Fill Out a Valid Independent Contractor Pay Stub Template

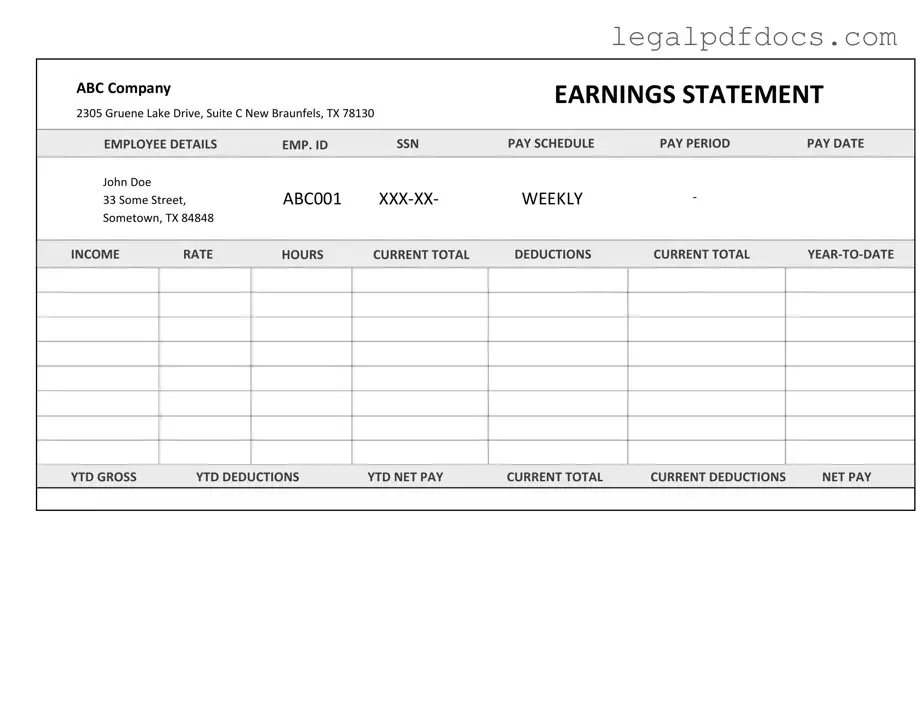

The Independent Contractor Pay Stub form is a vital document for both contractors and businesses that engage their services. This form provides a clear record of payments made to independent contractors, ensuring transparency in financial transactions. It typically includes essential details such as the contractor's name, payment date, and the amount earned for services rendered. Additionally, the form may outline any deductions or withholdings that apply, giving contractors a comprehensive view of their earnings. By using this pay stub, businesses can maintain accurate financial records, while contractors can easily track their income for tax purposes. Overall, the Independent Contractor Pay Stub form serves as an important tool for managing and documenting the financial relationship between independent contractors and the companies that hire them.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it’s important to ensure accuracy and clarity. Here’s a helpful list of dos and don’ts to guide you through the process.

- Do double-check all personal information, such as your name and address, to ensure it is correct.

- Do clearly itemize your services and the corresponding payment amounts for transparency.

- Do include the correct tax identification number to avoid any issues with tax reporting.

- Do keep a copy of the pay stub for your records.

- Don't leave any sections blank; incomplete forms can lead to delays in payment.

- Don't use unclear language or abbreviations that might confuse the recipient.

How to Use Independent Contractor Pay Stub

Once you have the Independent Contractor Pay Stub form ready, it’s time to fill it out accurately. Completing this form correctly ensures that all payment details are clear and organized for both the contractor and the payer.

- Begin by entering the contractor's full name at the top of the form.

- Provide the contractor's address, including street, city, state, and zip code.

- Fill in the date of the pay period. This indicates the start and end dates for the work completed.

- List the services provided by the contractor during the pay period.

- Input the total hours worked or the number of projects completed, depending on how the contractor is compensated.

- Specify the rate of pay per hour or per project. Ensure this aligns with any agreements made.

- Calculate the total amount due by multiplying the hours worked by the rate of pay, or by listing the total amount for projects.

- Include any deductions, if applicable, such as taxes or fees. Clearly itemize these deductions.

- Finally, sign and date the form to confirm that all information is accurate and complete.

More PDF Templates

How to File Taxes in Florida - It supports individuals who have limited time to manage their tax affairs.

Tuberculin Test - Healthcare providers use this form for patient records and follow-up care.

Documents used along the form

When working with independent contractors, several important documents may accompany the Independent Contractor Pay Stub form. Each of these documents serves a specific purpose and helps ensure clarity and compliance in the working relationship. Here are five forms that are commonly used alongside the pay stub:

- Independent Contractor Agreement: This document outlines the terms of the working relationship between the contractor and the hiring entity. It includes details about the scope of work, payment terms, and duration of the contract.

- W-9 Form: This form is used by independent contractors to provide their taxpayer identification information to the hiring company. It ensures that the company has the necessary details for tax reporting purposes.

- Invoice: Contractors often submit invoices to request payment for their services. An invoice typically includes the contractor's details, a description of the services provided, and the total amount due.

- 1099 Form: At the end of the tax year, businesses must issue a 1099 form to independent contractors who earned $600 or more. This form reports the total payments made to the contractor for tax purposes.

- Time Sheet: A time sheet records the hours worked by the contractor. It provides a detailed account of the time spent on various tasks and can be used to verify hours for payment.

Understanding these documents can help foster a transparent and efficient working relationship between independent contractors and their clients. Proper documentation protects both parties and ensures that all aspects of the work arrangement are clear and agreed upon.

Misconceptions

Many people have misunderstandings about the Independent Contractor Pay Stub form. Here are some common misconceptions:

- Independent contractors don’t need pay stubs. Some believe that since they are not traditional employees, pay stubs are unnecessary. However, pay stubs can help track income and expenses for tax purposes.

- Pay stubs are only for employees. This is not true. Independent contractors can also benefit from pay stubs to document their earnings and provide proof of income when applying for loans or other financial services.

- Independent contractors can create their own pay stubs. While it is possible to create a pay stub, it must be accurate and reflect true earnings. Misrepresentation can lead to legal issues.

- All pay stubs must look the same. There is no one-size-fits-all format for pay stubs. They can vary based on the contractor's business and the services provided.

- Pay stubs are not necessary for tax filing. Some think they can file taxes without any documentation. However, having a pay stub can simplify the process and help ensure accuracy.

- Independent contractors don’t have to report all income. This is a misconception. All income earned must be reported to the IRS, regardless of whether a pay stub is issued.

- Pay stubs are only for full-time contractors. Part-time and freelance workers also benefit from having pay stubs. They provide a clear record of earnings, no matter the hours worked.

- Pay stubs are optional for independent contractors. While not legally required, having a pay stub can provide important documentation for financial planning and tax preparation.

Understanding these misconceptions can help independent contractors better manage their finances and stay compliant with tax regulations.

File Specs

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for independent contractors. |

| Purpose | This form provides a clear record of payments made to independent contractors, helping both parties track earnings and tax obligations. |

| Components | A typical pay stub includes the contractor's name, payment period, total earnings, deductions, and net pay. |

| Tax Implications | Independent contractors are responsible for their own taxes, including self-employment tax, which should be considered when reviewing pay stubs. |

| State-Specific Forms | Some states have specific requirements for pay stubs. For example, California requires detailed itemization of deductions under California Labor Code Section 226. |

| Record Keeping | Both independent contractors and businesses should keep copies of pay stubs for at least three years for tax and legal purposes. |

| Legal Compliance | Using a pay stub form helps ensure compliance with federal and state labor laws regarding payment documentation. |

Key takeaways

Filling out and using the Independent Contractor Pay Stub form can be straightforward, but understanding its components is essential for both contractors and those who hire them. Here are some key takeaways:

- Accurate Information: Always ensure that your name, address, and contact details are correct. This information is crucial for tax purposes and communication.

- Payment Details: Clearly indicate the payment amount and the date of payment. This helps maintain transparency between the contractor and the employer.

- Hours Worked: If applicable, include the number of hours worked or the project completed. This provides a clear record of services rendered.

- Tax Deductions: Although independent contractors typically handle their own taxes, it’s good practice to note any deductions if they apply to your situation.

- Payment Method: Specify how the payment was made—whether by check, direct deposit, or another method. This can help resolve any payment disputes.

- Contractor Signature: Signing the pay stub adds a level of authenticity and agreement to the payment details provided.

- Employer Information: Include the employer's name and contact information. This ensures that both parties can reach each other easily if questions arise.

- Record Keeping: Keep copies of all pay stubs for your records. They are important for tax filing and can serve as proof of income.

- Professional Appearance: Use a clean and professional format for your pay stub. This reflects well on your business practices.

- Consultation: If unsure about any aspect of the form, consider consulting with a tax professional or accountant. Their expertise can provide valuable insights.

By following these guidelines, both independent contractors and employers can ensure a smoother payment process and maintain clear records for future reference.