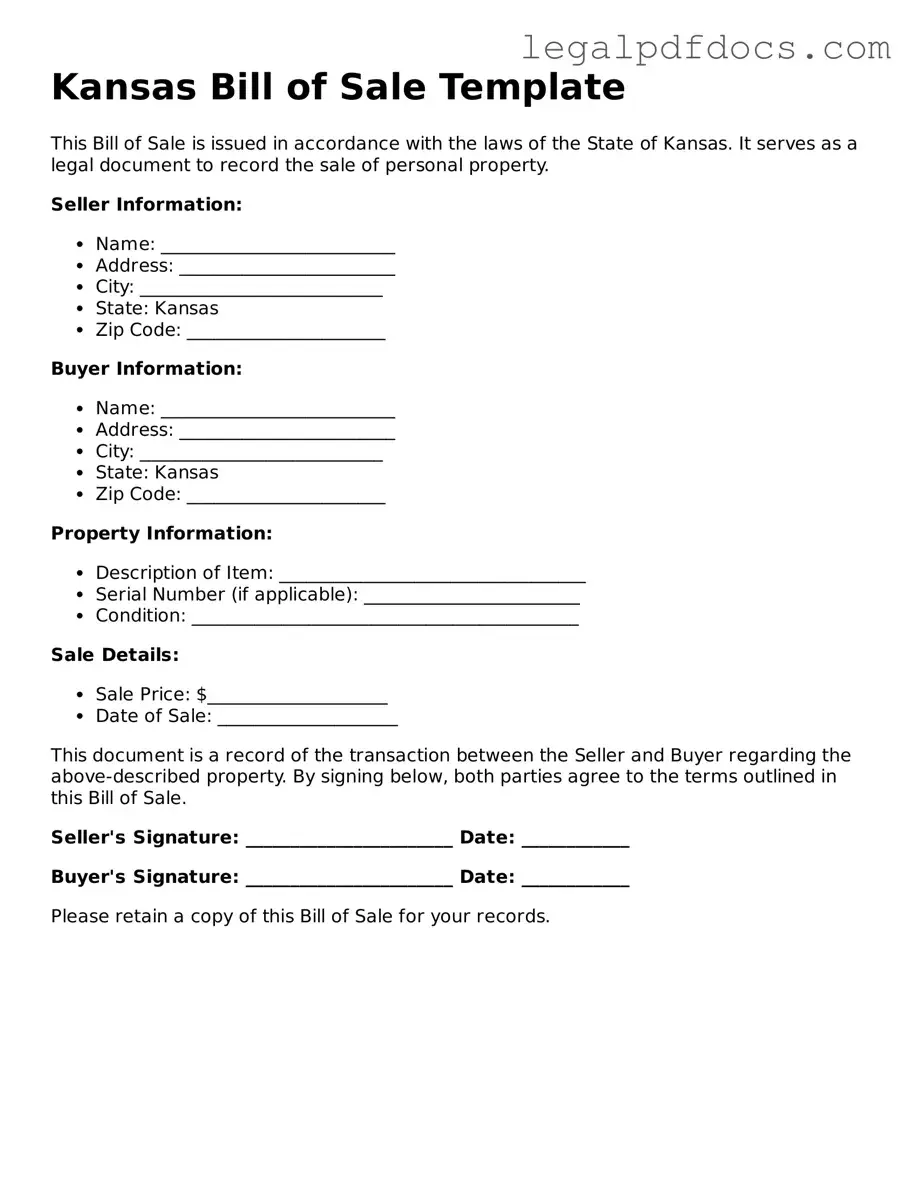

Official Bill of Sale Form for Kansas

When engaging in the sale or transfer of personal property in Kansas, a Bill of Sale form serves as a crucial document for both buyers and sellers. This form provides a written record of the transaction, detailing essential information such as the names and addresses of both parties, a description of the item being sold, and the agreed-upon purchase price. It not only protects the interests of both parties but also serves as proof of ownership transfer. In Kansas, a Bill of Sale can be used for various types of personal property, including vehicles, boats, and even household items. By including specific details like the vehicle identification number (VIN) for cars or the serial number for electronics, the form helps to clarify the exact items being sold. Additionally, it can include any warranties or conditions of the sale, further ensuring that both parties are on the same page. Understanding the importance and components of the Kansas Bill of Sale form is essential for anyone looking to make a secure and legitimate transaction.

Dos and Don'ts

When filling out the Kansas Bill of Sale form, it's important to ensure that the document is completed accurately. Here’s a helpful list of dos and don'ts to guide you through the process.

- Do include the full names and addresses of both the buyer and seller.

- Don't leave any fields blank; incomplete forms can lead to issues later.

- Do provide a detailed description of the item being sold, including make, model, and VIN for vehicles.

- Don't use vague terms; specificity helps prevent misunderstandings.

- Do clearly state the sale price and payment method.

- Don't forget to sign and date the form; signatures validate the agreement.

- Do check for any local requirements that may apply to your specific situation.

- Don't rush through the process; take your time to ensure accuracy.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't ignore the importance of having a witness or notary, if required for your transaction.

How to Use Kansas Bill of Sale

Completing the Kansas Bill of Sale form is an important step in documenting the transfer of ownership for personal property. After filling out the form, ensure that both parties keep a copy for their records. This will help protect your rights and provide proof of the transaction.

- Begin by obtaining the Kansas Bill of Sale form. You can find it online or at your local government office.

- Enter the date of the transaction at the top of the form.

- Provide the full name and address of the seller. Make sure to include any necessary contact information.

- Next, fill in the buyer's full name and address, including their contact information.

- Describe the item being sold. Include details such as the make, model, year, and any identification numbers, if applicable.

- State the purchase price clearly. Indicate whether it is in cash or another form of payment.

- Both the seller and buyer should sign and date the form. Ensure that the signatures are legible.

- Keep copies of the completed form for both parties for future reference.

Find Popular Bill of Sale Forms for US States

Dmv Bill of Sale California - With a Bill of Sale, sellers can demonstrate they have legally transferred their belongings.

Vehicle Bill of Sale Form - By documenting the sale, a Bill of Sale can also serve as a reference point for future discussions about the item.

Transfer Title of Car in Florida - It serves as evidence in case of theft or disputes over ownership.

Documents used along the form

When completing a transaction in Kansas, several forms and documents may accompany the Kansas Bill of Sale. These documents help ensure that the sale is legally binding and that both parties are protected. Below is a list of commonly used forms that you may need.

- Kansas Title Transfer Form: This form is essential for transferring ownership of a vehicle. It must be completed and submitted to the Kansas Department of Revenue to update the vehicle's registration.

- Vehicle Registration Application: After purchasing a vehicle, the new owner must fill out this application to register the vehicle in their name. This document includes details about the vehicle and the new owner.

- Affidavit of Sale: This document serves as a sworn statement confirming the sale of an item. It can provide additional legal protection and clarity about the transaction.

- Odometer Disclosure Statement: Required for vehicle sales, this statement records the vehicle's mileage at the time of sale. It helps prevent fraud and ensures transparency in the transaction.

- Sales Tax Form: Depending on the item sold, a sales tax form may be necessary to report and pay any applicable sales tax on the transaction. This ensures compliance with state tax laws.

- Purchase Agreement: This document outlines the terms of the sale, including price, payment method, and any warranties or conditions. It serves as a formal contract between the buyer and seller.

Using these forms in conjunction with the Kansas Bill of Sale can help facilitate a smooth transaction. Ensure that all documents are completed accurately to protect your interests and comply with state regulations.

Misconceptions

When dealing with the Kansas Bill of Sale form, various misconceptions can arise. Understanding these misconceptions is essential for ensuring a smooth transaction. Here are ten common misunderstandings:

- A Bill of Sale is only for vehicles. Many believe that a Bill of Sale is exclusively used for vehicle transactions. In reality, it can be used for any personal property, including furniture, electronics, and even livestock.

- It is not necessary for small transactions. Some think that a Bill of Sale is only important for large purchases. However, even small transactions benefit from having a written record to avoid disputes later.

- Verbal agreements are sufficient. While verbal agreements can be legally binding, they are often difficult to prove. A written Bill of Sale provides clear evidence of the transaction.

- All Bill of Sale forms are the same. This is a common misconception. Each state has its own requirements and formats. The Kansas Bill of Sale has specific elements that must be included to be valid.

- Only the seller needs to sign. Many people think that only the seller's signature is necessary. In fact, both the buyer and seller should sign the Bill of Sale to ensure mutual agreement.

- A Bill of Sale is not legally binding. Some believe that a Bill of Sale holds no legal weight. In truth, it is a legally binding document that can be enforced in court if needed.

- It is only needed for used items. There is a misconception that a Bill of Sale is only required for used items. New items, especially those sold by private sellers, also benefit from a Bill of Sale.

- Notarization is always required. While notarization can add an extra layer of security, it is not a requirement for all Bill of Sale transactions in Kansas.

- A Bill of Sale protects the buyer only. Some think that the Bill of Sale primarily protects the buyer. In reality, it protects both parties by documenting the terms of the sale.

- Once signed, it cannot be changed. Many believe that a Bill of Sale is final and cannot be modified. However, if both parties agree, they can amend the document or create a new one.

By addressing these misconceptions, individuals can approach their transactions with greater confidence and clarity. A well-prepared Bill of Sale can serve as a valuable tool in any property transfer.

PDF Specifications

| Fact Name | Details |

|---|---|

| Definition | A Kansas Bill of Sale is a legal document used to transfer ownership of personal property from one person to another. |

| Governing Law | The Kansas Bill of Sale is governed by Kansas Statutes Annotated (K.S.A.) 84-9-101 et seq. |

| Types of Property | This form can be used for various types of personal property, including vehicles, furniture, and equipment. |

| Notarization | While notarization is not always required, it is recommended for certain transactions, especially for vehicles. |

| Consideration | The document should state the consideration, or payment, made for the property being sold. |

| Seller and Buyer Information | Full names and addresses of both the seller and the buyer must be included in the form. |

| Property Description | A clear description of the property being sold is necessary to avoid any confusion. |

| As-Is Clause | Many bills of sale include an "as-is" clause, indicating that the buyer accepts the property in its current condition. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records after signing. |

Key takeaways

When filling out and using the Kansas Bill of Sale form, it's important to keep a few key points in mind. This document serves as a record of the transfer of ownership for various items, including vehicles and personal property.

- Provide Accurate Information: Ensure that all details, such as the names of the buyer and seller, the item description, and the sale price, are filled out accurately.

- Include Signatures: Both the buyer and seller must sign the form. This confirms that both parties agree to the terms of the sale.

- Consider Notarization: While notarization is not always required, having the Bill of Sale notarized can add an extra layer of protection and legitimacy to the transaction.

- Keep Copies: After completing the form, both parties should keep a copy for their records. This can be useful for future reference or in case of disputes.

- Check Local Regulations: Depending on the type of item being sold, there may be additional regulations or requirements to consider, so it’s wise to check local laws.

By following these guidelines, you can ensure that the Kansas Bill of Sale form is completed correctly and serves its intended purpose effectively.