Official Deed Form for Kansas

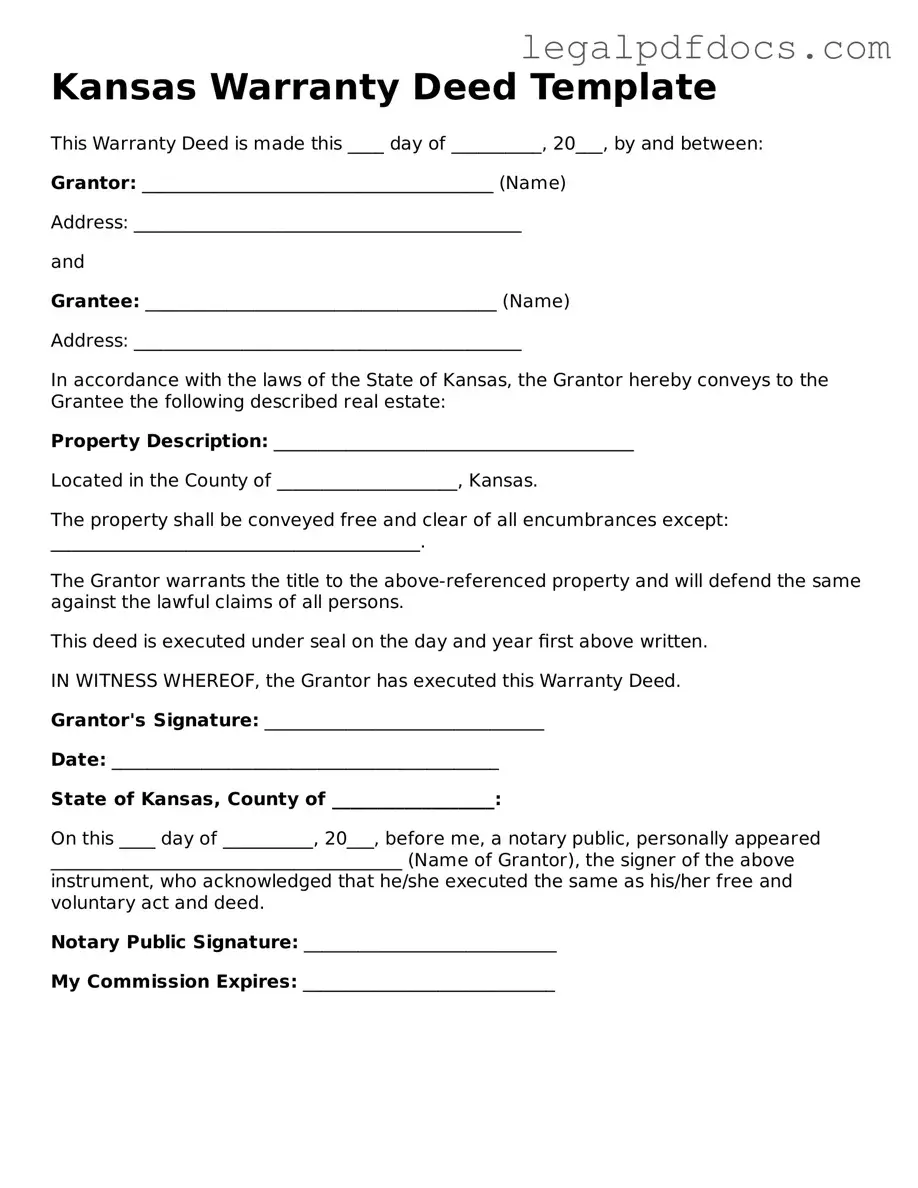

In the realm of property ownership, the Kansas Deed form serves as a crucial document, facilitating the transfer of real estate from one party to another. This form encapsulates essential information, including the names of the grantor and grantee, a legal description of the property, and the consideration, or payment, involved in the transaction. It not only outlines the rights being transferred but also ensures that the transfer complies with state laws, thereby protecting the interests of both parties. Various types of deeds exist in Kansas, such as warranty deeds and quitclaim deeds, each serving distinct purposes and offering different levels of protection. Understanding the nuances of these forms can empower individuals to navigate the complexities of real estate transactions with confidence. As property ownership can significantly impact one’s financial future, grasping the importance and function of the Kansas Deed form is essential for anyone looking to buy or sell property in the Sunflower State.

Dos and Don'ts

When filling out the Kansas Deed form, attention to detail is crucial. Here’s a helpful list of things to do and avoid to ensure the process goes smoothly.

- Do read the instructions carefully before starting.

- Do provide accurate information for all parties involved.

- Do include the legal description of the property.

- Do sign the form in the presence of a notary.

- Do keep a copy of the completed deed for your records.

- Don't leave any fields blank unless instructed.

- Don't use correction fluid or erase any mistakes.

- Don't forget to check local recording requirements.

- Don't rush the process; take your time to ensure accuracy.

- Don't assume that verbal agreements are sufficient; everything must be in writing.

By following these guidelines, you can help ensure that your deed is filled out correctly and is legally binding.

How to Use Kansas Deed

After you have gathered all necessary information and documents, it's time to fill out the Kansas Deed form. Completing this form accurately is essential for ensuring a smooth transfer of property ownership. Follow these steps carefully to avoid any mistakes that could delay the process.

- Begin by entering the date at the top of the form. This should reflect the day you are completing the deed.

- Next, identify the grantor (the person transferring the property). Provide the full name and address of the grantor.

- Now, move on to the grantee (the person receiving the property). Clearly write the full name and address of the grantee.

- In the next section, describe the property being transferred. Include the legal description, which may require a survey or existing property records to ensure accuracy.

- Indicate the consideration (the amount paid for the property). This can be a specific dollar amount or another form of compensation.

- After that, both the grantor and grantee must sign the document. Ensure that signatures are clear and legible.

- Have the deed notarized. A notary public will verify the identities of the signers and witness the signing.

- Finally, file the completed deed with the appropriate county office. This step is crucial to make the transfer official and protect the interests of both parties.

Once the form is filled out and submitted, keep a copy for your records. This document will serve as proof of the property transfer and may be needed for future reference.

Find Popular Deed Forms for US States

Warranty Deed Form Idaho - Deeds may also include provisions for property maintenance responsibilities.

Michigan House Deed - Serves as proof of ownership for legal purposes.

Quit Claim Deed Georgia - This form must be recorded with local authorities.

Property Deed Form - Recording the deed with the county ensures public notice of the ownership change.

Documents used along the form

When completing a property transfer in Kansas, several forms and documents may accompany the Kansas Deed form. Each of these documents serves a specific purpose in ensuring that the transaction is legally sound and properly recorded. Below is a list of commonly used documents in conjunction with the Kansas Deed form.

- Property Disclosure Statement: This document provides potential buyers with information about the property's condition. Sellers are required to disclose any known defects or issues, ensuring transparency in the sale process.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and that there are no outstanding liens or claims against it. It serves to protect the buyer from potential legal disputes.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document outlines all financial details of the transaction, including costs, fees, and the final sale price. Both parties review this statement before finalizing the sale.

- Title Insurance Policy: This policy protects the buyer and lender from any future claims against the property. It ensures that the title is clear and free of defects, providing peace of mind for the new owner.

- Bill of Sale: While not always necessary, this document transfers ownership of personal property included in the sale, such as appliances or furniture. It helps clarify what is part of the transaction.

- IRS Form 1099-S: This form reports the sale of real estate to the Internal Revenue Service. It is essential for tax purposes, ensuring that any capital gains are properly reported by the seller.

Each of these documents plays a crucial role in the property transfer process in Kansas. Properly preparing and understanding these forms can help facilitate a smooth transaction and protect the interests of all parties involved.

Misconceptions

Understanding the Kansas Deed form is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion and potentially costly mistakes. Here are seven common misunderstandings about the Kansas Deed form:

- All deeds are the same. Many people think that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with specific legal implications.

- A deed must be notarized to be valid. While notarization is often required for a deed to be recorded, a deed can still be valid without it. However, for legal protection and public record, notarization is highly recommended.

- Only lawyers can prepare a deed. This is not true. While lawyers can certainly assist, individuals can prepare their own deeds as long as they follow the proper guidelines and include all necessary information.

- The Kansas Deed form is only for transferring property. Some believe that the deed form is solely for property transfers. In fact, it can also be used for other purposes, such as conveying interests in real estate or clarifying ownership.

- Once a deed is recorded, it cannot be changed. While recording a deed makes it part of the public record, it is possible to change ownership through a new deed. This means that ownership can be updated or transferred at any time.

- All property transfers require a deed. Although most property transfers do require a deed, certain situations, like transfers between spouses or in some cases of inheritance, may not necessitate one.

- The Kansas Deed form is a one-size-fits-all document. Many assume that the standard form will suit all situations. However, specific circumstances may require additional clauses or modifications to the standard form to ensure that all parties are protected.

By understanding these misconceptions, individuals can approach the Kansas Deed form with greater confidence and clarity. This knowledge can help ensure that property transactions are handled correctly and legally.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Kansas Deed form is governed by the Kansas Statutes Annotated (K.S.A.) Chapter 58, which outlines property conveyance laws. |

| Types of Deeds | Kansas recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Signature Requirements | For a deed to be valid in Kansas, it must be signed by the grantor (the person transferring the property) in the presence of a notary public. |

| Recording | Deeds must be recorded with the county register of deeds in the county where the property is located to provide public notice of the transfer. |

| Consideration | The deed must state the consideration, or payment, for the property, although it can be a nominal amount. |

| Legal Description | A complete legal description of the property being conveyed is required in the deed to ensure clarity and avoid disputes. |

Key takeaways

When filling out and using the Kansas Deed form, keep these key takeaways in mind:

- Accuracy is crucial. Ensure all names, addresses, and property descriptions are correct to avoid legal issues later.

- Signatures matter. The deed must be signed by the grantor, and notarization is typically required to validate the document.

- Consider the type of deed. Different types of deeds, such as warranty deeds or quitclaim deeds, serve different purposes. Choose the one that fits your needs.

- File with the appropriate office. After completing the deed, it must be filed with the county register of deeds where the property is located.

- Understand tax implications. Transferring property may trigger tax obligations. Consult a tax professional if needed.

- Keep a copy. Always retain a copy of the executed deed for your records, as it serves as proof of ownership.