Official Deed Form for Illinois

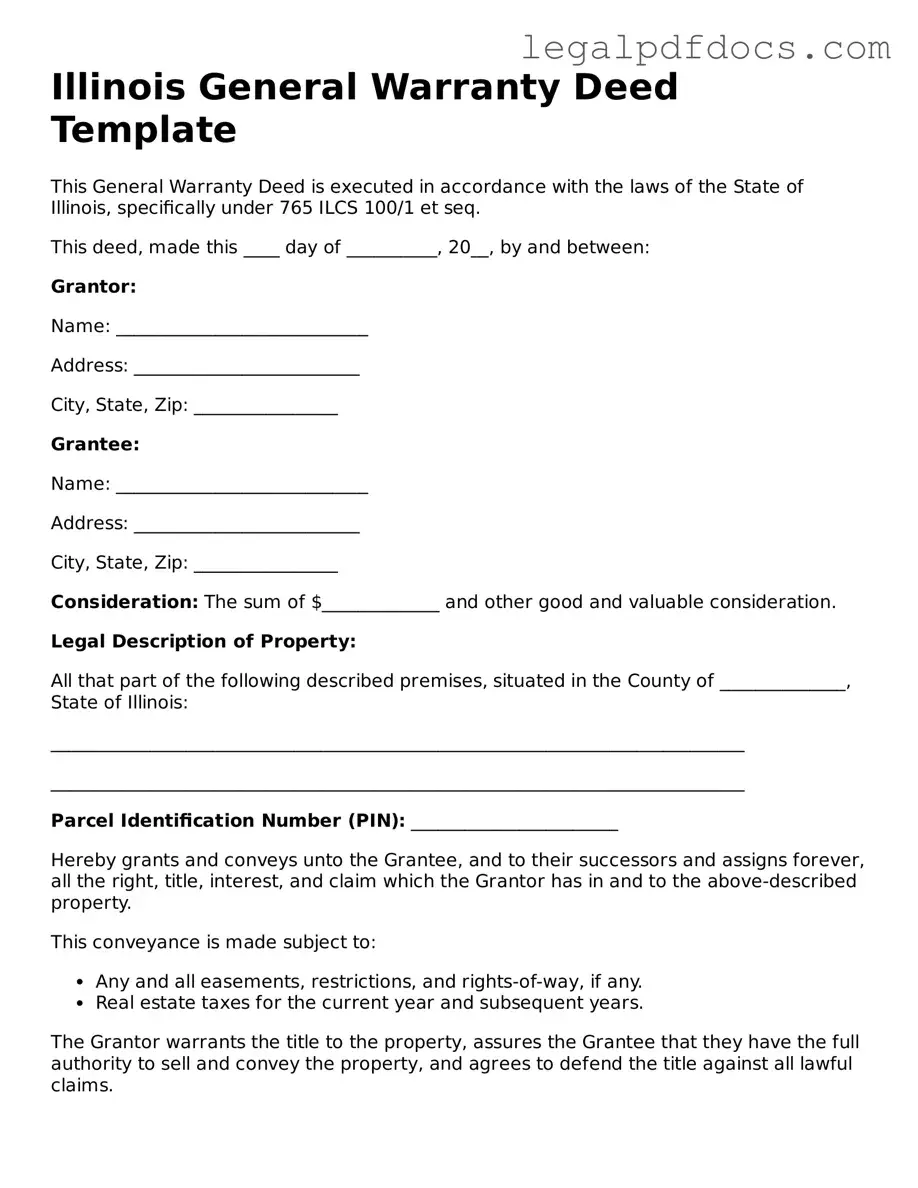

The Illinois Deed form serves as a crucial legal document in real estate transactions, facilitating the transfer of property ownership from one party to another. This form typically includes essential information such as the names of the grantor and grantee, a description of the property being transferred, and the consideration or payment involved in the transaction. Various types of deeds exist within Illinois law, including warranty deeds, quitclaim deeds, and special warranty deeds, each offering different levels of protection and assurance to the parties involved. The execution of the deed requires signatures from the grantor, and in some cases, witnesses or notarization may be necessary to ensure its validity. Additionally, the form must be filed with the appropriate county recorder's office to provide public notice of the ownership change. Understanding the Illinois Deed form is essential for both buyers and sellers, as it not only formalizes the transfer but also helps prevent future disputes over property rights.

Dos and Don'ts

When filling out the Illinois Deed form, it’s important to ensure accuracy and clarity. Here’s a helpful list of things to do and avoid:

- Do double-check the names of all parties involved to ensure they are spelled correctly.

- Do provide a clear and accurate legal description of the property being transferred.

- Do sign the deed in front of a notary public to ensure it is legally valid.

- Do include the date of the transaction on the form.

- Don't leave any required fields blank; incomplete forms can cause delays.

- Don't use abbreviations or shorthand when filling out the form; clarity is key.

- Don't forget to check local recording requirements, as they may vary by county.

By following these guidelines, you can help ensure that the deed is filled out correctly and processed without issues.

How to Use Illinois Deed

After you have gathered the necessary information, you are ready to fill out the Illinois Deed form. This process involves entering specific details about the property and the parties involved. Be sure to double-check your entries for accuracy before submitting the form.

- Begin by entering the name of the grantor, the person transferring the property. Make sure to include the full legal name.

- Next, list the name of the grantee, the person receiving the property. Again, use the full legal name.

- Provide the complete address of the property being transferred. This includes the street address, city, state, and zip code.

- Include a legal description of the property. This may require a survey or previous deed for accuracy.

- Indicate the date of the transaction. This should be the date when the deed is being executed.

- Sign the deed in the presence of a notary public. The notary will then notarize your signature.

- Finally, submit the completed deed to the appropriate county recorder’s office for filing. Be prepared to pay any associated fees.

Find Popular Deed Forms for US States

Warranty Deed Form Idaho - A quitclaim deed transfers interest in a property without any guarantees.

Michigan House Deed - Acts as a formal agreement between involved parties.

Documents used along the form

When transferring property in Illinois, the deed form is just one piece of the puzzle. Several other documents often accompany the deed to ensure a smooth and legally compliant transaction. Below is a list of common forms and documents used alongside the Illinois Deed form, each serving a specific purpose in the property transfer process.

- Title Insurance Policy: This document protects the buyer and lender from potential issues related to the property’s title, such as liens or ownership disputes.

- Property Transfer Tax Declaration: This form is required to report the transfer of property and assess any applicable transfer taxes.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner of the property and that there are no undisclosed liens or claims against it.

- Settlement Statement (HUD-1): This document outlines all financial details of the transaction, including costs, fees, and credits for both the buyer and seller.

- Power of Attorney: If a party cannot be present to sign the deed, a power of attorney allows another person to act on their behalf in the transaction.

- Warranty Deed: This type of deed guarantees that the seller holds clear title to the property and offers assurances against future claims.

- Quitclaim Deed: Often used to transfer property between family members or in divorce settlements, this deed conveys whatever interest the seller has without guarantees.

- Real Estate Contract: This agreement outlines the terms of the sale, including price, contingencies, and the responsibilities of both parties.

Understanding these accompanying documents can help ensure that property transactions in Illinois are conducted smoothly and legally. Each document plays a vital role in protecting the interests of all parties involved.

Misconceptions

When dealing with real estate transactions in Illinois, there are several misconceptions about the Illinois Deed form that can lead to confusion. Understanding these misconceptions can help ensure that property transfers go smoothly. Here are nine common misunderstandings:

- All deeds are the same. Many believe that all deed forms are interchangeable. In reality, different types of deeds serve specific purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds. Each type offers varying levels of protection and rights.

- Deeds do not need to be recorded. Some people think that recording a deed is optional. However, recording a deed with the county clerk is crucial. It provides public notice of ownership and protects against future claims on the property.

- Only attorneys can prepare a deed. While it is advisable to consult an attorney for complex transactions, individuals can prepare a deed themselves if they understand the requirements. There are templates available that can assist in this process.

- Signatures are not important. Some may underestimate the importance of signatures on a deed. A deed must be signed by the grantor (the person transferring the property) to be valid. Without proper signatures, the deed is not legally binding.

- A deed does not need a legal description. It is a common misconception that a simple address is sufficient. However, a legal description is necessary to clearly define the property being transferred. This description helps avoid disputes over property boundaries.

- All deeds are permanent. Many people believe that once a deed is executed, it cannot be changed. In fact, deeds can be amended or revoked under certain circumstances, but this process requires careful legal consideration.

- Deeds transfer ownership immediately. Some assume that signing a deed automatically transfers ownership. While the deed represents the intent to transfer, actual ownership transfer may depend on recording the deed and other legal formalities.

- Only the seller needs to sign the deed. It is a misconception that only the seller's signature is required. In some cases, the buyer may also need to sign the deed, especially in transactions involving multiple parties.

- Tax implications are not related to the deed. Some individuals overlook the fact that transferring property can have tax consequences. It's essential to understand how the transfer may affect property taxes and capital gains taxes.

By clarifying these misconceptions, individuals can approach the process of creating and executing an Illinois Deed form with greater confidence and awareness.

PDF Specifications

| Fact Name | Details |

|---|---|

| Type of Deed | In Illinois, the most common types of deeds are warranty deeds and quitclaim deeds. Each serves different purposes in property transfer. |

| Governing Laws | The Illinois Real Property Transfer on Death Instrument Act governs the transfer of property upon death, while the Illinois Compiled Statutes, specifically 765 ILCS 1005, cover the use of deeds. |

| Signature Requirement | For a deed to be valid in Illinois, it must be signed by the grantor. Additionally, it should be acknowledged before a notary public. |

| Recording | To ensure public notice, deeds must be recorded with the county clerk's office. This protects the interests of the grantee and future buyers. |

Key takeaways

When filling out and using the Illinois Deed form, keep these key takeaways in mind:

- Ensure all parties involved are clearly identified. This includes both the grantor (seller) and grantee (buyer).

- Use the correct legal description of the property. This is crucial for the deed to be valid.

- Check for any necessary signatures. All parties must sign the deed for it to be enforceable.

- Consider having the deed notarized. While not always required, notarization adds an extra layer of authenticity.

- Be aware of the transfer tax implications. Illinois may require payment of a transfer tax when the property changes hands.

- File the deed with the appropriate county recorder’s office. This step is essential to make the transfer official.

- Keep a copy of the filed deed for your records. This will be important for future reference.

- Consult a real estate professional if unsure. They can provide guidance and ensure everything is completed correctly.