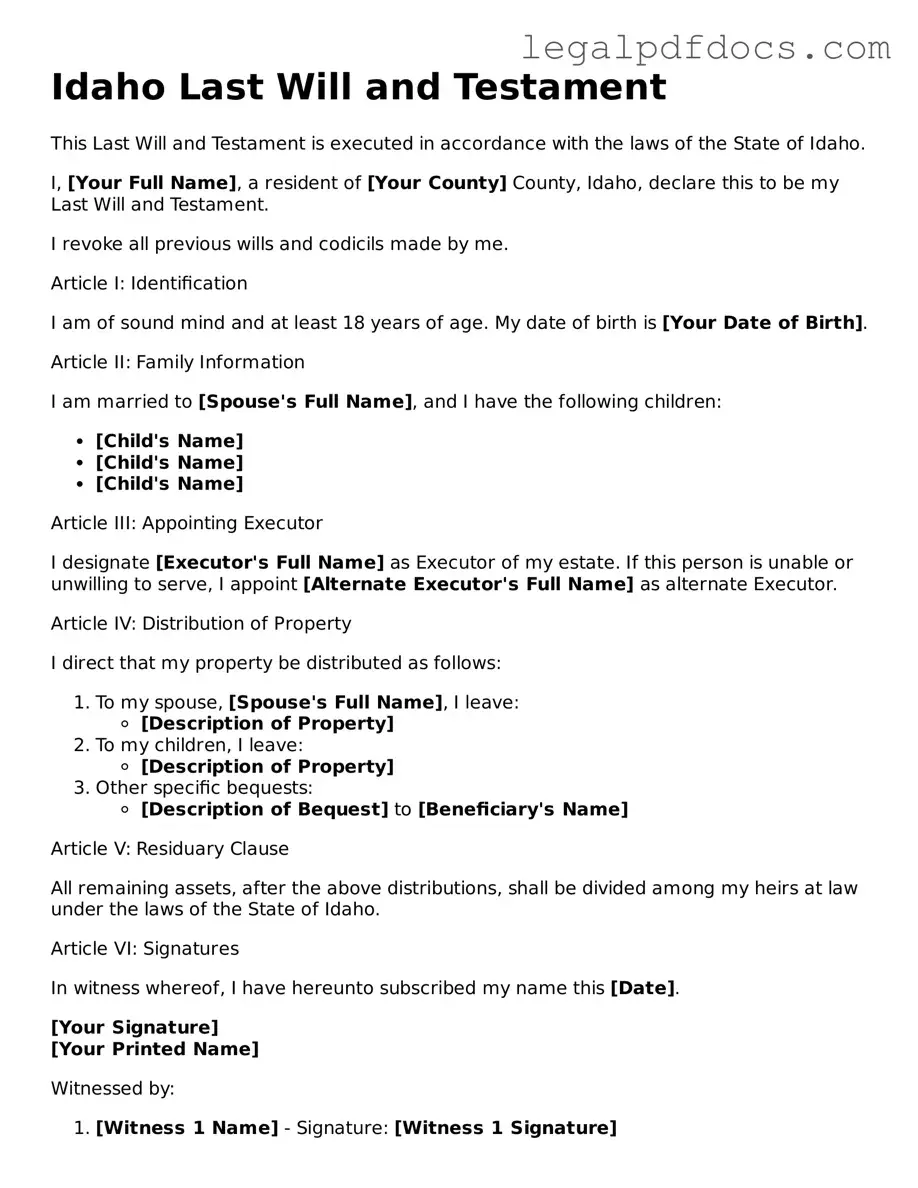

Official Last Will and Testament Form for Idaho

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Idaho, this legal document allows individuals to outline how their assets should be distributed, who will serve as guardians for minor children, and who will manage the estate. The Idaho Last Will and Testament form is designed to be straightforward, enabling individuals to express their intentions clearly. It includes sections for naming beneficiaries, specifying the distribution of property, and appointing an executor to oversee the administration of the estate. Additionally, it provides space for personal wishes regarding funeral arrangements and other final requests. Understanding the key elements of this form is essential for anyone looking to plan for the future and protect their loved ones from potential disputes or confusion. By taking the time to complete this document properly, individuals can gain peace of mind knowing their affairs are in order.

Dos and Don'ts

When filling out the Idaho Last Will and Testament form, it’s important to approach the task carefully. Here are some essential dos and don’ts to keep in mind:

- Do clearly identify yourself at the beginning of the document.

- Do state your intentions regarding the distribution of your assets.

- Do name an executor who will manage your estate after your passing.

- Do sign the will in front of two witnesses who are not beneficiaries.

- Do keep the will in a safe place and inform your executor of its location.

- Don't use vague language that could lead to confusion about your wishes.

- Don't forget to date the document when you sign it.

- Don't attempt to make changes to the will without following proper procedures.

- Don't neglect to review your will regularly, especially after major life events.

- Don't ignore state-specific requirements that may affect the validity of your will.

How to Use Idaho Last Will and Testament

After obtaining the Idaho Last Will and Testament form, it's important to carefully complete it to ensure that your wishes are clearly documented. Follow these steps to fill out the form accurately.

- Begin by entering your full legal name at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- State your date of birth to confirm your identity.

- Designate an executor by naming a trusted individual who will manage your estate.

- List your beneficiaries. Include their full names and relationships to you.

- Detail any specific bequests, such as personal items or amounts of money, to particular beneficiaries.

- Indicate how you want the remainder of your estate to be distributed after specific bequests have been made.

- Sign and date the document at the bottom, ensuring you do so in the presence of witnesses.

- Have at least two witnesses sign the form, confirming that they observed you signing the will.

- Consider having the will notarized for added legal protection, though this may not be required in Idaho.

Once the form is completed, store it in a safe place and inform your executor where it can be found. Regularly review and update the will as necessary to reflect any changes in your circumstances or wishes.

Find Popular Last Will and Testament Forms for US States

Template for a Will - Can establish a clear order of who inherits if multiple beneficiaries are involved.

Georgia Last Will and Testament - Should be stored safely and shared with relevant parties.

Free Will Forms to Print - Living wills and last wills serve different functions within estate planning.

Documents used along the form

When creating a comprehensive estate plan in Idaho, several important documents often accompany the Last Will and Testament. These documents help clarify intentions and ensure that an individual's wishes are honored after their passing. Below is a list of commonly used forms that work in conjunction with a will.

- Durable Power of Attorney: This document allows an individual to designate someone to manage their financial affairs if they become incapacitated. It ensures that financial decisions can be made on their behalf without court intervention.

- Advance Healthcare Directive: Also known as a living will, this document outlines a person's preferences regarding medical treatment in the event they are unable to communicate their wishes. It provides guidance to healthcare providers and loved ones about end-of-life care.

- Revocable Living Trust: This legal arrangement allows an individual to place their assets into a trust during their lifetime. It provides a way to manage those assets and can help avoid probate upon death, making the distribution of assets more efficient.

- Beneficiary Designations: These forms are used to specify who will receive certain assets, such as life insurance policies and retirement accounts, upon the owner's death. They take precedence over a will and can be crucial for ensuring that assets are distributed according to the individual's wishes.

Incorporating these documents into an estate plan can enhance clarity and ensure that an individual's wishes are respected. It is essential to consider each of these forms carefully to create a comprehensive strategy for asset management and distribution.

Misconceptions

-

Misconception 1: A handwritten will is not valid in Idaho.

This is not true. In Idaho, a handwritten will, also known as a holographic will, can be valid if it meets certain requirements. The testator must write the will in their own handwriting and sign it. However, it is advisable to follow the formalities of a typed will to avoid potential disputes.

-

Misconception 2: You need a lawyer to create a valid will in Idaho.

While having a lawyer can be beneficial, it is not a requirement. Individuals can create their own will using the Idaho Last Will and Testament form. It is important to ensure that all legal requirements are met to avoid complications later.

-

Misconception 3: A will can cover all types of property.

This is misleading. A will typically governs personal property and real estate, but certain assets, like life insurance policies and retirement accounts, may have designated beneficiaries. These assets will pass outside of the will, so it's essential to review all property and accounts.

-

Misconception 4: Once a will is created, it cannot be changed.

This is incorrect. In Idaho, a will can be amended or revoked at any time before the testator's death. Changes can be made through a codicil, which is an amendment to the will, or by creating an entirely new will. Regularly reviewing and updating a will is a good practice.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Idaho Last Will and Testament is governed by Idaho Code § 15-2-501 to § 15-2-513. |

| Age Requirement | In Idaho, you must be at least 18 years old to create a valid will. |

| Capacity | Testators must be of sound mind when drafting their will, meaning they understand the nature of their actions. |

| Witness Requirement | Idaho law requires that a will be signed by at least two witnesses who are present at the same time. |

| Holographic Wills | Handwritten wills, known as holographic wills, are recognized in Idaho if they are signed by the testator. |

| Revocation | A will can be revoked in Idaho by creating a new will or by physically destroying the original document. |

| Self-Proving Wills | Idaho allows for self-proving wills, which can simplify the probate process by including a notarized affidavit. |

| Filing Requirements | While there is no requirement to file a will during the testator's lifetime, it must be filed with the probate court after their death. |

Key takeaways

Creating a Last Will and Testament is an important step in ensuring that your wishes are honored after your passing. In Idaho, there are specific guidelines to follow when filling out this legal document. Here are some key takeaways to consider:

- Understand the Purpose: A will outlines how your assets will be distributed and can designate guardians for minor children.

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in Idaho.

- Writing the Will: While you can write your will by hand, using a standard form can help ensure that you include all necessary information.

- Include Essential Information: Clearly state your full name, address, and a declaration that the document is your last will.

- Executor Designation: Appoint an executor who will manage your estate and ensure your wishes are carried out.

- Be Specific: Clearly describe your assets and how you wish to distribute them to avoid confusion among beneficiaries.

- Sign and Date: You must sign and date your will in the presence of at least two witnesses who are not beneficiaries.

- Witness Requirements: Witnesses must be at least 18 years old and of sound mind; their signatures validate your will.

- Store Safely: Keep your will in a secure place and inform your executor and trusted family members where it can be found.

- Review and Update: Regularly review your will, especially after major life events like marriage, divorce, or the birth of children.

By following these guidelines, you can create a will that reflects your wishes and provides peace of mind for you and your loved ones.