Fill Out a Valid IRS 1120 Template

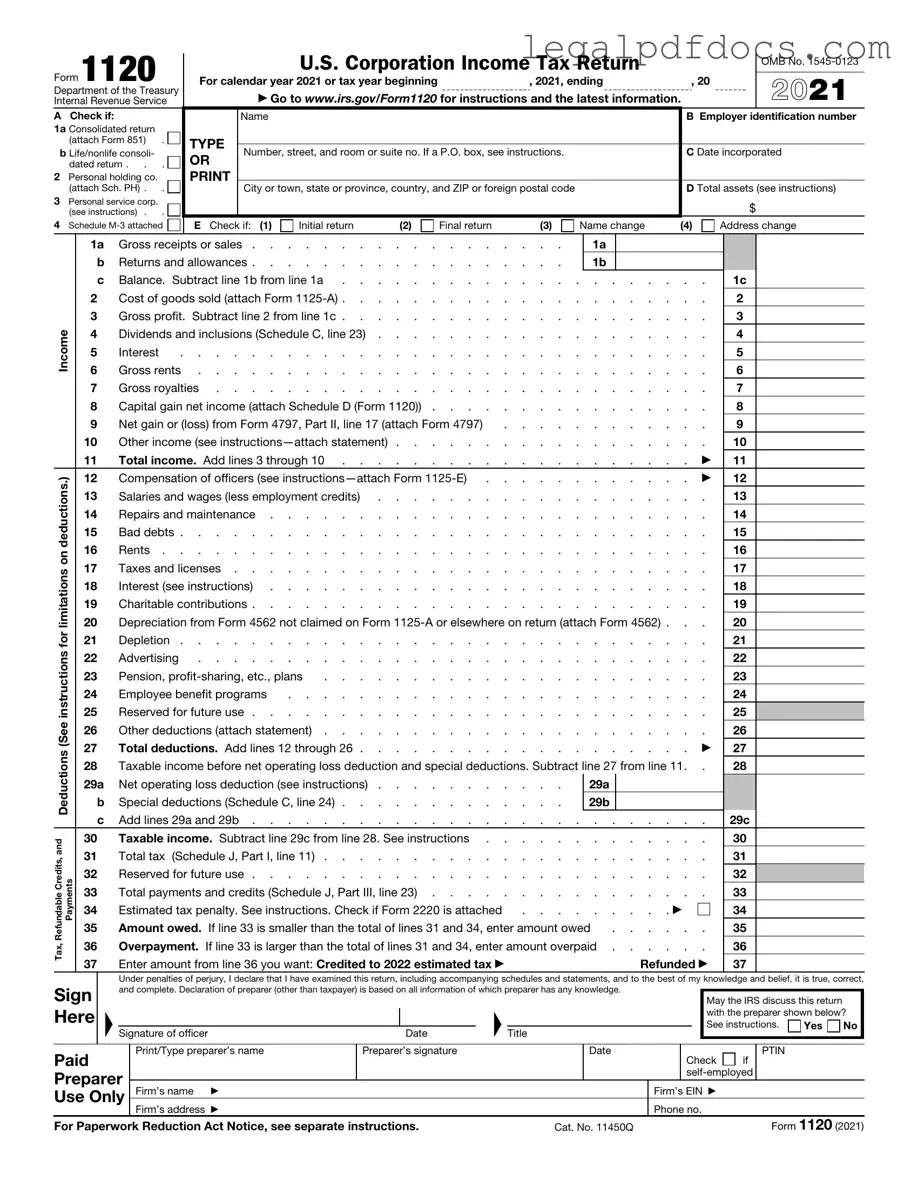

The IRS Form 1120 serves as a crucial document for corporations operating within the United States, reflecting their financial activities over the course of a tax year. This form is not merely a requirement; it provides a comprehensive overview of a corporation’s income, deductions, and credits, ultimately determining the tax liability owed to the federal government. Corporations must report their earnings, which include revenue from sales and services, alongside any other income sources. Deductions play a pivotal role, allowing businesses to reduce their taxable income by accounting for necessary expenses such as salaries, rent, and utilities. Additionally, Form 1120 requires corporations to disclose information about their shareholders and any dividends distributed, ensuring transparency in financial reporting. Understanding the intricacies of this form can significantly impact a corporation's financial health and compliance status, making it essential for business owners and financial professionals alike to navigate its requirements with diligence and care.

Dos and Don'ts

When filling out the IRS 1120 form, careful attention to detail is crucial. Here are ten important dos and don'ts to keep in mind:

- Do ensure that all information is accurate and complete.

- Don't forget to double-check your math; errors can lead to delays or audits.

- Do use the latest version of the form available on the IRS website.

- Don't ignore the instructions; they provide essential guidance for proper completion.

- Do keep copies of all documents submitted for your records.

- Don't overlook deadlines; timely submission is critical to avoid penalties.

- Do consult a tax professional if you have questions or uncertainties.

- Don't rush through the form; take your time to ensure accuracy.

- Do sign and date the form before submitting it.

- Don't forget to report all income, including any foreign income, if applicable.

Following these guidelines can help ensure a smoother filing process and reduce the risk of complications with the IRS.

How to Use IRS 1120

Completing the IRS 1120 form is an essential task for corporations to report their income, gains, losses, deductions, and credits. Following the steps below will help ensure that the form is filled out accurately and submitted on time.

- Gather necessary documents: Collect financial statements, income records, and any relevant tax documents.

- Obtain the IRS 1120 form: Download the form from the IRS website or request a paper copy.

- Fill in basic information: Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report income: Complete the income section by entering gross receipts or sales, returns and allowances, and other income sources.

- Calculate cost of goods sold: If applicable, fill out the cost of goods sold section to determine the gross profit.

- List deductions: Detail all deductions, including salaries, rent, and other business expenses, in the appropriate section.

- Determine taxable income: Subtract total deductions from gross income to find the taxable income.

- Calculate tax liability: Use the tax rate schedule to compute the tax owed based on the taxable income.

- Complete additional sections: Fill out any additional schedules or forms required based on your corporation's specific situation.

- Review the form: Double-check all entries for accuracy and completeness.

- Sign and date the form: Ensure that an authorized person signs the form before submission.

- Submit the form: File the completed form electronically or mail it to the appropriate IRS address.

Once the form is submitted, keep a copy for your records. Monitor any communications from the IRS regarding the status of your filing or any additional information they may require.

More PDF Templates

Medical Prescription Paper - It simplifies the process of getting medications by providing clear details.

P 45 Meaning - Additional forms may be needed if there are changes in employment status after leaving.

Miscarriage Discharge Papers - Patients can address inquiries directly related to their choices indicated on the form.

Documents used along the form

The IRS Form 1120 is essential for corporations in the United States to report their income, gains, losses, deductions, and credits. However, several other forms and documents are often required to ensure compliance and provide a complete picture of the corporation's financial activities. Below is a list of these documents, each playing a crucial role in the tax filing process.

- Schedule C: This schedule is used by corporations to report their cost of goods sold. It details the direct costs associated with the production of goods sold during the tax year, which is essential for calculating gross profit.

- Schedule G: This form provides information about the corporation's shareholders. It is important for reporting ownership and any changes in stock ownership during the tax year, which can affect tax obligations.

- Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is typically filed quarterly and is crucial for maintaining compliance with federal payroll tax requirements.

- Form 4562: This form is used to claim depreciation and amortization. It allows corporations to deduct the cost of certain assets over their useful lives, which can significantly impact taxable income.

Understanding these additional forms and documents is vital for accurate and timely tax filing. Each one serves a specific purpose and contributes to a comprehensive view of the corporation's financial situation, ensuring compliance with IRS regulations.

Misconceptions

The IRS Form 1120 is essential for corporations in the United States, but several misconceptions surround its purpose and requirements. Understanding these misconceptions can help clarify the filing process for business owners. Below are some common misunderstandings about Form 1120.

- Only large corporations need to file Form 1120. Many people believe that only large corporations are required to file this form. In reality, any corporation, regardless of size, must file Form 1120 if it is subject to federal income tax.

- Form 1120 is only for C corporations. While Form 1120 is primarily used by C corporations, S corporations also need to file a different form, specifically Form 1120-S. This distinction is important for understanding the different tax implications for each type of corporation.

- Filing Form 1120 is optional for corporations. Some individuals think that filing this form is optional. However, corporations must file Form 1120 annually to report their income, gains, losses, deductions, and credits.

- All income is taxed at the same rate on Form 1120. Many assume that all corporate income is taxed at a flat rate. In fact, the tax rate can vary based on the corporation's income level and other factors, and there may be deductions that can lower the taxable income.

- Form 1120 can be filed at any time during the year. It is a common belief that corporations can file Form 1120 whenever they choose. However, there are specific deadlines for filing, typically on the 15th day of the fourth month after the end of the corporation's tax year.

- Filing Form 1120 guarantees a refund. Some corporations might think that submitting Form 1120 will automatically result in a tax refund. However, whether a refund is issued depends on the corporation's tax situation, including any overpayments or credits.

- Once filed, Form 1120 cannot be amended. There is a misconception that corporations cannot amend Form 1120 after it has been submitted. In fact, if errors are discovered, corporations can file an amended return to correct any mistakes.

These misconceptions can lead to confusion regarding the responsibilities of corporations when it comes to filing taxes. It is essential for business owners to understand their obligations and ensure compliance with IRS requirements.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Deadline | Form 1120 must be filed by the 15th day of the fourth month after the end of the corporation's tax year. For calendar year corporations, this means April 15th. |

| Estimated Payments | Corporations may need to make estimated tax payments throughout the year if they expect to owe tax of $500 or more when filing their return. |

| State-Specific Forms | Many states have their own corporate tax forms, such as California Form 100, governed by the California Revenue and Taxation Code. |

| Electronic Filing | Corporations are encouraged to file Form 1120 electronically. This method is often faster and can help ensure accuracy. |

Key takeaways

The IRS Form 1120 is essential for corporations in the United States to report their income, gains, losses, deductions, and credits. Understanding how to fill out this form accurately is crucial for compliance and financial reporting. Here are some key takeaways regarding the form:

- Eligibility: Only corporations, including C corporations, must file Form 1120. Other business structures, like sole proprietorships and partnerships, use different forms.

- Filing Deadline: The form is typically due on the 15th day of the fourth month after the end of the corporation's tax year. For corporations on a calendar year, this means April 15.

- Income Reporting: Corporations must report all sources of income, including sales, dividends, and interest, on the form. Accurate reporting is essential for calculating tax liability.

- Deductions: Corporations can deduct certain business expenses, such as salaries, rent, and utilities. Understanding what qualifies as a deductible expense can help reduce taxable income.

- Tax Rates: The corporate tax rate is a flat rate, which was established by the Tax Cuts and Jobs Act. Corporations should be aware of the current tax rate to accurately calculate their tax owed.

- Schedule C: This schedule is used to report dividends, interest, and royalties. It’s important to complete this section if applicable, as it helps clarify income sources.

- Electronic Filing: Corporations are encouraged to file electronically. This method can simplify the process and reduce the likelihood of errors.

By keeping these points in mind, corporations can navigate the process of completing and submitting Form 1120 more effectively.