Official Durable Power of Attorney Form for Illinois

In Illinois, the Durable Power of Attorney form is an essential legal document that allows individuals to designate someone they trust to make decisions on their behalf when they are unable to do so. This powerful tool can cover a wide range of decisions, from financial matters to healthcare choices, ensuring that your wishes are respected even when you cannot communicate them. By granting authority to an agent, you empower them to act in your best interest, whether it involves managing your bank accounts, paying bills, or making medical decisions. Importantly, the Durable Power of Attorney remains effective even if you become incapacitated, providing peace of mind for both you and your loved ones. Understanding the nuances of this form, including how to properly fill it out and the responsibilities it entails for your appointed agent, is crucial for anyone considering this option. With the right preparation, you can safeguard your future and ensure that your preferences are honored when it matters most.

Dos and Don'ts

When filling out the Illinois Durable Power of Attorney form, it’s important to approach the process thoughtfully. Here are some key do's and don'ts to keep in mind:

- Do ensure you understand the powers you are granting. Clearly define the authority you want to give your agent.

- Do choose a trustworthy agent. This person will make important decisions on your behalf, so select someone you can rely on.

- Don't leave any sections blank. Incomplete forms can lead to confusion or disputes later on.

- Don't forget to sign and date the document. Without your signature, the form is not valid.

How to Use Illinois Durable Power of Attorney

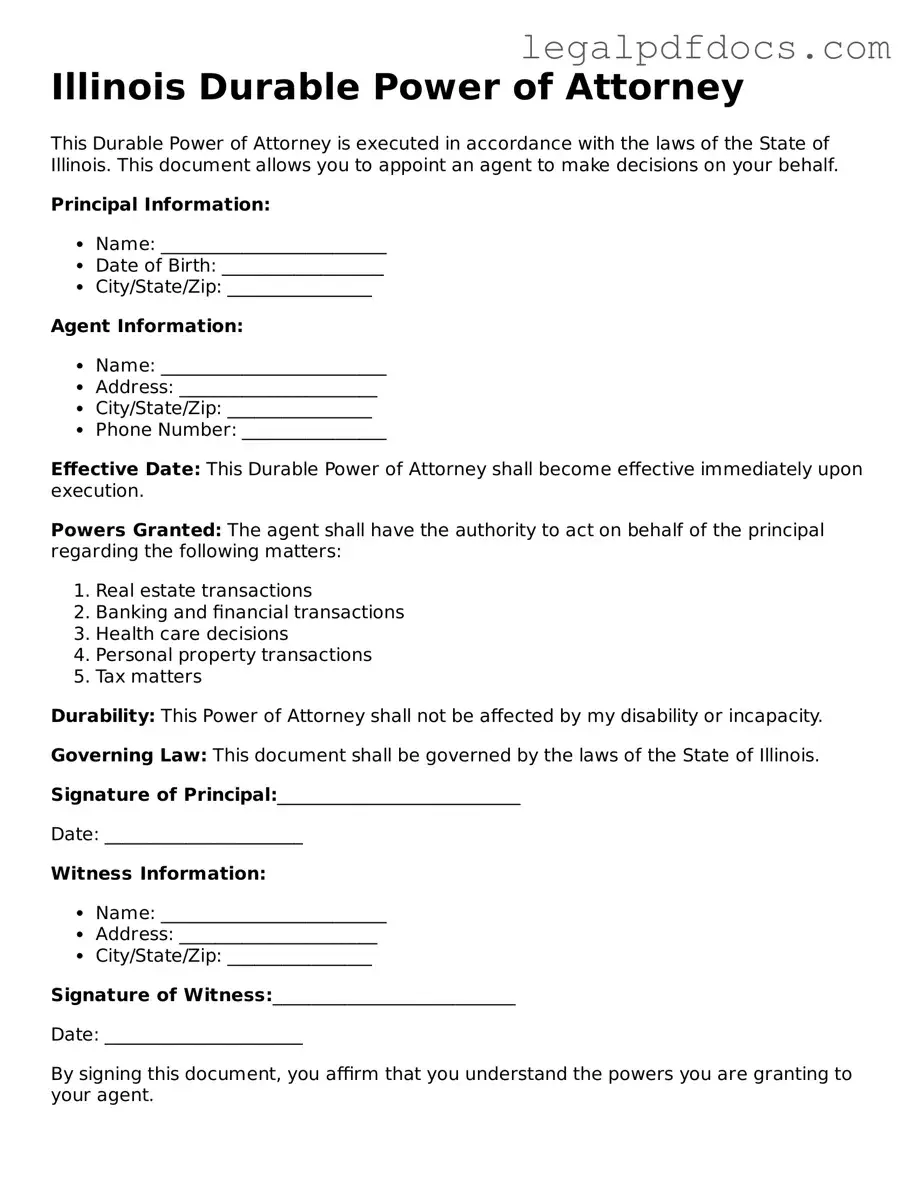

Filling out the Illinois Durable Power of Attorney form is an important step in ensuring your wishes are honored regarding financial and healthcare decisions. After completing the form, you will need to sign it in front of a witness and possibly a notary, depending on your specific needs. Here are the steps to guide you through the process of filling out the form.

- Begin by downloading the Illinois Durable Power of Attorney form from a reliable source.

- Read through the entire form to understand its sections and requirements.

- In the first section, provide your full name and address as the principal. This identifies you as the person granting the power.

- Next, select the agent you wish to appoint. Include their full name and address. This person will act on your behalf.

- Decide if you want to grant your agent specific powers or general powers. If you choose specific powers, list them clearly in the designated section.

- Indicate any limitations or conditions you want to place on the agent’s authority, if applicable.

- Review the section regarding alternate agents. If you want to name someone else in case your primary agent is unable to serve, fill in their information.

- Sign and date the form at the bottom. Ensure that your signature matches your name as written at the top.

- Have one witness sign the form. The witness should be someone who is not related to you and who will not benefit from the power of attorney.

- If required, take the form to a notary public for notarization. This step may not be necessary for all situations, but it adds an extra layer of validity.

Once you have completed these steps, keep the original form in a safe place and provide copies to your agent and any relevant parties. This will ensure that your wishes are clearly communicated and can be acted upon when needed.

Find Popular Durable Power of Attorney Forms for US States

Durable Power of Attorney Forms - The principal must ensure the agent understands their values and intentions.

Michigan Durable Power of Attorney Form - Updating your Durable Power of Attorney as your situation changes is essential for ensuring it remains effective.

Idaho Power of Attorney Form - Choose wisely; the selected agent should be reliable and trustworthy.

Documents used along the form

A Durable Power of Attorney (DPOA) is an important document that allows someone to make decisions on your behalf if you become unable to do so. Along with the DPOA, several other forms and documents can help ensure your wishes are respected and your affairs are managed properly. Here are some common documents that are often used in conjunction with the Illinois Durable Power of Attorney form:

- Health Care Power of Attorney: This document allows you to appoint someone to make medical decisions for you if you are unable to communicate your wishes.

- Living Will: A living will outlines your preferences regarding medical treatment and end-of-life care, guiding your health care provider and family in critical situations.

- Do Not Resuscitate (DNR) Order: This order specifies that you do not want to receive CPR or other life-saving measures in the event of cardiac arrest.

- Will: A will is a legal document that details how your assets should be distributed after your death and can name guardians for minor children.

- Trust: A trust allows you to manage your assets during your lifetime and specify how they should be distributed after your death, potentially avoiding probate.

- Beneficiary Designations: These designations are used for accounts like life insurance or retirement plans, allowing you to specify who will receive the benefits upon your death.

- Property Deeds: If you own real estate, transferring property into a trust or specifying ownership can help manage your assets and avoid probate issues.

Each of these documents plays a crucial role in estate planning and health care decision-making. Together with the Durable Power of Attorney, they provide a comprehensive approach to managing your affairs and ensuring your wishes are honored.

Misconceptions

Understanding the Illinois Durable Power of Attorney form can be challenging, especially with the many misconceptions surrounding it. Here’s a list of ten common misunderstandings to clarify how this important document works.

- It only applies to financial decisions. Many people believe that a Durable Power of Attorney is solely for financial matters. In reality, it can also grant authority for healthcare decisions, depending on how it is drafted.

- It becomes effective only when the principal is incapacitated. Some think that the document only takes effect when the person is unable to make decisions. However, a Durable Power of Attorney can be set to become effective immediately upon signing.

- It can be used indefinitely without any limitations. While the authority granted can last until the principal's death, it does not mean that the agent can act without any restrictions. The principal can specify limitations or conditions in the document.

- Anyone can be appointed as an agent. Although the principal has the freedom to choose their agent, it’s essential that the selected person is trustworthy and capable of making decisions on their behalf.

- Once signed, it cannot be changed. This is a common myth. The principal retains the right to revoke or amend the Durable Power of Attorney at any time, as long as they are competent to do so.

- It is only necessary for older adults. Many believe that only seniors need a Durable Power of Attorney. In fact, anyone over 18 can benefit from having this document, especially if they want to ensure their wishes are followed in case of unexpected events.

- The agent must be a lawyer. While some may think that only legal professionals can serve as agents, this is not the case. A trusted friend or family member can fulfill this role, provided they are willing and able to take on the responsibility.

- It is the same as a regular Power of Attorney. A Durable Power of Attorney differs from a regular Power of Attorney in that it remains effective even if the principal becomes incapacitated. This distinction is crucial for ensuring ongoing decision-making authority.

- It is a one-size-fits-all document. Each Durable Power of Attorney can be tailored to fit the principal's unique needs and preferences. Customizing the document is important to ensure it accurately reflects their wishes.

- It automatically includes the ability to make medical decisions. While a Durable Power of Attorney can include healthcare decisions, it must explicitly state this authority. If it does not, the agent may not have the power to make medical choices on behalf of the principal.

By understanding these misconceptions, individuals can better navigate the process of creating a Durable Power of Attorney in Illinois. This document is a powerful tool for ensuring that one’s wishes are respected and that trusted individuals are empowered to act when needed.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | The Illinois Durable Power of Attorney form allows an individual to designate another person to make decisions on their behalf, particularly in financial or healthcare matters. |

| Governing Law | This form is governed by the Illinois Power of Attorney Act, specifically 755 ILCS 45/2-1 et seq. |

| Durability | The "durable" aspect means that the power of attorney remains effective even if the principal becomes incapacitated. |

| Types of Decisions | Agents can make a wide range of decisions, including financial transactions, real estate management, and healthcare choices. |

| Agent Requirements | The designated agent must be at least 18 years old and cannot be the principal's healthcare provider or an employee of the healthcare provider. |

| Execution | The form must be signed by the principal in the presence of a witness or a notary public to be legally valid. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent to do so. |

Key takeaways

When considering the Illinois Durable Power of Attorney form, it is important to understand several key aspects to ensure it is completed correctly and serves its intended purpose. Here are six essential takeaways:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make decisions on your behalf if you become unable to do so. This can include financial, legal, or healthcare decisions.

- Choose Your Agent Wisely: The person you select as your agent should be someone you trust completely. This individual will have significant authority over your affairs, so consider their judgment and reliability.

- Specify Powers Clearly: The form allows you to outline the specific powers you are granting to your agent. Be explicit about what decisions they can make to avoid any confusion in the future.

- Consider Alternate Agents: It is wise to name an alternate agent in case your primary agent is unable or unwilling to act. This ensures that someone is always available to make decisions on your behalf.

- Sign and Date Appropriately: For the Durable Power of Attorney to be valid, it must be signed and dated by you. Additionally, it should be witnessed and notarized to meet Illinois legal requirements.

- Review Regularly: Life circumstances change, and so might your preferences. Regularly review and update your Durable Power of Attorney to reflect any changes in your relationships or wishes.

By keeping these takeaways in mind, individuals can navigate the process of creating a Durable Power of Attorney in Illinois more effectively, ensuring that their wishes are honored when they may no longer be able to express them.