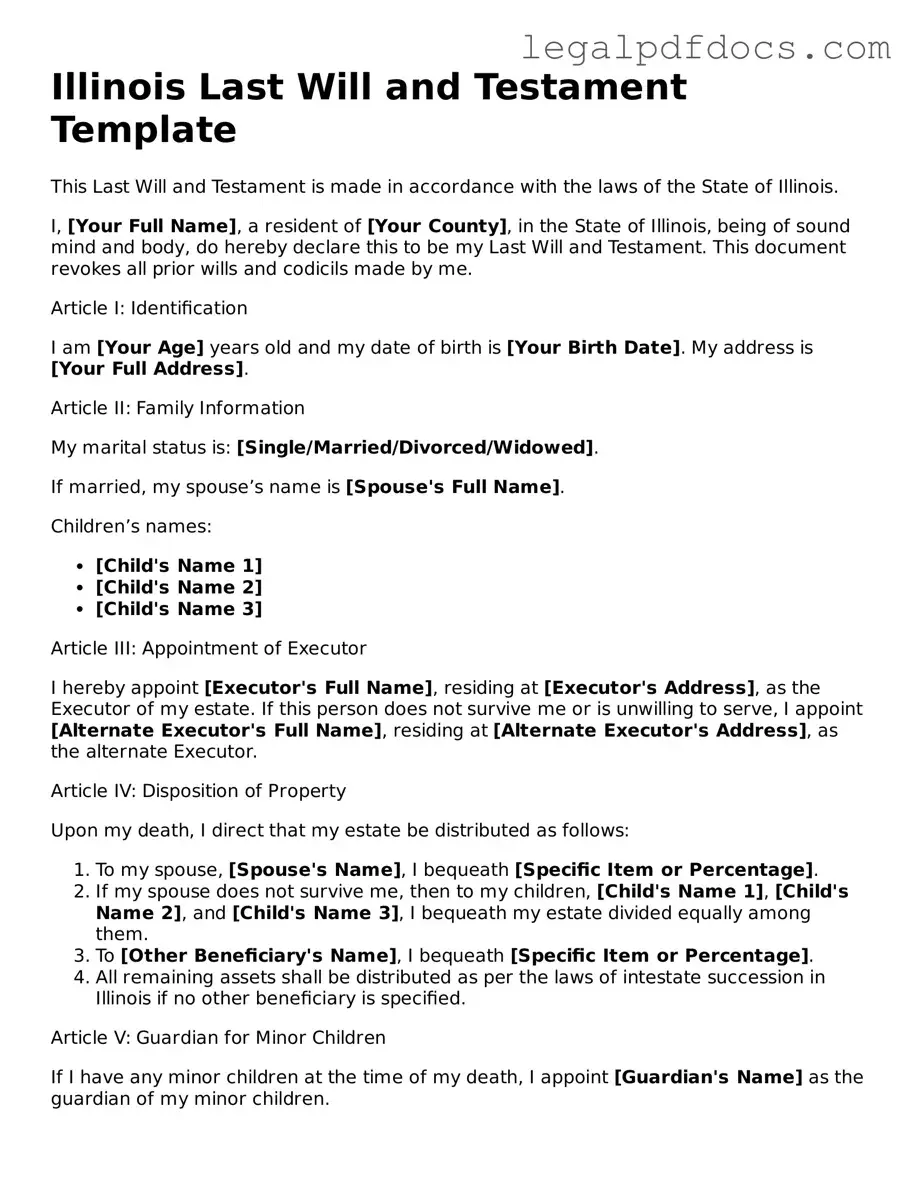

Official Last Will and Testament Form for Illinois

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Illinois, this legal document serves as a formal declaration of how you would like your assets distributed and who will manage your estate. The Illinois Last Will and Testament form outlines important aspects such as the appointment of an executor, who will be responsible for carrying out your wishes, and the designation of guardians for any minor children. Additionally, it allows you to specify particular bequests, ensuring that cherished possessions go to the intended recipients. The form must be signed in the presence of witnesses to validate its authenticity, reflecting the importance of following the state’s legal requirements. Understanding these components will empower you to create a comprehensive will that truly reflects your intentions and provides peace of mind for both you and your loved ones.

Dos and Don'ts

When filling out the Illinois Last Will and Testament form, it is essential to follow certain guidelines to ensure that your wishes are clearly communicated and legally valid. Here’s a list of things you should and shouldn’t do:

- Do clearly state your full name and address at the beginning of the document.

- Do appoint an executor who will carry out your wishes after your passing.

- Do specify how you want your assets distributed among your beneficiaries.

- Do date the will to indicate when it was created.

- Do sign the will in the presence of at least two witnesses.

- Don't use vague language that could lead to confusion about your intentions.

- Don't forget to review the will periodically and update it as necessary.

- Don't include any illegal provisions that cannot be enforced.

- Don't assume that a handwritten will is valid without proper witnesses.

Taking these steps can help ensure that your will is valid and reflects your wishes accurately. Always consider seeking guidance if you have questions or concerns.

How to Use Illinois Last Will and Testament

Once you have your Illinois Last Will and Testament form ready, it’s time to complete it with your personal information and wishes. This process is straightforward, but attention to detail is crucial to ensure everything is accurate and legally binding.

- Gather Necessary Information: Collect details about your assets, beneficiaries, and any specific wishes you have regarding your estate.

- Fill in Your Personal Information: Start by entering your full name, address, and the date. Make sure this information is correct.

- Identify Your Beneficiaries: Clearly list the names and relationships of the people or organizations you wish to inherit your assets.

- Specify Your Executor: Choose someone you trust to carry out the terms of your will. Include their name and contact information.

- Detail Your Wishes: Outline how you want your assets distributed. Be specific to avoid confusion later on.

- Include a Guardian (if applicable): If you have minor children, name a guardian for them. This is an important decision that should be made carefully.

- Review the Document: Go through the form to ensure all information is accurate and complete. Double-check for any errors.

- Sign the Will: Sign the document in the presence of at least two witnesses. They should also sign the will to validate it.

- Store the Will Safely: Keep the signed will in a secure place, such as a safe or with a trusted individual. Make sure your executor knows where to find it.

Find Popular Last Will and Testament Forms for US States

Idaho Last Will and Testament - Including a no-contest clause in a Will can discourage beneficiaries from disputing the provisions outlined within it.

Georgia Last Will and Testament - May offer the opportunity to express personal messages to loved ones.

Last Will and Testament Arizona - Helps to prevent state laws from deciding how assets are divided.

Template for a Will - Can help you avoid probate court, which can be lengthy and costly.

Documents used along the form

When creating a comprehensive estate plan in Illinois, several documents often accompany the Last Will and Testament. Each of these documents serves a specific purpose and can help ensure that a person's wishes are honored after their passing. Below is a list of common forms and documents that individuals may consider including in their estate planning process.

- Living Will: This document outlines a person's wishes regarding medical treatment in situations where they are unable to communicate their preferences. It typically addresses end-of-life care and life-sustaining treatments.

- Durable Power of Attorney for Healthcare: This form designates an individual to make healthcare decisions on behalf of the person if they become incapacitated. It ensures that someone trusted can advocate for the person's medical preferences.

- Durable Power of Attorney for Finances: This document allows a designated person to manage financial matters if the individual is unable to do so. It can include tasks such as paying bills, managing investments, and handling real estate transactions.

- Trust Agreement: A trust can hold assets for the benefit of specific individuals. It can help avoid probate and provide for the management of assets during the grantor's lifetime and after their death.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, such as life insurance policies or retirement accounts, upon the individual's death. They override instructions in a will.

- Letter of Instruction: This informal document provides guidance to loved ones about personal wishes, funeral arrangements, and the location of important documents. It can help ease the burden on family members during a difficult time.

- Pet Trust: This specialized trust ensures that pets are cared for after the owner's death. It can outline how funds should be used for their care and designate a caregiver.

- Transfer on Death Deed: This deed allows a property owner to designate a beneficiary who will receive the property upon the owner's death, bypassing the probate process.

- Guardianship Designation: For parents, this document specifies who will take care of their minor children if they pass away. It is crucial for ensuring that children are placed in the care of someone trusted.

Incorporating these documents into an estate plan can provide clarity and direction for loved ones. Each serves a unique role in helping individuals express their wishes and protect their interests. It is advisable to consult with a legal professional to ensure that all documents are properly drafted and executed according to Illinois law.

Misconceptions

When it comes to creating a Last Will and Testament in Illinois, several misconceptions can lead to confusion and mistakes. Understanding these misconceptions is crucial for anyone looking to ensure their wishes are honored after they pass away. Below are five common misconceptions about the Illinois Last Will and Testament form.

- Misconception 1: A handwritten will is not valid.

- Misconception 2: You need an attorney to create a will.

- Misconception 3: A will can be verbal.

- Misconception 4: Once a will is created, it cannot be changed.

- Misconception 5: A will automatically goes into effect upon death.

Many people believe that only formally typed wills are legally recognized. In Illinois, however, a handwritten will, known as a holographic will, can be valid if it meets certain criteria, such as being signed by the testator and clearly expressing their intentions.

While consulting an attorney can be beneficial, it is not a legal requirement in Illinois. Individuals can create their own wills using the appropriate forms, provided they follow the state’s guidelines for validity.

Some people think that simply stating their wishes out loud is enough to create a valid will. In Illinois, a will must be in writing to be enforceable. Verbal declarations do not hold up in court.

This is a common misunderstanding. In Illinois, individuals have the right to modify or revoke their wills at any time, as long as they follow the proper procedures. This flexibility allows for changes in circumstances or wishes.

Many assume that a will takes effect immediately after death. In reality, the will must go through a legal process called probate before it can be executed. This process ensures that the will is valid and that the deceased's wishes are honored.

PDF Specifications

| Fact Name | Details |

|---|---|

| Legal Requirement | In Illinois, a Last Will and Testament must be in writing, either typed or handwritten. |

| Age Requirement | The testator (the person making the will) must be at least 18 years old. |

| Witnesses | Two witnesses are required to sign the will, and they must be present at the same time as the testator. |

| Revocation | A will can be revoked by creating a new will or by destroying the original document. |

| Self-Proving Will | Illinois allows for a self-proving will, which simplifies the probate process by including a notarized affidavit from the witnesses. |

| Governing Law | The Illinois Probate Act governs the creation and execution of wills in the state. |

| Distribution of Assets | The will outlines how the testator's assets will be distributed after their death, ensuring their wishes are honored. |

Key takeaways

Ensure you are at least 18 years old and of sound mind when creating your will. This is a basic requirement for the document to be legally valid.

Clearly identify yourself in the will. Include your full name and address to avoid any confusion about your identity.

Designate an executor. This person will be responsible for carrying out your wishes as stated in the will. Choose someone you trust.

Be specific about your assets. Clearly list your property, money, and other assets, detailing who will receive each item.

Sign the will in front of two witnesses. They must also sign the document, affirming that they witnessed you signing it.

Store the will in a safe place. Inform your executor and loved ones where it can be found after your passing.