Official Deed in Lieu of Foreclosure Form for Illinois

In the state of Illinois, the Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial distress and the potential loss of their property. This form allows a homeowner to voluntarily transfer ownership of their property back to the lender, effectively avoiding the lengthy and often stressful foreclosure process. By doing so, the homeowner can mitigate the negative impact on their credit score and potentially negotiate more favorable terms regarding any remaining debt. The process typically involves the homeowner working closely with the lender to ensure that all obligations are understood and met. Furthermore, the Deed in Lieu of Foreclosure can provide a more amicable resolution for both parties, as it allows the lender to take possession of the property without the need for court intervention. Understanding the requirements and implications of this form is essential for homeowners considering this option, as it can lead to a fresh start and a chance to rebuild financially.

Dos and Don'ts

When filling out the Illinois Deed in Lieu of Foreclosure form, it is essential to follow certain guidelines to ensure that the process goes smoothly. Below are five things you should and should not do.

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have any questions about the process or implications of the deed.

- Do sign the document in the presence of a notary public to validate your signature.

- Don't rush through the form. Take your time to understand each section before filling it out.

- Don't leave any sections blank unless instructed otherwise. Incomplete forms may lead to delays or rejection.

How to Use Illinois Deed in Lieu of Foreclosure

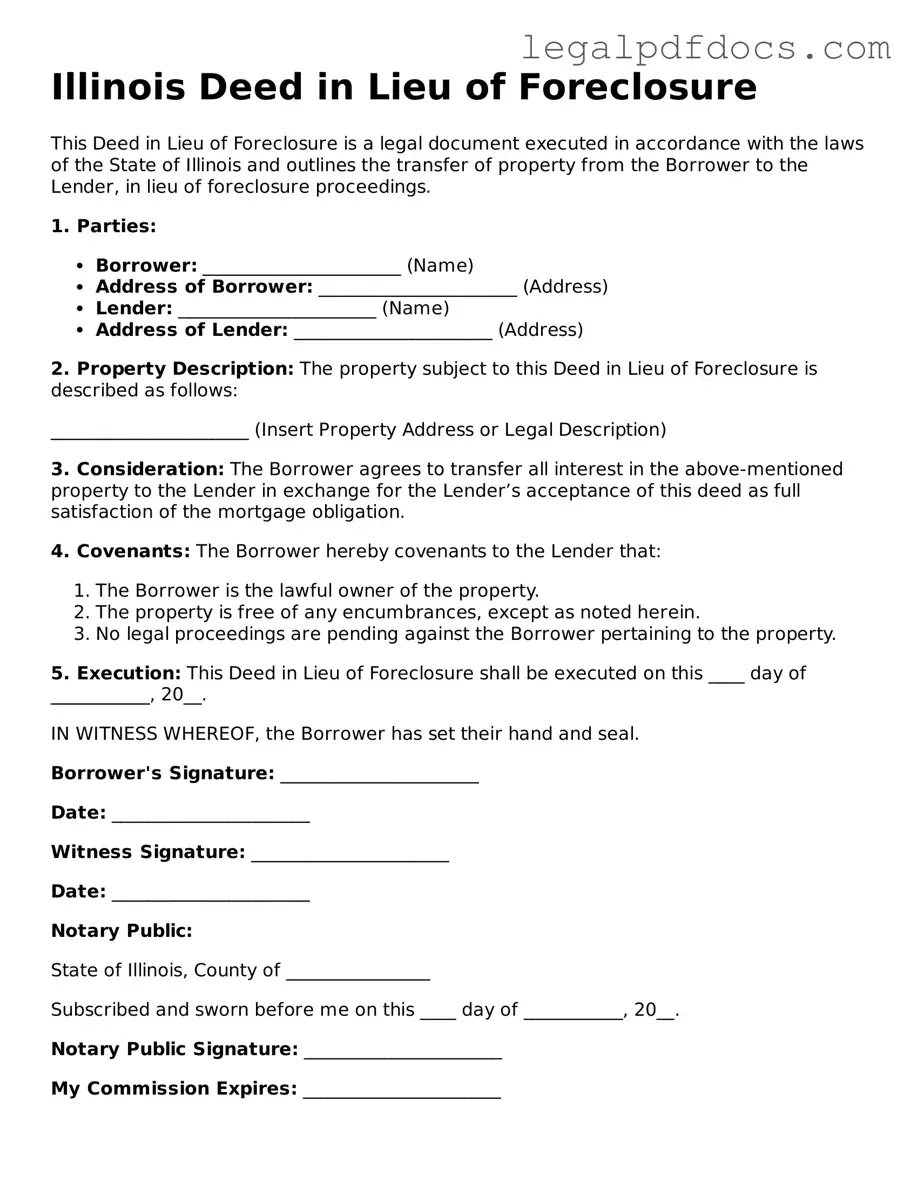

Once you have the Illinois Deed in Lieu of Foreclosure form ready, it’s important to fill it out accurately. Completing this form correctly will help ensure that the process moves forward without unnecessary delays. Follow these steps carefully.

- Obtain the Form: Download the Illinois Deed in Lieu of Foreclosure form from a reliable source or obtain a physical copy.

- Fill in the Grantor Information: Enter the full name(s) of the person(s) transferring the property. This is typically the homeowner(s).

- Provide Grantee Information: Write the name of the entity receiving the property, usually the lender or bank.

- Describe the Property: Include the full address of the property. Make sure to provide any additional identifying details, such as parcel number or legal description, if required.

- Check the Terms: Review any specific terms or conditions that may need to be included. Ensure they reflect your agreement with the lender.

- Sign the Document: The grantor(s) must sign the form in the designated area. Make sure to date the signatures.

- Notarization: Have the document notarized. This step is essential for the form to be legally binding.

- Submit the Form: Once completed, submit the form to the appropriate county recorder’s office. Keep a copy for your records.

After you have submitted the form, follow up with the county recorder’s office to confirm that the deed has been processed. This will help ensure that everything is in order and that you are protected throughout the transition.

Find Popular Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu Vs Foreclosure - Choosing a Deed in Lieu gives you a chance to demonstrate responsibility to your lender by taking a proactive stance.

Sale in Lieu of Foreclosure - The homeowner typically works directly with the lender to complete necessary paperwork for the deed transfer.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Illinois, several other forms and documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose and helps clarify the rights and responsibilities of all parties involved. Here’s a list of commonly used forms that you might encounter.

- Loan Modification Agreement: This document outlines any changes made to the original loan terms. It can help borrowers retain their home by making payments more manageable.

- Notice of Default: This formal notice informs the borrower that they are in default on their mortgage. It typically outlines the amount owed and the timeframe to remedy the situation.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It can be particularly useful if the homeowner is unable to sign documents in person.

- Release of Liability: This form releases the borrower from any further obligations under the mortgage after the Deed in Lieu is executed, ensuring they are no longer responsible for the loan.

- Settlement Statement: Also known as a HUD-1, this document provides a detailed account of all costs associated with the transaction, ensuring transparency for both parties.

- Title Search Report: This report confirms the legal ownership of the property and checks for any liens or encumbrances that could affect the transaction.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and discloses any issues that may affect the title.

Understanding these additional forms can make the process of executing a Deed in Lieu of Foreclosure much clearer. Each document plays a vital role in protecting the interests of both the borrower and the lender, ensuring that all parties are on the same page throughout the transaction.

Misconceptions

Understanding the Illinois Deed in Lieu of Foreclosure can be challenging. Here are ten common misconceptions that often arise:

- It eliminates all debt immediately. Many believe that signing a deed in lieu of foreclosure will erase all their mortgage debt. However, this is not always the case, as some debts may still remain.

- It is a quick process. While a deed in lieu can be faster than a foreclosure, it still involves various steps and can take time to finalize.

- It protects the homeowner from credit damage. Some think that a deed in lieu will not affect their credit score. Unfortunately, it can still have a negative impact, though typically less severe than a foreclosure.

- It is available to anyone. Not everyone qualifies for a deed in lieu of foreclosure. Lenders have specific criteria that must be met.

- It is the same as a short sale. A deed in lieu is different from a short sale. In a short sale, the property is sold for less than the mortgage amount, while a deed in lieu involves transferring ownership back to the lender.

- Homeowners can stay in the property. Once a deed in lieu is signed, the homeowner typically must vacate the property, as ownership transfers to the lender.

- It absolves all liability. Signing a deed in lieu does not always release the homeowner from all liability. Some lenders may pursue a deficiency judgment for any remaining balance.

- It is a last resort option. Many view a deed in lieu as the only option when facing foreclosure. However, it can be a strategic choice even when other options are available.

- It requires court approval. Unlike foreclosure proceedings, a deed in lieu does not require court involvement, making it a more straightforward process.

- All lenders accept it. Not all lenders are willing to accept a deed in lieu of foreclosure. Each lender has its own policies and procedures regarding this option.

Understanding these misconceptions can help homeowners make informed decisions regarding their financial situations. Seeking guidance from a qualified professional is always advisable when navigating these options.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | The Illinois Deed in Lieu of Foreclosure is governed by the Illinois Mortgage Foreclosure Law. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may be eligible for this option. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process while minimizing damage to their credit score. |

| Requirements | Typically, the lender must agree to accept the deed in lieu, and the borrower must be current on property taxes and insurance. |

| Process | The borrower must submit a request to the lender, who will then review the application and negotiate terms. |

| Title Transfer | Once agreed upon, the deed is executed, and the title is transferred to the lender, freeing the borrower from mortgage obligations. |

| Impact on Credit | While a deed in lieu may have less impact than a foreclosure, it can still affect a borrower's credit score negatively. |

| Alternatives | Other options include loan modification, short sale, or traditional foreclosure, which should be considered based on individual circumstances. |

| Legal Advice | Consulting with a legal professional is advisable to understand the implications and ensure all legal requirements are met. |

Key takeaways

Filling out and using the Illinois Deed in Lieu of Foreclosure form requires careful attention to detail. Here are some key takeaways to consider:

- The form serves as a legal document transferring property ownership from the borrower to the lender.

- It is crucial to ensure that the property is free of other liens or encumbrances before proceeding.

- Both parties must agree to the terms outlined in the deed, which should be documented in writing.

- The borrower should consult with a legal expert to understand the implications of signing the deed.

- Filing the deed with the appropriate county recorder’s office is necessary to make the transfer official.

- Consideration should be given to the impact on credit scores, as this action may still affect credit history.

- The lender may offer certain incentives or benefits for accepting a deed in lieu of foreclosure, which should be negotiated upfront.