Official Operating Agreement Form for Idaho

The Idaho Operating Agreement form serves as a vital document for limited liability companies (LLCs) operating within the state. This agreement outlines the internal workings of the company, detailing the rights, responsibilities, and obligations of its members. It typically includes essential elements such as the management structure, voting procedures, and profit distribution among members. By clearly defining these aspects, the Operating Agreement helps to prevent misunderstandings and disputes among members, fostering a cooperative business environment. Additionally, it may address the process for adding or removing members, procedures for resolving conflicts, and guidelines for the dissolution of the company if necessary. Having a well-structured Operating Agreement is not just a legal formality; it is a crucial tool that promotes transparency and accountability, ensuring that all members are on the same page regarding the operation and governance of the LLC.

Dos and Don'ts

When filling out the Idaho Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things to do and not to do:

- Do read the instructions carefully before starting the form.

- Do provide accurate information about the members and management structure.

- Do review the completed form for any errors or omissions.

- Do keep a copy of the signed agreement for your records.

- Don't leave any required fields blank.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to date and sign the agreement.

- Don't submit the form without a thorough review.

How to Use Idaho Operating Agreement

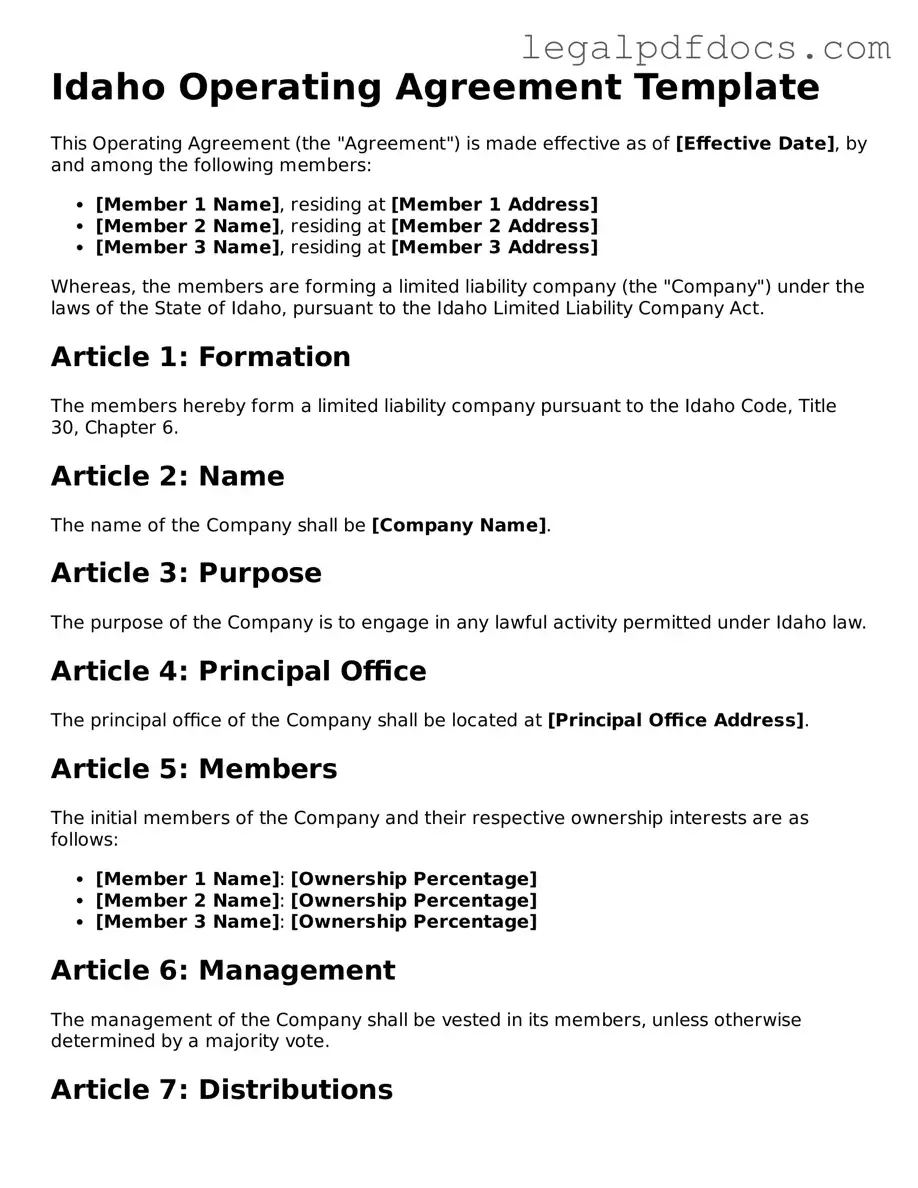

After gathering the necessary information, you will proceed to fill out the Idaho Operating Agreement form. This form outlines the structure and operational procedures of your business. Ensure you have all relevant details at hand, as accuracy is crucial for compliance.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Include their ownership percentages.

- Outline the purpose of the LLC. Be clear and concise about the business activities.

- Specify how profits and losses will be distributed among members.

- Indicate the management structure. State whether the LLC will be member-managed or manager-managed.

- Include details about how meetings will be conducted and how decisions will be made.

- Provide any additional provisions that may be relevant to your LLC's operation.

- Review the completed form for accuracy and completeness.

- Have all members sign and date the form to validate it.

Find Popular Operating Agreement Forms for US States

State Filing Fee for Llc in Texas - Can define how decisions about debt and financing will be made.

How to Set Up an Operating Agreement for Llc - It is essential for LLCs to formalize expectations and limit personal liability.

Operating Agreement Llc Arizona Template - The document can provide guidance on what to do if a member wants to leave the LLC.

Sample Florida Llc Operating Agreement - The document can establish how disputes are resolved internally.

Documents used along the form

When forming a Limited Liability Company (LLC) in Idaho, there are several important documents that complement the Operating Agreement. Each of these documents serves a specific purpose in the management and operation of the LLC.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Member Consent Form: This form is used to document the agreement among members regarding important decisions, such as the admission of new members or major changes to the business structure.

- Bylaws: While not required for LLCs, bylaws can outline the internal rules and procedures for the organization. They help define the roles of members and how meetings will be conducted.

- Tax Identification Number (EIN) Application: This form is submitted to the IRS to obtain an Employer Identification Number. The EIN is necessary for tax purposes and is often required when opening a business bank account.

These documents work together to ensure that the LLC operates smoothly and in compliance with state laws. Properly managing these forms can help avoid misunderstandings and legal issues in the future.

Misconceptions

When it comes to the Idaho Operating Agreement form, many people hold misconceptions that can lead to confusion. Here are seven common misunderstandings:

- It’s only necessary for large businesses. Many believe that only large companies need an operating agreement. In reality, even small businesses benefit from having one. It helps clarify ownership and management structures.

- It’s the same as the Articles of Organization. Some think that the operating agreement and the Articles of Organization are interchangeable. They are not. The Articles of Organization register your business, while the operating agreement outlines how it will run.

- It is a public document. There’s a misconception that operating agreements must be filed with the state and are public records. In Idaho, this is not the case. The operating agreement is a private document.

- It can’t be changed once created. Many people believe that once an operating agreement is in place, it cannot be modified. This is false. You can amend the agreement as your business evolves.

- It’s only for LLCs. While operating agreements are commonly associated with LLCs, other business structures can also benefit from them. Partnerships and corporations can use similar agreements to outline their operational procedures.

- It doesn’t need to be detailed. Some think a brief operating agreement is sufficient. However, a well-detailed agreement can prevent misunderstandings and disputes among members.

- Legal assistance is unnecessary. Many believe they can create an operating agreement without any legal help. While templates are available, consulting a legal professional can ensure that the agreement meets all necessary requirements and addresses specific needs.

Understanding these misconceptions can help you make informed decisions about your business structure in Idaho. Having a clear and comprehensive operating agreement is an essential step in protecting your interests.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Idaho Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC) in Idaho. |

| Governing Law | The agreement is governed by the Idaho Limited Liability Company Act, specifically Title 30, Chapter 6 of the Idaho Code. |

| Flexibility | Idaho law allows LLCs to customize their Operating Agreement to suit their specific needs, including provisions for management, profit distribution, and member responsibilities. |

| Importance | Having an Operating Agreement is crucial for establishing clear expectations among members and protecting personal assets from business liabilities. |

Key takeaways

Here are some key takeaways about filling out and using the Idaho Operating Agreement form:

- Understand the Purpose: An operating agreement outlines the management structure and operational procedures for your business.

- Identify Members: Clearly list all members of the LLC, including their roles and ownership percentages.

- Define Management Structure: Specify whether the LLC will be member-managed or manager-managed.

- Outline Voting Rights: Detail how decisions will be made and the voting rights of each member.

- Include Profit Distribution: Clearly state how profits and losses will be distributed among members.

- Address Changes: Include provisions for adding new members or handling the departure of existing ones.

- Ensure Compliance: Make sure the agreement complies with Idaho state laws and regulations.

- Keep it Updated: Regularly review and update the agreement as needed to reflect changes in the business.

Following these guidelines will help ensure that your operating agreement is effective and meets the needs of your LLC.