Fill Out a Valid IRS 2553 Template

The IRS Form 2553 is an essential document for small business owners looking to elect S corporation status for their entity. This form allows qualifying corporations to be taxed as S corporations, which can lead to significant tax benefits, including avoiding double taxation on corporate income. Filing this form is crucial for businesses that meet specific criteria, such as having no more than 100 shareholders and only one class of stock. Additionally, the form requires careful attention to detail, as it must be submitted within a designated timeframe—typically within 75 days of the corporation's formation or by the 15th day of the third month of the tax year in which the election is to take effect. Completing Form 2553 accurately ensures that the business can enjoy the advantages of pass-through taxation, where income is reported on the shareholders' personal tax returns, thereby simplifying the overall tax process. Understanding the nuances of this form can empower business owners to make informed decisions about their tax strategy and corporate structure.

Dos and Don'ts

When filling out the IRS Form 2553, which is used to elect S Corporation status, there are several important dos and don'ts to keep in mind. This form is critical for businesses seeking to benefit from pass-through taxation. Below is a concise list to guide you through the process.

- Do ensure that all information is accurate and complete. Double-check names, addresses, and identification numbers.

- Do file the form on time. The deadline is typically within two months and 15 days after the beginning of the tax year.

- Do make sure that all shareholders consent to the S Corporation election. Their signatures are required on the form.

- Do consult with a tax professional if you have questions or uncertainties regarding your eligibility or the election process.

- Do keep a copy of the completed form for your records. This can be useful for future reference or in case of an audit.

- Don't submit the form without checking for errors. Mistakes can lead to delays or rejection of your election.

- Don't forget to review the eligibility requirements for S Corporations. Not all businesses qualify.

- Don't ignore the state requirements. Some states have additional forms or procedures for S Corporation elections.

- Don't assume that filing Form 2553 guarantees S Corporation status. The IRS must approve your application.

- Don't neglect to inform shareholders of any changes that may affect the S Corporation election after filing.

How to Use IRS 2553

Filling out the IRS Form 2553 is an important step for certain businesses that wish to elect S corporation status. Once the form is completed and submitted, the IRS will review it to determine if the election is accepted. Below are the steps to guide you through the process of filling out the form.

- Obtain a copy of IRS Form 2553. You can download it from the IRS website or request a paper copy.

- Provide the name of your corporation as it appears on your articles of incorporation in the designated field.

- Enter the address of your corporation, including the city, state, and ZIP code.

- Fill in the Employer Identification Number (EIN) if you have one. If you do not have an EIN, you may need to apply for one before completing this form.

- Indicate the date of incorporation in the appropriate section.

- Specify the tax year your corporation will follow. Most corporations choose a calendar year, but you can select a fiscal year if applicable.

- List the names and addresses of all shareholders. Each shareholder must sign the form, indicating their consent to the S corporation election.

- Complete the section regarding the number of shares of stock issued and outstanding.

- Sign and date the form. Ensure that an authorized officer of the corporation signs it.

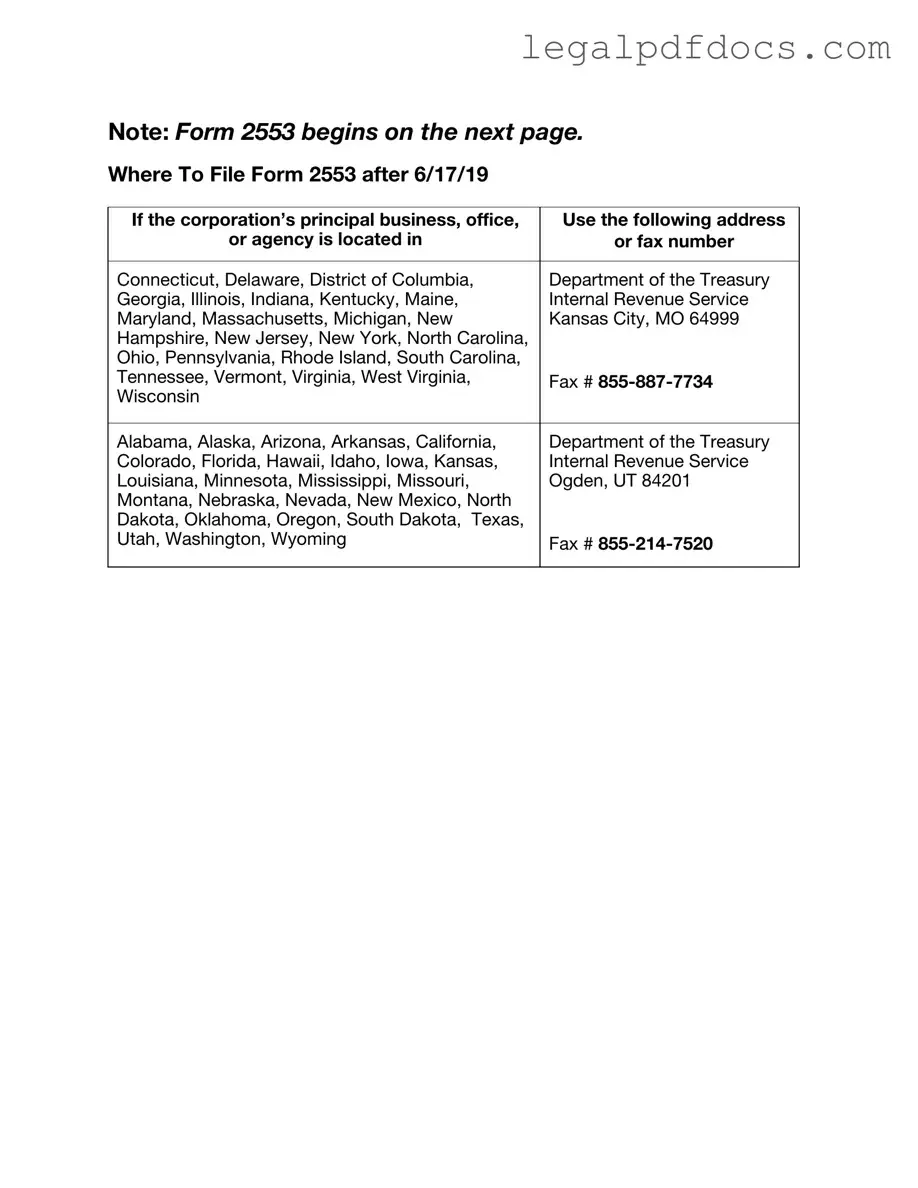

- Mail the completed form to the appropriate IRS address listed in the instructions, ensuring it is sent within the required timeframe.

After submitting the form, keep a copy for your records. The IRS will notify you of their decision regarding your S corporation election. If you have any questions during the process, consider consulting with a tax professional.

More PDF Templates

Goodwill Donation Form - This document is important for tax filing purposes.

T47 Paralympics - This affidavit plays an important role in the closing process of real estate deals.

Documents used along the form

When forming an S Corporation, submitting the IRS Form 2553 is just one step in the process. Several other forms and documents are often required to ensure compliance with federal and state regulations. Here’s a brief overview of five key documents that you might encounter along the way.

- IRS Form 1120S: This is the tax return form specifically for S Corporations. It reports income, deductions, and credits, and is essential for the corporation to fulfill its tax obligations annually.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN). An EIN is crucial for tax administration and is required for opening a business bank account, hiring employees, and filing tax returns.

- State S Corporation Election Form: Many states require their own form to elect S Corporation status. This form often mirrors the IRS Form 2553 but is specific to state regulations and must be filed in addition to the federal form.

- Operating Agreement: While not a formal requirement, an operating agreement outlines the management structure and operating procedures of the S Corporation. This document helps clarify roles and responsibilities among shareholders and can prevent disputes down the line.

- Form 941: This is the Employer's Quarterly Federal Tax Return. If your S Corporation has employees, you must file this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages.

Understanding these documents is essential for navigating the complexities of establishing and maintaining an S Corporation. Each plays a unique role in ensuring that your business operates smoothly and remains compliant with applicable laws.

Misconceptions

The IRS Form 2553 is an important document for small business owners looking to elect S corporation status. However, several misconceptions surround this form that can lead to confusion. Here are nine common myths debunked:

- Only large corporations need to file Form 2553. Many people think this form is only for big businesses. In reality, it's designed for small businesses that want to benefit from S corporation status, which can provide tax advantages.

- Form 2553 is only for new businesses. Some believe that only startups can file this form. Existing businesses can also elect S corporation status by submitting Form 2553, provided they meet the eligibility requirements.

- Filing Form 2553 guarantees S corporation status. While submitting the form is a crucial step, it doesn't automatically ensure approval. The IRS must review the application and confirm that the business meets all necessary criteria.

- You can file Form 2553 anytime during the year. Many think they can submit this form at any point. However, there are deadlines to be aware of. Generally, the form must be filed within two months and 15 days of the beginning of the tax year for which the election is to take effect.

- All businesses can qualify for S corporation status. It's a common misconception that any business can elect S corporation status. Only domestic corporations that meet specific criteria, such as having a limited number of shareholders, can qualify.

- Form 2553 is too complicated to fill out. Some people shy away from filing because they think the form is overly complex. While it does require accurate information, many find it manageable with a little guidance and preparation.

- Once you file Form 2553, you can never change your status. This myth suggests that filing is a permanent decision. In fact, businesses can revoke their S corporation status or re-elect it in the future, subject to certain conditions.

- Filing Form 2553 eliminates all tax obligations. Some believe that electing S corporation status means they won't owe taxes. While S corporations can avoid double taxation, they still have tax obligations at both the federal and state levels.

- Professional help is unnecessary for filing Form 2553. Many think they can handle the form on their own without any assistance. While some may successfully file independently, consulting a tax professional can help ensure accuracy and compliance with IRS regulations.

Understanding these misconceptions can help small business owners navigate the process of electing S corporation status more effectively. Being informed is the first step toward making the best choices for your business.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect to be taxed as an S corporation. |

| Eligibility | To qualify for S corporation status, the business must meet specific criteria, including having no more than 100 shareholders. |

| Filing Deadline | The form must be filed within 75 days of the beginning of the tax year for which the election is to take effect. |

| Shareholder Requirements | Shareholders must be individuals, certain trusts, or estates, and cannot be partnerships or corporations. |

| State-Specific Forms | Some states require their own forms for S corporation election, such as California's Form 100S. |

| Revocation of Election | An S corporation can revoke its election by filing a statement with the IRS, but specific procedures must be followed. |

| Tax Benefits | S corporations generally enjoy pass-through taxation, meaning income is taxed at the shareholder level, not at the corporate level. |

| Form Components | The form requires information such as the name of the corporation, address, and the date of incorporation. |

| IRS Approval | Once submitted, the IRS will notify the corporation if the election has been accepted or if further information is needed. |

Key takeaways

Filling out and using the IRS Form 2553 is crucial for small business owners who wish to elect S Corporation status. Here are key takeaways to keep in mind:

- The form must be filed within 75 days of the beginning of the tax year for which the election is to take effect.

- All shareholders must consent to the S Corporation election. This consent is documented on the form.

- The business must meet specific eligibility requirements, including having no more than 100 shareholders and only one class of stock.

- Shareholders must be individuals, certain trusts, or estates. Corporations and partnerships cannot be shareholders.

- Filing the form is done by mailing it to the appropriate IRS address, which can vary based on the location of the business.

- Late elections may be accepted under certain circumstances, but this requires additional documentation and justification.

- Form 2553 must be signed and dated by an authorized officer of the corporation.

- Once approved, the S Corporation status allows the business to avoid double taxation on corporate income.

- It is advisable to keep a copy of the completed form for your records, as well as any correspondence with the IRS regarding the election.