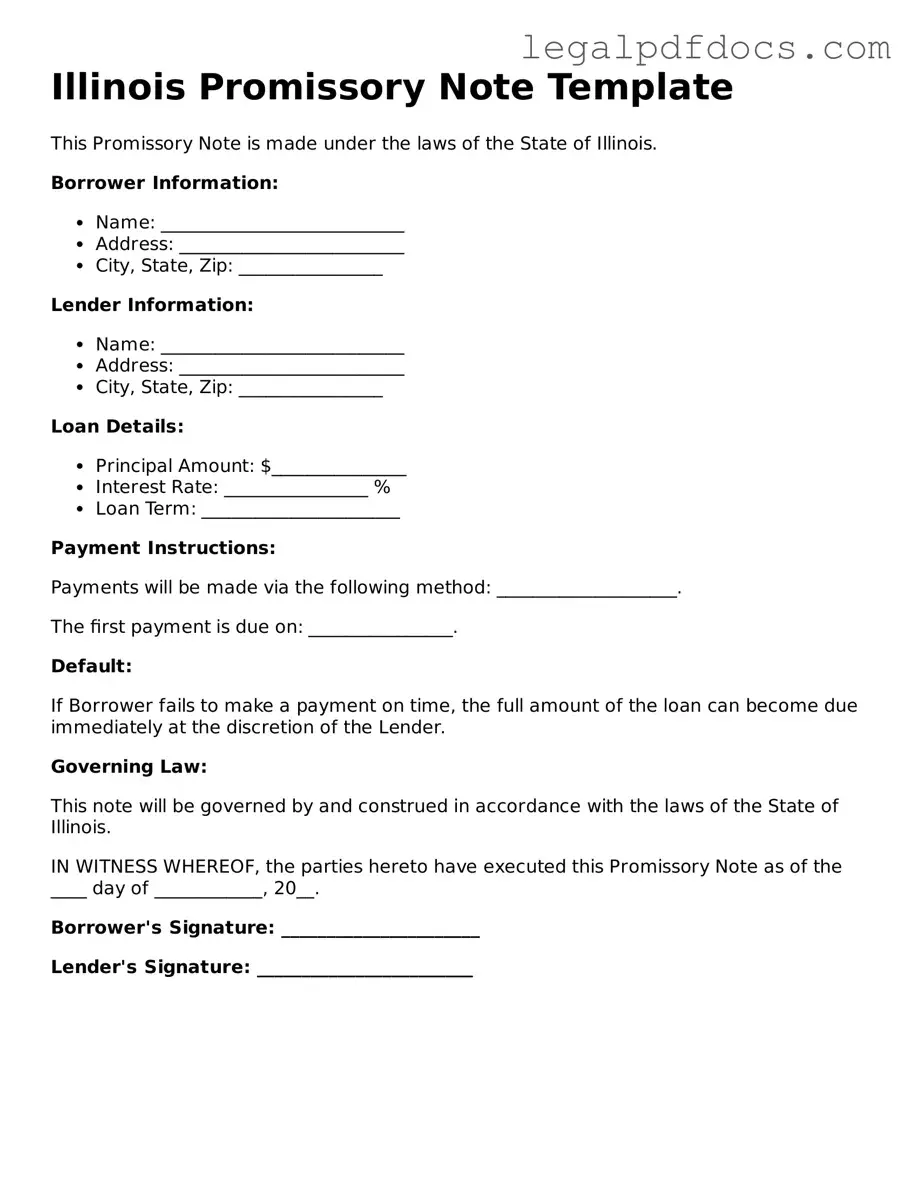

Official Promissory Note Form for Illinois

In the realm of financial transactions, the Illinois Promissory Note serves as a vital tool for individuals and businesses alike. This legal document outlines the terms under which one party promises to pay a specified amount of money to another party, typically within a designated timeframe. Key elements of the form include the principal amount, interest rate, payment schedule, and the identities of the borrower and lender. By clearly defining these terms, the Promissory Note helps prevent misunderstandings and disputes that may arise during the repayment process. Additionally, it often includes provisions regarding default and the rights of both parties in such an event. Understanding the nuances of this form is essential for anyone entering into a lending agreement in Illinois, as it not only provides legal protection but also establishes a clear framework for financial obligations.

Dos and Don'ts

When filling out the Illinois Promissory Note form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do:

- Do read the instructions carefully before starting. Understanding the requirements can save you time and prevent mistakes.

- Do provide accurate information. Double-check names, addresses, and amounts to ensure everything is correct.

- Do sign the document. A signature is necessary for the note to be legally binding.

- Do keep a copy for your records. Having a copy can be helpful in case any disputes arise later.

- Don't leave any fields blank. If a section doesn’t apply, indicate that it is not applicable instead of skipping it.

- Don't use white-out or erasers. If you make a mistake, it’s better to cross it out and initial the change.

By following these guidelines, you can ensure that your Illinois Promissory Note is filled out correctly and is legally enforceable.

How to Use Illinois Promissory Note

Once you have the Illinois Promissory Note form in front of you, it’s important to complete it accurately to ensure all parties understand their obligations. After filling out the form, you will typically need to have it signed by both the borrower and the lender, and it may require notarization depending on your specific situation.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, fill in the name and address of the borrower. Ensure this information is correct and complete.

- In the following section, provide the name and address of the lender. Double-check for accuracy.

- Specify the principal amount being borrowed. This should be a clear numerical figure.

- Indicate the interest rate, if applicable. Write this as a percentage.

- State the repayment terms. Include details about the payment schedule, such as monthly or quarterly payments.

- Include the due date for the final payment. This should be a specific date.

- Detail any late fees or penalties for missed payments, if applicable.

- Sign the form as the borrower. Make sure to use your full legal name.

- Have the lender sign the form as well. Again, they should use their full legal name.

- If required, arrange for a notary public to witness the signatures and provide notarization.

Find Popular Promissory Note Forms for US States

Idaho Promissory Note Descargar - A promissory note can vary in complexity based on the financial transaction's nature.

Promissory Note California - The effectiveness of a promissory note lies in its simplicity and clarity.

Promissory Note Florida Pdf - A promissory note may be accompanied by other documents, such as a loan agreement or personal guarantee.

Documents used along the form

In Illinois, a Promissory Note serves as a written promise to pay a specified sum of money to a lender. However, several other forms and documents often accompany this note to ensure clarity and legal protection for both parties involved. Below is a list of commonly used documents that may be relevant in conjunction with an Illinois Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged. It provides the lender with legal rights to the collateral in case of default.

- Guaranty Agreement: This document involves a third party who agrees to take responsibility for the loan if the borrower fails to repay. It adds an extra layer of security for the lender.

- Disclosure Statement: Required by law in many cases, this statement provides borrowers with essential information about the loan terms, including fees and potential risks. Transparency is key in financial transactions.

- Amortization Schedule: This is a detailed table that outlines each payment over the life of the loan, showing how much goes toward interest and how much reduces the principal. It helps borrowers understand their payment obligations.

- Default Notice: Should the borrower fail to meet their payment obligations, this document serves as a formal notification of default. It typically outlines the consequences and next steps for both parties.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations. It provides proof that the debt has been satisfied.

These documents, when used alongside the Illinois Promissory Note, can help ensure that all parties have a clear understanding of their rights and responsibilities. Proper documentation is essential for a smooth lending process and can protect both the lender and borrower in the event of disputes.

Misconceptions

Understanding the Illinois Promissory Note form is essential for anyone involved in lending or borrowing money. Unfortunately, several misconceptions can lead to confusion and potential legal issues. Below are ten common misconceptions about this important document.

- All promissory notes must be notarized. Many believe that notarization is a requirement for all promissory notes. In Illinois, notarization is not mandatory, but it can provide additional legal protection.

- Promissory notes are only for large loans. Some people think promissory notes are only necessary for substantial amounts. In reality, they can be used for any loan amount, regardless of size.

- Verbal agreements are sufficient. Many assume that a verbal agreement is enough for a loan. However, having a written promissory note is crucial for clarity and enforceability.

- All promissory notes are the same. It's a common misconception that all promissory notes follow a standard format. In fact, the terms can vary significantly based on the agreement between the parties.

- Interest rates must be specified. Some believe that every promissory note must include an interest rate. While it is common, it is not a legal requirement; a note can be interest-free.

- Promissory notes are only for personal loans. Many think these documents are only applicable in personal lending situations. However, they are also used in business transactions and real estate deals.

- Once signed, a promissory note cannot be changed. Some people think that a signed note is set in stone. In reality, parties can amend the note if both agree to the changes.

- Defaulting on a promissory note has no consequences. Many borrowers underestimate the seriousness of defaulting. Consequences can include legal action and damage to credit scores.

- A promissory note guarantees repayment. It is a common belief that having a promissory note guarantees repayment. While it provides a legal framework, it does not ensure the borrower will pay.

- Only lenders need to worry about promissory notes. Some think that only lenders should concern themselves with these documents. Borrowers also need to understand the terms and implications of the note they sign.

Being aware of these misconceptions can help both borrowers and lenders navigate the lending process more effectively. Clarity and understanding are key to avoiding potential pitfalls.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a defined time. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in Illinois. |

| Parties Involved | The note involves two primary parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the note. |

| Payment Terms | Payment terms should specify the due date and the amount to be paid, including any late fees. |

| Signatures | The note must be signed by the maker to be legally binding. |

| Enforceability | Promissory notes are enforceable in court, provided they meet legal requirements. |

| Transferability | Promissory notes can often be transferred to another party, allowing for assignment of rights. |

Key takeaways

When filling out and using the Illinois Promissory Note form, keep the following key takeaways in mind:

- Understand the Basics: A promissory note is a written promise to pay a specified amount of money to a specific person or entity.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that all parties are identifiable.

- Specify the Amount: Clearly indicate the principal amount being borrowed. This figure is crucial for the enforceability of the note.

- Detail the Terms: Outline the repayment terms, including the interest rate, payment schedule, and due dates. Clarity helps avoid misunderstandings.

- Include Signatures: Both parties must sign the note. This signature represents agreement to the terms outlined in the document.

- Consider Notarization: While not always required, having the note notarized can provide additional legal protection and validity.

- Keep Copies: After signing, both parties should retain copies of the promissory note for their records. This ensures everyone has access to the agreement.

- Review State Laws: Familiarize yourself with Illinois laws regarding promissory notes, as they can affect the note's enforceability.

- Seek Legal Advice: If unsure about any aspect of the promissory note, consider consulting a legal professional for guidance.