Official Transfer-on-Death Deed Form for Idaho

The Idaho Transfer-on-Death Deed form serves as a valuable estate planning tool, allowing property owners to designate beneficiaries who will automatically inherit real estate upon their passing. This form simplifies the transfer process, enabling individuals to bypass the often lengthy and costly probate process. By executing this deed, property owners retain full control over their property during their lifetime, with the ability to sell, mortgage, or revoke the deed at any time. The form requires specific information, including the legal description of the property and the names of the beneficiaries, ensuring clarity and precision in the transfer process. Importantly, the deed must be recorded with the county recorder's office to be valid, providing a public record of the intended transfer. This mechanism not only facilitates a smoother transition of assets but also allows property owners to express their wishes regarding their estate in a straightforward manner.

Dos and Don'ts

When filling out the Idaho Transfer-on-Death Deed form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do provide accurate property information. Make sure the legal description of the property is complete and correct.

- Do include the names of all beneficiaries clearly. This helps avoid confusion about who will inherit the property.

- Do sign the deed in front of a notary public. This step is crucial for the deed to be legally binding.

- Do file the deed with the county recorder’s office. This ensures that the deed is officially recorded and recognized.

- Don’t leave any sections blank. Incomplete forms can lead to legal issues or delays.

- Don’t use vague language. Be specific about the property and the beneficiaries to avoid misunderstandings.

- Don’t forget to check state laws. Ensure you comply with Idaho’s specific requirements for transfer-on-death deeds.

- Don’t rush the process. Take your time to review the form and consult a professional if needed.

How to Use Idaho Transfer-on-Death Deed

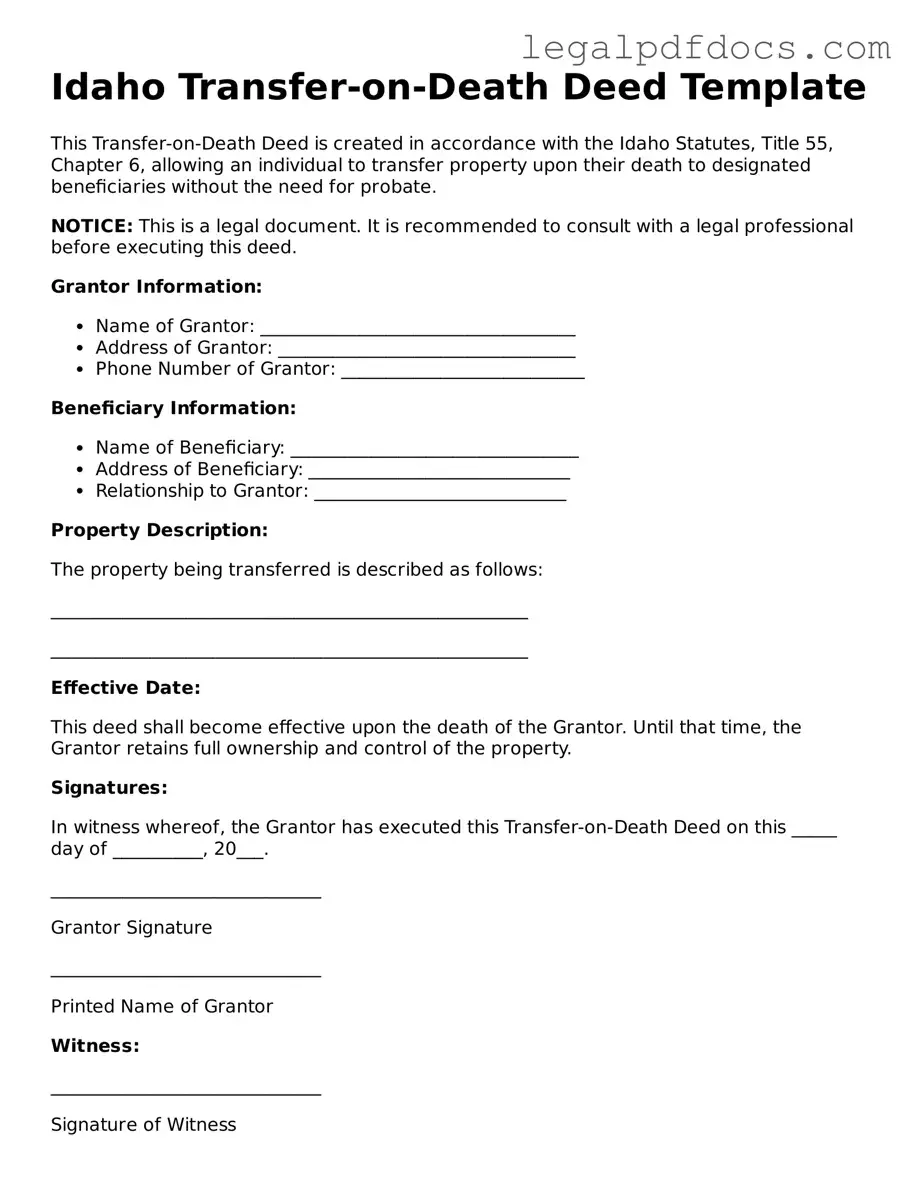

Filling out the Idaho Transfer-on-Death Deed form is an important step in ensuring that your property is transferred according to your wishes after your passing. Once the form is completed, it will need to be signed and filed with the appropriate county recorder's office to be legally effective.

- Obtain the Idaho Transfer-on-Death Deed form. This can usually be found online or at your local county recorder's office.

- Enter your name as the property owner in the designated section. Make sure to include any middle names or initials to avoid confusion.

- Provide your address. This should be the address where you currently reside.

- Identify the property that you wish to transfer. Include the legal description of the property, which can often be found on your property deed or tax records.

- List the names of the beneficiaries who will receive the property upon your passing. Include their full names and any relevant details, such as their relationship to you.

- Specify whether the transfer is to be made to multiple beneficiaries. If so, clarify how the property will be divided among them.

- Sign the form in the presence of a notary public. This step is crucial for ensuring that the document is valid.

- Make copies of the completed and notarized form for your records and for the beneficiaries.

- File the original form with the county recorder’s office in the county where the property is located. Check for any filing fees that may apply.

Find Popular Transfer-on-Death Deed Forms for US States

Beneficiary Deed Georgia - It is an effective way to keep family property in the family and avoid lengthy probate processes.

Does a Transfer on Death Deed Supersede a Will - Beneficiaries named in the deed do not have any rights to the property until the original owner passes away.

How to File a Beneficiary Deed in Arizona - It is a cost-effective way to transfer property outside of probate.

Documents used along the form

The Idaho Transfer-on-Death Deed is a useful tool for estate planning, allowing property owners to designate beneficiaries to receive their property upon their death without going through probate. However, several other forms and documents may accompany this deed to ensure a smooth transfer and proper handling of the estate. Here’s a brief overview of these documents.

- Last Will and Testament: This document outlines how a person's assets will be distributed upon their death. It can include specific bequests, appoint guardians for minors, and name an executor to manage the estate.

- Durable Power of Attorney: This form allows someone to make financial and legal decisions on behalf of the property owner if they become incapacitated. It ensures that the owner's affairs are managed according to their wishes.

- Health Care Power of Attorney: This document designates an individual to make medical decisions for the property owner if they are unable to do so. It is essential for ensuring that health care preferences are honored.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance, retirement plans, and bank accounts. They specify who will receive the assets directly upon the owner's death, bypassing probate.

- Revocable Living Trust: This legal arrangement allows the property owner to place their assets into a trust during their lifetime. It provides more control over how assets are managed and distributed after death, often avoiding probate.

- Property Title Documents: These documents prove ownership of real estate and may need to be updated to reflect the transfer-on-death designation. They are crucial for confirming the beneficiary’s claim to the property.

- Affidavit of Heirship: This document is often used to establish the heirs of a deceased person, especially when no will exists. It can help clarify ownership and facilitate the transfer of property.

Understanding these documents can significantly enhance the effectiveness of estate planning. Each plays a vital role in ensuring that property is transferred smoothly and according to the owner's wishes. Proper preparation can save time, reduce stress, and minimize potential disputes among beneficiaries.

Misconceptions

Understanding the Idaho Transfer-on-Death Deed can be challenging, and several misconceptions may lead to confusion. Here are four common misunderstandings:

- Misconception 1: The Transfer-on-Death Deed automatically transfers ownership upon the death of the owner.

- Misconception 2: A Transfer-on-Death Deed can be used for any type of property.

- Misconception 3: Once a Transfer-on-Death Deed is filed, it cannot be changed or revoked.

- Misconception 4: The Transfer-on-Death Deed avoids all taxes and fees associated with transferring property.

This is not entirely accurate. While the deed allows for the transfer of property after death, it does not take effect until the owner passes away. Until then, the owner retains full control and ownership of the property.

This is misleading. The Transfer-on-Death Deed is specifically designed for real property, such as land and buildings. It cannot be used for personal property, bank accounts, or other assets.

This is incorrect. The owner has the right to change or revoke the deed at any time before their death. This flexibility allows for adjustments based on changing circumstances or preferences.

This is a common misunderstanding. While the deed can simplify the transfer process and may help avoid probate, it does not exempt the property from taxes or other fees that may apply upon the owner's death.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | The Idaho Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, without the need for probate. |

| Governing Law | This deed is governed by Idaho Code § 55-1821 through § 55-1831. |

| Revocability | The deed can be revoked or modified at any time by the property owner, as long as they are alive and competent. |

| Execution Requirements | To be valid, the deed must be signed by the property owner and notarized. It must also be recorded with the county recorder’s office. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the property can be divided among them. Clear instructions should be provided to avoid confusion. |

| Tax Implications | Property transferred through a Transfer-on-Death Deed may have different tax implications, so consulting a tax professional is advisable. |

Key takeaways

When filling out and using the Idaho Transfer-on-Death Deed form, it’s crucial to keep several key points in mind:

- Eligibility: Ensure that the property you want to transfer qualifies for a Transfer-on-Death Deed. Only real property in Idaho is eligible.

- Complete the Form Accurately: Fill out the form with precise information. Include the names of the grantor and the beneficiary, along with a clear description of the property.

- Signatures Required: The deed must be signed by the grantor. If there are multiple grantors, all must sign.

- Witnesses and Notarization: Have the deed witnessed by two individuals and notarized. This step is essential for the deed to be valid.

- Recording the Deed: After signing and notarizing, file the deed with the county recorder’s office where the property is located. This step is critical to make the transfer effective.

- Revocation: Understand that you can revoke the Transfer-on-Death Deed at any time before your death. Follow the same procedure for revocation as you did for the original deed.

- Consult Legal Advice: Consider seeking legal advice to ensure compliance with all state laws and to address any specific concerns about your situation.

These takeaways will help ensure a smooth process when using the Idaho Transfer-on-Death Deed form.