Official Promissory Note Form for Kansas

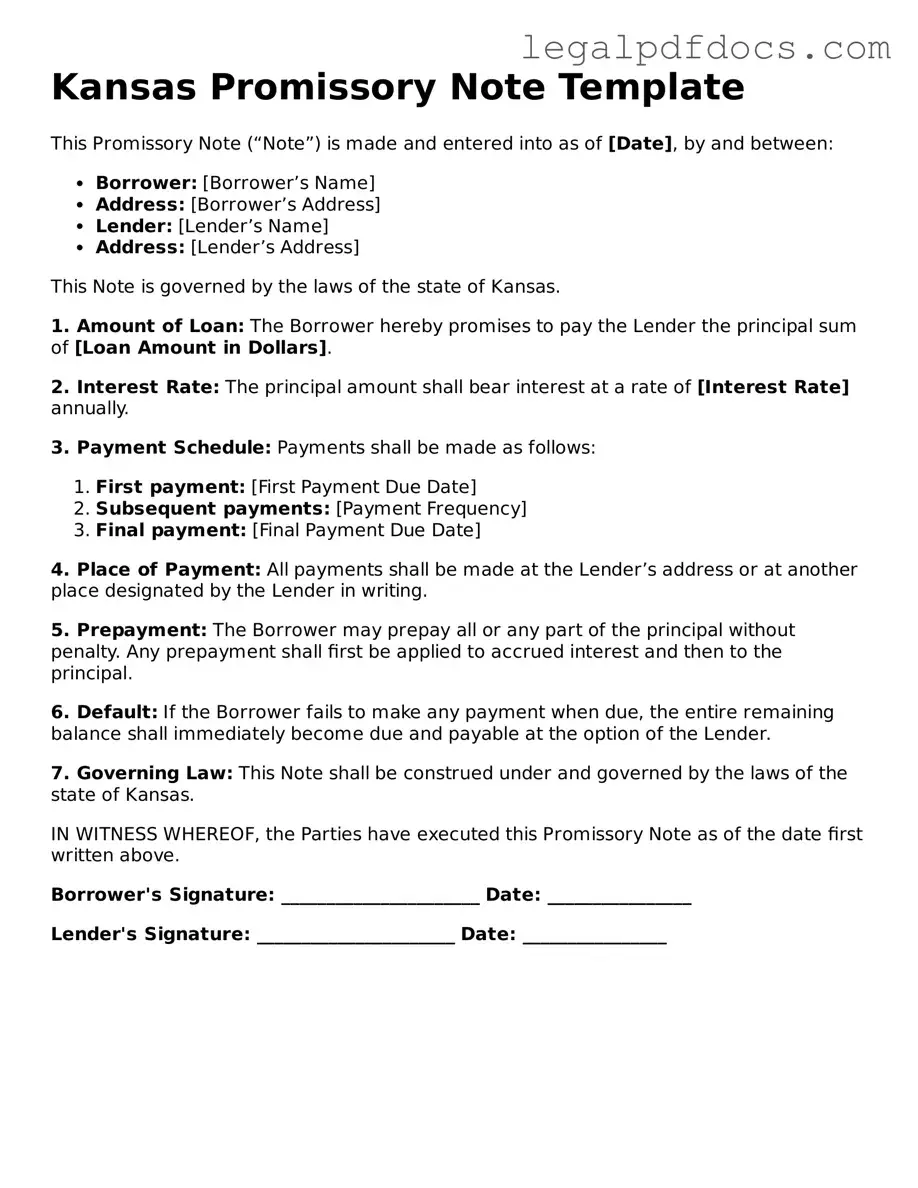

The Kansas Promissory Note form serves as a crucial document in lending agreements, outlining the terms under which a borrower agrees to repay a loan. This form typically includes essential details such as the names of the parties involved, the principal amount borrowed, and the interest rate applicable to the loan. Additionally, it specifies the repayment schedule, detailing when payments are due and the total duration of the loan. The note may also address what happens in the event of default, providing clarity on the rights and responsibilities of both the lender and borrower. By clearly documenting these terms, the Kansas Promissory Note helps prevent misunderstandings and disputes, ensuring that both parties are on the same page regarding their financial obligations. Understanding this form is vital for anyone involved in lending or borrowing money in Kansas, as it lays the foundation for a legally binding agreement that can protect both parties' interests.

Dos and Don'ts

When filling out the Kansas Promissory Note form, it is important to ensure accuracy and clarity. Here are five things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Don't leave any required fields blank; ensure all necessary information is provided.

- Do use clear and legible handwriting or type the information to avoid confusion.

- Don't use abbreviations or slang; stick to formal language to maintain professionalism.

- Do double-check all figures and terms to ensure they are accurate and reflect your intentions.

Following these guidelines can help prevent misunderstandings and potential disputes in the future. Properly completing the form is essential for both parties involved in the agreement.

How to Use Kansas Promissory Note

After completing the Kansas Promissory Note form, it’s important to ensure that all information is accurate and clearly presented. This document will serve as a binding agreement between the lender and the borrower, outlining the terms of the loan. Follow these steps to fill out the form correctly.

- Obtain the form: Download the Kansas Promissory Note form from a reliable source or request a physical copy from a legal office.

- Enter the date: Write the date on which the note is being executed at the top of the form.

- Identify the borrower: Fill in the full legal name and address of the borrower. This should include any middle names or initials.

- Identify the lender: Provide the full legal name and address of the lender in the designated section.

- Specify the loan amount: Clearly write the total amount of money being borrowed. Make sure to use both numerals and words for clarity.

- State the interest rate: Indicate the interest rate that will apply to the loan. Be precise about whether it is fixed or variable.

- Detail the repayment terms: Outline how and when the borrower will repay the loan. Include the frequency of payments (e.g., monthly, quarterly) and the final due date.

- Include any additional terms: If there are specific conditions or clauses that apply to the loan, write them in the appropriate section.

- Signatures: Both the borrower and lender must sign and date the form to validate the agreement. Ensure that the signatures are legible.

- Witness or notarization: Depending on Kansas law, you may need a witness or notarization. Check local requirements and complete this step if necessary.

Find Popular Promissory Note Forms for US States

Promissory Note California - It is vital for borrowers to ensure they can meet the payment obligations outlined in the note.

Texas Promissory Note Template - Digital signatures can be utilized on Promissory Notes, making the process more convenient in today’s world.

Promissory Note Template Georgia - proactive approach in approaching a Promissory Note benefits both parties in the long run.

Promissory Note Florida Pdf - International parties may use the promissory note to facilitate loans across borders.

Documents used along the form

When dealing with a Kansas Promissory Note, several other forms and documents may be relevant to the transaction. These documents help clarify the terms, protect the parties involved, and ensure compliance with state laws. Below is a list of commonly used forms that often accompany a promissory note.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any conditions that must be met by the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged as security and the rights of the lender in case of default.

- Personal Guarantee: This form is used when an individual agrees to be personally responsible for the debt if the primary borrower fails to repay the loan.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and any potential risks associated with borrowing.

- Payment Schedule: A detailed timeline outlining when payments are due, how much is owed for each installment, and the total repayment period.

- Amendment Agreement: If any changes need to be made to the original promissory note or loan agreement, this document formally records those changes.

- Default Notice: Should the borrower fail to make payments, this notice informs them of the default and outlines the consequences as per the terms of the promissory note.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations under the promissory note.

- Notice of Assignment: If the lender sells or transfers the promissory note to another party, this notice informs the borrower of the change in the lender's identity.

Each of these documents serves a specific purpose in the lending process. They help ensure that all parties understand their rights and responsibilities, contributing to a smoother transaction. Proper documentation can prevent misunderstandings and provide clarity throughout the life of the loan.

Misconceptions

-

Misconception 1: A promissory note is the same as a loan agreement.

Many people believe that a promissory note and a loan agreement are interchangeable. While both documents relate to borrowing money, they serve different purposes. A promissory note is a simple, straightforward promise to repay a specific amount of money, often including details like interest rates and payment schedules. In contrast, a loan agreement is more comprehensive and may include terms and conditions, collateral, and other legal obligations.

-

Misconception 2: A promissory note must be notarized to be valid.

Some individuals think that notarization is a requirement for a promissory note to be legally binding. In Kansas, this is not true. A promissory note can be valid without a notary's signature, as long as it meets certain criteria, such as being in writing and signed by the borrower. However, notarization can provide an extra layer of protection and help prove the authenticity of the document if disputes arise.

-

Misconception 3: Promissory notes are only for large loans.

Another common belief is that promissory notes are only used for substantial loans. In reality, they can be utilized for any amount, large or small. Whether it's a family member lending a few hundred dollars or a business transaction involving thousands, a promissory note can be an effective way to outline the terms of repayment and protect both parties involved.

-

Misconception 4: Once a promissory note is signed, it cannot be changed.

Many assume that a signed promissory note is set in stone. This is not entirely accurate. While the original terms of the note are binding, parties can agree to modify the terms if both sides consent. It’s essential to document any changes in writing to ensure clarity and avoid future misunderstandings.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Kansas Promissory Note is a written promise to pay a specified amount of money to a designated person at a specific time or on demand. |

| Governing Law | This form is governed by the Uniform Commercial Code (UCC) as adopted by the State of Kansas. |

| Key Components | Essential elements include the principal amount, interest rate, payment terms, and signatures of the parties involved. |

| Purpose | It serves to formalize a loan agreement, providing legal protection for both the lender and the borrower. |

| Enforceability | A properly executed promissory note is legally enforceable in a court of law, ensuring that the lender can seek repayment. |

Key takeaways

When filling out and using the Kansas Promissory Note form, it is essential to understand several key aspects to ensure the document is valid and enforceable. Below are important takeaways to consider:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are easily identifiable.

- Loan Amount: Specify the exact amount of money being borrowed. This amount should be clearly written in both numerical and written form to avoid confusion.

- Interest Rate: Include the interest rate applicable to the loan. If the loan is interest-free, this should be explicitly stated.

- Repayment Terms: Outline the repayment schedule, including due dates and the frequency of payments (monthly, quarterly, etc.). This clarity helps both parties manage expectations.

- Late Fees: Specify any penalties for late payments. This can motivate timely repayment and provide a clear consequence for delays.

- Prepayment Clause: Indicate whether the borrower can pay off the loan early without penalties. This clause can be beneficial for borrowers looking to save on interest.

- Governing Law: Mention that the note is governed by Kansas law. This establishes the legal framework under which the note will be interpreted.

- Signatures: Ensure that both parties sign and date the document. This step is crucial for the note's validity and enforceability.

- Record Keeping: Keep a copy of the signed promissory note for personal records. This serves as proof of the agreement and can be referenced in case of disputes.

By following these guidelines, individuals can create a clear and effective Kansas Promissory Note that protects the interests of both the lender and the borrower.