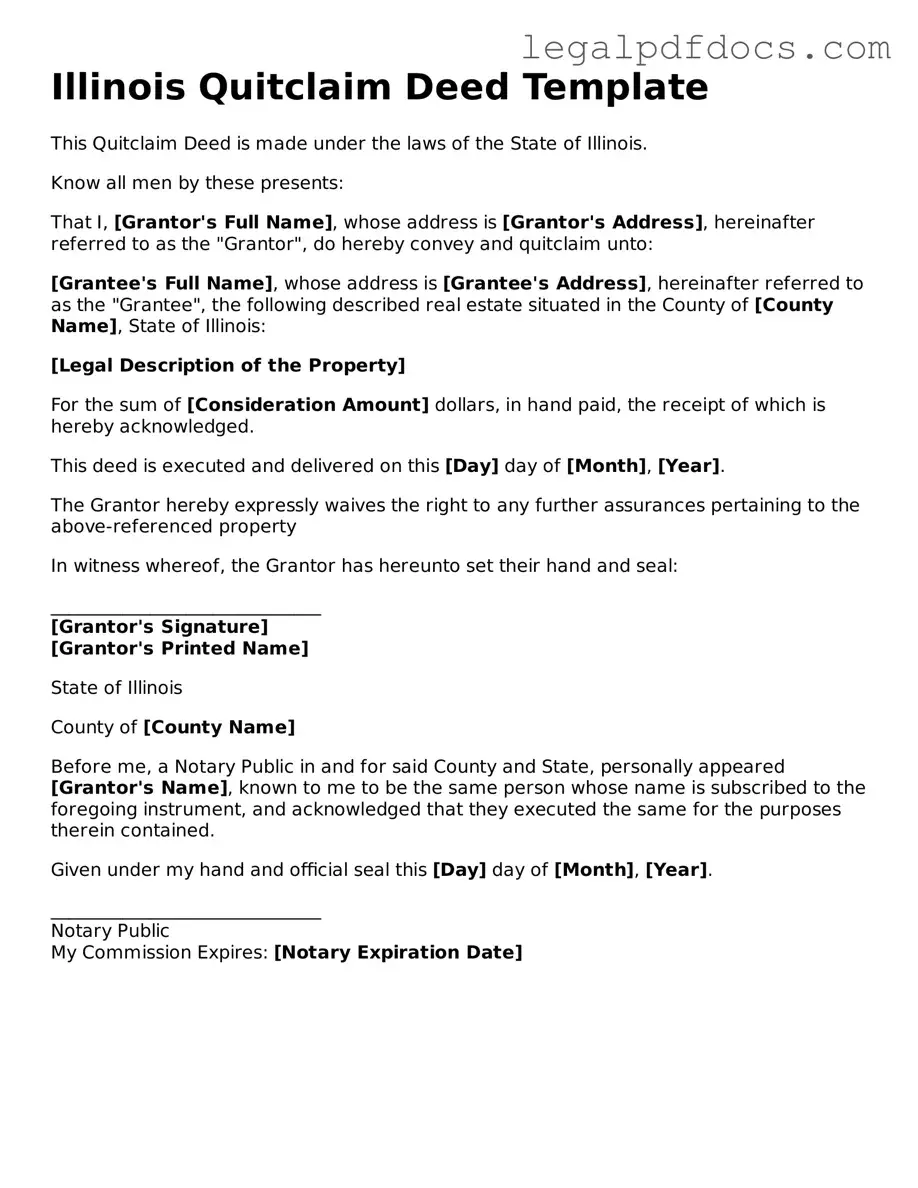

Official Quitclaim Deed Form for Illinois

In Illinois, the Quitclaim Deed form serves as an essential tool for property owners looking to transfer their interest in real estate without making any guarantees about the property's title. This straightforward document allows one party, known as the grantor, to convey their rights to another party, called the grantee. Unlike other types of deeds, a Quitclaim Deed does not ensure that the title is free of liens or other claims, making it a popular choice for transferring property between family members, friends, or in situations where the parties know each other well. The form requires specific information, such as the names of the parties involved, a legal description of the property, and the date of the transfer. Additionally, it must be signed in front of a notary public to be legally valid. Understanding the Quitclaim Deed is crucial for anyone involved in property transactions in Illinois, as it highlights the importance of knowing what rights are being transferred and the potential risks involved in such transactions.

Dos and Don'ts

When filling out the Illinois Quitclaim Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do ensure that all parties involved are clearly identified, including full names and addresses.

- Do provide a complete legal description of the property being transferred.

- Do sign the form in the presence of a notary public to validate the document.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't forget to check local requirements, as they may vary by county.

How to Use Illinois Quitclaim Deed

Once you have the Illinois Quitclaim Deed form in hand, it’s time to fill it out carefully. This document is essential for transferring property ownership, so accuracy is key. After completing the form, you will need to sign it in front of a notary public and then file it with the appropriate county office.

- Begin by entering the name of the current owner (the grantor) at the top of the form.

- Next, write the name of the new owner (the grantee) in the designated space.

- Include the property’s legal description. This can usually be found on the property’s existing deed or tax records.

- Fill in the address of the property being transferred.

- Indicate the date of the transfer.

- Sign the form where indicated. Ensure the grantor’s signature matches their name as listed above.

- Have the signature notarized. A notary public will verify the identity of the signer and witness the signing.

- Make a copy of the completed and notarized deed for your records.

- File the original Quitclaim Deed with the county recorder’s office where the property is located. Check if there are any filing fees.

Find Popular Quitclaim Deed Forms for US States

Free Quit Claim Deed Form Arizona - Property owners may use a quitclaim deed to add or remove a person's name from the title.

Idaho Quitclaim Deed Form - A Quitclaim Deed protects the grantor from future claims on the property.

Where Do I File a Quitclaim Deed - A Quitclaim Deed is appropriate for non-commercial property transfers.

Quit Claim Deed Georgia - This form is used to relinquish any claim to a property.

Documents used along the form

The Illinois Quitclaim Deed is a legal document used to transfer ownership of real property. Alongside this form, several other documents may be necessary to ensure a smooth transaction and proper record-keeping. Below is a list of commonly used forms and documents that often accompany the Illinois Quitclaim Deed.

- Property Transfer Tax Declaration: This form is required to disclose any property transfer taxes owed to the state or local government upon the transfer of real estate.

- Affidavit of Title: This document provides a sworn statement regarding the ownership of the property, confirming that the seller has the right to transfer the property and that there are no undisclosed liens or encumbrances.

- Title Insurance Policy: This insurance protects the buyer against potential claims or disputes regarding the title of the property. It is often obtained during the closing process.

- Real Estate Purchase Agreement: This contract outlines the terms and conditions of the sale, including the purchase price, contingencies, and the responsibilities of both the buyer and seller.

- Closing Statement: Also known as a settlement statement, this document itemizes all financial aspects of the transaction, including fees, taxes, and the final amount due at closing.

- Notice of Transfer: This form notifies relevant parties, such as the local tax assessor, of the change in property ownership, ensuring that tax records are updated accordingly.

- Power of Attorney: In some cases, a seller may designate another person to act on their behalf in the property transfer process. This document grants that authority.

- Certificate of Compliance: This document certifies that the property meets local zoning and building regulations, which may be required by the buyer or lender.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, documents detailing the rules, regulations, and fees associated with the association may be necessary.

- Deed of Trust: If financing is involved, this document secures the loan with the property itself, outlining the lender's rights in case of default.

Each of these documents plays a crucial role in the property transfer process, ensuring that all legal requirements are met and protecting the interests of all parties involved. Proper preparation and understanding of these forms can facilitate a more efficient and transparent transaction.

Misconceptions

Many people have misunderstandings about the Illinois Quitclaim Deed form. Here are ten common misconceptions, along with clarifications to help clear up any confusion.

- It transfers ownership of the property. A quitclaim deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property.

- It is only used in divorce cases. While quitclaim deeds are often used to transfer property between spouses, they can be used in various situations, including gifting property or clearing up title issues.

- It requires a lawyer to complete. Although having legal assistance can be beneficial, individuals can fill out and file a quitclaim deed on their own if they understand the process.

- It is the same as a warranty deed. Unlike a warranty deed, a quitclaim deed does not provide any warranties or guarantees about the property’s title.

- It is only for residential property. Quitclaim deeds can be used for any type of property, including commercial real estate and vacant land.

- It must be notarized to be valid. While notarization is highly recommended for a quitclaim deed to be accepted by the county, it is not a legal requirement in Illinois.

- It can be used to transfer property without consent. All parties involved must agree to the transfer. A quitclaim deed does not bypass the need for consent.

- It can eliminate mortgage obligations. A quitclaim deed does not remove any mortgage or liens on the property. The original borrower remains responsible for those obligations.

- It is not necessary to record the deed. Although it is not legally required to record a quitclaim deed, failing to do so can lead to disputes about ownership in the future.

- It is a quick way to sell property. A quitclaim deed does not involve a sale. It is a method of transferring interest and does not include any financial transaction.

Understanding these misconceptions can help individuals make informed decisions when dealing with property transfers in Illinois.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | An Illinois Quitclaim Deed transfers ownership of property without guaranteeing the title's validity. |

| Governing Law | The Illinois Quitclaim Deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Usage | This form is commonly used to transfer property between family members or to clear up title issues. |

| Requirements | The deed must be signed by the grantor and notarized to be valid in Illinois. |

Key takeaways

When filling out and using the Illinois Quitclaim Deed form, it is important to keep several key points in mind:

- Understand the Purpose: A quitclaim deed transfers ownership of property from one person to another without guaranteeing that the title is clear. This means the seller does not promise that they own the property free and clear of any liens or claims.

- Complete All Required Information: Ensure that the form is filled out completely. This includes the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), as well as a description of the property.

- Signatures Are Essential: The deed must be signed by the grantor in front of a notary public. Without the grantor's signature and notarization, the deed may not be legally valid.

- File the Deed: After the deed is completed and signed, it should be filed with the county recorder’s office where the property is located. This step is crucial for making the transfer public and protecting the grantee’s interest.

- Consider Tax Implications: Be aware that transferring property can have tax consequences. It may be beneficial to consult with a tax professional to understand any potential implications related to property taxes or capital gains.