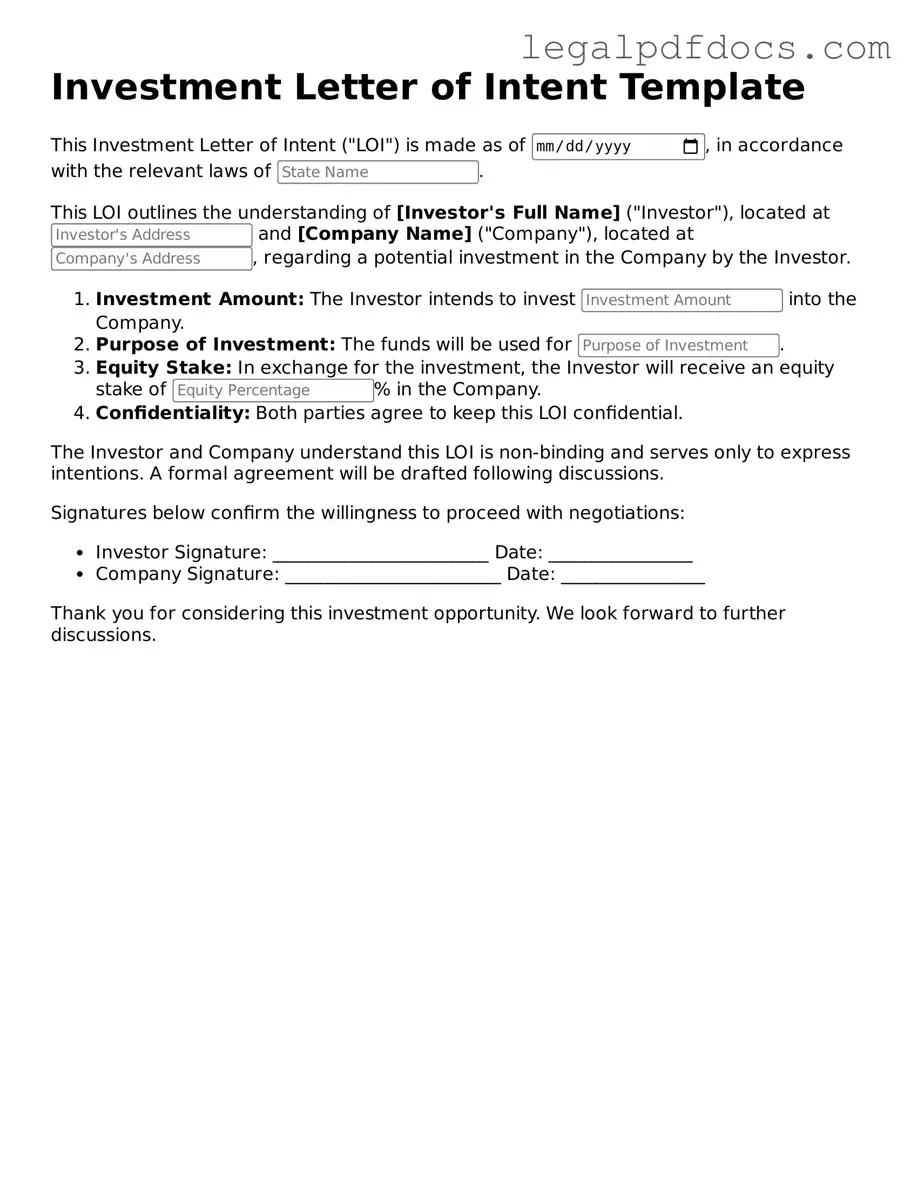

Investment Letter of Intent Template

The Investment Letter of Intent (LOI) serves as a crucial preliminary document in the investment process, outlining the intentions and expectations of the parties involved. This form typically addresses key elements such as the proposed investment amount, the structure of the transaction, and the timeline for due diligence and closing. It establishes a framework for negotiations, providing clarity on the terms that will govern the future agreement. Additionally, the LOI often includes confidentiality clauses to protect sensitive information shared during discussions. By clearly articulating the goals and responsibilities of each party, the Investment Letter of Intent fosters a sense of trust and cooperation, laying the groundwork for a successful partnership. Understanding its components can empower investors and businesses alike to navigate the complexities of investment transactions with confidence.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is crucial to approach the task with care. The following guidelines will help ensure that the process goes smoothly.

- Do: Read the entire form carefully before starting to fill it out.

- Do: Provide accurate and truthful information throughout the form.

- Do: Double-check all entries for spelling and numerical accuracy.

- Do: Ensure that you sign and date the form where required.

- Don't: Rush through the form; take your time to ensure completeness.

- Don't: Leave any required fields blank; this could delay processing.

- Don't: Use jargon or abbreviations that may not be understood.

- Don't: Submit the form without reviewing it for any errors or omissions.

How to Use Investment Letter of Intent

After obtaining the Investment Letter of Intent form, you are ready to begin the process of filling it out. This form is essential for outlining your intentions regarding an investment. Follow the steps below to ensure that you complete it accurately.

- Start with your personal information. Fill in your full name, address, and contact details at the top of the form.

- Provide the date on which you are completing the form. This is typically found near the top or in a designated date field.

- Identify the investment opportunity. Clearly state the name of the company or project you are interested in.

- Outline the amount you intend to invest. Be specific about the dollar amount and any conditions that may apply.

- Include any terms or conditions that are relevant to your investment. This may cover timelines, expected returns, or other stipulations.

- Sign and date the form. Your signature signifies your commitment to the stated intentions.

- Review the completed form for accuracy. Ensure that all information is correct and legible.

- Submit the form as instructed, whether electronically or by mailing a hard copy.

Check out Popular Types of Investment Letter of Intent Templates

Grant Letter of Intent Template - Outline your communication strategy for the project.

Documents used along the form

The Investment Letter of Intent form serves as a preliminary agreement between parties interested in a potential investment. This document outlines the basic terms and conditions that will govern future negotiations and agreements. Alongside this form, several other documents are commonly used to ensure clarity and mutual understanding in the investment process. Below are four key documents that often accompany the Investment Letter of Intent.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains protected. It establishes the obligations of both parties to keep proprietary information confidential, fostering trust and open communication.

- Term Sheet: A term sheet outlines the main terms and conditions of the investment deal. It serves as a summary of the agreement, detailing aspects such as investment amount, valuation, and equity stake. This document helps clarify expectations before formal contracts are drafted.

- Due Diligence Checklist: This checklist is used to guide the investigation process of the investment opportunity. It includes items that need to be reviewed, such as financial statements, legal documents, and operational details, ensuring that both parties are fully informed before proceeding.

- Investment Agreement: Once negotiations are complete, the investment agreement formalizes the terms established in the letter of intent and other documents. It is a legally binding contract that outlines the rights and obligations of each party, providing a framework for the investment relationship.

These documents, when used in conjunction with the Investment Letter of Intent, create a comprehensive foundation for successful investment negotiations. They help ensure that all parties are aligned in their expectations and commitments, ultimately facilitating a smoother investment process.

Misconceptions

The Investment Letter of Intent (LOI) is a critical document in the investment process, yet several misconceptions surround its purpose and function. Below is a list of common misunderstandings about this important form, along with clarifications to help demystify its role.

- Misconception 1: The LOI is a legally binding contract.

- Misconception 2: An LOI guarantees that a deal will be finalized.

- Misconception 3: The LOI is only necessary for large investments.

- Misconception 4: An LOI is a one-size-fits-all document.

- Misconception 5: The LOI can be ignored once signed.

- Misconception 6: The LOI should include every detail of the investment.

- Misconception 7: Only one party needs to draft the LOI.

- Misconception 8: An LOI cannot be modified once signed.

While the LOI outlines the intentions of the parties involved, it is typically not legally binding. Instead, it serves as a preliminary agreement that sets the stage for future negotiations.

Signing an LOI does not guarantee that a transaction will occur. It merely indicates that both parties are interested in pursuing the deal and are willing to negotiate further.

Regardless of the size of the investment, an LOI can be beneficial. It helps clarify the terms and intentions of both parties, which can prevent misunderstandings later on.

Each LOI should be tailored to the specific deal and parties involved. Different investments may require different terms and conditions, so customization is key.

Although the LOI is not legally binding, it still holds significance. It can guide the negotiation process and set expectations for both parties, making it important to adhere to its terms.

While the LOI should outline key terms and conditions, it does not need to include every detail. It serves as a summary of the main points that will be further developed in a more formal agreement.

Both parties should be involved in drafting the LOI. Collaboration ensures that all interests are represented and that both sides agree on the terms before moving forward.

Changes can be made to an LOI after it has been signed, as long as both parties agree to the modifications. Flexibility is often necessary as negotiations progress.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | An Investment Letter of Intent (LOI) outlines the preliminary terms of an investment agreement between parties. |

| Purpose | The LOI serves as a basis for negotiating a formal contract, establishing key terms and conditions before finalizing the deal. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that the parties are not legally obligated to proceed with the investment. |

| Key Components | Common elements include the investment amount, valuation, timelines, and confidentiality clauses. |

| State-Specific Forms | Some states may have specific requirements or forms for LOIs, governed by state laws such as the Uniform Commercial Code (UCC). |

| Due Diligence | The LOI often outlines the due diligence process that the investor will undertake before finalizing the investment. |

| Governing Law | LOIs may specify the governing law, which varies by state, affecting how disputes are resolved. |

Key takeaways

Filling out an Investment Letter of Intent form can be a crucial step in your investment journey. Here are some key takeaways to keep in mind:

- Understand the Purpose: The form outlines your intent to invest and helps clarify the terms before a formal agreement is made.

- Be Clear and Concise: Use straightforward language. Clearly state your investment goals and expectations.

- Include Key Details: Provide essential information such as the amount you intend to invest, the type of investment, and the timeframe.

- Review Before Submitting: Double-check all information for accuracy. Mistakes can lead to misunderstandings later on.

- Seek Professional Guidance: If you’re unsure about any part of the form, consider consulting with a financial advisor or legal professional.

- Keep a Copy: Always retain a copy of the submitted form for your records. This can be helpful for future reference.

- Follow Up: After submission, follow up with the recipient to ensure they received your letter and understand your intentions.

- Be Prepared for Next Steps: Filling out the form is just the beginning. Be ready to engage in further discussions or negotiations.