verifies the VIN of the tractor, ensuring that it matches the records. It helps prevent fraud and confirms that the vehicle is not stolen.

- Affidavit of Ownership: In cases where the title is lost or unavailable, this affidavit serves as a sworn statement declaring the seller's ownership of the tractor. It can help facilitate the transfer process.

- Odometer Disclosure Statement: If the tractor has a motor, this statement records the mileage at the time of sale. It is required by federal law for certain vehicles to prevent odometer fraud.

- Sales Tax Exemption Certificate: If the buyer qualifies for a sales tax exemption, this certificate should be completed to avoid paying taxes on the purchase. It is particularly relevant for agricultural use tractors.

- Insurance Verification: Proof of insurance may be required by the lender or for registration purposes. This document shows that the buyer has obtained the necessary coverage for the tractor.

- Power of Attorney: If the seller cannot be present for the transaction, a power of attorney document allows another person to sign on their behalf, facilitating the sale.

- Inspection Certificate: Some buyers may request an inspection certificate to confirm that the tractor is in good working condition. This document can provide peace of mind to the buyer.

Having these documents prepared and organized can help streamline the buying or selling process. It ensures that all legal requirements are met and protects both parties involved in the transaction. Being diligent in gathering the necessary paperwork will ultimately lead to a smoother experience.

Misconceptions

The Kansas Tractor Bill of Sale form is an important document for individuals involved in the sale or purchase of tractors in the state of Kansas. However, several misconceptions surround this form. Below is a list of ten common misunderstandings along with clarifications.

-

It is not necessary to have a bill of sale for a tractor sale.

In Kansas, while a bill of sale is not legally required for every transaction, it is highly recommended. This document serves as proof of the transaction and can protect both the buyer and seller in case of disputes.

-

Only licensed dealers can use the bill of sale.

This is incorrect. Any individual can use the Kansas Tractor Bill of Sale form, whether they are a licensed dealer or a private seller.

-

All sales must be notarized.

Notarization is not a requirement for the bill of sale in Kansas. However, having the document notarized can add an extra layer of authenticity and may be beneficial in certain situations.

-

The bill of sale must be filed with the state.

There is no requirement to file the bill of sale with any state agency in Kansas. The document is typically retained by the buyer and seller for their records.

-

The form is the same for all types of vehicles.

The Kansas Tractor Bill of Sale is specifically designed for tractors and may not be suitable for other types of vehicles. Different forms exist for different vehicle categories.

-

Once signed, the bill of sale cannot be altered.

While it is best practice to complete the form accurately before signing, amendments can be made if both parties agree. It is advisable to document any changes clearly.

-

Buyers do not need to check the tractor’s condition before signing.

It is essential for buyers to inspect the tractor thoroughly before finalizing the sale. The bill of sale does not guarantee the condition of the tractor; it simply documents the transaction.

-

The bill of sale is only for private sales.

This is a misconception. The Kansas Tractor Bill of Sale can be used for both private sales and transactions conducted by dealers.

-

There is a specific format that must be followed.

While the Kansas Tractor Bill of Sale should include certain key information, there is flexibility in how the document is formatted. As long as it contains necessary details, it can be customized.

-

Once the bill of sale is signed, the seller cannot retain any rights.

Signing the bill of sale transfers ownership to the buyer, but it does not necessarily eliminate all rights for the seller. Any warranties or agreements made outside the bill of sale may still apply.

Understanding these misconceptions can help individuals navigate the process of buying or selling a tractor in Kansas more effectively. Clear communication and proper documentation are key components in ensuring a smooth transaction.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Kansas Tractor Bill of Sale form serves as a legal document to record the sale and transfer of ownership of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by the Kansas Statutes Annotated, specifically K.S.A. 8-135, which outlines the requirements for vehicle sales and transfers. |

| Information Required | Essential details must be included, such as the names and addresses of both the buyer and seller, the tractor's make, model, year, and Vehicle Identification Number (VIN). |

| Signature Requirement | Both parties must sign the form to validate the transaction, ensuring that the sale is recognized legally. |

| Use for Registration | The completed Bill of Sale can be used to register the tractor with the Kansas Department of Revenue, facilitating a smooth transition of ownership. |

Key takeaways

Ensure all information is accurate. Double-check the details of the tractor, including make, model, and VIN.

Both the buyer and seller must sign the form. This validates the transaction and protects both parties.

Include the sale price clearly. This helps establish the value of the tractor for tax purposes.

Consider having the bill of sale notarized. This adds an extra layer of authenticity to the document.

Keep a copy for your records. Both parties should retain a signed copy for future reference.

Check local regulations. Ensure compliance with any specific requirements in your county or city.