Official Quitclaim Deed Form for Idaho

The Idaho Quitclaim Deed form serves as a vital tool for property owners looking to transfer their interest in real estate without making any guarantees about the title's validity. This type of deed is particularly useful in situations where the parties involved have a level of trust, such as family members or close friends. Unlike other types of deeds, a quitclaim deed does not provide a warranty of title, meaning the grantor does not assure the grantee that the property is free from claims or liens. Instead, the document simply conveys whatever interest the grantor may have at the time of the transfer. This form can be beneficial for quick transfers, such as when a property owner wishes to add or remove someone from the title, or during estate planning. It's important to note that while a quitclaim deed can simplify the transfer process, it does not eliminate the need for due diligence. Understanding the implications of using a quitclaim deed in Idaho can help individuals make informed decisions regarding their property transactions.

Dos and Don'ts

When completing the Idaho Quitclaim Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Below are some recommended practices and common mistakes to avoid.

- Do ensure all parties' names are accurately spelled and match official identification.

- Do provide a complete legal description of the property being transferred.

- Do sign the document in the presence of a notary public.

- Do keep a copy of the completed deed for your records.

- Don't leave any required fields blank; all sections must be filled out completely.

- Don't use incorrect or outdated forms; always use the most current version of the Quitclaim Deed.

- Don't forget to check state-specific filing requirements, as they may vary.

- Don't overlook the importance of consulting a professional if unsure about the process.

How to Use Idaho Quitclaim Deed

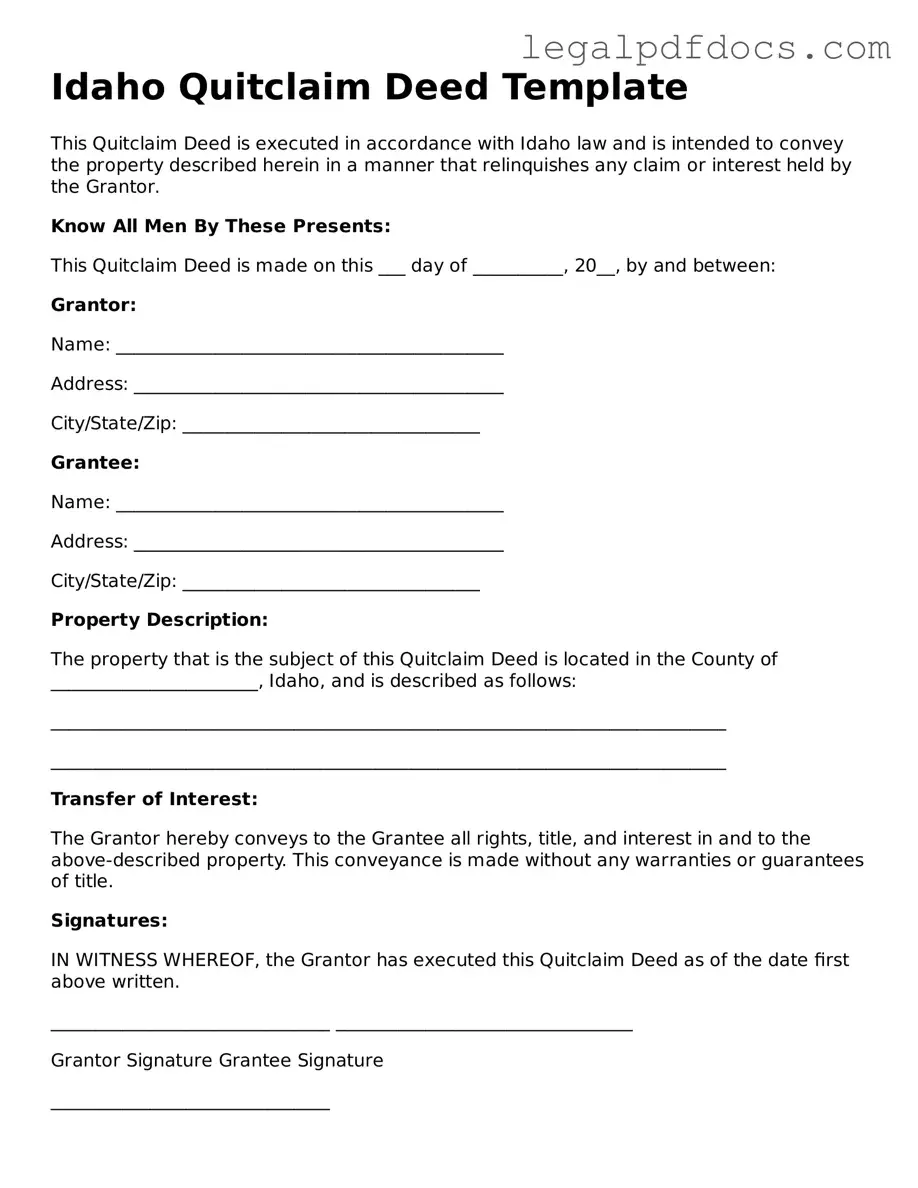

Once you have obtained the Idaho Quitclaim Deed form, you are ready to fill it out. This process involves providing specific information about the property and the parties involved. It is important to ensure that all details are accurate to avoid any issues in the future.

- Begin by entering the date at the top of the form.

- In the section labeled "Grantor," write the full name of the person transferring the property.

- Next, in the "Grantee" section, provide the full name of the person receiving the property.

- Include the property address in the designated area. Be sure to include the street number, street name, city, and zip code.

- Describe the property by including a legal description. This may involve referencing a previous deed or providing a survey description.

- Check the box indicating whether the property is residential or commercial, if applicable.

- Sign the form in the presence of a notary public. The notary will need to witness your signature and provide their seal.

- Finally, ensure that all parties receive a copy of the completed deed for their records.

After completing the form, it is essential to file it with the appropriate county recorder's office. This step finalizes the transfer of property ownership and makes the deed a matter of public record.

Find Popular Quitclaim Deed Forms for US States

Illinois Quick Claim Deed - A straightforward way to give up ownership is through a Quitclaim Deed.

Wuick Claim Deed - Records of the Quitclaim Deed can be important for future ownership claims.

Quitclaim Deed Form Texas - The deed must be recorded in the appropriate county office to ensure public notice of the change in ownership.

Documents used along the form

When transferring property in Idaho, the Quitclaim Deed is a crucial document. However, several other forms and documents may accompany it to ensure a smooth transaction. Below is a list of these essential documents, each serving a specific purpose in the property transfer process.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. It provides the buyer with protection against future claims to the property.

- Grant Deed: Similar to a warranty deed, a grant deed assures the buyer that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Title Search Report: This report outlines the history of the property title, including any liens, claims, or ownership disputes. It helps buyers ensure they are acquiring a clear title.

- Property Survey: A survey provides a detailed map of the property boundaries and any structures on it. It is essential for confirming the exact dimensions and any easements.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and discloses any known issues that might affect the title.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the sale price, closing costs, and any adjustments made during the closing process.

- Transfer Tax Declaration: This form is often required by local governments to assess any transfer taxes due upon the sale of the property.

- Power of Attorney: If the seller cannot be present for the transaction, a power of attorney allows another person to act on their behalf, facilitating the signing of necessary documents.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide rules, regulations, and financial information about the association, which may affect the buyer's decision.

- Disclosure Statements: Sellers may be required to provide disclosures regarding the property's condition, including any known defects or issues, ensuring transparency in the transaction.

Understanding these documents is vital for anyone involved in property transactions in Idaho. Each form plays a significant role in protecting the interests of both the buyer and the seller, fostering a fair and transparent transfer of property rights.

Misconceptions

Understanding the Idaho Quitclaim Deed form is essential for anyone involved in property transfers. However, several misconceptions can lead to confusion. Below are some common misunderstandings regarding this document.

- Misconception 1: A quitclaim deed transfers ownership of the property.

- Misconception 2: Quitclaim deeds are only used in divorce cases.

- Misconception 3: A quitclaim deed eliminates all claims against the property.

- Misconception 4: Quitclaim deeds are only valid if notarized.

- Misconception 5: A quitclaim deed can be used to transfer property without a sale.

- Misconception 6: A quitclaim deed is the same as a warranty deed.

- Misconception 7: You cannot change a quitclaim deed once it is filed.

- Misconception 8: All states use the same quitclaim deed format.

This is partially true. A quitclaim deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor holds clear title. If the grantor has no ownership interest, the recipient receives nothing.

While quitclaim deeds are often used to transfer property between former spouses, they are not limited to this situation. They can be used in various circumstances, such as transferring property to family members or as part of estate planning.

This is incorrect. A quitclaim deed does not eliminate liens or other claims against the property. The new owner may still be responsible for any existing debts tied to the property.

While notarization is important for the validity of a quitclaim deed, it is not the only requirement. The deed must also be properly executed and recorded with the county clerk's office to ensure legal effectiveness.

This is true. A quitclaim deed does not require a sale or exchange of money. It can be used for gifts or transfers between family members, making it a flexible option for property transfers.

This is a common misunderstanding. A warranty deed provides a guarantee of clear title, while a quitclaim deed offers no such assurance. The differences in liability and protection are significant.

Once a quitclaim deed is filed, it cannot be changed. However, if a mistake is made, a new deed can be created to correct the error. This new deed must also be filed with the appropriate authorities.

This is false. Each state, including Idaho, has its own specific requirements and formats for quitclaim deeds. It is crucial to follow Idaho's regulations to ensure compliance and validity.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties or guarantees regarding the title. |

| Governing Law | The Idaho Quitclaim Deed is governed by Idaho Code § 55-601 through § 55-617. |

| Use Cases | Commonly used among family members, to clear up title issues, or in divorce settlements. |

| No Guarantees | The grantor does not guarantee that they own the property or that the title is clear. |

| Filing Requirements | The completed quitclaim deed must be filed with the county recorder's office to be effective. |

Key takeaways

Filling out and using the Idaho Quitclaim Deed form can seem daunting, but understanding the key points can simplify the process. Here are some important takeaways:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of property without guaranteeing that the title is clear.

- Parties Involved: The deed requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: A precise description of the property must be included. This often means referencing the legal description found in previous deeds or property records.

- Consideration: While it’s not always necessary to specify a price for the transfer, mentioning any consideration (like a nominal fee) can clarify the intent.

- Signatures: The grantor must sign the deed in front of a notary public to ensure the transfer is legally recognized.

- Filing the Deed: After completion, the Quitclaim Deed must be filed with the county recorder's office to make the transfer official.

- Legal Advice: It’s often wise to consult with a legal professional before completing a Quitclaim Deed, especially if there are concerns about title issues.

By keeping these points in mind, you can navigate the Quitclaim Deed process with greater confidence.