Fill Out a Valid Intent To Lien Florida Template

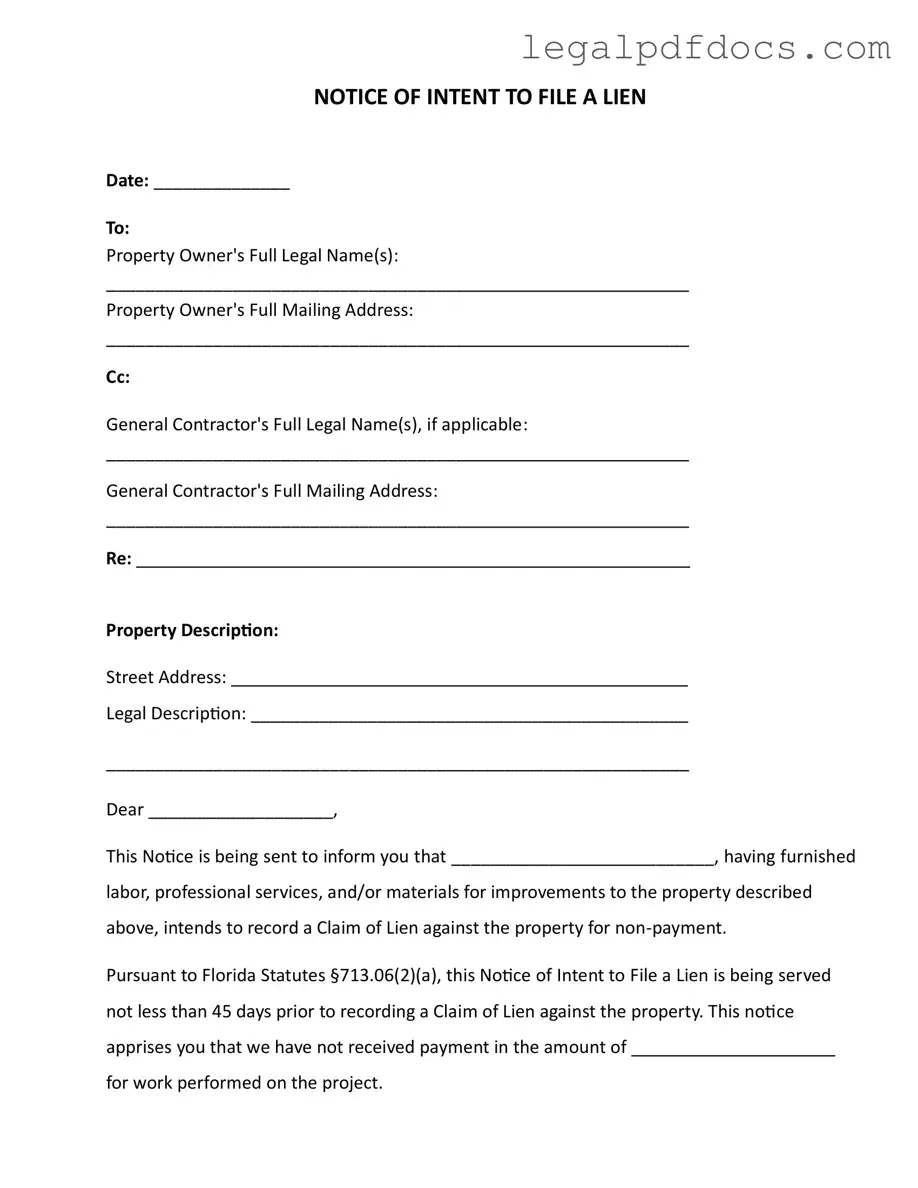

The Intent to Lien Florida form serves as a critical communication tool for contractors, suppliers, and service providers who have not received payment for their work on a property. This form is an official notice that alerts property owners about an impending claim of lien, which can be a serious matter. It includes essential information such as the date of the notice, the names and addresses of the property owner and general contractor, and a detailed description of the property in question. The notice clearly states the amount owed for the services or materials provided, emphasizing the importance of timely payment. According to Florida law, this notice must be sent at least 45 days before filing a lien, giving property owners a chance to address any payment issues. If payment is not made or a satisfactory response is not received within 30 days, the contractor may proceed to record a lien, potentially leading to foreclosure proceedings and additional costs for the property owner. This form also includes a certificate of service, ensuring that the notice has been properly delivered, which adds another layer of accountability to the process. Understanding the Intent to Lien form is essential for both property owners and contractors, as it outlines rights and responsibilities that can significantly impact their financial and legal standing.

Dos and Don'ts

When filling out the Intent to Lien Florida form, there are several important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do ensure all property owner names are correctly spelled and match legal documents.

- Do provide a complete mailing address for the property owner to ensure proper delivery.

- Do clearly describe the property, including both the street address and legal description.

- Do specify the amount owed for the work performed to avoid confusion.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to serve the notice at least 45 days before filing the lien.

- Don't neglect to keep a copy of the completed form for your records.

How to Use Intent To Lien Florida

After completing the Intent To Lien Florida form, you will need to serve it to the property owner and possibly the general contractor. This step is crucial to ensure that all parties are aware of your intent to file a lien due to non-payment. Timely delivery is essential, as it sets the stage for potential legal action if payment is not made.

- Date: Fill in the date at the top of the form.

- Property Owner's Name: Enter the full legal name(s) of the property owner(s).

- Property Owner's Mailing Address: Provide the full mailing address of the property owner(s).

- General Contractor's Name: If applicable, enter the full legal name(s) of the general contractor.

- General Contractor's Mailing Address: Include the full mailing address of the general contractor.

- Property Description: Write the street address of the property.

- Legal Description: Provide the legal description of the property.

- Amount Due: State the amount you are owed for the work performed.

- Your Name: Sign your name where indicated.

- Your Title: Enter your title or position.

- Your Contact Information: Fill in your phone number and email address.

- Certificate of Service: Indicate how the notice was served and provide the recipient’s name and address.

- Signature: Sign the certificate of service.

More PDF Templates

Employee Change Form Template - A necessary step for any HR status review process.

Pay Stub for Independent Contractor - Keeps track of multiple projects and their respective payments.

Doctor's Note to Return to Work - The form is not a guarantee of approval; it requires careful consideration from officials.

Documents used along the form

The Intent to Lien form is an essential document in Florida that serves as a preliminary notice to property owners regarding unpaid debts for services or materials provided. Alongside this form, several other documents may be required or beneficial in the lien process. Below is a list of related forms and documents commonly used in conjunction with the Intent to Lien Florida form.

- Claim of Lien: This document is filed after the Notice of Intent to Lien if payment is not made. It officially claims a lien against the property, detailing the amount owed and the nature of the work performed.

- Notice of Lien: Similar to the Claim of Lien, this notice informs interested parties that a lien has been placed on the property. It typically includes the same information as the Claim of Lien but serves as a notification rather than a legal claim.

- Waiver of Lien: This document is used to relinquish any claim to a lien on a property. It may be issued after payment is received, ensuring that the contractor or service provider no longer has a claim against the property.

- Release of Lien: Once payment is made, a Release of Lien is filed to officially remove the lien from the property records. This document provides proof that the debt has been settled.

- Notice to Owner: This form serves as a notification to the property owner that services or materials have been provided. It is often used by subcontractors and suppliers to establish their right to file a lien if necessary.

- Contractor's Affidavit: This document is typically used to affirm that all subcontractors and suppliers have been paid. It can be required before a release of lien is issued, ensuring that the property owner is protected from future claims.

- Payment Bond: In some cases, a payment bond may be required. This bond ensures that funds are available to pay for labor and materials, protecting subcontractors and suppliers from non-payment.

- Construction Contract: A written agreement between the property owner and the contractor, detailing the scope of work, payment terms, and other essential elements of the project. This document is foundational for any lien claims.

- Affidavit of Service: This form certifies that the Notice of Intent to Lien was properly served to the property owner and any relevant parties. It provides proof of delivery and is important in case of disputes.

Understanding these documents can help property owners and contractors navigate the lien process more effectively. Each form plays a critical role in ensuring that all parties are informed and protected throughout the construction or renovation project.

Misconceptions

Here are four common misconceptions about the Intent To Lien Florida form:

- It is a lien itself. Many people think that sending an Intent To Lien means a lien has already been placed on the property. In reality, this notice is a warning that a lien may be filed if payment is not made.

- It guarantees payment. Some believe that submitting this form ensures they will receive payment. However, it simply serves as a formal notice to the property owner about the outstanding debt.

- It can be ignored. A common misconception is that property owners can ignore this notice without consequence. Ignoring the Intent To Lien can lead to a lien being recorded, which may result in foreclosure proceedings.

- It has no legal implications. Some individuals think this notice is just a formality. In fact, it carries legal weight and can affect the property owner's credit and ability to sell the property.

File Specs

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form serves to notify property owners that a lien may be filed due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements and procedures for filing a lien in Florida. |

| Notice Period | The notice must be served at least 45 days prior to recording a Claim of Lien, ensuring the property owner is informed of potential actions. |

| Response Time | Property owners have 30 days to respond to the notice. Failure to respond may lead to the recording of a lien and possible foreclosure proceedings. |

Key takeaways

Filling out and using the Intent To Lien Florida form is an important step for those who have provided labor or materials for property improvements and have not received payment. Here are some key takeaways to keep in mind:

- Timeliness is Crucial: The form must be sent at least 45 days before recording a Claim of Lien. This timeline is mandated by Florida law, ensuring that property owners are informed well in advance.

- Clear Communication: It is essential to provide accurate information regarding the property owner, the general contractor (if applicable), and the property description. This clarity helps avoid any confusion regarding the lien.

- Consequences of Non-Payment: The notice warns that if payment is not made or a satisfactory response is not received within 30 days, a lien may be recorded. This could lead to foreclosure proceedings and additional costs for the property owner.

- Documentation is Key: Ensure that a copy of the notice is served properly and documented. The Certificate of Service section should be filled out accurately to confirm that the notice was delivered to the appropriate party.