Fill Out a Valid IRS 941 Template

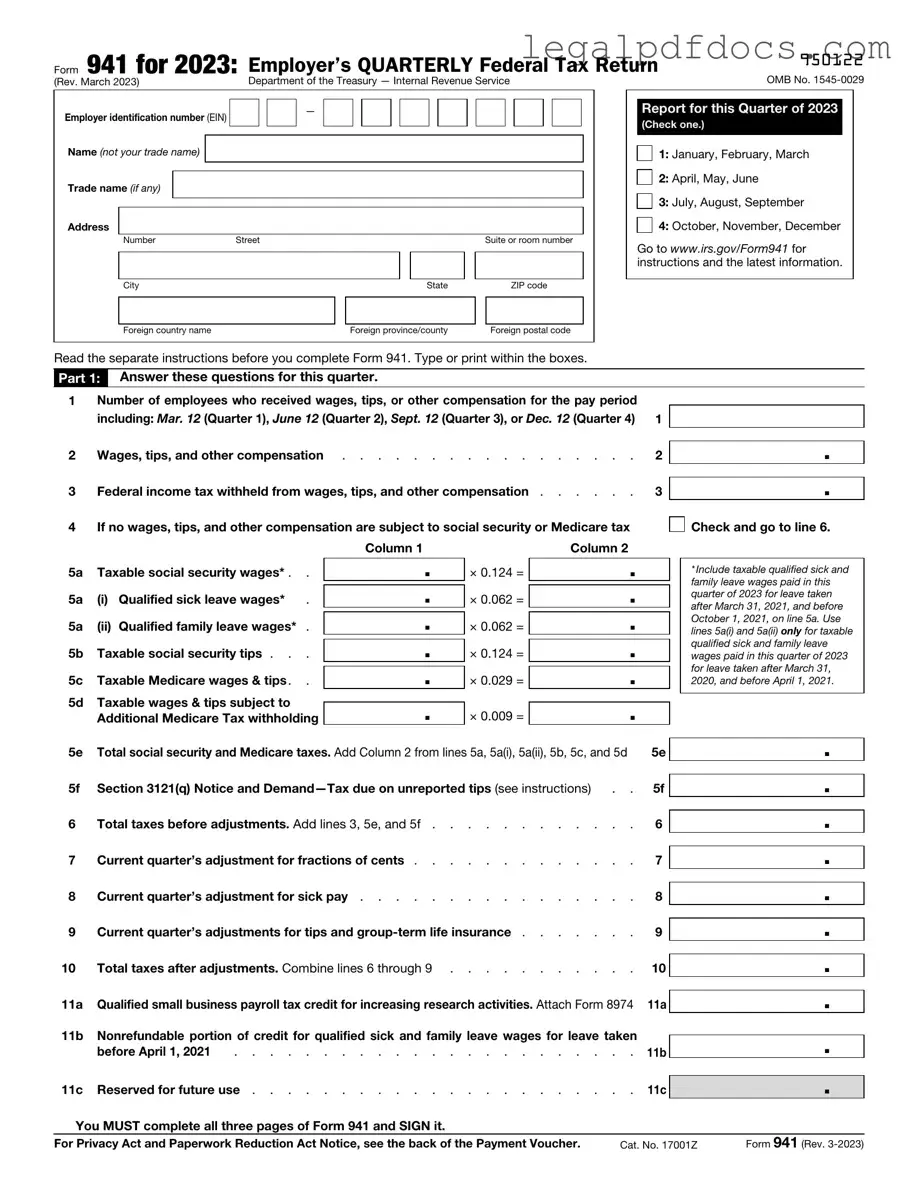

The IRS 941 form plays a crucial role in the landscape of payroll reporting for employers in the United States. This quarterly tax form is designed to help businesses report income taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks. Each quarter, employers must accurately complete and submit this form to the Internal Revenue Service to ensure compliance with federal tax regulations. The form not only details the wages paid to employees but also provides a breakdown of the taxes withheld, offering a comprehensive snapshot of an employer's tax obligations. Additionally, it allows for the reporting of adjustments to tax liabilities, ensuring that any overpayments or underpayments are accounted for. Understanding the nuances of the IRS 941 form is essential for employers, as timely and accurate submissions can prevent penalties and interest charges, thereby safeguarding a business's financial health. For many, navigating this form can seem daunting, but with a clear grasp of its components and requirements, employers can streamline their payroll processes and maintain compliance with federal tax laws.

Dos and Don'ts

When filling out the IRS 941 form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts:

- Do double-check all entries for accuracy before submission.

- Do use the correct tax year and quarter for the form.

- Do report all wages, tips, and other compensation accurately.

- Do include all applicable tax credits to reduce your tax liability.

- Don't forget to sign and date the form before sending it.

- Don't leave any required fields blank; provide all necessary information.

- Don't use pencil or erasable ink; always use black or blue ink.

- Don't submit the form late; be mindful of deadlines to avoid penalties.

How to Use IRS 941

Once you have gathered all necessary information, you’re ready to fill out the IRS Form 941. This form is essential for reporting your payroll taxes, and completing it accurately ensures compliance with federal regulations. Follow the steps below to fill out the form correctly.

- Begin by entering your business information at the top of the form. This includes your name, address, and Employer Identification Number (EIN).

- In the section for reporting the quarter, indicate the correct quarter for which you are filing. Ensure you select the right year as well.

- Next, report the number of employees you had during the quarter. This information helps calculate your tax obligations.

- Fill in the total wages, tips, and other compensation paid to employees during the quarter. Be precise to avoid discrepancies.

- Calculate and enter the total amount of federal income tax withheld from your employees’ paychecks.

- Report the total amount of Social Security and Medicare taxes owed. This includes both the employee and employer portions.

- If applicable, indicate any adjustments for fractions of cents, sick pay, or other specific adjustments.

- Determine your total tax liability for the quarter by adding the amounts from the previous steps.

- Complete the section regarding any deposits you’ve made for the quarter. This includes any payments made towards your tax liability.

- Finally, sign and date the form. Ensure that the person signing is authorized to do so on behalf of the business.

After filling out the form, review all entries for accuracy. Once confirmed, submit it to the IRS by the deadline. Keeping a copy for your records is also a good practice.

More PDF Templates

Miscellaneous Information - Keep track of all payments made to contractors and vendors to simplify your 1099-MISC reporting.

Roof Quote Template - Indicate if you have already chosen a roofing contractor.

Documents used along the form

The IRS Form 941 is essential for employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. However, several other forms and documents often accompany it to ensure compliance with tax obligations. Below is a list of these commonly used forms.

- IRS Form 940: This form is used to report annual Federal Unemployment Tax Act (FUTA) tax. Employers file it to determine their liability for unemployment taxes based on employee wages.

- IRS Form W-2: This form is issued to employees at the end of the year. It reports wages, tips, and other compensation, along with the taxes withheld. Employers must provide a W-2 to each employee and file copies with the IRS.

- IRS Form W-3: This is a summary form that accompanies the W-2 forms when submitted to the IRS. It provides a total of all W-2s issued by an employer, ensuring accurate reporting of wages and tax withholdings.

- IRS Form 1099: Various types of 1099 forms are used to report income other than wages, salaries, and tips. For example, Form 1099-MISC is often issued to independent contractors, detailing payments made throughout the year.

Understanding these additional forms helps employers stay organized and compliant with tax regulations. Proper documentation not only aids in accurate reporting but also minimizes the risk of penalties or audits from the IRS.

Misconceptions

The IRS Form 941 is a crucial document for employers in the United States. However, various misconceptions about this form can lead to confusion and errors in filing. Below is a list of ten common misconceptions regarding Form 941, along with clarifications for each.

- Form 941 is only for large employers. Many believe that only large employers need to file this form. In reality, all employers who withhold income tax, Social Security, or Medicare from employee wages must file Form 941, regardless of their size.

- Form 941 is filed annually. Some think that Form 941 is an annual filing requirement. In fact, it is a quarterly form that must be filed four times a year, typically by the last day of the month following the end of each quarter.

- Only employees need to be reported on Form 941. A common misconception is that Form 941 only pertains to employees. However, it also includes information about certain non-employee compensation, such as payments to independent contractors in specific situations.

- Form 941 can be filed at any time. Many assume that they can file Form 941 whenever they choose. In truth, there are strict deadlines for submission, and late filings may incur penalties.

- Form 941 does not require payment of taxes. Some individuals think that filing Form 941 does not involve any tax payments. However, employers must also pay the taxes they report on this form, including withheld income tax and the employer's share of Social Security and Medicare taxes.

- Form 941 is not necessary if there are no employees. It is a common belief that if an employer has no employees during a quarter, they do not need to file Form 941. However, if an employer has previously filed and has no employees for a quarter, they must still file a Form 941 to indicate that there are no wages or taxes due.

- Filing Form 941 is optional. Some employers think that filing Form 941 is optional. This is incorrect; it is a mandatory requirement for employers who meet certain criteria related to payroll taxes.

- Form 941 can be filed electronically only. There is a misconception that Form 941 can only be filed electronically. While electronic filing is encouraged and often preferred, employers can still file paper forms if they choose to do so.

- Corrections to Form 941 can be made on subsequent filings. Some believe that they can simply correct errors in future filings. However, if an error occurs, a specific process must be followed to amend the original Form 941, which may involve filing Form 941-X.

- All states have the same rules for Form 941. It is a common misconception that the rules governing Form 941 are uniform across all states. In reality, while the federal requirements apply nationwide, individual states may have additional requirements or different forms related to state employment taxes.

Understanding these misconceptions can help employers navigate their responsibilities more effectively. Accurate filing of Form 941 is essential for compliance with federal tax obligations.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. |

| Filing Frequency | This form must be filed quarterly, specifically at the end of January, April, July, and October. |

| Eligibility | All employers who withhold taxes from employees must file Form 941, regardless of the size of their business. |

| State-Specific Forms | Some states may require additional forms for state income tax withholding. For example, California requires Form DE 9. |

| Penalties | Failure to file Form 941 on time can result in penalties, which increase over time if the form remains unfiled. |

| Electronic Filing | Employers can file Form 941 electronically, which can streamline the process and reduce errors. |

Key takeaways

The IRS Form 941 is an essential document for employers in the United States. It is used to report payroll taxes withheld from employees and the employer's share of Social Security and Medicare taxes. Here are some key takeaways about filling out and using this form:

- Filing Frequency: Employers must file Form 941 quarterly. This means it should be submitted four times a year, typically by the last day of the month following the end of each quarter.

- Accurate Reporting: Ensure that all information, including wages paid and taxes withheld, is reported accurately. Inaccuracies can lead to penalties and interest.

- Employee Count: Report the number of employees who received wages during the quarter. This figure is important for calculating certain tax obligations.

- Tax Liability: Calculate the total tax liability for the quarter. This includes both the employee and employer portions of Social Security and Medicare taxes.

- Payments: If you owe taxes, make sure to submit payments on time to avoid late fees. The IRS provides various payment options, including electronic payments.

- Signature Requirement: The form must be signed and dated by an authorized person. This could be the business owner or another designated individual.

- Amendments: If you discover an error after filing, you can amend your Form 941 by submitting Form 941-X. This is crucial for correcting any mistakes.

- Record Keeping: Maintain copies of all filed Forms 941 and related documents for at least four years. This is important for compliance and potential audits.

Understanding these key aspects of Form 941 can help ensure compliance and smooth operations for employers. Proper management of payroll taxes is crucial for maintaining a healthy business and avoiding unnecessary penalties.