Official Motor Vehicle Bill of Sale Form for Kansas

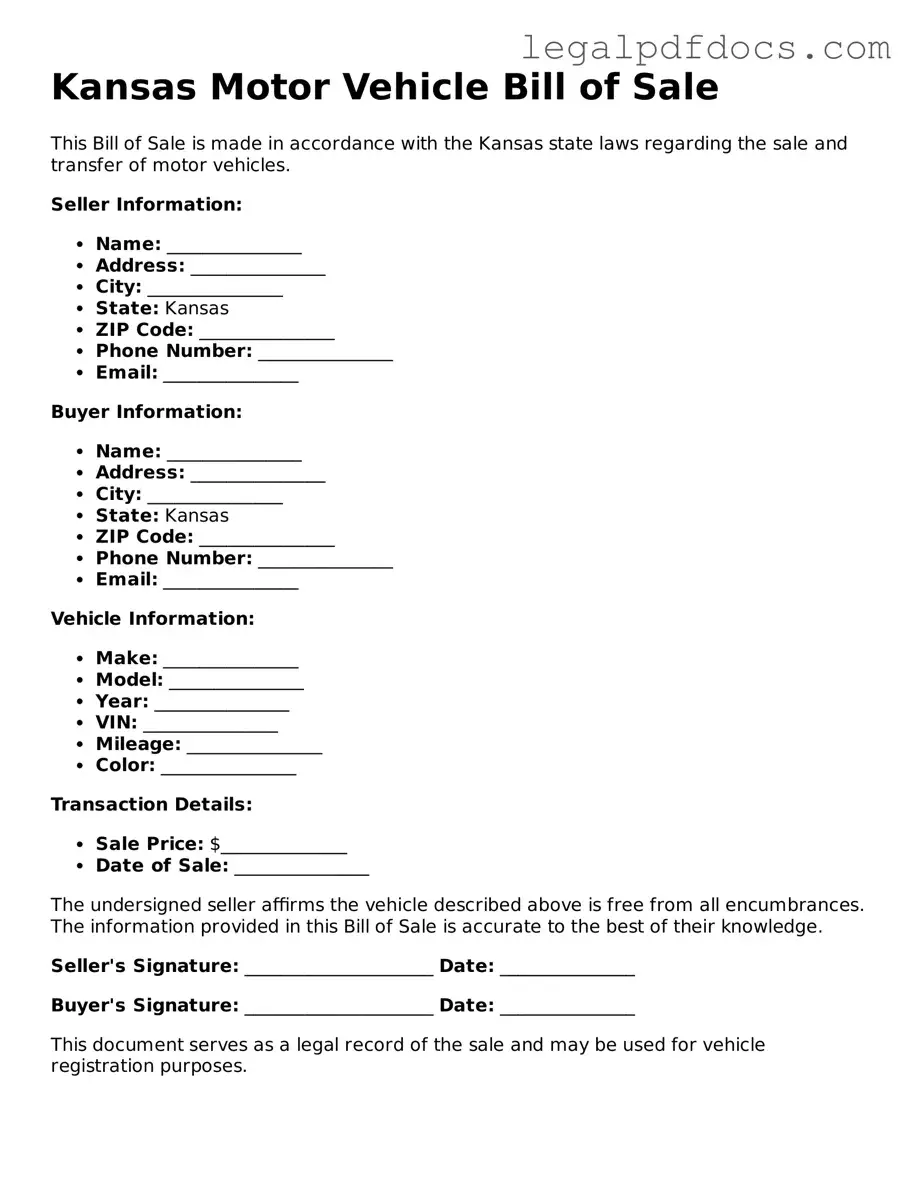

The Kansas Motor Vehicle Bill of Sale form serves as a crucial document in the process of buying or selling a vehicle within the state. This form not only provides a written record of the transaction but also helps protect the interests of both the buyer and the seller. Essential details included in the form encompass the vehicle's make, model, year, and Vehicle Identification Number (VIN), which uniquely identifies the car. Additionally, the form captures the sale price, the date of the transaction, and the names and addresses of both parties involved. By documenting this information, the Bill of Sale establishes proof of ownership transfer and can be invaluable in resolving any disputes that may arise later. Furthermore, it may also be required when registering the vehicle with the Kansas Department of Revenue, making it an essential step in the vehicle transfer process. Understanding the significance of this form can help ensure a smooth transaction and provide peace of mind for everyone involved.

Dos and Don'ts

When filling out the Kansas Motor Vehicle Bill of Sale form, it's essential to ensure accuracy and completeness. Here’s a helpful list of things to do and avoid:

- Do provide accurate vehicle details, including the make, model, year, and VIN.

- Do include the purchase price clearly to avoid any disputes later.

- Do ensure both the buyer and seller sign the document to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any sections blank; incomplete forms can lead to problems.

- Don't use white-out or erasers; if you make a mistake, cross it out and initial it.

- Don't forget to include the date of the sale; this is crucial for registration purposes.

- Don't overlook any local requirements that may be specific to your county.

How to Use Kansas Motor Vehicle Bill of Sale

Once you have the Kansas Motor Vehicle Bill of Sale form ready, it is essential to complete it accurately to ensure a smooth transfer of ownership. This document will serve as proof of the sale and can be useful for both the seller and the buyer in future transactions or registrations.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Make sure to include the street address, city, state, and zip code.

- Next, fill in the buyer's full name and address in the same format as the seller's information.

- Indicate the vehicle's details, including the make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price of the vehicle. This should be the agreed-upon amount between the buyer and seller.

- If applicable, include any additional terms of the sale, such as warranties or conditions, in the designated section.

- Both the seller and buyer should sign and date the form to validate the transaction.

After completing the form, the seller should provide a copy to the buyer for their records. This document will be important for the buyer when they go to register the vehicle in their name.

Find Popular Motor Vehicle Bill of Sale Forms for US States

Printable Bill of Sale Idaho - It can be used in cases of donation or gifts of motor vehicles.

Texas Department of Motor Vehicle - Often required by state authorities when registering a newly purchased vehicle.

Vehicle Bill of Sale Form - Important for establishing the date of sale for tax purposes.

Documents used along the form

The Kansas Motor Vehicle Bill of Sale form serves as an essential document in the transfer of ownership for a vehicle. However, several other forms and documents are often required or recommended to ensure a smooth transaction. Below is a list of these documents, each playing a crucial role in the process.

- Kansas Title Application: This form is used to apply for a new title after purchasing a vehicle. It must be completed and submitted to the appropriate state agency to officially register the vehicle in the new owner's name.

- Vehicle Identification Number (VIN) Inspection Form: This document verifies the VIN of the vehicle being sold. It may be required to confirm the vehicle's identity and ensure it is not stolen or improperly registered.

- Odometer Disclosure Statement: This form records the vehicle's mileage at the time of sale. Federal law mandates this disclosure to prevent odometer fraud and ensure transparency in the sale process.

- Sales Tax Receipt: This document serves as proof of sales tax payment on the vehicle purchase. It is often required for registration and can be requested by the Department of Revenue.

- Release of Liability Form: This form protects the seller by formally notifying the state that they are no longer responsible for the vehicle after the sale. It helps prevent any future liability related to the vehicle.

- Insurance Verification: Proof of insurance is typically needed to register the vehicle. This document shows that the new owner has obtained the necessary coverage before driving the vehicle.

- Power of Attorney: If the seller cannot be present for the transaction, a power of attorney may be needed. This document allows another person to act on behalf of the seller in completing the sale.

- Affidavit of Ownership: In cases where the title is lost or unavailable, this document can help establish ownership. It requires the seller to declare their ownership of the vehicle under oath.

Each of these documents plays a vital role in the vehicle sale process in Kansas. Ensuring all necessary forms are completed and submitted can help avoid complications and facilitate a smooth transfer of ownership.

Misconceptions

-

Misconception 1: The Bill of Sale is only necessary for private sales.

This is incorrect. While a Bill of Sale is essential for private transactions, it is also useful for sales conducted through dealerships. It serves as a record of the transaction and can help clarify terms for both parties.

-

Misconception 2: A Bill of Sale is the same as a title transfer.

This is a common misunderstanding. A Bill of Sale documents the sale of the vehicle, while the title transfer legally changes ownership. Both are important, but they serve different purposes in the transaction process.

-

Misconception 3: A Bill of Sale does not need to be notarized.

Many believe that notarization is unnecessary. However, while not always required, having a Bill of Sale notarized can provide additional legal protection and verification for both the buyer and seller.

-

Misconception 4: The Bill of Sale is only for vehicles sold in Kansas.

This is misleading. Although the form is specific to Kansas, a Bill of Sale can be used in any state. Each state may have its own requirements, but the concept of documenting a vehicle sale is universal.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Kansas Motor Vehicle Bill of Sale form is used to document the sale of a vehicle between a buyer and a seller. |

| Requirements | Both the buyer and seller must sign the form to validate the transaction. |

| Governing Law | This form is governed by Kansas Statutes Annotated, Chapter 8, Article 1. |

| Record Keeping | It is important for both parties to keep a copy of the completed Bill of Sale for their records. |

Key takeaways

When dealing with the Kansas Motor Vehicle Bill of Sale form, there are several important points to keep in mind. This form serves as a legal document that records the sale of a vehicle. Here are some key takeaways:

- Purpose: The Bill of Sale documents the transfer of ownership from the seller to the buyer.

- Required Information: Include details such as the vehicle identification number (VIN), make, model, year, and odometer reading.

- Seller and Buyer Details: Both parties must provide their names and addresses. This ensures clear identification.

- Sale Price: Clearly state the agreed-upon sale price of the vehicle. This is crucial for tax purposes.

- Signatures: Both the seller and buyer must sign the form to validate the transaction.

- Notarization: While not always required, having the Bill of Sale notarized can add an extra layer of security.

- Record Keeping: Both parties should keep a copy of the Bill of Sale for their records. This can be useful for future reference.

- Transfer of Title: After completing the Bill of Sale, the seller should also provide the vehicle title to the buyer.

- Local Regulations: Be aware of any local regulations or requirements that may apply when selling a vehicle in Kansas.

Filling out the Kansas Motor Vehicle Bill of Sale accurately helps ensure a smooth transaction and protects both the seller and the buyer.