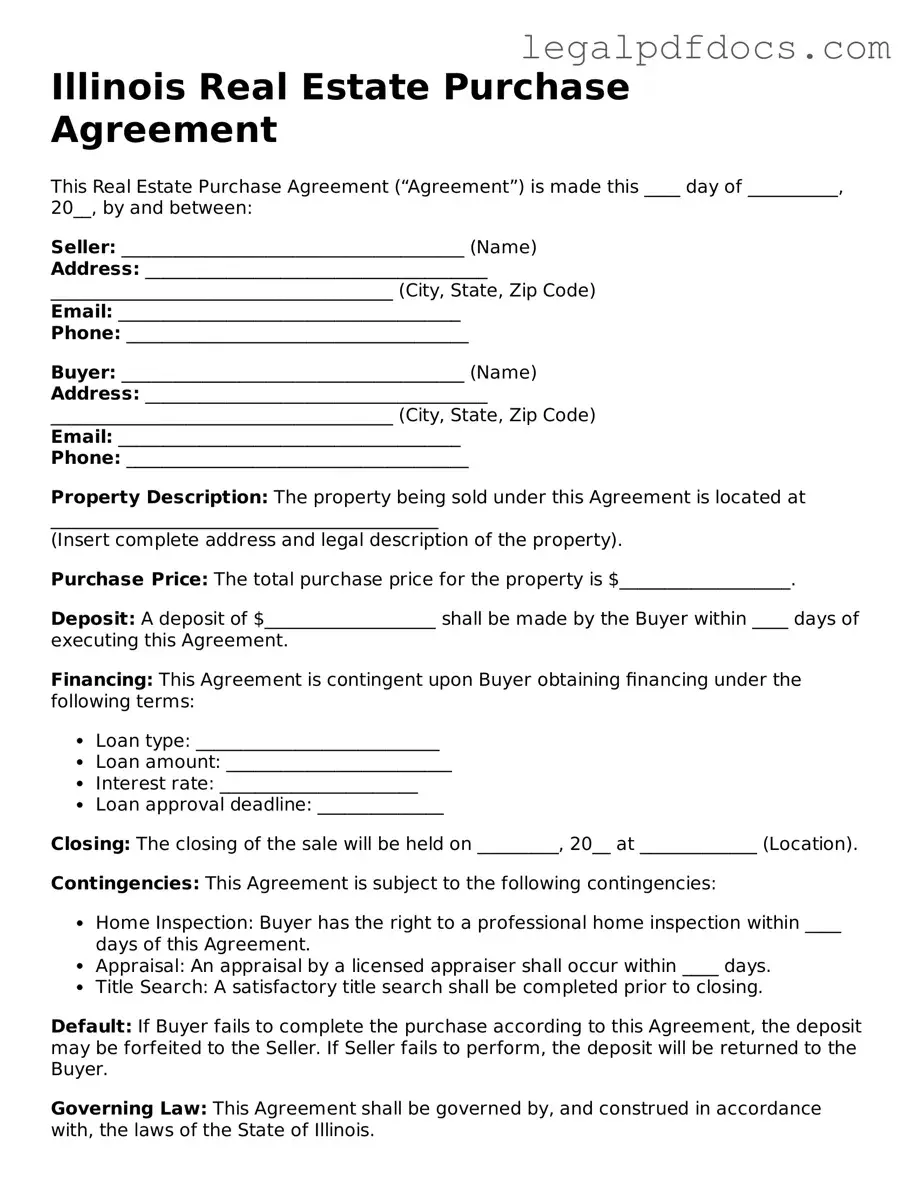

Official Real Estate Purchase Agreement Form for Illinois

When navigating the world of real estate transactions in Illinois, understanding the Illinois Real Estate Purchase Agreement form is essential for both buyers and sellers. This document serves as a crucial foundation for any property sale, outlining the terms and conditions agreed upon by both parties. It typically includes key elements such as the purchase price, financing details, and contingencies that protect the interests of both the buyer and seller. Additionally, it addresses important aspects like property disclosures, closing dates, and any applicable earnest money deposits. By clearly defining the rights and responsibilities of each party, this agreement helps to minimize misunderstandings and potential disputes down the line. Familiarity with this form not only streamlines the transaction process but also empowers individuals to make informed decisions as they embark on their real estate journey in the state of Illinois.

Dos and Don'ts

When filling out the Illinois Real Estate Purchase Agreement form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn't do:

- Do read the entire form carefully before filling it out.

- Do provide accurate information about the property and parties involved.

- Do include all necessary attachments, such as disclosures and addendums.

- Do consult with a real estate professional or attorney if you have questions.

- Do ensure all parties sign the agreement where required.

- Don't leave any sections blank unless instructed to do so.

- Don't rush through the process; take your time to avoid mistakes.

- Don't assume that verbal agreements will be honored; everything should be in writing.

- Don't ignore local laws or regulations that may affect the agreement.

By following these guidelines, you can help ensure that your Real Estate Purchase Agreement is completed correctly and efficiently.

How to Use Illinois Real Estate Purchase Agreement

Filling out the Illinois Real Estate Purchase Agreement form is a crucial step in the home buying process. Properly completing this form ensures that all parties involved understand the terms of the sale and can move forward with the transaction smoothly. After filling out the form, it will need to be signed by both the buyer and seller, and any necessary documents should be attached for a complete agreement.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of both the buyer and seller. Ensure that all names are spelled correctly.

- Fill in the property address, including city, state, and zip code. Be precise to avoid any confusion.

- Specify the purchase price in the designated section. This amount should be agreed upon by both parties.

- Outline any earnest money deposit details, including the amount and the method of payment.

- Indicate the closing date, ensuring it aligns with the timeline agreed upon by both parties.

- Detail any contingencies, such as financing or inspections, that need to be met before the sale can proceed.

- Include any additional terms or conditions that are specific to this transaction.

- Review the form carefully for accuracy and completeness.

- Have both the buyer and seller sign and date the form at the designated spots.

Find Popular Real Estate Purchase Agreement Forms for US States

Simple Real Estate Purchase Agreement - A Real Estate Purchase Agreement can cover aspects of title insurance.

Kansas Real Estate Purchase Contract - Both parties typically benefit from a detailed and honest Real Estate Purchase Agreement.

Purchasing Agreements - Explains the urgency and importance of meeting specified deadlines in the agreement.

Purchase Agreement Michigan for Sale by Owner - Addresses zoning and use restrictions affecting the property.

Documents used along the form

When engaging in a real estate transaction in Illinois, several key documents accompany the Real Estate Purchase Agreement. Each of these documents plays a vital role in ensuring that the transaction proceeds smoothly and legally. Below is a list of commonly used forms and documents.

- Property Disclosure Statement: This document requires the seller to disclose known issues with the property, such as structural problems or environmental hazards. It protects buyers by providing transparency about the property's condition.

- Lead-Based Paint Disclosure: For homes built before 1978, this form informs buyers about the potential risks of lead-based paint. Sellers must provide this disclosure to comply with federal law.

- Earnest Money Agreement: This document outlines the amount of earnest money the buyer will deposit to show serious intent to purchase. It details how the money will be handled if the sale does not proceed.

- Title Commitment: Issued by a title company, this document outlines the legal status of the property title. It identifies any liens or claims against the property and ensures that the title can be transferred free of issues.

- Closing Statement: This document summarizes all financial transactions that occur at closing. It details the costs associated with the sale, including fees, taxes, and the distribution of funds.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be valid.

- Financing Addendum: If the buyer is obtaining a mortgage, this document outlines the terms of the financing, including the loan amount, interest rate, and repayment terms.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide details about the rules, fees, and regulations governing the community.

Understanding these documents is crucial for both buyers and sellers. Each form serves a specific purpose, ensuring that the transaction adheres to legal standards and protects the interests of all parties involved.

Misconceptions

Understanding the Illinois Real Estate Purchase Agreement (REPA) is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Below is a list of common misconceptions regarding this form.

- Misconception 1: The REPA is a legally binding contract only after both parties sign it.

- Misconception 2: The REPA can be filled out without any legal assistance.

- Misconception 3: Once signed, the REPA cannot be changed.

- Misconception 4: The REPA includes all necessary disclosures.

- Misconception 5: The REPA guarantees that the sale will go through.

- Misconception 6: The REPA is the same as a lease agreement.

- Misconception 7: All real estate transactions in Illinois must use the REPA.

This is partially true. While the agreement becomes legally binding upon signature, certain conditions, such as contingencies, may affect its enforceability until those conditions are met.

While individuals can fill out the REPA, seeking legal advice is recommended. An attorney can ensure that all terms are clear and protect the interests of both parties.

This is incorrect. Amendments can be made to the REPA if both parties agree to the changes. Written amendments should be documented and signed to maintain clarity.

The REPA itself does not include all disclosures required by law. Sellers are obligated to provide specific disclosures separately, such as lead paint disclosures for homes built before 1978.

Signing the REPA does not guarantee a successful transaction. Various factors, including financing and inspections, can lead to the sale falling through even after the agreement is signed.

This is false. The REPA is specifically designed for the sale of real estate, while lease agreements govern rental terms. Each document serves a distinct purpose in real estate transactions.

While the REPA is a commonly used form, it is not mandatory. Parties may choose to create their own agreements or use alternative forms, provided they comply with state laws.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Real Estate Purchase Agreement is governed by the Illinois Compiled Statutes, particularly the Real Property Disclosure Act and the Illinois Residential Real Property Disclosure Act. |

| Purpose | This form outlines the terms and conditions under which a buyer agrees to purchase real estate from a seller. |

| Essential Components | Key elements include the purchase price, property description, and closing date. |

| Earnest Money | The agreement typically requires an earnest money deposit, which shows the buyer's commitment to the purchase. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which allow them to back out under certain conditions. |

| Disclosure Requirements | Sellers must provide certain disclosures about the property's condition, including any known issues or defects. |

| Legal Binding | Once signed by both parties, the agreement becomes a legally binding contract, enforceable in a court of law. |

Key takeaways

When filling out and using the Illinois Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Ensure all parties involved are clearly identified, including buyers and sellers. This helps avoid confusion later on.

- Be specific about the property details. Include the address and any relevant legal descriptions to ensure everyone knows what is being sold.

- Understand the terms of the agreement, such as the purchase price, earnest money, and any contingencies. Clear terms help protect both parties.

- Review the timeline for important dates, like closing and inspection periods. Staying on schedule is essential for a smooth transaction.

- Consider consulting with a real estate professional or attorney. They can provide valuable guidance and help you avoid common pitfalls.