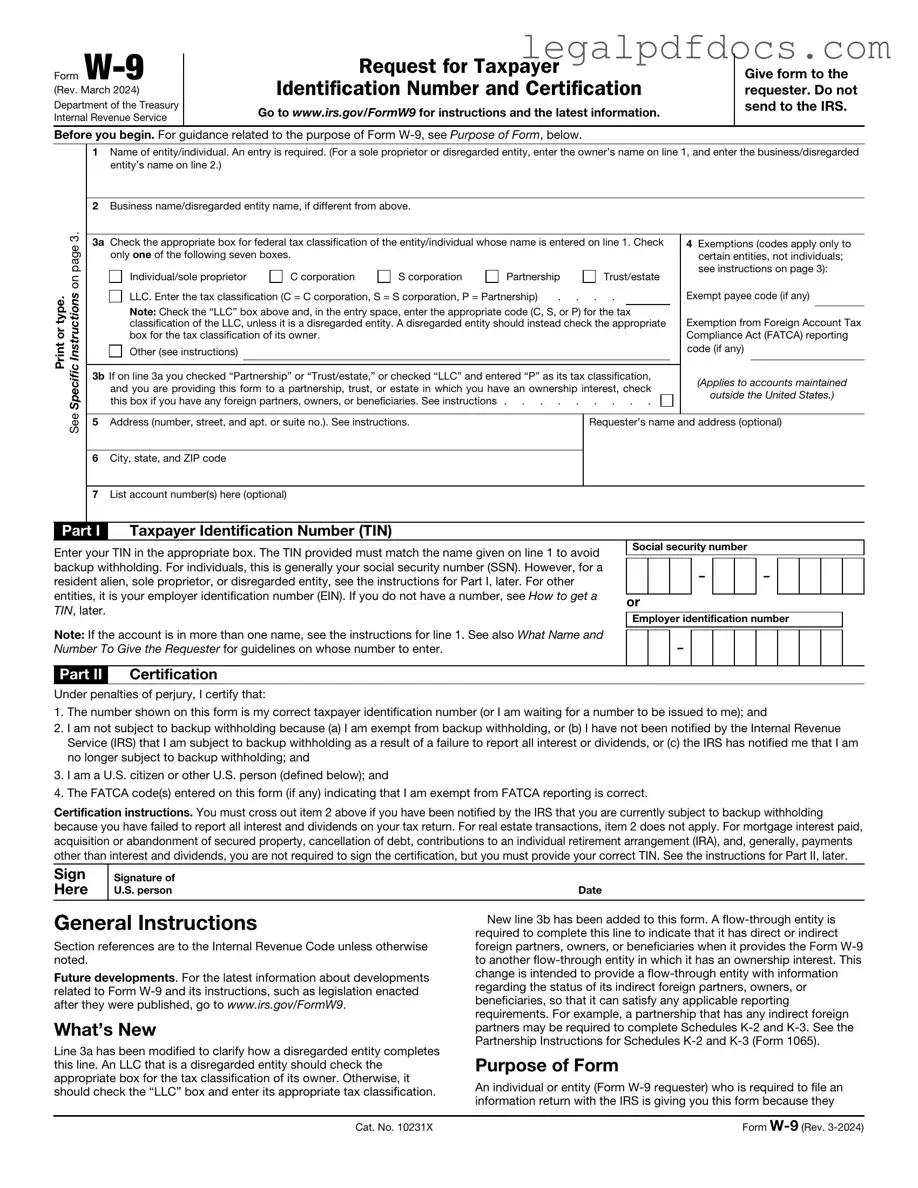

Fill Out a Valid IRS W-9 Template

The IRS W-9 form plays a crucial role in the landscape of tax documentation, serving as a request for taxpayer identification information. Individuals and businesses alike utilize this form to provide their correct name, business name (if applicable), and taxpayer identification number (TIN) to the entity that is requesting the information. This form is essential for independent contractors, freelancers, and other non-employees who receive payments that may require reporting to the IRS. By completing the W-9, recipients ensure that the payer can accurately report the income paid to them, typically on forms like the 1099-MISC or 1099-NEC. Moreover, the W-9 form also includes a certification section, where the individual confirms that the TIN provided is correct and that they are not subject to backup withholding. Understanding the nuances of the W-9 is vital for maintaining compliance with tax regulations and avoiding potential penalties. Whether you are a freelancer, a small business owner, or an individual receiving income, familiarizing yourself with this form can streamline your tax reporting process and safeguard your financial interests.

Dos and Don'ts

When filling out the IRS W-9 form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do provide your full legal name as it appears on your tax return.

- Don't use nicknames or abbreviations for your name.

- Do enter your business name if it differs from your legal name.

- Don't forget to check the appropriate box for your tax classification.

- Do provide your correct taxpayer identification number (TIN).

- Don't use a Social Security number (SSN) if you have an Employer Identification Number (EIN) for your business.

- Do ensure that all information is legible and accurate.

- Don't leave any required fields blank.

- Do sign and date the form before submission.

- Don't submit the form without reviewing it for errors.

How to Use IRS W-9

After completing the IRS W-9 form, it is essential to submit it to the requester, who may be an individual or an organization requiring your taxpayer information for reporting purposes. Ensure that you keep a copy for your records.

- Begin by downloading the IRS W-9 form from the official IRS website or obtaining a physical copy.

- At the top of the form, provide your name as it appears on your tax return.

- If applicable, enter your business name or disregarded entity name in the designated field.

- Check the appropriate box to indicate your federal tax classification (individual, corporation, partnership, etc.).

- Fill in your address, including street address, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If applicable, provide your account number(s) in the specified section.

- Sign and date the form to certify that the information provided is accurate.

More PDF Templates

CBP Declaration Form 6059B - Travelers should ask customs officials if they have questions about the form.

Five Wishes Document Pdf - Five Wishes is about creating a legacy of care that resonates with your personal values and desires.

Documents used along the form

The IRS W-9 form is an essential document used in various financial transactions, primarily for tax purposes. When working with independent contractors, freelancers, or other payees, several other forms and documents often accompany the W-9 to ensure proper reporting and compliance. Here’s a list of some commonly used forms and documents that may be relevant in conjunction with the W-9.

- IRS Form 1099-MISC: This form is used to report payments made to non-employees, such as independent contractors. If you pay someone $600 or more in a year, you must file a 1099-MISC to report that income.

- IRS Form 1099-NEC: This form is specifically for reporting non-employee compensation. It was reintroduced in 2020 to separate reporting for independent contractors from other types of income.

- IRS Form W-8BEN: Foreign individuals or entities use this form to certify their foreign status and claim tax treaty benefits. It helps ensure that the correct amount of tax is withheld from payments made to them.

- IRS Form W-4: Employees complete this form to determine the amount of federal income tax withholding from their paychecks. It is not directly related to the W-9 but is essential for employee tax withholding.

- IRS Form 1040: This is the individual income tax return form used by U.S. citizens and residents to report their annual income, including any income reported on 1099 forms.

- State Tax Forms: Various states have their own tax forms for reporting income and withholding. These forms vary by state and may be required alongside federal forms.

- Business License: If you are hiring independent contractors, you may need to verify that they have the appropriate business licenses to operate legally in your state or locality.

- Contract Agreements: Written agreements between parties outline the terms of the work to be performed, payment details, and other relevant conditions. These documents help clarify expectations and responsibilities.

- Invoices: Independent contractors typically submit invoices for payment. These documents detail the services provided, payment terms, and can serve as proof of income for tax purposes.

- Payment Receipts: These are records provided to the payee after payment has been made. They confirm that payment was received and can be important for both parties for tracking income and expenses.

Understanding these forms and documents can help you navigate financial transactions more effectively. Whether you are a business owner, contractor, or individual, being aware of these essential documents will aid in ensuring compliance with tax regulations and maintaining clear financial records.

Misconceptions

The IRS W-9 form is an important document used in various financial transactions, but many people hold misconceptions about its purpose and usage. Here are nine common misconceptions explained:

-

The W-9 form is only for freelancers.

This is not true. While freelancers often use the W-9 form to provide their taxpayer information to clients, anyone who receives income that is reportable to the IRS may need to fill out a W-9, including contractors, vendors, and other payees.

-

You only need to fill out a W-9 once.

In reality, you may need to complete a new W-9 form if your information changes, such as a change in your name or address, or if your tax classification changes.

-

The W-9 form is the same as a W-2 form.

This is a common misunderstanding. The W-2 form is used by employers to report wages and taxes withheld for employees, while the W-9 is used to provide taxpayer information for independent contractors and other payees.

-

Filling out a W-9 means you will be audited.

Providing a W-9 does not trigger an audit. It simply allows the requester to report payments made to you to the IRS accurately. Audits are based on a variety of factors, not solely on the submission of this form.

-

The W-9 form is only for U.S. citizens.

This is incorrect. Non-U.S. citizens who are residents or have a valid taxpayer identification number can also fill out a W-9. However, non-resident aliens typically use a different form, the W-8.

-

You don’t need to provide a W-9 if you are under a certain income threshold.

This misconception can lead to issues. If you are paid for services, you may still need to provide a W-9 regardless of the amount, as the payer must report payments to the IRS if they exceed $600 in a year.

-

The W-9 form is only required for tax purposes.

While the primary purpose is tax-related, businesses may also require a W-9 for internal record-keeping and to ensure compliance with IRS regulations.

-

Once you submit a W-9, it cannot be revoked.

This is a misunderstanding. If your information changes or if you no longer wish to receive payments, you can submit a new W-9 form or communicate directly with the requester to update your information.

-

All W-9 forms are the same.

While the basic structure is consistent, there may be variations based on the specific needs of the requester. Always check that you are using the most current version of the form, as updates may occur.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-9 form is used to provide taxpayer identification information to businesses or individuals who are required to report payments made to you. |

| Who Uses It | Independent contractors, freelancers, and vendors typically fill out the W-9 form when working with a business. |

| Tax Identification Number | The form requires you to provide either your Social Security Number (SSN) or Employer Identification Number (EIN). |

| Submission | You do not send the W-9 form to the IRS. Instead, you give it to the requester who needs it for their records. |

| Frequency of Use | There is no limit to how many times you can be asked to fill out a W-9. Each new client or business may request one. |

| State-Specific Forms | Some states have their own forms similar to the W-9, such as California's Form 590, which complies with state tax laws. |

| Exemptions | Certain entities, like corporations, may be exempt from backup withholding, which is noted on the form. |

| Backup Withholding | If you do not provide a W-9, the requester may be required to withhold a percentage of your payments for tax purposes. |

| Validity | The W-9 form does not expire, but you should update it if your information changes, such as a name change or new tax identification number. |

Key takeaways

Understanding the IRS W-9 form is essential for anyone who needs to provide their taxpayer information. Here are some key takeaways:

- Purpose: The W-9 form is used to provide your correct taxpayer identification number (TIN) to the person or business that will be paying you. This is often required for freelance work or contract jobs.

- Who Needs It: Individuals, sole proprietors, and businesses that receive payments must fill out a W-9. If you’re earning money that requires reporting to the IRS, you will likely need to complete this form.

- Accuracy Matters: It’s crucial to fill out the form accurately. Errors can lead to delays in payment or issues with tax reporting. Double-check your name, TIN, and address before submitting.

- Submission: You do not send the W-9 to the IRS. Instead, you provide it to the requester, such as a client or employer, who will use the information for their records and tax reporting.

- Privacy Concerns: Since the W-9 contains sensitive information, ensure that you trust the person or organization receiving it. Always ask how your information will be used and stored.