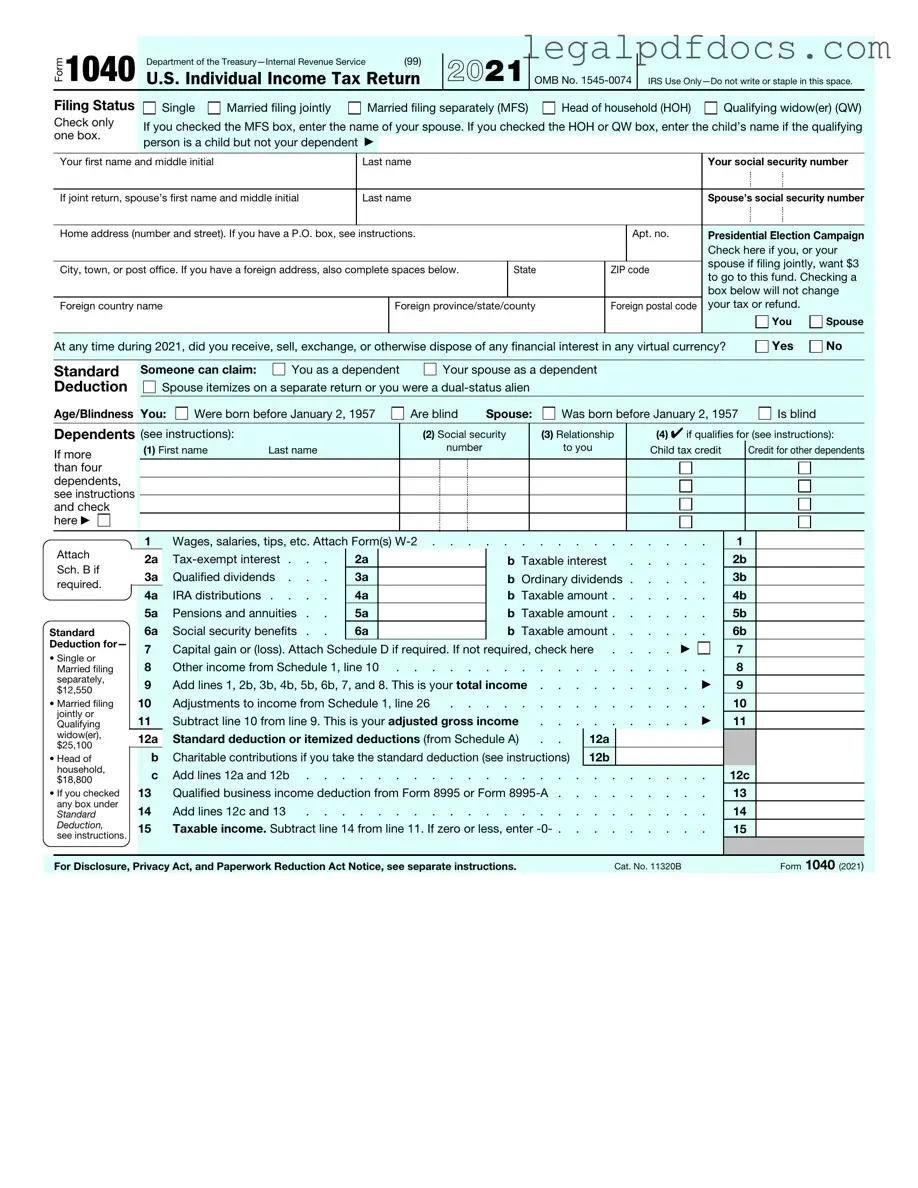

Fill Out a Valid IRS 1040 Template

The IRS 1040 form is a vital document for many Americans during tax season. This form allows individuals to report their income, claim deductions, and calculate their tax liability. Whether you're a salaried employee, self-employed, or a retiree, the 1040 form provides a structured way to present your financial information to the government. It includes sections for reporting wages, dividends, capital gains, and other sources of income. Additionally, taxpayers can claim various credits and deductions, such as the standard deduction or itemized deductions, which can significantly affect the amount of tax owed or refunded. The form also accommodates different filing statuses, allowing individuals to choose the one that best fits their situation, whether single, married filing jointly, or head of household. Understanding the nuances of the 1040 form is essential for ensuring compliance with tax laws and maximizing potential refunds. As you prepare to fill out this important document, knowing its key components will help streamline the process and alleviate some of the stress that often accompanies tax season.

Dos and Don'ts

Filling out the IRS 1040 form can be a straightforward process if you keep a few essential tips in mind. Here’s a list of things you should and shouldn’t do to ensure your tax filing goes smoothly.

- Do double-check your personal information, including your name, address, and Social Security number, for accuracy.

- Do gather all necessary documents, such as W-2s, 1099s, and any other income statements, before you start filling out the form.

- Do use the correct filing status that reflects your situation, whether you are single, married filing jointly, or head of household.

- Do claim all eligible deductions and credits to maximize your refund or minimize your tax liability.

- Don't rush through the form. Take your time to ensure that every section is filled out correctly.

- Don't forget to sign and date your return before submitting it, as an unsigned form is considered invalid.

By following these guidelines, you can help ensure that your tax filing is accurate and complete, leading to a smoother experience with the IRS.

How to Use IRS 1040

Completing the IRS 1040 form is an essential step in filing your annual tax return. After gathering all necessary documents, you can proceed to fill out the form accurately. Follow these steps to ensure you complete it correctly.

- Gather your documents, including W-2s, 1099s, and any other income statements.

- Enter your personal information at the top of the form, including your name, address, and Social Security number.

- Indicate your filing status by checking the appropriate box (e.g., single, married filing jointly).

- List your dependents, if applicable, including their names, Social Security numbers, and relationship to you.

- Report your income in the designated sections, including wages, dividends, and interest.

- Calculate your adjusted gross income (AGI) by subtracting any adjustments from your total income.

- Determine your taxable income by subtracting the standard deduction or itemized deductions from your AGI.

- Calculate your tax liability using the tax tables provided in the instructions.

- Account for any tax credits you qualify for, which will reduce your overall tax liability.

- Report any taxes you’ve already paid or withheld throughout the year.

- Determine whether you owe additional taxes or if you are due a refund.

- Sign and date the form at the bottom. If filing jointly, your spouse must also sign.

- Submit the completed form by mail or electronically, based on your preference and situation.

More PDF Templates

How to File a Trespassing Order - A clear message that entry onto my property is not allowed.

What Is Immunization Records - This form assists in adhering to public health guidelines for children's vaccinations.

Documents used along the form

The IRS 1040 form is a crucial document for individual taxpayers in the United States, serving as the foundation for reporting annual income and calculating tax liability. Alongside this form, several other documents and forms may be required to ensure a comprehensive and accurate tax return. Below is a list of commonly used forms and documents that complement the IRS 1040.

- W-2 Form: This form is provided by employers and details an employee's annual wages and the taxes withheld from their paycheck.

- 1099 Form: Various types of 1099 forms report income received from sources other than employment, such as freelance work or interest income.

- Schedule A: Used for itemizing deductions, this form allows taxpayers to detail specific expenses, such as medical costs and mortgage interest, to potentially lower their taxable income.

- Schedule C: For self-employed individuals, this form reports income and expenses related to business activities, helping to calculate net profit or loss.

- Schedule D: This form is utilized to report capital gains and losses from the sale of investments, such as stocks or real estate.

- Form 8862: If you have previously been denied the Earned Income Tax Credit (EITC), this form is necessary to claim it again, demonstrating eligibility.

- Form 8889: This form is used to report Health Savings Account (HSA) contributions and distributions, which may provide tax benefits.

- Form 1040-ES: This estimated tax payment form is for individuals who expect to owe tax of $1,000 or more when filing their return, allowing for quarterly payments.

- Form 8863: This form is used to claim education credits, helping to offset the costs of higher education for qualifying students.

Understanding these forms and documents is essential for ensuring a smooth tax filing process. Each plays a unique role in providing the necessary information to accurately complete the IRS 1040 form and fulfill tax obligations. By gathering these documents ahead of time, individuals can alleviate some of the stress often associated with tax season.

Misconceptions

The IRS 1040 form is a crucial document for individual taxpayers in the United States. However, several misconceptions exist regarding its use and requirements. Here are four common misunderstandings:

-

Everyone Must Use the 1040 Form:

Many people believe that all taxpayers are required to file a 1040 form. In reality, some individuals may qualify to use simpler forms, such as the 1040-EZ or 1040-A, depending on their specific financial situations.

-

Filing a 1040 Guarantees a Refund:

Another misconception is that completing a 1040 form will always result in a tax refund. Refunds depend on various factors, including income, deductions, and credits. Some taxpayers may actually owe money after filing.

-

Filing Late Always Leads to Penalties:

While it is true that filing a 1040 after the deadline can incur penalties, there are circumstances under which penalties may be waived. For example, if a taxpayer can show reasonable cause for the delay, they may not face penalties.

-

All Income Must Be Reported on the 1040:

Some individuals think that only certain types of income need to be reported on the 1040 form. However, all income, including side jobs and freelance work, must be reported to ensure compliance with tax laws.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1040 is used by individuals to file their annual income tax returns. |

| Filing Deadline | Typically, the deadline to file Form 1040 is April 15 of each year. |

| Income Reporting | Taxpayers report various types of income, including wages, dividends, and capital gains. |

| Deductions | Taxpayers can choose between standard deductions or itemized deductions to reduce taxable income. |

| Tax Credits | Eligible taxpayers can claim tax credits, which directly reduce the amount of tax owed. |

| State-Specific Forms | Many states require additional forms based on state tax laws, such as California's Form 540. |

| Signature Requirement | Taxpayers must sign and date the form to validate their submission. |

| Electronic Filing | Form 1040 can be filed electronically, which often speeds up processing times. |

Key takeaways

Filling out the IRS 1040 form is an important step in managing your taxes. Here are some key takeaways to keep in mind:

- Understand your filing status: Your filing status affects your tax rate and eligibility for certain credits. Make sure to choose the correct one based on your situation.

- Gather necessary documents: Collect all relevant documents, such as W-2s, 1099s, and other income statements before you start filling out the form.

- Report all income: Ensure that you report all sources of income, including wages, interest, dividends, and any freelance work.

- Take advantage of deductions: Familiarize yourself with available deductions that can lower your taxable income, such as student loan interest or mortgage interest.

- Consider credits: Look into tax credits that you may qualify for, such as the Earned Income Tax Credit or the Child Tax Credit, as these can directly reduce your tax bill.

- Double-check your math: Errors in calculations can lead to delays or issues with your return. Review your entries carefully.

- File on time: Ensure that you file your return by the deadline to avoid penalties. If you need more time, consider filing for an extension.

- Keep copies: After filing, retain copies of your completed form and any supporting documents for at least three years in case of an audit.

By following these key takeaways, you can navigate the IRS 1040 form more effectively and ensure a smoother tax filing experience.