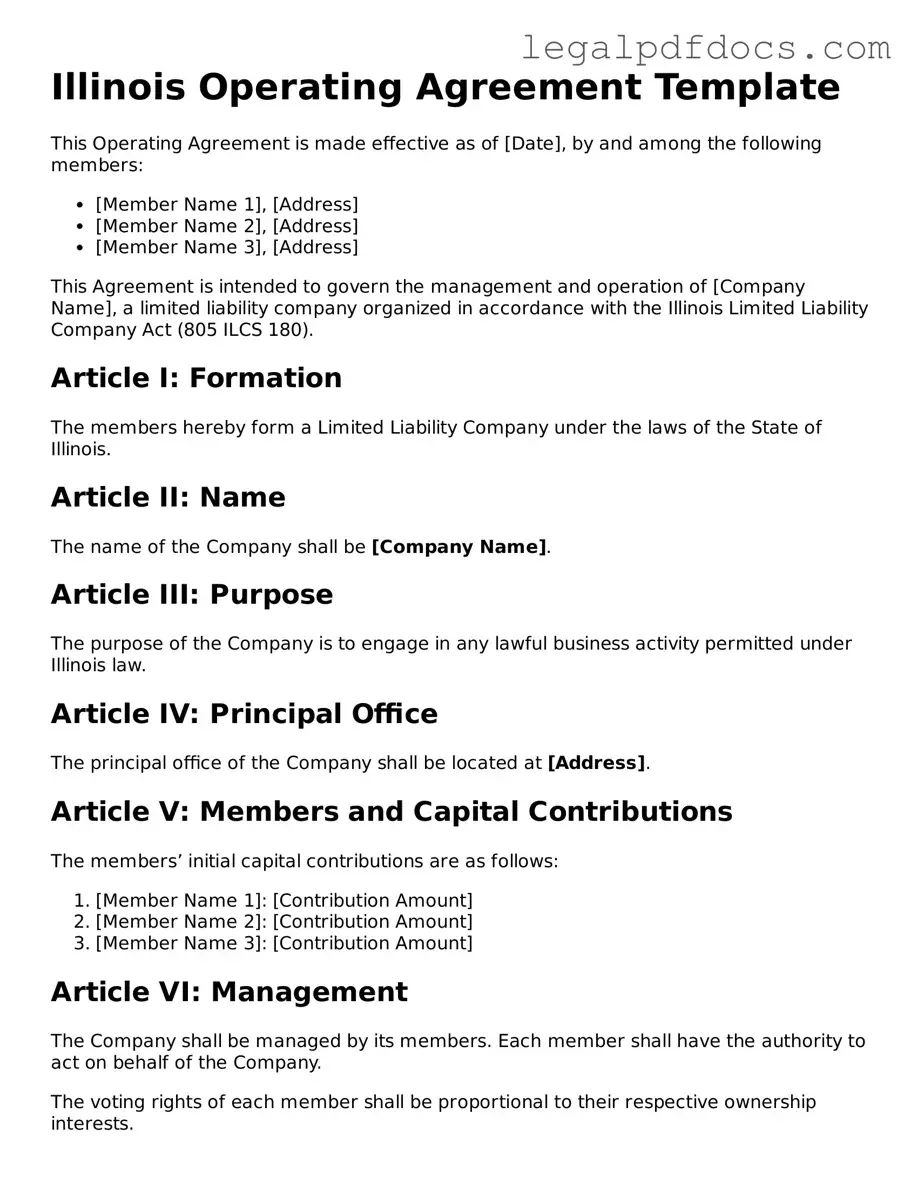

Official Operating Agreement Form for Illinois

The Illinois Operating Agreement form serves as a foundational document for limited liability companies (LLCs) operating within the state. This form outlines the internal structure and management of the LLC, detailing the rights and responsibilities of its members. Key components include provisions for member contributions, profit distribution, and decision-making processes. Additionally, the agreement addresses the procedures for adding or removing members, ensuring a clear framework for the evolution of the company. By establishing guidelines for dispute resolution and outlining the roles of managers, the Operating Agreement helps to prevent conflicts and misunderstandings among members. Ultimately, this document is crucial for protecting the interests of all parties involved and ensuring compliance with Illinois law.

Dos and Don'ts

When filling out the Illinois Operating Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do read the instructions carefully before starting the form.

- Do provide accurate information about the members and their roles.

- Do ensure that the agreement is signed by all members.

- Do keep a copy of the completed agreement for your records.

- Don't leave any required fields blank.

- Don't use ambiguous language that could lead to misunderstandings.

How to Use Illinois Operating Agreement

Completing the Illinois Operating Agreement form requires careful attention to detail. Once the form is filled out correctly, it can be submitted to establish the operational framework of a business entity. Follow the steps below to ensure accurate completion.

- Obtain the Illinois Operating Agreement form from the appropriate state website or legal resource.

- Read through the entire form to familiarize yourself with the required information.

- Begin by entering the name of the business entity at the top of the form.

- Provide the principal office address of the business. This should be a physical address, not a P.O. box.

- List the names and addresses of all members involved in the business. Ensure that each member's information is accurate and up-to-date.

- Specify the management structure of the business. Indicate whether it will be member-managed or manager-managed.

- Detail the financial contributions of each member. Include the amount and type of contribution (cash, property, etc.).

- Outline the profit and loss distribution among members. Clearly define how profits and losses will be shared.

- Include any additional provisions that may be relevant to the operation of the business, such as voting rights or decision-making processes.

- Review the completed form for accuracy and completeness. Check for any missing information or errors.

- Have all members sign the form to validate the agreement.

- Make copies of the signed form for your records before submission.

- Submit the completed form to the appropriate state office as instructed.

Find Popular Operating Agreement Forms for US States

Operating Agreement Llc Arizona Template - Members can specify how profits and losses will be distributed in the Operating Agreement.

How to Set Up an Operating Agreement for Llc - It may stipulate confidentiality requirements for members regarding business information.

Is an Operating Agreement Required for an Llc in California - The Operating Agreement can be a vital part of a company's governance strategy.

Documents used along the form

When forming a limited liability company (LLC) in Illinois, the Operating Agreement is a crucial document. However, several other forms and documents are often used in conjunction with it. Each of these plays a significant role in the overall structure and function of the LLC. Below is a list of these important documents.

- Articles of Organization: This is the foundational document filed with the state to officially create the LLC. It includes basic information such as the LLC’s name, address, and the name of the registered agent.

- Employer Identification Number (EIN): Issued by the IRS, this number is necessary for tax purposes. It allows the LLC to hire employees, open a bank account, and file tax returns.

- Operating Agreement: While already mentioned, it’s essential to note that this document outlines the management structure and operating procedures of the LLC, detailing the rights and responsibilities of its members.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- Initial Resolutions: This document records the initial decisions made by the members or managers of the LLC, such as appointing officers or approving the Operating Agreement.

- Bylaws: While not always required, bylaws can provide additional rules governing the LLC’s operations, including meeting procedures and voting rights.

- State and Local Business Licenses: Depending on the nature of the business, various licenses may be required to operate legally within the state or locality.

- Annual Reports: Many states, including Illinois, require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the company and its members.

Understanding these documents and their purposes is vital for anyone looking to establish and operate an LLC in Illinois. Each plays a distinct role in ensuring compliance and facilitating smooth business operations.

Misconceptions

When it comes to the Illinois Operating Agreement form, several misconceptions can lead to confusion for business owners. Understanding these misconceptions is crucial for effective business management.

- It’s not necessary for single-member LLCs. Many believe that single-member LLCs do not need an operating agreement. However, having one can provide clarity and legal protection, even for a single owner.

- It must be filed with the state. Some think that the operating agreement needs to be submitted to the state. In reality, this document is kept internally and does not require filing.

- It’s a one-size-fits-all document. There’s a common belief that a standard template will work for every business. Each operating agreement should be tailored to the specific needs and goals of the business.

- It can’t be changed once created. Some people assume that once the operating agreement is signed, it cannot be altered. In fact, members can amend it as needed to reflect changes in the business.

- It only addresses profit distribution. While profit distribution is a key component, the operating agreement also covers management structure, member responsibilities, and procedures for resolving disputes.

- It’s only important for legal reasons. Although it serves a legal purpose, the operating agreement also fosters communication among members and helps prevent misunderstandings.

- All members need to sign it for it to be valid. Some believe that every member must sign for the agreement to be effective. However, in a single-member LLC, the sole member's signature is sufficient.

By dispelling these misconceptions, business owners can better navigate the complexities of operating agreements in Illinois.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Operating Agreement outlines the management structure and operational procedures for an LLC. |

| Governing Law | This agreement is governed by the Illinois Limited Liability Company Act. |

| Flexibility | Members can customize the agreement to fit their specific needs, allowing for a variety of management styles. |

| Required Information | It typically includes details such as member roles, voting rights, and profit distribution. |

| Not Mandatory | While an Operating Agreement is not required by Illinois law, it is highly recommended for clarity and protection. |

Key takeaways

Filling out and using the Illinois Operating Agreement form is crucial for any business operating as a limited liability company (LLC) in the state. Here are key takeaways to consider:

- The Operating Agreement outlines the management structure and operational procedures of the LLC.

- It is not required by Illinois law, but having one is highly recommended to prevent disputes among members.

- Clearly define each member's roles and responsibilities within the agreement.

- Include provisions for how profits and losses will be distributed among members.

- Consider including procedures for adding new members or handling the departure of existing ones.

- Establish rules for decision-making processes to ensure clarity and efficiency.

- Review and update the Operating Agreement regularly to reflect any changes in the business or membership.

- Keep the Operating Agreement accessible to all members for reference and transparency.

- Consult with a legal professional if there are any uncertainties or complex provisions to include.

By following these guidelines, you can create a solid foundation for your LLC and help ensure its success.