Official Articles of Incorporation Form for Idaho

When embarking on the journey of establishing a business in Idaho, one of the first crucial steps involves completing the Articles of Incorporation form. This essential document serves as the foundation for your corporation, outlining key details that define its existence and operations. Within the form, you will find sections that require you to specify the name of your corporation, ensuring it is unique and compliant with state regulations. Additionally, the purpose of your business must be clearly articulated, providing insight into its intended activities. The form also necessitates the inclusion of the principal office address, which establishes a physical location for your corporation’s operations. Furthermore, you will need to designate a registered agent—an individual or business entity responsible for receiving legal documents on behalf of your corporation. Lastly, the Articles of Incorporation form allows for the inclusion of provisions regarding the management structure and the number of shares your corporation is authorized to issue, which can significantly influence your business’s governance and financial strategies. Completing this form accurately is not just a formality; it is a pivotal step toward legally establishing your corporation and setting the stage for future growth and success.

Dos and Don'ts

When filling out the Idaho Articles of Incorporation form, there are some important dos and don'ts to keep in mind. Following these guidelines can help ensure a smoother process.

- Do provide accurate information about your business name, ensuring it complies with Idaho naming rules.

- Do include the names and addresses of the incorporators clearly.

- Do specify the purpose of your corporation in simple terms.

- Do double-check for any spelling or typographical errors before submission.

- Do file the form with the appropriate fees to avoid delays.

- Don't use a name that is already taken by another business entity in Idaho.

- Don't forget to include the registered agent's information; this is crucial for legal notifications.

- Don't leave any sections of the form blank; incomplete forms can lead to rejection.

- Don't overlook the importance of reading the instructions carefully; they provide essential guidance.

- Don't rush through the process; take your time to ensure everything is correct.

How to Use Idaho Articles of Incorporation

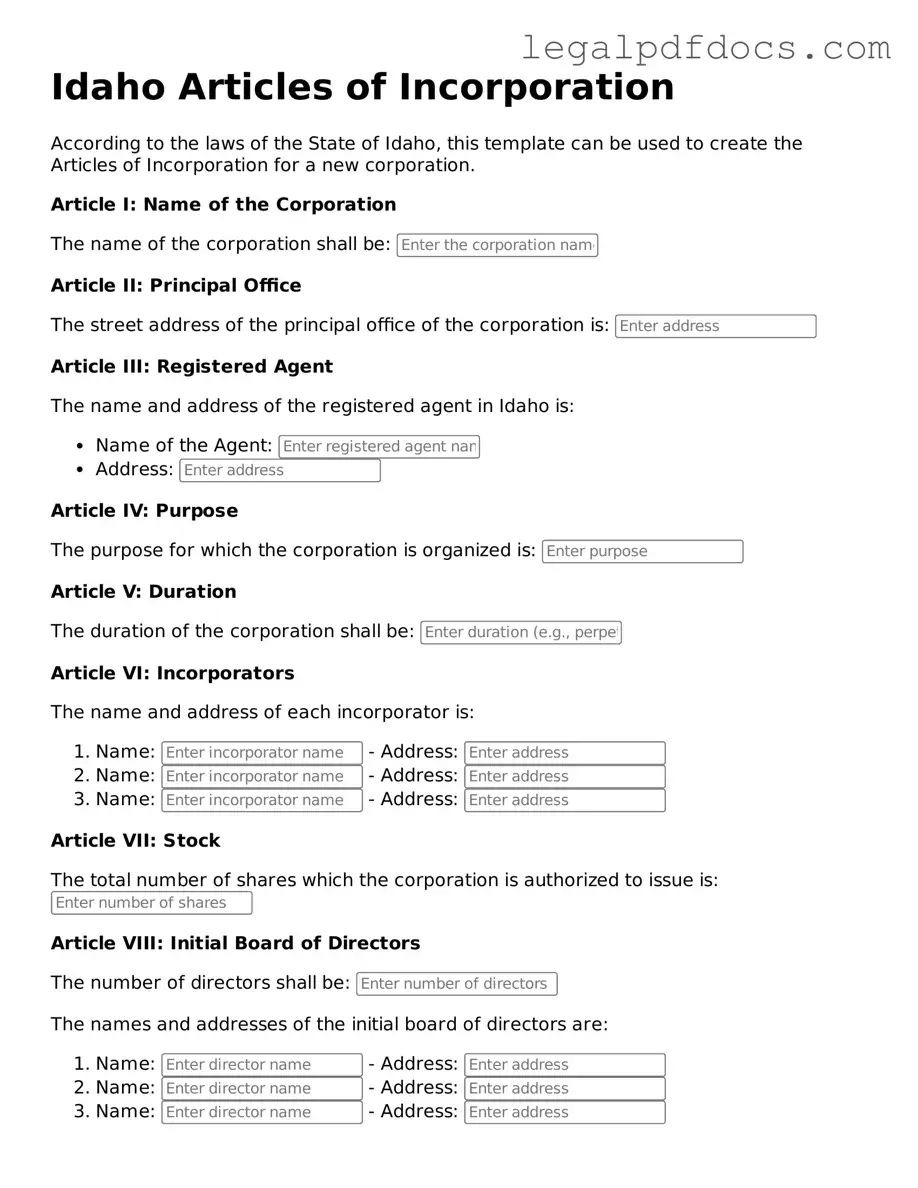

Once you have the Idaho Articles of Incorporation form in hand, you’re ready to fill it out. This form is essential for establishing your business entity in Idaho. After completing the form, you'll submit it to the appropriate state office along with any required fees. Here’s how to fill out the form step-by-step:

- Identify Your Business Name: Choose a unique name for your corporation. Ensure it complies with Idaho's naming requirements.

- Provide the Principal Office Address: Enter the street address of your corporation's main office. This cannot be a P.O. Box.

- List the Registered Agent: Designate a registered agent who will receive legal documents on behalf of your corporation. Include their name and address.

- State the Purpose: Clearly outline the purpose of your corporation. A general statement is usually acceptable.

- Indicate the Number of Shares: Specify the total number of shares your corporation is authorized to issue.

- Include the Names and Addresses of Incorporators: List the names and addresses of the individuals who are forming the corporation.

- Sign and Date the Form: Ensure that the incorporators sign and date the form. This is crucial for validation.

With the form filled out, double-check all the information for accuracy. Once you're confident everything is correct, you can submit it to the Idaho Secretary of State along with the required filing fee. Good luck with your new venture!

Find Popular Articles of Incorporation Forms for US States

Florida Division of Corporation - Consulting legal counsel can help finalize your Articles effectively.

Articles of Incorporation Michigan - They serve as a formal declaration to the state about the corporation's existence.

Documents used along the form

When forming a corporation in Idaho, the Articles of Incorporation is a crucial document. However, it is often accompanied by other important forms and documents that help establish and maintain your business. Below is a list of additional forms that you may need to consider as you move forward with your incorporation process.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It governs how the corporation will operate, including details about meetings, voting, and the roles of officers and directors.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report typically includes information about the corporation's officers and registered agent, ensuring that the state has up-to-date contact information.

- Registered Agent Consent Form: This form is used to designate a registered agent who will receive legal documents on behalf of the corporation. The agent must consent to this role, and their information must be included in the incorporation paperwork.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes and is required if the corporation plans to hire employees or open a business bank account. The application can be submitted online to the IRS.

- Business License Application: Depending on your business activities and location, you may need to apply for a business license at the city or county level. This license allows you to legally operate your business within your jurisdiction.

- Shareholder Agreements: If your corporation has multiple shareholders, a shareholder agreement can help clarify the rights and responsibilities of each party. This document can address issues such as profit distribution and decision-making processes.

- Operating Agreement: While typically associated with LLCs, some corporations may choose to create an operating agreement. This document outlines the management structure and operational procedures, providing clarity and structure for the business.

- Annual Report: Many states require corporations to file an annual report to maintain good standing. This report typically includes updated information about the corporation's activities, financial status, and leadership.

Understanding these additional forms and documents can greatly assist you in navigating the incorporation process. Each one plays a vital role in ensuring that your corporation operates smoothly and remains compliant with state regulations. Taking the time to prepare these documents will help lay a strong foundation for your business's future success.

Misconceptions

When it comes to the Idaho Articles of Incorporation form, several misconceptions can lead to confusion for those looking to start a business. Here are six common myths and the realities behind them:

- All businesses must file Articles of Incorporation. Many people believe that every type of business, including sole proprietorships and partnerships, must file Articles of Incorporation. In reality, only corporations need to file this document. Other business structures have different requirements.

- Filing Articles of Incorporation guarantees business success. Some assume that simply filing the Articles of Incorporation will lead to a successful business. While it is an important step in establishing a corporation, success depends on many factors, including business planning, market demand, and management.

- Once filed, Articles of Incorporation cannot be changed. There is a belief that after filing, the Articles are set in stone. However, corporations can amend their Articles of Incorporation to reflect changes in the business structure, name, or other key elements.

- All information in the Articles is confidential. Many think that the information provided in the Articles of Incorporation is private. In fact, most of this information becomes part of the public record and can be accessed by anyone.

- You don’t need legal assistance to file. Some entrepreneurs believe they can easily file the Articles of Incorporation on their own without any help. While it is possible to file without legal assistance, consulting with a lawyer can help ensure that all requirements are met and that the document is correctly prepared.

- Filing fees are the only cost associated with incorporation. There is a misconception that the filing fee is the only cost to consider when incorporating. In reality, there are often additional costs, such as legal fees, accounting services, and ongoing compliance expenses that must be factored in.

Understanding these misconceptions can help aspiring business owners navigate the incorporation process more effectively and set a solid foundation for their ventures.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Idaho Articles of Incorporation form is used to legally establish a corporation in the state of Idaho. |

| Governing Law | This form is governed by the Idaho Business Corporation Act, specifically Idaho Code Title 30, Chapter 29. |

| Filing Requirement | To complete the incorporation process, the form must be filed with the Idaho Secretary of State. |

| Information Needed | Key details required include the corporation's name, registered agent, and purpose of incorporation. |

| Filing Fee | A filing fee is required upon submission of the Articles of Incorporation, which varies based on the type of corporation. |

Key takeaways

When filling out and using the Idaho Articles of Incorporation form, there are several important points to keep in mind. These guidelines will help ensure a smooth process for establishing your corporation.

- Provide Accurate Information: Ensure all information, such as the corporation's name and address, is correct. Any errors can lead to delays or complications.

- Include Required Details: The form requires specific details, including the purpose of the corporation and the names of the initial directors. Omitting these can result in rejection.

- Understand Filing Fees: Be aware of the fees associated with filing the Articles of Incorporation. Payment must be submitted along with the form.

- File with the Correct Office: Submit the completed form to the Idaho Secretary of State. Filing it with the wrong office can cause significant delays.

- Keep Copies: After filing, retain copies of the submitted Articles of Incorporation for your records. This documentation is essential for future reference.