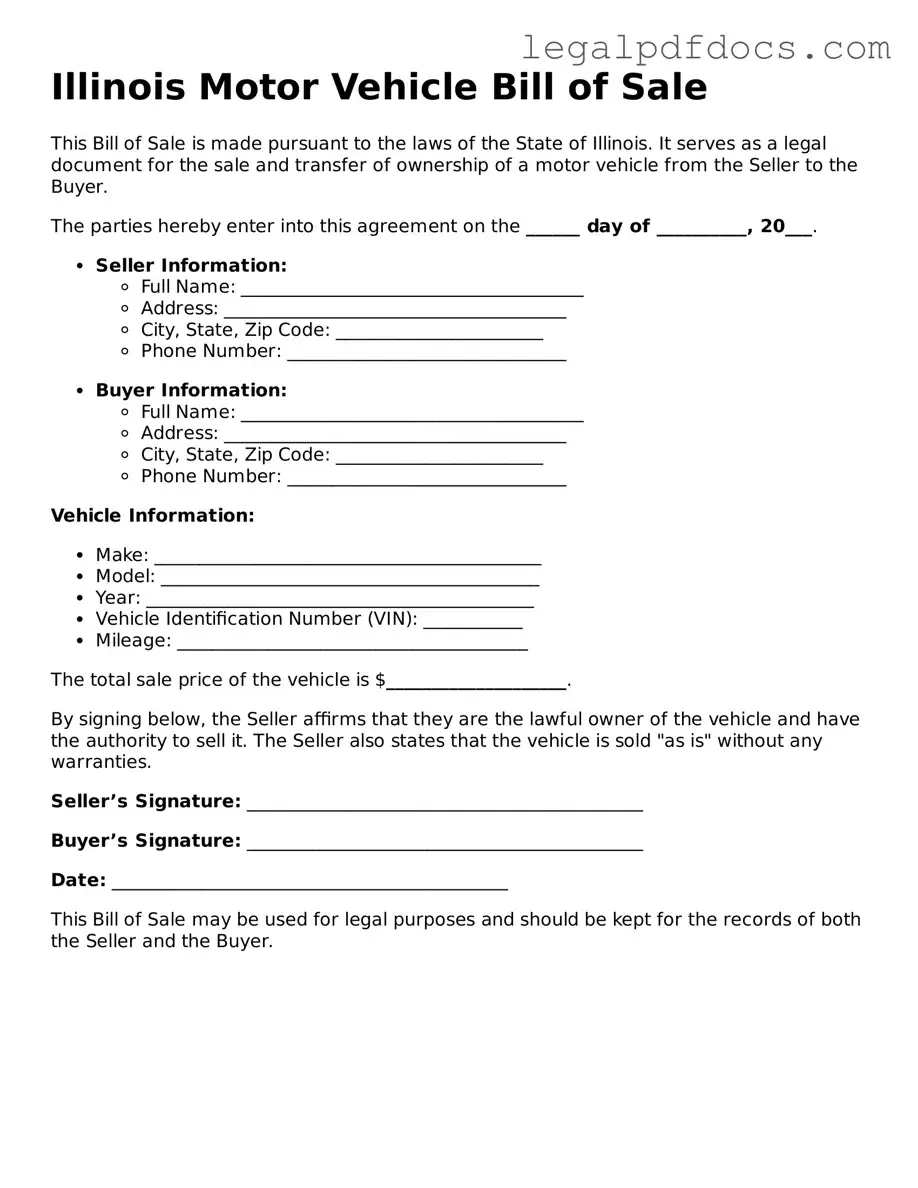

Official Motor Vehicle Bill of Sale Form for Illinois

When it comes to buying or selling a vehicle in Illinois, having the right documentation is crucial for a smooth transaction. The Illinois Motor Vehicle Bill of Sale form serves as an essential record that outlines the details of the sale, protecting both the buyer and the seller. This form typically includes important information such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), along with the sale price and the date of the transaction. Signatures from both parties validate the agreement, ensuring that the transfer of ownership is officially recognized. Additionally, the form may include spaces for the seller to disclose any known defects or issues with the vehicle, fostering transparency in the sale process. Understanding how to properly complete and utilize this form can save both parties from potential disputes and legal complications down the line.

Dos and Don'ts

When filling out the Illinois Motor Vehicle Bill of Sale form, it is crucial to follow specific guidelines to ensure the document is valid and serves its intended purpose. Here are four important dos and don'ts:

- Do provide accurate information about the vehicle, including make, model, year, and Vehicle Identification Number (VIN).

- Do include the names and addresses of both the buyer and the seller to establish clear ownership transfer.

- Don't leave any sections blank. All fields should be completed to avoid complications during the registration process.

- Don't forget to sign and date the form. Both parties must provide their signatures to validate the transaction.

How to Use Illinois Motor Vehicle Bill of Sale

After gathering the necessary information, you can begin filling out the Illinois Motor Vehicle Bill of Sale form. This document is important for transferring ownership of a vehicle from one party to another. Make sure to have all relevant details on hand for a smooth process.

- Start by entering the date of the sale at the top of the form.

- Fill in the seller's name and address. This is the person selling the vehicle.

- Next, provide the buyer's name and address. This is the person purchasing the vehicle.

- Include the vehicle's details: make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the vehicle clearly.

- If applicable, note any trade-in information or other considerations.

- Both the seller and buyer should sign and date the form at the bottom.

- Make a copy of the completed form for your records.

Find Popular Motor Vehicle Bill of Sale Forms for US States

Florida Bill of Sale Pdf - This form serves as proof of ownership transfer from seller to buyer.

How to Write Bill of Sale for Car - This document often requires the listing of accessories or additional items included with the vehicle.

Do You Need a Bill of Sale in Arizona - A necessary form to ensure both parties document the sale clearly.

Documents used along the form

The Illinois Motor Vehicle Bill of Sale form serves as a crucial document in the transfer of vehicle ownership. However, several other forms and documents are often used in conjunction with this bill of sale to ensure a smooth transaction. Below is a list of additional forms that may be required or beneficial during the process of buying or selling a vehicle in Illinois.

- Vehicle Title: This document proves ownership of the vehicle. The seller must sign over the title to the buyer during the transaction.

- Application for Title and Registration: This form is necessary for the buyer to register the vehicle in their name. It includes details about the vehicle and the new owner.

- Odometer Disclosure Statement: This statement verifies the vehicle's mileage at the time of sale. It is often required by law to prevent odometer fraud.

- Bill of Sale for a Trade-In Vehicle: If a trade-in is involved, this document records the details of the vehicle being traded in, including its condition and value.

- Emissions Test Certificate: In some areas, an emissions test is required before a vehicle can be registered. This certificate confirms that the vehicle meets environmental standards.

- Power of Attorney: This document allows one person to act on behalf of another in the transaction. It can be useful if the seller cannot be present during the sale.

- Sales Tax Form: This form is used to report the sales tax collected during the transaction. Buyers may need it when registering the vehicle with the state.

Utilizing these forms alongside the Illinois Motor Vehicle Bill of Sale can help facilitate a clear and legally binding vehicle transaction. Ensuring that all necessary documentation is completed accurately can prevent future disputes and streamline the registration process.

Misconceptions

Understanding the Illinois Motor Vehicle Bill of Sale form is essential for anyone involved in buying or selling a vehicle in the state. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It's not necessary for private sales. Many people believe that a Bill of Sale is only required for transactions involving dealerships. In reality, a Bill of Sale is important for private sales as well, providing proof of ownership transfer.

- All states use the same Bill of Sale form. Some assume that a Bill of Sale from one state is valid in another. Each state, including Illinois, has its own requirements and forms, which must be adhered to for legal purposes.

- The form is only for used vehicles. This misconception overlooks that the Bill of Sale can be used for both new and used vehicles. It documents the sale regardless of the vehicle's age.

- It doesn’t need to be notarized. While notarization is not always required in Illinois, having the Bill of Sale notarized can provide an extra layer of security and authenticity, which can be beneficial in disputes.

- It’s only for the seller's protection. Some people think that the Bill of Sale only serves the seller’s interests. In truth, it protects both parties by documenting the transaction and terms agreed upon.

- There is no time limit for submitting it. Many believe that they can submit the Bill of Sale at any time after the sale. However, it is advisable to complete and submit it promptly to ensure that the vehicle registration is updated without delay.

- It’s unnecessary if the title is signed over. While signing over the title is crucial, the Bill of Sale serves as a detailed record of the transaction, including sale price and date, which the title alone does not provide.

- Only one copy is needed. It’s a common belief that a single copy suffices. In reality, both the buyer and seller should retain a copy for their records, as it may be needed for future reference.

- The Bill of Sale is the same as a receipt. Although a receipt acknowledges payment, a Bill of Sale is a more comprehensive document that outlines the details of the sale, including vehicle information and the terms of the agreement.

Clearing up these misconceptions can help ensure a smoother transaction process for both buyers and sellers in Illinois.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Motor Vehicle Bill of Sale serves as a legal document to record the sale of a vehicle between a buyer and a seller. |

| Governing Law | The form is governed by the Illinois Vehicle Code, specifically 625 ILCS 5/3-101 et seq. |

| Required Information | The form requires details such as the vehicle identification number (VIN), make, model, year, and odometer reading. |

| Signatures | Both the buyer and seller must sign the Bill of Sale to validate the transaction. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

| Tax Implications | The Bill of Sale may be used to determine sales tax obligations when registering the vehicle with the state. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it can be useful for future reference. |

| Transfer of Ownership | The Bill of Sale facilitates the transfer of ownership, but it does not replace the title transfer process. |

| Availability | The form can be obtained online or from local Department of Motor Vehicles (DMV) offices. |

Key takeaways

When dealing with the Illinois Motor Vehicle Bill of Sale form, there are several important points to keep in mind. This document serves as a crucial record of the transaction between the buyer and the seller. Here are key takeaways to consider:

- Understand the Purpose: The Bill of Sale acts as proof of the transfer of ownership for a vehicle. It can be required for registration and title transfer.

- Complete All Required Fields: Ensure that all necessary information is filled out, including the vehicle's make, model, year, and Vehicle Identification Number (VIN).

- Accurate Seller and Buyer Information: Include the full names and addresses of both the seller and the buyer. This information is essential for record-keeping.

- Sale Price Documentation: Clearly state the sale price of the vehicle. This amount may be relevant for tax purposes.

- Signatures Matter: Both parties must sign the Bill of Sale. This signature confirms that the transaction has taken place.

- Consider Notarization: While not always required, having the Bill of Sale notarized can add an extra layer of legitimacy to the document.

- Keep Copies: After completing the form, both the buyer and seller should keep copies for their records. This can be useful for future reference.

- Check Local Regulations: Different counties may have specific requirements regarding the Bill of Sale, so it’s wise to verify local rules.

- Use the Correct Form: Ensure you are using the most current version of the Illinois Motor Vehicle Bill of Sale form, as outdated forms may not be accepted.

By following these key points, both buyers and sellers can navigate the process of transferring vehicle ownership smoothly and efficiently.