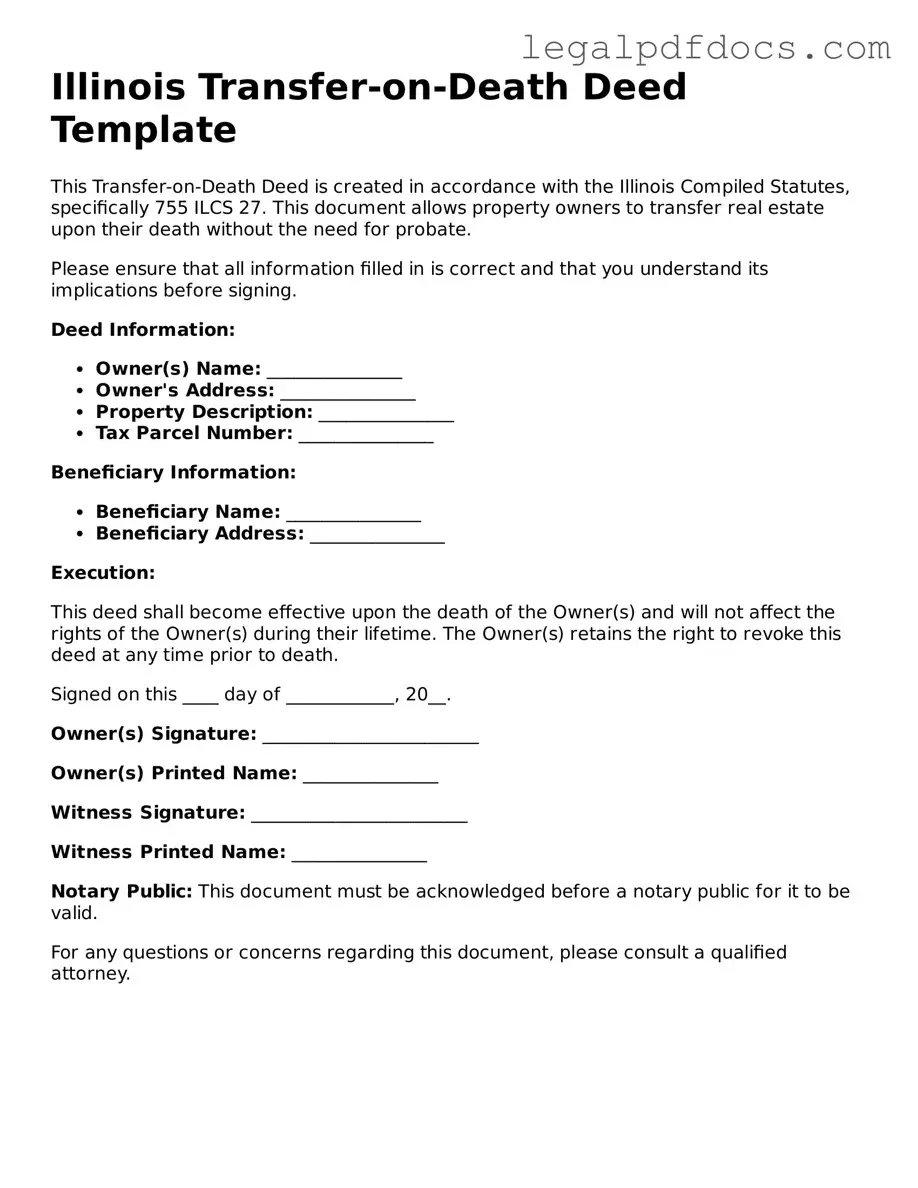

Official Transfer-on-Death Deed Form for Illinois

The Illinois Transfer-on-Death Deed (TOD) form offers a straightforward mechanism for property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the often lengthy and costly probate process. This deed allows individuals to retain full control of their property during their lifetime, ensuring that they can sell, mortgage, or alter the property as they see fit without interference from the beneficiaries. Upon the owner's death, the property automatically transfers to the named beneficiaries, simplifying the transfer process and providing clarity regarding the owner’s wishes. The form must be properly executed and recorded with the county recorder’s office to be valid, and it is crucial to ensure that the beneficiaries are clearly identified to avoid disputes. Additionally, the TOD deed can be revoked or modified at any time before the owner's death, offering flexibility in estate planning. Understanding the nuances of this form can empower property owners in Illinois to make informed decisions about their estate and ensure a smooth transition of their assets to their loved ones.

Dos and Don'ts

When filling out the Illinois Transfer-on-Death Deed form, it’s important to follow specific guidelines to ensure the document is valid and meets your intentions. Here’s a list of things to do and avoid:

- Do provide accurate property information, including the legal description.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Do file the completed deed with the county recorder’s office.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to check local requirements, as they can vary by county.

- Don't use vague language; be specific about your intentions.

- Don't attempt to make changes after the deed has been notarized.

How to Use Illinois Transfer-on-Death Deed

After obtaining the Illinois Transfer-on-Death Deed form, it is important to fill it out accurately to ensure that your wishes regarding property transfer are clearly expressed. This document allows you to designate a beneficiary who will receive your property upon your passing, without the need for probate. Follow these steps carefully to complete the form.

- Begin by entering the name of the property owner(s) at the top of the form. Ensure that the names are spelled correctly and match the titles on the property deed.

- Next, provide the address of the property. This should include the street address, city, state, and ZIP code.

- In the designated section, describe the property in detail. Include the legal description if available, which can often be found on the current deed.

- Identify the beneficiary or beneficiaries. Write their full names and any relevant details, such as their relationship to you.

- Indicate whether the transfer should occur to multiple beneficiaries equally or if specific shares are to be assigned. This clarity is essential for future reference.

- Sign and date the form in the appropriate spaces. The signature must be yours, and it must be done in the presence of a notary public.

- Have the form notarized. This step is crucial for the validity of the deed. The notary will verify your identity and witness your signature.

- Finally, file the completed and notarized deed with the appropriate county recorder’s office. This ensures that the deed is officially recorded and accessible to future parties.

Once the form is completed and filed, it becomes part of the public record. This allows your designated beneficiary to claim the property upon your passing, simplifying the transfer process and avoiding probate complications.

Find Popular Transfer-on-Death Deed Forms for US States

How to File a Beneficiary Deed in Arizona - Transfer-on-Death Deeds are not suitable for all types of property transfers.

Tod Deed California - Finalizing this deed requires careful attention to detail to ensure that it aligns with state laws.

Documents used along the form

When considering the Illinois Transfer-on-Death Deed, it is essential to understand that this document often works in conjunction with several other forms and documents to ensure a smooth transfer of property upon death. Each of these documents serves a unique purpose and can help clarify the intentions of the property owner while providing necessary legal protections.

- Will: A will outlines how a person's assets will be distributed after their death. It can provide additional instructions regarding the transfer of property and can name guardians for minor children.

- Revocable Living Trust: This legal arrangement allows individuals to place their assets into a trust during their lifetime. The trust can help avoid probate, making the transfer of assets more efficient and private.

- Beneficiary Designation Forms: These forms are used for financial accounts, insurance policies, and retirement plans. They specify who will receive the assets upon the account holder's death, complementing the intentions expressed in a Transfer-on-Death Deed.

- Power of Attorney: This document grants someone the authority to make decisions on behalf of another person, particularly in financial or medical matters. It can be crucial in managing affairs if the property owner becomes incapacitated.

- Affidavit of Heirship: This sworn statement identifies the heirs of a deceased person. It can help clarify ownership and facilitate the transfer of property, especially when no will exists.

Understanding these documents and their relationships to the Transfer-on-Death Deed can empower individuals to make informed decisions about their estate planning. Each form plays a vital role in ensuring that one's wishes are respected and that the transfer of property occurs smoothly and efficiently.

Misconceptions

Understanding the Illinois Transfer-on-Death Deed can help individuals make informed decisions about their estate planning. However, several misconceptions can lead to confusion. Below are some common misunderstandings regarding this important legal tool.

- It only applies to real estate. Many believe that the Transfer-on-Death Deed can only be used for real property. While it primarily pertains to real estate, it does not cover personal property or other assets.

- It requires the consent of beneficiaries. Some individuals think they need to obtain permission from beneficiaries before executing the deed. In reality, the property owner can designate beneficiaries without their consent.

- It is irrevocable once signed. A common myth is that once the deed is executed, it cannot be changed. In fact, property owners can revoke or alter the deed at any time before their death.

- It avoids probate completely. While a Transfer-on-Death Deed can help bypass probate for the designated property, it does not eliminate the probate process for other assets owned by the deceased.

- It is only for married couples. There is a misconception that only married couples can utilize this deed. In truth, any individual can create a Transfer-on-Death Deed to designate beneficiaries.

- It automatically transfers ownership upon signing. Some people think that signing the deed immediately transfers ownership of the property. However, the transfer occurs only after the owner's death.

- It is a substitute for a will. Many believe that a Transfer-on-Death Deed can replace a will. While it can be part of an estate plan, it does not address all aspects of estate distribution.

Being aware of these misconceptions can empower individuals to make better choices regarding their estate planning needs. It is always advisable to consult with a qualified professional to ensure that the chosen estate planning tools align with personal circumstances and goals.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | The Illinois Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Eligibility | Any individual who owns real estate in Illinois can use the Transfer-on-Death Deed to designate beneficiaries. |

| Beneficiary Designation | Property owners can name one or more beneficiaries, and they can also specify alternate beneficiaries if the primary ones do not survive. |

| Revocability | The Transfer-on-Death Deed can be revoked at any time by the property owner, as long as they are alive and competent. |

| Filing Requirements | To be valid, the deed must be signed by the property owner and witnessed by two individuals or notarized before being recorded with the county clerk. |

| Tax Implications | Transferring property via a Transfer-on-Death Deed does not trigger gift tax during the owner's lifetime, but it may have estate tax implications. |

| Effect on Creditors | Creditors may still claim against the estate of the deceased owner, even if the property is transferred via this deed. |

| Limitations | This deed cannot be used for certain types of property, such as joint tenancy properties or properties held in trust. |

| Legal Advice | While the form is straightforward, consulting with a legal professional is advisable to ensure it aligns with your overall estate plan. |

Key takeaways

When considering the Illinois Transfer-on-Death Deed form, several key aspects warrant attention. Understanding these points can facilitate a smoother process for transferring property upon death without the need for probate.

- Purpose: The Illinois Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property after their death, bypassing the probate process.

- Eligibility: This deed can be used for various types of real estate, including residential and commercial properties, as long as the owner holds title to the property.

- Form Requirements: The form must be completed accurately and signed by the property owner in the presence of a notary public.

- Beneficiary Designation: Property owners can name one or more beneficiaries, and they can also specify alternate beneficiaries in case the primary ones predecease them.

- Revocation: The Transfer-on-Death Deed can be revoked at any time before the owner’s death, allowing for flexibility in estate planning.

- Filing: While the deed must be signed and notarized, it also needs to be recorded with the appropriate county recorder’s office to be effective.

- No Immediate Transfer: The property does not transfer to the beneficiaries until the death of the owner, meaning the owner retains full control during their lifetime.

- Tax Implications: Beneficiaries may face tax implications upon inheriting the property, so consulting with a tax professional is advisable.

- Limitations: The Transfer-on-Death Deed cannot be used for certain types of property, such as property held in a trust or jointly owned property with rights of survivorship.

- Legal Advice: Consulting an attorney is recommended to ensure that the deed aligns with overall estate planning goals and to navigate any complexities that may arise.

Understanding these key takeaways can empower property owners in Illinois to utilize the Transfer-on-Death Deed effectively, ensuring their wishes are honored after their passing.