Official Operating Agreement Form for Kansas

The Kansas Operating Agreement form serves as a vital document for limited liability companies (LLCs) operating in the state of Kansas. This agreement outlines the internal workings of the LLC, detailing the roles and responsibilities of members, management structure, and decision-making processes. It addresses key aspects such as profit distribution, capital contributions, and procedures for adding or removing members. By establishing clear guidelines, the Operating Agreement helps prevent misunderstandings and disputes among members. Additionally, it may include provisions for resolving conflicts, outlining the process for amending the agreement, and specifying the duration of the LLC. Having a well-crafted Operating Agreement is essential for ensuring compliance with state regulations and protecting the interests of all members involved.

Dos and Don'ts

When filling out the Kansas Operating Agreement form, it is essential to approach the task with care. Here are ten important dos and don'ts to keep in mind:

- Do read the instructions carefully before starting.

- Don't leave any required fields blank.

- Do provide accurate and up-to-date information.

- Don't use vague language; be specific in your descriptions.

- Do consult with a legal expert if you have questions.

- Don't rush through the process; take your time to ensure accuracy.

- Do keep a copy of the completed form for your records.

- Don't forget to sign and date the document where required.

- Do check for any additional documents that may need to be submitted.

- Don't submit the form without reviewing it for errors.

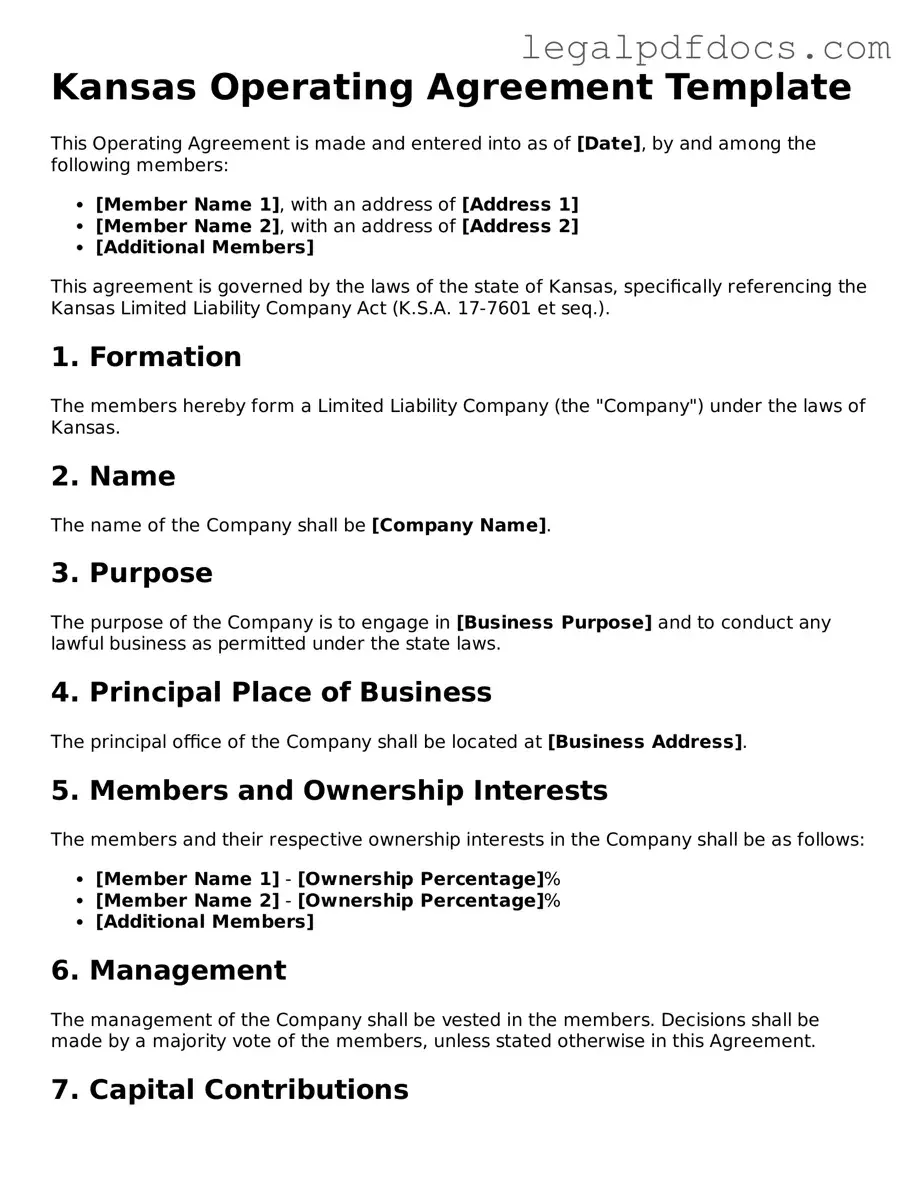

How to Use Kansas Operating Agreement

Completing the Kansas Operating Agreement form is an essential step for establishing the structure and rules of your business. After you have gathered all necessary information, you will be ready to fill out the form accurately to ensure compliance with state regulations.

- Begin by entering the name of your business at the top of the form. Ensure that it matches the name registered with the state.

- Next, provide the principal office address. This should be the main location where your business operates.

- List the names and addresses of all members involved in the business. Each member's role should also be clarified, whether they are managing or non-managing members.

- Specify the purpose of the business. This should be a brief description of what your business intends to do.

- Outline the management structure. Indicate whether the business will be managed by its members or by appointed managers.

- Detail the capital contributions from each member. This includes the amount of money or assets each member is investing in the business.

- Describe the distribution of profits and losses among members. Clearly state how profits will be shared and how losses will be allocated.

- Include provisions for adding or removing members in the future. This should outline the process to follow if changes in membership occur.

- Provide a section for signatures. All members should sign and date the document to validate the agreement.

Once the form is filled out, review it carefully to ensure all information is accurate. After that, you can proceed to file the agreement with the appropriate state office, keeping a copy for your records.

Find Popular Operating Agreement Forms for US States

State Filing Fee for Llc in Texas - The document sets the rules for financial audits and record-keeping.

Is an Operating Agreement Required for an Llc in California - Members can specify the criteria for evaluating performance and making changes in management.

How to Write an Operating Agreement - By defining profit distribution methods, the Operating Agreement helps align member interests.

How to Set Up an Operating Agreement for Llc - This document encourages accountability among members and management.

Documents used along the form

When forming a Limited Liability Company (LLC) in Kansas, the Operating Agreement is a crucial document. However, there are several other forms and documents that are often used in conjunction with it. These documents help outline the structure, responsibilities, and operational procedures of the LLC, ensuring that all members are on the same page. Below are four important documents that you might encounter during the formation and operation of an LLC in Kansas.

- Articles of Organization: This is the foundational document that you file with the Kansas Secretary of State to officially create your LLC. It includes essential information such as the LLC's name, address, and the names of its members or managers.

- Member Consent Form: This document is often used to obtain formal approval from all members for significant decisions or actions. It can serve as a record of agreements made outside of regular meetings, ensuring transparency and accountability among members.

- Bylaws: While not always required for LLCs, bylaws can be helpful in outlining the internal rules and procedures for managing the company. They can cover aspects such as voting rights, meeting protocols, and the roles of members and managers.

- Annual Report: In Kansas, LLCs are required to file an annual report with the Secretary of State. This document updates the state on the LLC's current address, members, and any changes in management, helping maintain good standing.

Understanding these documents is essential for anyone looking to establish and operate an LLC in Kansas. Each plays a unique role in ensuring that the business runs smoothly and complies with state regulations. By preparing these documents thoughtfully, members can help safeguard their interests and promote a successful partnership.

Misconceptions

When it comes to the Kansas Operating Agreement form, several misconceptions can lead to confusion. Here’s a breakdown of eight common misunderstandings about this important document.

- It’s only for large businesses. Many believe that only large companies need an Operating Agreement. In reality, any business entity, regardless of size, can benefit from having one. It provides clarity and structure.

- It’s not legally required. While Kansas law does not mandate an Operating Agreement, having one is highly advisable. It helps prevent disputes and outlines the rules for your business.

- It’s a one-time document. Some think that once the Operating Agreement is created, it never needs to be updated. This isn’t true. As your business evolves, so should your Operating Agreement to reflect changes.

- All Operating Agreements are the same. This is a common myth. Each Operating Agreement should be tailored to the specific needs and goals of the business, making it unique.

- It only covers ownership percentages. While ownership is a key component, an Operating Agreement also addresses management structure, profit distribution, and procedures for resolving disputes.

- Only members need to sign it. Many think that only the business owners need to sign the Operating Agreement. However, it can also be beneficial for key employees or partners to sign, ensuring everyone is on the same page.

- It’s not necessary if you have a partnership agreement. A partnership agreement and an Operating Agreement serve different purposes. The former focuses on the relationship between partners, while the latter outlines the operational aspects of the business.

- It’s too complicated to create. Some people shy away from creating an Operating Agreement because they believe it’s too complex. In truth, many templates are available, and with a bit of guidance, it can be a straightforward process.

Understanding these misconceptions can help you make informed decisions about your business structure and ensure that your Kansas Operating Agreement serves its intended purpose effectively.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Kansas Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC) in Kansas. |

| Governing Law | This agreement is governed by the Kansas Limited Liability Company Act, K.S.A. 17-7662 et seq. |

| Customization | Members can customize the agreement to fit their specific needs, allowing flexibility in management and profit distribution. |

| Filing Requirement | While the Operating Agreement is not required to be filed with the state, it is essential for internal governance. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which helps to prevent conflicts. |

Key takeaways

Filling out and using the Kansas Operating Agreement form is a crucial step for business owners. Here are some key takeaways to consider:

- The agreement outlines the management structure of the business, detailing the roles and responsibilities of each member.

- It serves as a legal document that can help prevent disputes among members by clearly defining expectations and procedures.

- Regularly updating the agreement is essential to reflect any changes in membership or business operations.

- Consulting with a legal professional can provide valuable guidance in ensuring the agreement complies with state laws and meets the needs of the business.