Official Loan Agreement Form for Illinois

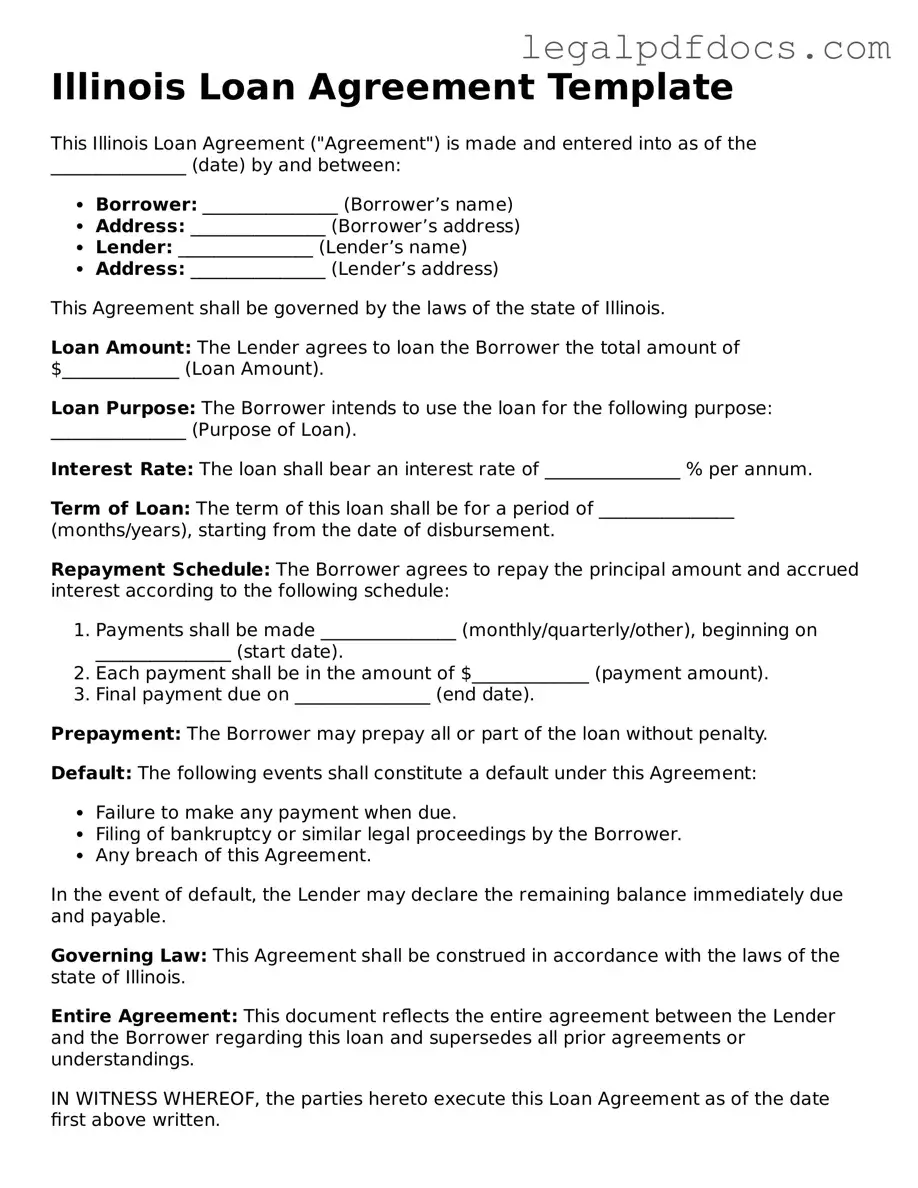

When entering into a loan agreement in Illinois, understanding the essential components of the Illinois Loan Agreement form is crucial for both lenders and borrowers. This form outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any fees associated with the loan. It also specifies the rights and obligations of both parties, ensuring clarity and reducing the potential for disputes. Additionally, the agreement may include provisions for default, collateral requirements, and any applicable state laws that govern the loan. By clearly defining these aspects, the Illinois Loan Agreement form serves as a vital tool for facilitating transparent and fair lending practices.

Dos and Don'ts

When filling out the Illinois Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should do and five things you should avoid.

Things You Should Do:

- Read the entire form carefully before starting.

- Provide accurate and complete information.

- Double-check all numbers and dates for correctness.

- Sign and date the form in the designated areas.

- Keep a copy of the completed form for your records.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid using unclear or ambiguous language.

- Do not rush through the process; take your time.

- Refrain from providing false or misleading information.

- Do not forget to review the terms and conditions before signing.

How to Use Illinois Loan Agreement

Filling out the Illinois Loan Agreement form is a straightforward process. This document outlines the terms of the loan and protects both the lender and the borrower. Ensure you have all necessary information ready before starting to complete the form.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the lender and the borrower in the designated sections.

- Clearly state the loan amount in the appropriate field.

- Specify the interest rate applicable to the loan.

- Indicate the repayment schedule, including the frequency of payments (e.g., monthly, bi-weekly).

- Provide details regarding any collateral, if applicable.

- Include any additional terms or conditions that may apply to the loan.

- Both parties should sign and date the form at the bottom.

- Make copies of the completed form for both the lender and the borrower for their records.

Find Popular Loan Agreement Forms for US States

Promissory Note Georgia - Summarizes any borrower obligations upon loan termination.

Loan Agreement Template Texas - The document serves as a reference for both parties throughout the loan duration.

Promissory Note California - Changes in circumstances may trigger a review of the terms in the Loan Agreement.

Documents used along the form

When entering into a loan agreement in Illinois, several other forms and documents may accompany the primary loan agreement to ensure that all parties are clear on their obligations and rights. Each of these documents serves a specific purpose, helping to create a comprehensive understanding of the terms of the loan. Below is a list of commonly used forms that complement the Illinois Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged by the borrower. It protects the lender's interests by establishing a legal claim to the collateral in case of default.

- Loan Disclosure Statement: This form provides essential information about the loan, including the total cost, interest rates, and any fees associated with the loan. It ensures transparency and helps borrowers make informed decisions.

- Personal Guarantee: In some cases, lenders may require a personal guarantee from the borrower or a third party. This document holds the guarantor personally responsible for the loan if the borrower fails to repay it.

- Amortization Schedule: This schedule breaks down the loan repayment process, showing how much of each payment goes toward interest and principal over time. It helps borrowers understand their payment obligations throughout the loan term.

These documents collectively enhance the clarity and security of the loan agreement, ensuring that both the lender and borrower are protected and fully informed. When drafting or reviewing a loan agreement, it is essential to consider these accompanying forms to facilitate a smooth transaction.

Misconceptions

When it comes to the Illinois Loan Agreement form, several misconceptions can lead to confusion. Understanding the truth behind these myths can help borrowers and lenders navigate the process more smoothly.

- Misconception 1: The form is only for large loans.

- Misconception 2: Verbal agreements are sufficient.

- Misconception 3: The form is too complicated to fill out.

- Misconception 4: Once signed, the terms cannot be changed.

Many people believe that the Illinois Loan Agreement form is only necessary for significant loans. In reality, this form can be used for loans of any size. Whether you’re borrowing a small amount or a substantial sum, having a written agreement is beneficial for both parties.

Some individuals think that a verbal agreement is enough to secure a loan. However, without a written document, it can be challenging to prove the terms of the loan if disputes arise. A written agreement provides clarity and serves as evidence of the terms agreed upon.

Another common belief is that the Illinois Loan Agreement form is overly complex. While it does include specific terms and conditions, it is designed to be user-friendly. Most people can complete it without legal assistance, as long as they understand the basic components of a loan.

Many assume that once the Illinois Loan Agreement is signed, the terms are set in stone. In fact, parties can negotiate changes to the agreement as long as both sides consent. It’s important to document any modifications in writing to avoid future misunderstandings.

PDF Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Illinois, specifically under the Illinois Compiled Statutes. |

| Key Components | It typically includes details such as loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures Required | Both parties must sign the agreement to make it legally binding, ensuring mutual consent to the terms. |

Key takeaways

When filling out and using the Illinois Loan Agreement form, consider the following key takeaways:

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. This ensures that all parties are accurately represented.

- Loan Amount: Specify the exact amount being loaned. This avoids confusion and sets clear expectations for repayment.

- Interest Rate: Include the interest rate applicable to the loan. Be aware of Illinois usury laws to ensure compliance.

- Repayment Terms: Outline the repayment schedule, including due dates and payment methods. Clarity here can prevent future disputes.

- Default Conditions: Define what constitutes a default on the loan. This helps both parties understand the consequences of non-payment.

- Governing Law: Indicate that the agreement is governed by Illinois law. This provides a legal framework for resolving disputes.

- Signatures: Ensure that both parties sign the agreement. A signature is essential for the document to be legally binding.

- Keep Copies: Retain copies of the signed agreement for both parties. This serves as a reference point in case of any issues.