Official Bill of Sale Form for Illinois

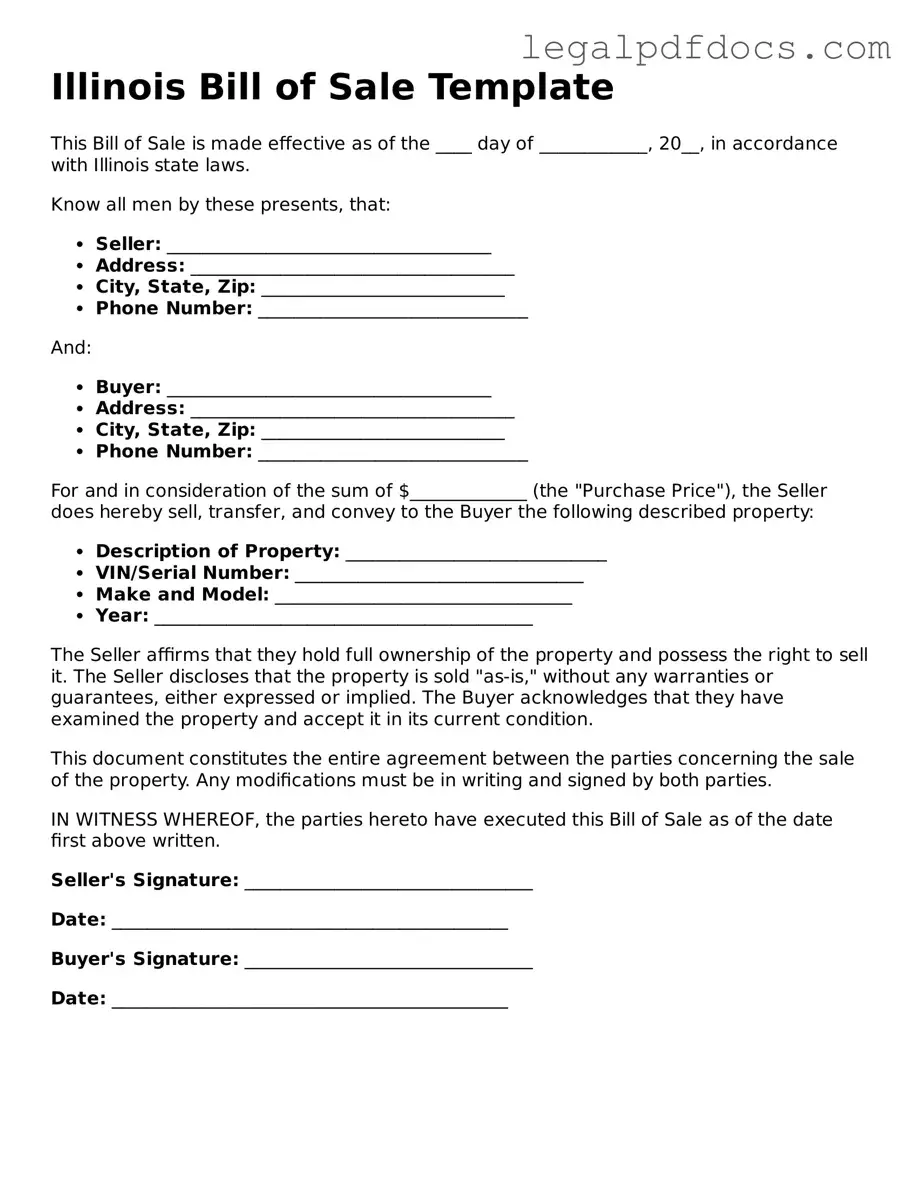

The Illinois Bill of Sale form serves as a crucial document in the transfer of ownership for various types of personal property, whether it be vehicles, boats, or other tangible items. This form not only provides a written record of the transaction but also includes essential details such as the names and addresses of both the buyer and seller, a description of the item being sold, and the purchase price. By documenting the date of sale, the form helps establish a clear timeline for ownership transfer. Additionally, it may include specific terms and conditions related to the sale, such as warranties or disclosures about the item's condition. While not always legally required, having a Bill of Sale can protect both parties by offering proof of the transaction and clarifying their rights and responsibilities. Understanding the components and significance of this form is vital for anyone engaging in a sale in Illinois, as it helps ensure a smooth and transparent transfer of property.

Dos and Don'ts

When filling out the Illinois Bill of Sale form, it's important to follow certain guidelines to ensure the document is valid and serves its intended purpose. Here are some dos and don'ts to keep in mind:

- Do provide accurate information about the buyer and seller, including names and addresses.

- Do clearly describe the item being sold, including make, model, and any identifying numbers.

- Do specify the sale price to avoid any confusion later on.

- Do sign and date the document to validate the transaction.

- Don't leave any sections blank; incomplete forms can lead to issues.

- Don't use abbreviations or unclear language that might confuse the details of the sale.

- Don't forget to check for any local requirements that may apply to the sale.

- Don't overlook the importance of keeping a copy of the Bill of Sale for your records.

How to Use Illinois Bill of Sale

Once you have the Illinois Bill of Sale form in front of you, it's time to fill it out accurately. This document will serve as proof of a transaction, so it’s important to provide all the required information clearly. Follow these steps to complete the form effectively.

- Obtain the Form: Download the Illinois Bill of Sale form from a reliable source or obtain a physical copy.

- Identify the Seller: Write the full name and address of the seller in the designated section.

- Identify the Buyer: Enter the full name and address of the buyer next to the seller's information.

- Describe the Item: Clearly describe the item being sold. Include details such as make, model, year, and any identifying numbers like VIN for vehicles.

- State the Sale Price: Indicate the agreed-upon sale price for the item in the appropriate field.

- Include Date of Sale: Write the date when the transaction takes place.

- Signatures: Ensure both the seller and buyer sign the form. This step is crucial for the document's validity.

- Witness or Notary (if required): Depending on the nature of the sale, you may need a witness or notary signature to finalize the document.

After completing the form, both parties should keep a copy for their records. This will help ensure that both the buyer and seller have proof of the transaction should any questions arise in the future.

Find Popular Bill of Sale Forms for US States

Vehicle Bill of Sale Form - A Bill of Sale may also be beneficial in warranty disputes by establishing clearly defined terms.

Do I Need a Bill of Sale in Kansas - A Bill of Sale can help in tracking ownership history for collectors and enthusiasts.

Handwritten Bill of Sale - This form can help track ownership history in case of theft or loss.

Bill of Sale Idaho Pdf - Do not overlook the importance of this simple yet effective form.

Documents used along the form

When completing a transaction in Illinois, especially when buying or selling a vehicle, personal property, or other significant items, various forms and documents may accompany the Bill of Sale. Each document serves a specific purpose and helps ensure that the transaction is legally sound and properly documented. Here are some common forms you may encounter:

- Title Transfer Form: This document is crucial for transferring ownership of a vehicle. It must be completed and submitted to the Illinois Secretary of State to officially record the new owner.

- Odometer Disclosure Statement: Required for vehicle sales, this form verifies the mileage on the vehicle at the time of sale. It helps prevent fraud and ensures that buyers are aware of the vehicle's condition.

- Vehicle Registration Application: After purchasing a vehicle, the new owner must register it with the state. This application provides necessary information about the vehicle and its owner.

- Release of Liability Form: This document protects the seller from future claims related to the vehicle after the sale. It confirms that the seller is no longer responsible for the vehicle once it has been sold.

- Notarized Affidavit: In some cases, a notarized affidavit may be necessary to verify the authenticity of the sale or the identity of the parties involved. This adds an extra layer of security to the transaction.

- Sales Tax Form: This form is used to report and pay any sales tax due on the transaction. It ensures compliance with state tax laws and helps avoid future penalties.

- Purchase Agreement: This document outlines the terms of the sale, including the price, payment method, and any warranties or guarantees. It serves as a contract between the buyer and seller.

- Identification Documents: Both parties may need to provide identification, such as a driver's license or state ID, to verify their identities and facilitate the transaction.

Having these forms and documents prepared can simplify the buying or selling process. It helps ensure that both parties understand their rights and responsibilities, ultimately leading to a smoother transaction. Always consider consulting with a legal professional if you have questions about any specific document or requirement.

Misconceptions

Understanding the Illinois Bill of Sale form is essential for anyone involved in buying or selling personal property in the state. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

The Bill of Sale is only necessary for vehicle transactions.

Many people believe that a Bill of Sale is only required when buying or selling vehicles. In reality, this document is useful for any personal property transaction, including boats, furniture, and electronics.

-

A Bill of Sale is the same as a title transfer.

While a Bill of Sale serves as proof of the transaction, it does not replace the need for a title transfer, especially for vehicles. The title is a legal document that establishes ownership, while the Bill of Sale records the sale itself.

-

Notarization is mandatory for all Bills of Sale.

Some believe that a Bill of Sale must be notarized to be valid. In Illinois, notarization is not required for most transactions, although it can provide additional protection and credibility.

-

Once signed, a Bill of Sale cannot be changed.

It is a misconception that a Bill of Sale is set in stone once signed. Parties can agree to amend the document if both sides consent and sign the new version.

-

The seller is responsible for all future liabilities after the sale.

Many people think that once a Bill of Sale is signed, the seller is liable for any issues that arise with the item. However, the Bill of Sale can include clauses that limit the seller's liability after the transaction is completed.

-

A Bill of Sale is not legally binding.

This is a common myth. In fact, a properly completed Bill of Sale is a legally binding document that can be used in court to prove ownership and the terms of the sale.

By clarifying these misconceptions, individuals can better navigate the process of buying and selling personal property in Illinois, ensuring that their transactions are smooth and legally sound.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Bill of Sale form serves as a legal document to record the transfer of ownership of personal property from one party to another. |

| Governing Law | The use of the Bill of Sale in Illinois is governed by the Illinois Uniform Commercial Code (UCC), specifically Article 2, which pertains to the sale of goods. |

| Required Information | The form typically requires the names and addresses of both the buyer and seller, a description of the item being sold, and the sale price. |

| Notarization | While notarization is not mandatory for a Bill of Sale in Illinois, having it notarized can provide additional legal protection and verification of the transaction. |

| Use Cases | This form is commonly used for the sale of vehicles, boats, and other personal property, ensuring both parties have a record of the transaction. |

Key takeaways

When filling out and using the Illinois Bill of Sale form, there are several important points to keep in mind. These takeaways will help ensure that the process is smooth and legally sound.

- The Bill of Sale serves as a legal document that records the transfer of ownership of a specific item, typically a vehicle or personal property.

- Both the seller and buyer should complete the form. This ensures that both parties are in agreement about the transaction.

- Accurate details are crucial. Include the full names and addresses of both the seller and buyer, along with a description of the item being sold.

- In the case of vehicles, include the Vehicle Identification Number (VIN) to clearly identify the specific vehicle.

- The sale price must be clearly stated. This amount is important for tax purposes and future reference.

- Both parties should sign and date the form. This step is essential for validating the agreement.

- Consider having the Bill of Sale notarized. While not required, notarization can provide an additional layer of security and legitimacy.

- Keep a copy of the completed Bill of Sale for your records. This document may be needed for future reference or legal purposes.

- Check local regulations. Different counties or municipalities may have specific requirements regarding the Bill of Sale.