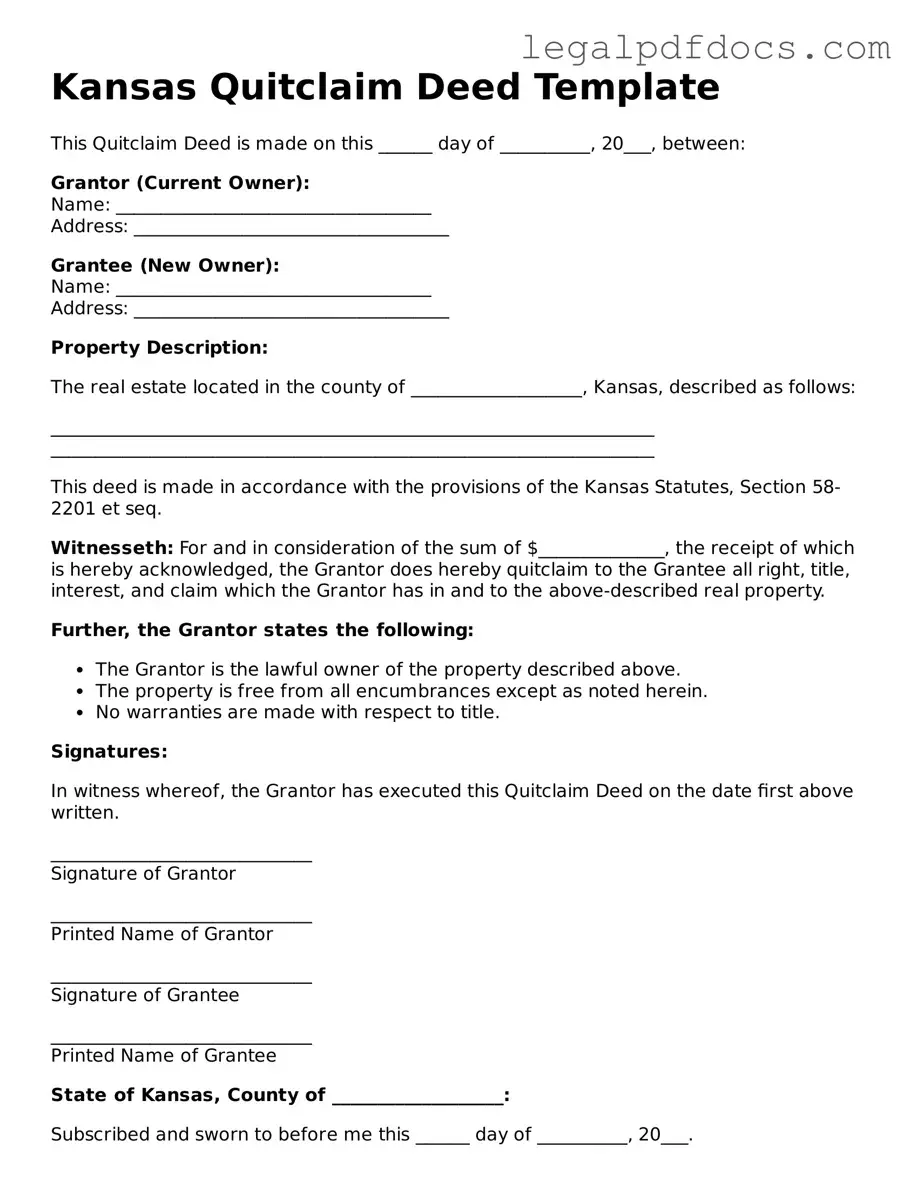

Official Quitclaim Deed Form for Kansas

The Kansas Quitclaim Deed form serves as a crucial legal document for transferring property rights from one party to another. This form is particularly useful in situations where the seller may not have a guaranteed title to the property, or when the buyer is willing to accept the property with its existing conditions. It allows the grantor, or the person transferring the property, to relinquish any claim they have to the property without providing any warranties regarding its title. The form typically includes important details such as the names of the parties involved, a description of the property, and the date of the transfer. Additionally, it requires signatures from the grantor and may need to be notarized to ensure its validity. Understanding the nuances of the Kansas Quitclaim Deed is essential for anyone looking to navigate property transactions in the state, as it can impact future ownership rights and responsibilities.

Dos and Don'ts

When filling out the Kansas Quitclaim Deed form, it's important to approach the task with care. Here are some key dos and don'ts to keep in mind:

- Do ensure that all property details are accurate and complete.

- Do include the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Don't leave any sections blank; every part of the form must be filled out to avoid delays.

- Don't forget to have the form notarized to make it legally binding.

How to Use Kansas Quitclaim Deed

Filling out the Kansas Quitclaim Deed form requires careful attention to detail. Once the form is completed, it will need to be filed with the appropriate county office to ensure proper transfer of property ownership.

- Begin by downloading the Kansas Quitclaim Deed form from a reliable source or obtain a physical copy from your local county office.

- At the top of the form, fill in the names and addresses of the parties involved. The person transferring the property is known as the "Grantor," while the person receiving the property is the "Grantee."

- Provide the legal description of the property. This can typically be found on the property tax statement or the current deed. Be precise to avoid any confusion.

- Indicate the date of the transfer. This is the date when the Grantor signs the deed.

- Include any consideration amount, if applicable. This is the amount paid for the property, although a nominal amount can be used if the transfer is a gift.

- Have the Grantor sign the form in the designated area. The signature must be notarized to ensure it is legally valid.

- After signing, the notary will complete their section, verifying the identity of the Grantor and witnessing the signature.

- Once the form is completed and notarized, make copies for your records before filing.

- File the completed Quitclaim Deed with the county clerk or register of deeds in the county where the property is located. There may be a filing fee, so check in advance.

Find Popular Quitclaim Deed Forms for US States

Where Do I File a Quitclaim Deed - This document is used to relinquish any claim to a property.

Free Quit Claim Deed Form Arizona - Quitclaim deeds are often used in informal transfers, such as between friends or relatives.

Who Can Prepare a Quit Claim Deed in Florida - While simple, it serves a significant purpose in property law.

Documents used along the form

A Kansas Quitclaim Deed is a legal document used to transfer ownership of property from one party to another without guaranteeing that the title is free of defects. When engaging in property transactions, several other forms and documents may accompany the Quitclaim Deed to ensure a smooth transfer of ownership and to fulfill legal requirements. Below is a list of commonly used documents in conjunction with a Kansas Quitclaim Deed.

- Title Search Report: This document outlines the history of ownership and any liens or encumbrances on the property. It is essential for verifying the seller's right to transfer the property.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and discloses any known issues affecting the title.

- Property Transfer Declaration: This form provides information about the property transfer for tax assessment purposes. It typically includes details about the sale price and property characteristics.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, closing date, and any contingencies. It serves as a binding agreement between the buyer and seller.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document itemizes all closing costs associated with the transaction. It provides a detailed account of funds exchanged at closing.

- Property Tax Statement: This document shows the current property tax status and any outstanding taxes owed on the property, which can affect the transfer process.

- Power of Attorney: If the seller cannot be present for the transaction, this document allows another person to act on their behalf in signing the Quitclaim Deed and other related documents.

- Notice of Transfer: This form notifies local authorities of the property transfer, which is often required for updating public records.

Understanding these documents is crucial for anyone involved in property transactions in Kansas. Each plays a specific role in ensuring that the transfer of ownership is clear, legal, and binding. Proper documentation helps protect the interests of both the buyer and seller, facilitating a smoother transaction process.

Misconceptions

The Kansas Quitclaim Deed is a legal document that transfers ownership of real estate from one party to another. Despite its straightforward nature, several misconceptions surround this form. Understanding these misconceptions can help individuals navigate property transactions more effectively.

- Misconception 1: A quitclaim deed guarantees clear title.

- Misconception 2: Quitclaim deeds are only for transferring property between family members.

- Misconception 3: A quitclaim deed is the same as a warranty deed.

- Misconception 4: You do not need to record a quitclaim deed.

- Misconception 5: A quitclaim deed can be revoked after it has been executed.

- Misconception 6: You can use a quitclaim deed to transfer property that you do not own.

- Misconception 7: Quitclaim deeds are only for real estate.

- Misconception 8: All quitclaim deeds must be notarized.

This is not true. A quitclaim deed simply transfers whatever interest the grantor has in the property, if any. It does not ensure that the title is free of liens or claims.

While they are often used for family transactions, quitclaim deeds can be used in various situations, including sales between strangers or even for clearing up title issues.

These two types of deeds serve different purposes. A warranty deed provides a guarantee of clear title, while a quitclaim deed does not offer any such assurances.

Recording the deed is essential to protect the new owner's rights. Failing to record it may lead to disputes over ownership in the future.

Once a quitclaim deed is executed and delivered, it cannot be revoked. The transfer of ownership is final unless a court order states otherwise.

This is misleading. A quitclaim deed transfers only the interest the grantor has. If the grantor does not own the property, the deed will not convey any ownership rights.

While primarily used for real estate, quitclaim deeds can also be used to transfer other types of property, such as personal property, although this is less common.

In Kansas, while notarization is highly recommended for the validity of the deed, it is not strictly required for the deed to be effective. However, having it notarized can simplify the recording process.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties. |

| Governing Law | The Kansas Quitclaim Deed is governed by Kansas Statutes Annotated (K.S.A.) § 58-2201 et seq. |

| Purpose | It is often used to clear up title issues or transfer property between family members. |

| Warranties | Unlike warranty deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. |

| Filing Requirements | The deed must be signed by the grantor and may need to be notarized before filing with the county register of deeds. |

| Tax Implications | In Kansas, transferring property via a quitclaim deed may trigger property tax reassessment. |

| Revocation | Once a quitclaim deed is executed and recorded, it cannot be revoked without the consent of the grantee. |

| Common Uses | Commonly used in divorce settlements, estate planning, and transferring property to trusts. |

| Limitations | Due to the lack of warranties, buyers should be cautious when accepting a quitclaim deed. |

Key takeaways

When filling out and using the Kansas Quitclaim Deed form, keep these key takeaways in mind:

- Ensure that all parties involved are clearly identified. This includes the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a complete legal description of the property. This description should be accurate and detailed to avoid any confusion about the property being transferred.

- Sign the deed in front of a notary public. This step is crucial as it validates the document and makes it legally binding.

- File the completed deed with the appropriate county office. This ensures that the transfer is officially recorded and protects the rights of the new property owner.