Fill Out a Valid IRS Schedule C 1040 Template

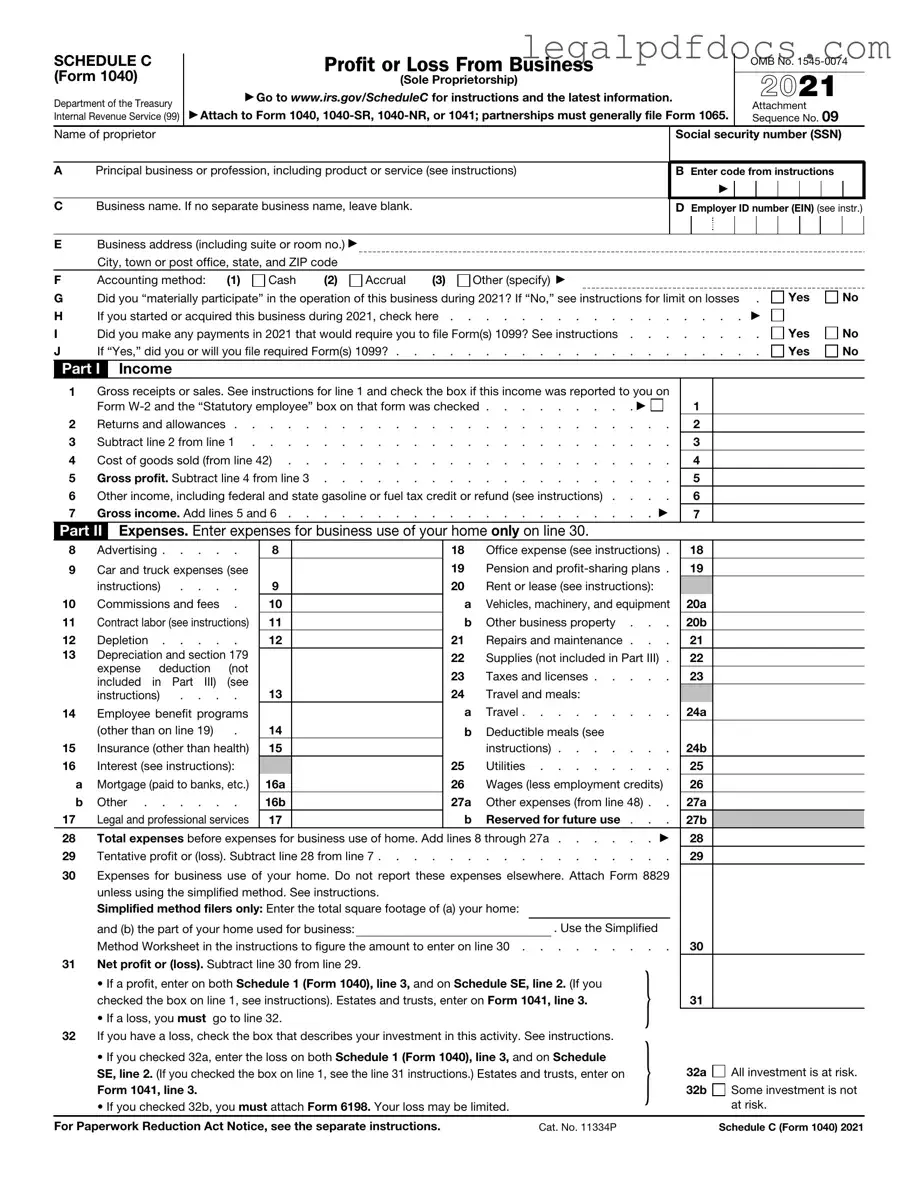

The IRS Schedule C (Form 1040) serves as a crucial tool for self-employed individuals and small business owners in the United States, enabling them to report income and expenses related to their business activities. This form captures essential financial details, allowing taxpayers to outline their earnings, deduct qualifying business expenses, and ultimately determine their net profit or loss for the year. By accurately completing Schedule C, individuals can take advantage of various deductions that may significantly reduce their taxable income, such as costs for supplies, equipment, and even home office expenses. Additionally, the form requires information about the type of business operated, providing the IRS with insight into the nature of the enterprise. Understanding how to navigate Schedule C is vital for anyone engaged in self-employment, as it not only impacts tax liability but also plays a role in future financial planning and business growth.

Dos and Don'ts

When filling out the IRS Schedule C 1040 form, there are important guidelines to follow. Here is a list of things you should and shouldn't do:

- Do gather all necessary documentation before starting.

- Do report all income accurately.

- Do keep detailed records of your business expenses.

- Do use the correct business classification code.

- Do review the form for any errors before submission.

- Don't exaggerate your expenses.

- Don't forget to sign and date the form.

- Don't leave any sections blank; fill out all applicable areas.

- Don't ignore IRS instructions or guidelines.

- Don't submit the form without making a copy for your records.

How to Use IRS Schedule C 1040

Filling out the IRS Schedule C 1040 form is a crucial step for self-employed individuals reporting their business income and expenses. This form allows you to detail your earnings and deductions, which ultimately impacts your tax liability. Follow these steps to complete the form accurately.

- Gather your business records. Collect all necessary documents, including income statements, receipts, and any other relevant financial information.

- Start with your basic information. Fill in your name, Social Security number, and business name at the top of the form.

- Indicate your business structure. Specify whether you operate as a sole proprietorship, partnership, or another structure.

- Report your income. In Part I, list your gross receipts or sales from your business. Be sure to include all sources of income.

- Calculate your expenses. In Part II, categorize and total your business expenses. Common categories include advertising, car and truck expenses, and supplies.

- Subtract your total expenses from your total income. This will give you your net profit or loss. Enter this amount on the appropriate line.

- Complete the remaining sections. If applicable, fill out any additional parts of the form, such as information on vehicle use or home office deductions.

- Review your entries. Double-check all information for accuracy and completeness before submitting the form.

- Sign and date the form. Ensure that you sign and date the form before filing it with the IRS.

After completing the Schedule C, you will need to submit it along with your Form 1040 by the tax deadline. Keeping copies of your forms and records is essential for your files and any potential audits.

More PDF Templates

Medical Prescription Paper - Keep this form updated to reflect any new health information you provide.

P 45 Meaning - The form assists in maintaining accurate tax records for employees during transitions.

Documents used along the form

When filing taxes as a sole proprietor, several forms and documents may accompany the IRS Schedule C (Form 1040). Each of these documents serves a specific purpose and helps to provide a complete picture of your financial situation.

- Form 1040: This is the main individual income tax return form. It summarizes your total income, deductions, and tax liability.

- Schedule SE: This form calculates self-employment tax. It is used to report income from self-employment and determine the amount owed for Social Security and Medicare.

- Form 4562: This form is used to claim depreciation on assets and to report certain business expenses. It helps to account for the wear and tear of business property over time.

- Form 8829: This form is for claiming expenses for business use of your home. It allows you to deduct a portion of your home expenses if you use part of your home exclusively for business.

- Form 1099-MISC: This form reports income received from clients or other sources. It is essential for tracking income that is not reported on a W-2.

- Receipts and Invoices: Keeping detailed records of all business-related expenses is crucial. These documents support deductions claimed on Schedule C and provide proof of income and expenses.

Gathering these documents ensures accurate reporting and compliance with tax regulations. Proper preparation can simplify the filing process and help avoid potential issues with the IRS.

Misconceptions

The IRS Schedule C 1040 form is an essential document for self-employed individuals and small business owners. However, several misconceptions can lead to confusion and errors. Here are ten common misconceptions about this form:

- Only business owners need to file Schedule C. Many people believe that only those who run a formal business must complete this form. In reality, anyone who earns income from self-employment, including freelancers and gig workers, must file.

- All income must be reported on Schedule C. Some individuals think they can exclude certain income types. However, all income from self-employment activities must be reported, regardless of the source.

- Expenses can only be deducted if they are receipts. Many assume that only documented expenses qualify for deductions. In fact, reasonable estimates can be used for some expenses, provided they are justifiable.

- Schedule C is only for profit-making businesses. Some individuals believe that if their business operates at a loss, they do not need to file. However, even if a business is not profitable, filing Schedule C is still necessary to report losses.

- Filing Schedule C guarantees a tax refund. There is a misconception that completing this form will automatically result in a refund. Refunds depend on various factors, including total income, deductions, and tax credits.

- Once filed, Schedule C cannot be amended. Some people think that changes cannot be made after submission. In reality, taxpayers can amend their Schedule C using Form 1040-X if they discover errors.

- Self-employment tax is only based on profit. Many believe that only net income is subject to self-employment tax. However, the entire income from self-employment is considered when calculating this tax.

- There are no penalties for late filing. Some individuals think they can file Schedule C at their convenience without consequences. However, late filings can incur penalties and interest, which can add up quickly.

- Schedule C is the same for every business type. Many assume that the form is uniform for all businesses. In truth, different types of businesses may have unique considerations that affect how they complete the form.

- Professional help is unnecessary. Some believe they can handle Schedule C without assistance. While many can, seeking professional guidance can help avoid mistakes and ensure compliance with tax laws.

Understanding these misconceptions is crucial for accurate tax reporting and compliance. Taking the time to clarify these points can prevent costly errors and ensure proper handling of your self-employment income.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used to report income or loss from a business operated as a sole proprietorship. |

| Eligibility | Individuals who operate a business as a sole proprietor can file Schedule C. |

| Income Reporting | All income earned from the business must be reported on Schedule C, including cash and non-cash payments. |

| Expenses | Business expenses can be deducted, reducing taxable income. Common deductions include supplies, utilities, and travel expenses. |

| Net Profit or Loss | The difference between income and expenses is calculated to determine net profit or loss, which is then transferred to Form 1040. |

| Filing Deadline | Schedule C must be filed by the tax return deadline, typically April 15, unless an extension is granted. |

| Record Keeping | Accurate records of income and expenses are essential for completing Schedule C and for potential audits. |

| Self-Employment Tax | Net earnings from Schedule C are subject to self-employment tax, which contributes to Social Security and Medicare. |

| State-Specific Forms | Some states require additional forms for reporting business income. For example, California has its own Schedule C equivalent under California Revenue and Taxation Code. |

| Amendments | If errors are found after filing, taxpayers can amend their return using Form 1040-X, which includes updated Schedule C information. |

Key takeaways

Filling out the IRS Schedule C (Form 1040) can be an essential task for self-employed individuals and small business owners. Understanding the key aspects of this form can help ensure accurate reporting of income and expenses. Here are some important takeaways to consider:

- Purpose of Schedule C: This form is used to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

- Record Keeping: Keep detailed records of all business income and expenses throughout the year. Good record-keeping simplifies the process of filling out the form.

- Income Reporting: Report all income earned from your business. This includes cash, checks, and credit card payments. Be thorough to avoid underreporting.

- Deductible Expenses: Familiarize yourself with what expenses you can deduct. Common deductions include costs for supplies, utilities, and travel related to your business.

- Home Office Deduction: If you use part of your home for business, you may qualify for a home office deduction. Ensure you understand the requirements to claim this deduction.

- Net Profit or Loss: The bottom line of Schedule C will show your net profit or loss. This figure is important as it affects your overall tax liability.

- Filing Deadlines: Be aware of the tax filing deadlines. Schedule C is typically due on the same day as your personal tax return, which is usually April 15.

- Seek Professional Help: If you find the process overwhelming, consider consulting a tax professional. They can provide guidance tailored to your specific situation.

By keeping these key points in mind, you can navigate the process of filling out Schedule C more effectively. Remember, accurate reporting is crucial for compliance and can help you maximize your deductions.