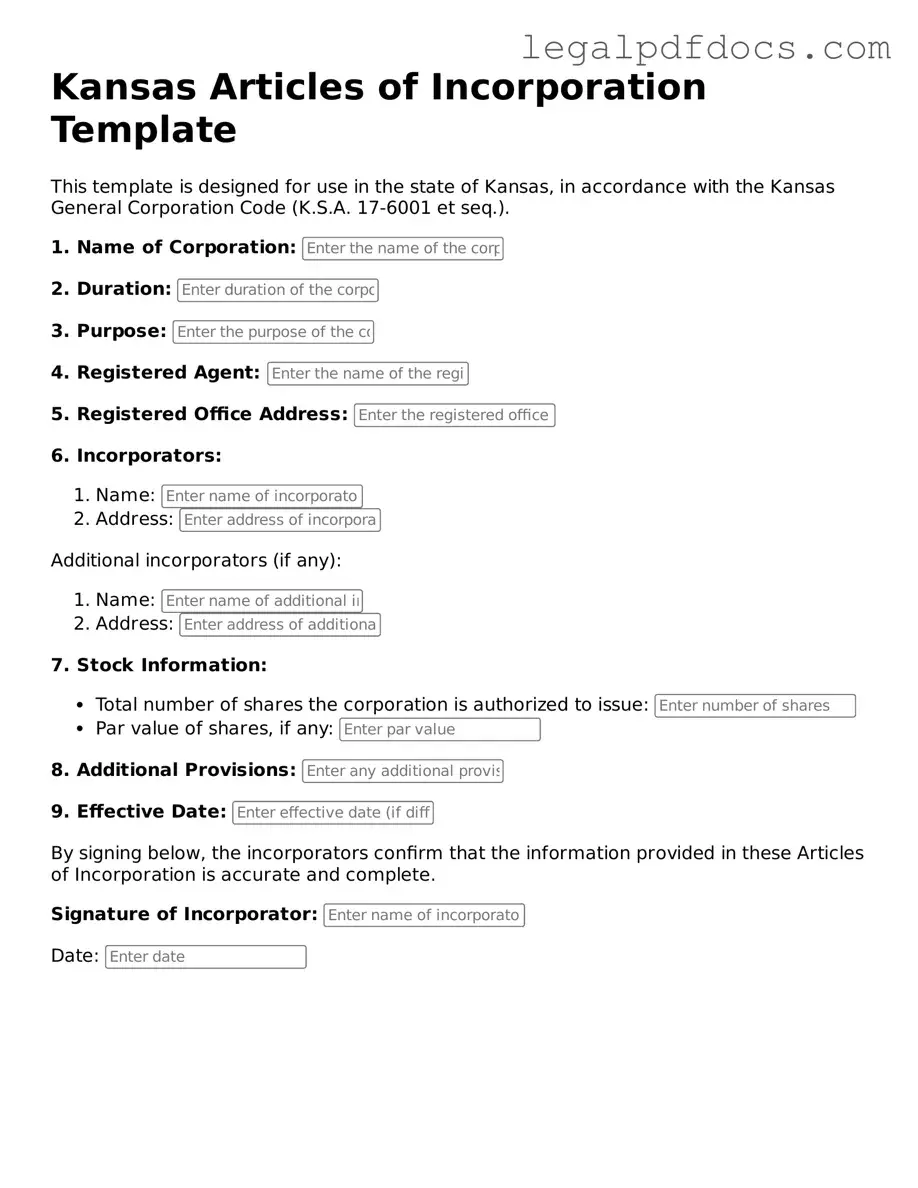

Official Articles of Incorporation Form for Kansas

When starting a business in Kansas, one of the first steps is to file the Articles of Incorporation. This essential document serves as the foundation for establishing a corporation in the state. It outlines key information about the business, including its name, purpose, and the address of its registered office. Additionally, the form requires details about the corporation's structure, such as the number of shares it is authorized to issue and the names of the initial directors. By completing the Articles of Incorporation, business owners not only comply with state regulations but also gain legal recognition for their enterprise. Understanding the components of this form is crucial for anyone looking to navigate the incorporation process smoothly and successfully. With careful attention to detail, entrepreneurs can set the stage for their business's future growth and development in Kansas.

Dos and Don'ts

When filling out the Kansas Articles of Incorporation form, it's important to follow certain guidelines to ensure your application is processed smoothly. Here are some do's and don'ts to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do include the name of your corporation as it will appear on official documents.

- Do list a registered agent with a physical address in Kansas.

- Do check for any required signatures before submitting.

- Don't leave any required fields blank.

- Don't use abbreviations for your corporation's name unless allowed.

- Don't forget to pay the required filing fee.

- Don't submit the form without reviewing it for errors.

How to Use Kansas Articles of Incorporation

Once you have the Kansas Articles of Incorporation form in hand, you'll need to complete it carefully to ensure that your business is properly established. After filling out the form, you will submit it to the Kansas Secretary of State's office along with the required filing fee. This process marks the beginning of your business's legal existence in the state.

- Begin by entering the name of your corporation. Ensure that the name complies with Kansas naming requirements.

- Provide the principal office address. This should be a physical location, not a P.O. Box.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Indicate the purpose of your corporation. Be clear and specific about what your business will do.

- Fill in the number of shares your corporation is authorized to issue. If applicable, specify the classes of shares as well.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that the signatures are from the incorporators listed.

- Prepare your payment for the filing fee. Check the current fee amount on the Kansas Secretary of State's website.

- Submit the completed form and payment to the Kansas Secretary of State's office either by mail or in person.

Find Popular Articles of Incorporation Forms for US States

Business Formation - Registered agents accept legal documents on behalf of the corporation and must be designated in the form.

Articles of Incorporation Michigan - Compliance with tax regulations is often referenced in the articles.

Georgia Secretary of State Forms - The articles help protect the personal assets of corporate owners.

How Do I Get a Certificate of Good Standing - The incorporation process can lead to various advantages, including improved credibility and access to funding.

Documents used along the form

When forming a corporation in Kansas, the Articles of Incorporation serve as a foundational document. However, several other forms and documents are often required or recommended to ensure compliance with state laws and to facilitate smooth business operations. Below is a list of key documents that you may need to consider alongside the Articles of Incorporation.

- Bylaws: These internal rules govern the management and operation of the corporation. Bylaws outline the roles of officers, procedures for meetings, and other essential governance matters.

- Initial Report: This document provides information about the corporation's officers and registered agent. It is typically filed shortly after the Articles of Incorporation to keep state records current.

- Employer Identification Number (EIN) Application: Obtaining an EIN from the IRS is crucial for tax purposes. This number is required for hiring employees and filing tax returns.

- Registered Agent Consent Form: This form confirms that the registered agent agrees to serve in that capacity. It is essential for ensuring that there is a designated person or entity to receive legal documents on behalf of the corporation.

- Operating Agreement (for LLCs): If the corporation is structured as a Limited Liability Company (LLC), this document outlines the management structure and operational procedures, similar to bylaws for corporations.

- Business Licenses and Permits: Depending on the nature of the business, various licenses and permits may be required at the local, state, or federal level. These ensure compliance with regulations specific to the industry.

- Stock Certificates: If the corporation issues stock, stock certificates serve as proof of ownership for shareholders. They detail the number of shares owned and may include other pertinent information.

- Annual Report: Most states, including Kansas, require corporations to file annual reports. These reports update the state on the corporation's activities, financial status, and any changes in management or structure.

Understanding these documents and their purposes can help streamline the incorporation process and ensure your corporation operates within the legal framework. Each document plays a vital role in establishing a solid foundation for your business, paving the way for future success.

Misconceptions

There are several misconceptions about the Kansas Articles of Incorporation form that can lead to confusion for those looking to establish a corporation in the state. Here are five common misunderstandings:

- Misconception 1: The Articles of Incorporation are the only requirement for forming a corporation in Kansas.

- Misconception 2: Filing the Articles of Incorporation guarantees immediate approval.

- Misconception 3: There is no need to include a registered agent in the Articles of Incorporation.

- Misconception 4: The Articles of Incorporation can be filed at any time without consequence.

- Misconception 5: The Articles of Incorporation do not need to be updated once filed.

While the Articles of Incorporation are essential, they are not the only requirement. Additional filings, such as obtaining an Employer Identification Number (EIN) from the IRS and registering for state taxes, may also be necessary.

Filing the Articles does not guarantee immediate approval. The Secretary of State reviews the documents, and approval can take time, especially if there are errors or omissions.

A registered agent is a legal requirement in Kansas. This person or entity receives official documents on behalf of the corporation, and their information must be included in the Articles.

Filing at the wrong time can have implications. For example, if a business is already operating, it is important to file the Articles promptly to limit personal liability and ensure compliance with state laws.

It is crucial to update the Articles if there are changes in the corporation, such as changes in the registered agent or business address. Failure to do so can lead to legal complications.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Kansas Articles of Incorporation are governed by the Kansas General Corporation Code, specifically K.S.A. 17-6001 et seq. |

| Purpose of Form | This form is used to officially create a corporation in the state of Kansas. |

| Required Information | Key details such as the corporation's name, duration, registered agent, and business address must be included. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Submission Method | Articles can be submitted online, by mail, or in person at the Kansas Secretary of State's office. |

Key takeaways

Filling out the Kansas Articles of Incorporation form is a critical step in establishing a corporation in the state. Understanding the key components of this process can help ensure compliance and facilitate a smoother incorporation experience. Here are some important takeaways:

- Accurate Information is Essential: Ensure that all information provided on the form is accurate and complete. This includes the corporation's name, address, and the names of the initial directors.

- Filing Fees Apply: Be aware that there is a filing fee associated with submitting the Articles of Incorporation. Check the current fee schedule to avoid any surprises.

- Purpose Statement: Clearly articulate the purpose of the corporation. This statement should reflect the primary activities the corporation will engage in, as it may impact future legal and operational matters.

- Review and Sign: Before submitting the form, review it thoroughly for any errors or omissions. The form must be signed by an incorporator, who can be an individual or a business entity.