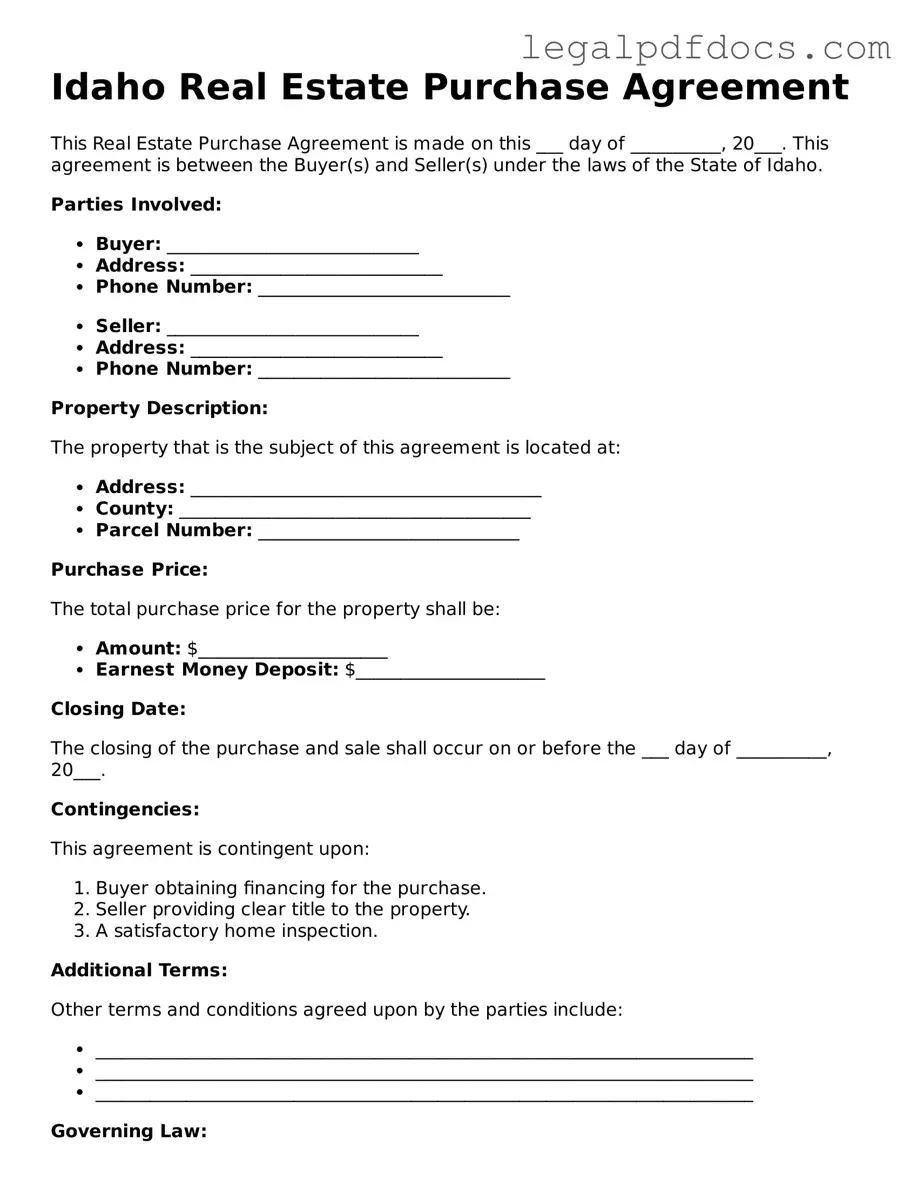

Official Real Estate Purchase Agreement Form for Idaho

When navigating the process of buying or selling property in Idaho, understanding the Idaho Real Estate Purchase Agreement form is essential. This document serves as a legally binding contract between the buyer and seller, outlining the terms and conditions of the transaction. Key components of the agreement include the purchase price, financing details, and the closing date, all of which are crucial for ensuring a smooth transfer of ownership. Additionally, the form addresses contingencies, such as inspections and appraisals, which protect both parties' interests. It also specifies the responsibilities of each party, from disclosures to earnest money deposits. Clarity in this agreement fosters trust and minimizes misunderstandings, making it a vital tool in real estate transactions. By familiarizing yourself with the Idaho Real Estate Purchase Agreement, you can approach your real estate dealings with confidence, knowing that you are equipped with the necessary information to make informed decisions.

Dos and Don'ts

When filling out the Idaho Real Estate Purchase Agreement form, it is important to follow certain guidelines. Here are six things to do and avoid:

- Do: Read the entire form carefully before starting to fill it out.

- Do: Provide accurate and complete information for all required fields.

- Do: Review the agreement with all parties involved before signing.

- Do: Keep a copy of the signed agreement for your records.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any required sections blank; fill in all necessary information.

How to Use Idaho Real Estate Purchase Agreement

Completing the Idaho Real Estate Purchase Agreement form is an important step in the home buying process. It lays out the terms of the sale and ensures that both the buyer and seller are on the same page. Once you fill out this form, you can proceed to negotiate the terms and finalize the transaction.

- Start with the date at the top of the form. Write the date when you are filling out the agreement.

- Identify the parties involved. Fill in the names and contact information of the buyer(s) and seller(s).

- Provide the property address. Include the complete address of the property being sold.

- Specify the purchase price. Clearly state the agreed-upon price for the property.

- Outline the earnest money deposit. Indicate the amount and terms regarding the deposit made by the buyer.

- Detail any contingencies. List any conditions that must be met for the sale to proceed, such as financing or inspections.

- Include the closing date. Specify when the transaction will be finalized and ownership will transfer.

- Address any additional terms. If there are any special agreements between the buyer and seller, include them here.

- Sign and date the agreement. Ensure all parties sign the document to make it legally binding.

Find Popular Real Estate Purchase Agreement Forms for US States

Florida Purchase Agreement - The purchase agreement may outline who pays closing costs.

Purchase and Sale Agreement Georgia - Covers the agreement for title transfer at closing.

Kansas Real Estate Purchase Contract - This legal document serves as a roadmap for the entire buying process.

Arizona Real Estate Purchase Contract Pdf - May require an earnest money deposit to secure the agreement.

Documents used along the form

The Idaho Real Estate Purchase Agreement form is a crucial document in real estate transactions. It outlines the terms and conditions of the sale between the buyer and seller. However, several other forms and documents often accompany this agreement to ensure a smooth transaction. Below is a list of commonly used documents that complement the Idaho Real Estate Purchase Agreement.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues with the property. It provides potential buyers with important information about the condition of the home, including past repairs and existing problems.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint. Sellers must provide this disclosure to ensure buyers are aware of any health risks associated with lead exposure.

- Title Commitment: This document is issued by a title company and outlines the legal status of the property. It confirms ownership and identifies any liens or encumbrances that may affect the sale, ensuring that the buyer receives clear title upon closing.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document details all financial transactions involved in the sale. It includes the purchase price, closing costs, and any adjustments made, providing transparency for both parties at the closing table.

These documents play a vital role in the real estate transaction process. Together with the Idaho Real Estate Purchase Agreement, they help protect the interests of both buyers and sellers, ensuring a clear understanding of the terms and conditions involved in the sale.

Misconceptions

Understanding the Idaho Real Estate Purchase Agreement form is essential for both buyers and sellers. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- Misconception 1: The form is only for residential transactions.

- Misconception 2: The agreement is a legally binding contract as soon as it is signed.

- Misconception 3: The form does not require any negotiation.

- Misconception 4: All real estate transactions in Idaho require this specific form.

- Misconception 5: The form covers all potential issues that may arise during the transaction.

This is not true. The Idaho Real Estate Purchase Agreement can be used for various types of properties, including commercial and agricultural real estate. Its flexibility makes it applicable to a wide range of real estate transactions.

While the agreement becomes legally binding once both parties sign it, certain conditions may need to be met first. For example, financing contingencies or inspections can affect the binding nature of the contract.

Many believe that the Idaho Real Estate Purchase Agreement is a standard form that leaves no room for negotiation. In reality, terms such as price, closing date, and contingencies can be negotiated to suit the needs of both parties.

This is incorrect. While the Idaho Real Estate Purchase Agreement is commonly used, it is not mandatory. Parties can create their own agreements, as long as they comply with state laws and regulations.

The agreement provides a solid foundation, but it cannot address every possible scenario. Buyers and sellers should consider additional agreements or disclosures to cover specific concerns or unique circumstances related to their transaction.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Idaho Real Estate Purchase Agreement is governed by Idaho state law. |

| Parties Involved | The agreement typically involves a buyer and a seller. |

| Property Description | A detailed description of the property must be included in the agreement. |

| Purchase Price | The purchase price of the property is explicitly stated in the agreement. |

| Earnest Money | Earnest money is often required to demonstrate the buyer's serious intent. |

| Contingencies | Common contingencies include financing, inspections, and appraisals. |

| Closing Date | The agreement specifies a closing date when the transaction will be finalized. |

| Disclosures | Sellers are required to provide certain disclosures about the property condition. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

When filling out and using the Idaho Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Understand the purpose: This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller.

- Complete all sections: Ensure every part of the form is filled out completely. Missing information can lead to delays or disputes.

- Provide accurate details: Include correct names, addresses, and property descriptions to avoid confusion later on.

- Review contingencies: Pay attention to any contingencies that may affect the sale, such as financing or inspection requirements.

- Negotiate terms: Be prepared to discuss and negotiate terms like price, closing date, and any repairs needed before the sale.

- Include earnest money: Specify the amount of earnest money to be deposited, which shows the buyer's commitment to the purchase.

- Consult with professionals: It’s wise to seek advice from real estate agents or attorneys to ensure all legal aspects are covered.

- Sign and date: Both parties must sign and date the agreement to make it legally binding. Ensure all signatures are present.

- Keep copies: After signing, keep copies of the agreement for your records. This will help in future reference and any potential disputes.