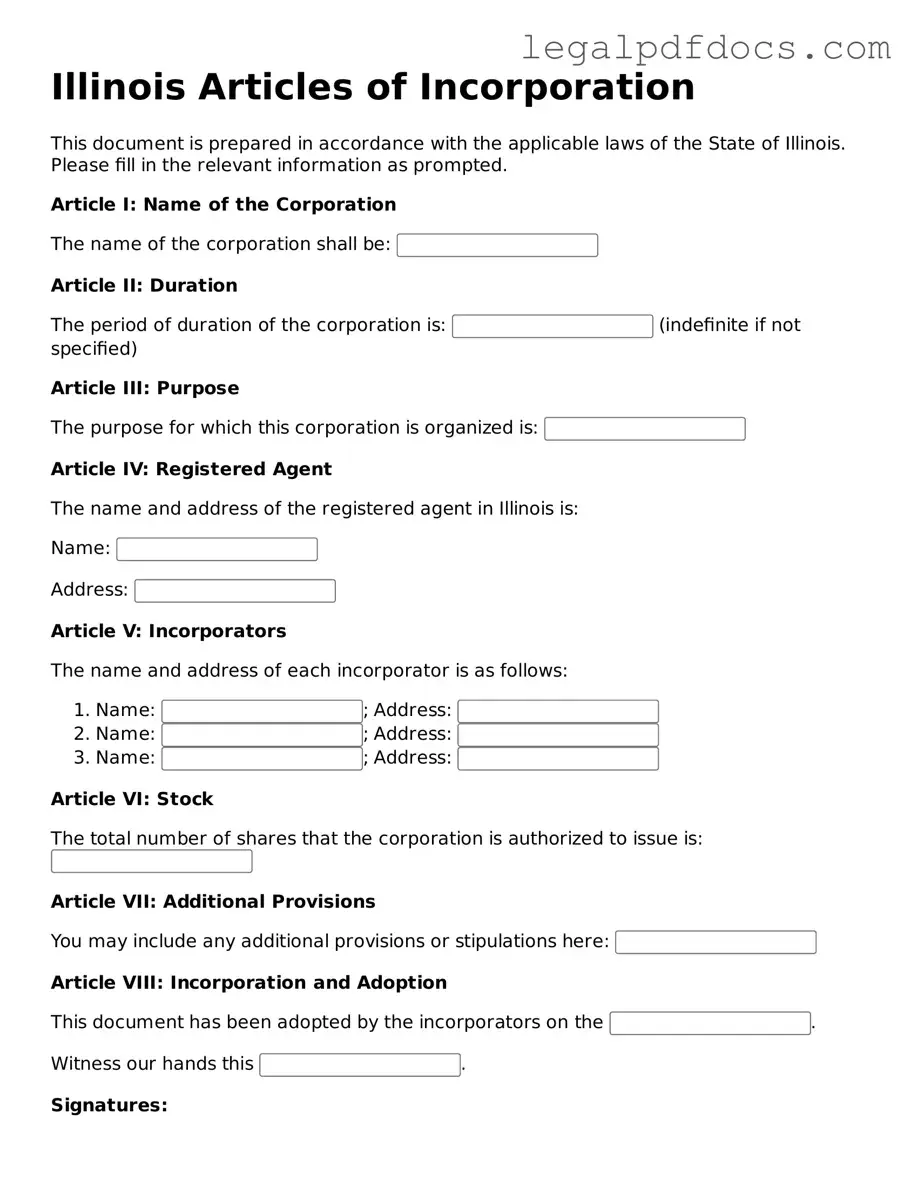

Official Articles of Incorporation Form for Illinois

When starting a business in Illinois, one of the first steps is to file the Articles of Incorporation. This essential document serves as the foundation for establishing a corporation in the state. It includes vital information such as the corporation's name, which must be unique and distinguishable from existing entities. The form also requires the designation of a registered agent, an individual or business responsible for receiving legal documents on behalf of the corporation. Additionally, the Articles outline the purpose of the corporation, which can range from general business activities to specific services. The filing must indicate the number of shares the corporation is authorized to issue, as well as the par value of those shares, if applicable. Importantly, the Articles of Incorporation must be signed by the incorporators, who are the individuals responsible for setting up the corporation. Understanding these components is crucial for anyone looking to navigate the incorporation process successfully in Illinois.

Dos and Don'ts

When filling out the Illinois Articles of Incorporation form, it's essential to approach the task with care. Here’s a helpful list of things to do and avoid:

- Do read the instructions carefully before starting.

- Do provide accurate information about your business name.

- Do include the registered agent’s name and address.

- Do specify the purpose of your corporation clearly.

- Do ensure that the incorporators sign the form.

- Don’t use a name that is already taken by another corporation.

- Don’t leave any required fields blank.

- Don’t forget to check for typos before submitting.

- Don’t submit the form without the necessary filing fee.

- Don’t rush through the process; take your time to ensure accuracy.

By following these guidelines, you can help ensure that your Articles of Incorporation are completed correctly and efficiently.

How to Use Illinois Articles of Incorporation

Once you have the Illinois Articles of Incorporation form in hand, you are ready to begin the process of establishing your corporation. Completing this form accurately is essential for ensuring that your business is recognized as a legal entity. Follow these steps carefully to fill out the form correctly.

- Begin by entering the name of your corporation. Ensure that it complies with Illinois naming requirements, including the use of an appropriate corporate designator like "Corporation," "Incorporated," or "Limited."

- Provide the purpose of your corporation. A brief statement outlining the business activities will suffice.

- Fill in the duration of your corporation. Most corporations are set to exist perpetually unless specified otherwise.

- Enter the address of your corporation's registered office. This must be a physical address in Illinois, not a P.O. Box.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the number of shares the corporation is authorized to issue. If you plan to issue different classes of shares, specify that as well.

- Provide the names and addresses of the incorporators. These are the individuals who are forming the corporation.

- Sign and date the form. Make sure that all incorporators sign, as their signatures are required for validation.

After completing the form, review it carefully for accuracy. Once confirmed, you will need to file it with the Illinois Secretary of State, along with the required filing fee. Keep a copy for your records. This step is crucial for ensuring that your corporation is officially recognized and can begin operating legally.

Find Popular Articles of Incorporation Forms for US States

Articles of Incorporation Michigan - Failure to file may lead to penalties or the inability to operate.

Georgia Secretary of State Forms - This form is also known as the Certificate of Incorporation in some states.

How Much Does a Llc Cost in Texas - Articles of Incorporation often indicate the corporation's duration, if limited.

Documents used along the form

When forming a corporation in Illinois, the Articles of Incorporation is just the first step. Several other documents are often required or recommended to ensure your corporation is set up correctly and operates smoothly. Below is a list of forms and documents that you may need to consider.

- Bylaws: This document outlines the rules and procedures for managing the corporation. It includes details about meetings, voting rights, and the roles of officers and directors.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document provides basic information about the corporation, including its address and the names of its officers.

- Employer Identification Number (EIN): This number, issued by the IRS, is necessary for tax purposes. It is required for opening a bank account and hiring employees.

- Operating Agreement: While more common for LLCs, some corporations choose to create an operating agreement. This document details the management structure and operational procedures.

- Shareholder Agreement: This agreement governs the relationship between shareholders. It can cover topics like share transfers, voting rights, and how to handle disputes.

- Business Licenses: Depending on your industry and location, you may need specific licenses or permits to operate legally. Check with local and state authorities for requirements.

- Meeting Minutes: Keeping detailed records of corporate meetings is essential. Minutes document decisions made and actions taken, providing a legal record of corporate governance.

- Annual Report: Most states require corporations to file an annual report. This document updates the state on the corporation’s status and may include financial information.

- Registered Agent Consent: If you appoint a registered agent, you may need a document confirming their consent to serve in that role. This ensures that legal documents can be properly received.

Having these documents prepared and organized will help streamline the process of establishing your corporation. It will also support compliance with state regulations and improve your business's overall management.

Misconceptions

Understanding the Illinois Articles of Incorporation form is essential for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- Filing the Articles of Incorporation is optional. Many people believe that filing this document is not necessary. In reality, submitting the Articles of Incorporation is a legal requirement to officially form a corporation in Illinois.

- Any business can use the same Articles of Incorporation template. Some assume that a one-size-fits-all template works for every type of corporation. However, different types of corporations, such as nonprofit or for-profit, have specific requirements that must be met.

- Once filed, the Articles of Incorporation cannot be changed. There is a belief that the information in the Articles is permanent. In fact, amendments can be made to the Articles if changes in the corporation’s structure or operations occur.

- All states have the same Articles of Incorporation requirements. Some think that the requirements for filing Articles of Incorporation are uniform across the U.S. Each state has its own rules and regulations, including Illinois, which may differ significantly.

- Filing the Articles guarantees a corporation’s success. It is a misconception that simply filing the Articles will ensure a business thrives. While this step is crucial, success depends on various factors such as market research, business planning, and management.

- You can file the Articles of Incorporation without any legal assistance. Many believe that legal help is unnecessary. While individuals can file on their own, seeking legal advice can help avoid errors and ensure compliance with state laws.

By clarifying these misconceptions, individuals can better navigate the process of incorporating a business in Illinois.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Articles of Incorporation form is used to legally create a corporation in the state of Illinois. |

| Governing Law | This form is governed by the Illinois Business Corporation Act of 1983. |

| Filing Requirement | To finalize the incorporation process, the completed form must be filed with the Illinois Secretary of State. |

| Information Needed | Key information includes the corporation's name, purpose, registered agent, and the number of shares authorized. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

Key takeaways

Filling out and using the Illinois Articles of Incorporation form is a crucial step in establishing a corporation. Here are some key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They officially create your business entity in the eyes of the state.

- Choose a Unique Name: Your corporation's name must be distinguishable from existing entities in Illinois. Conduct a name search to ensure availability before filing.

- Designate a Registered Agent: Every corporation must have a registered agent in Illinois. This person or entity will receive legal documents on behalf of the corporation.

- Specify the Business Purpose: Clearly outline the purpose of your corporation. This can be broad, but it must be legal and comply with state regulations.

- Include the Number of Shares: If your corporation will issue stock, indicate the number of shares and their par value. This is essential for establishing ownership structure.

- File with the Secretary of State: Submit your completed Articles of Incorporation to the Illinois Secretary of State along with the required filing fee. Keep a copy for your records.

By following these guidelines, you can ensure a smoother process in forming your corporation in Illinois.