Fill Out a Valid Goodwill donation receipt Template

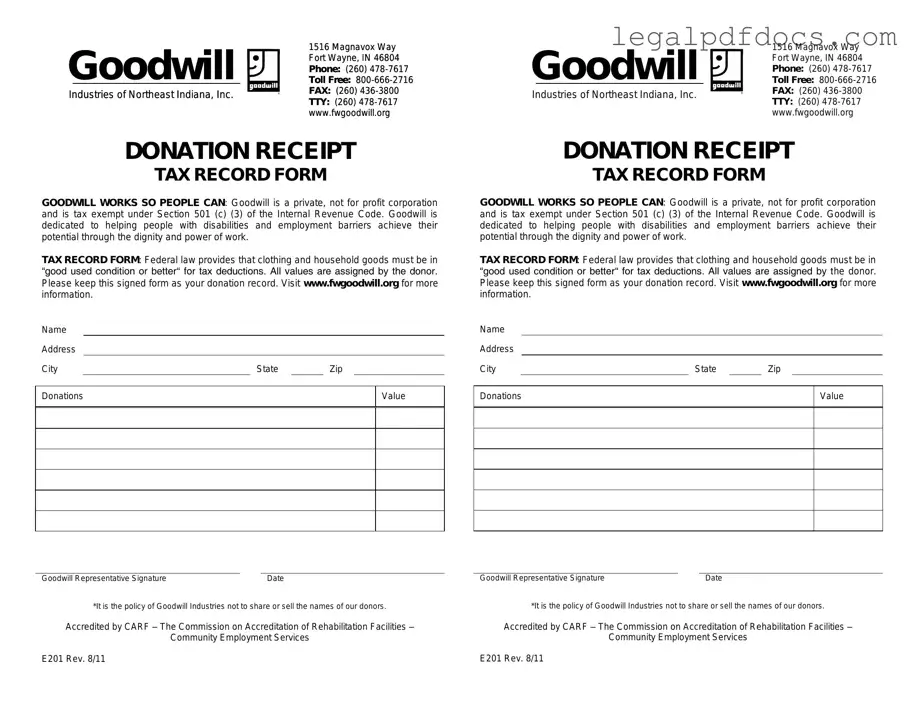

When you donate items to Goodwill, you not only help those in need but also create an opportunity for potential tax deductions. A Goodwill donation receipt form plays a crucial role in this process. This form serves as proof of your charitable contribution and includes important details such as the date of the donation, a description of the items donated, and their estimated value. While you don’t need to list every single item, providing a general overview can be helpful. The receipt also typically includes the name and address of the Goodwill location where you made your donation. Keeping this form is essential, especially during tax season, as it can substantiate your claims for deductions. Understanding how to properly fill out and utilize this receipt can make the donation process smoother and more beneficial for you.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it's important to ensure accuracy and completeness. Here are some guidelines to help you navigate the process effectively:

- Do provide your name and contact information clearly.

- Do list each item you are donating, along with a brief description.

- Do estimate the fair market value of each item.

- Do keep a copy of the receipt for your records.

- Do sign and date the form to validate your donation.

- Don't leave any sections of the form blank.

- Don't overestimate the value of items; be honest in your assessment.

- Don't forget to check the donation guidelines specific to your local Goodwill.

- Don't use vague descriptions; be specific about each item's condition.

- Don't disregard the importance of keeping your donation records organized.

How to Use Goodwill donation receipt

Once you have gathered your items for donation, you will need to fill out the Goodwill donation receipt form. This form helps you keep track of your donations for tax purposes. Follow these steps to ensure that you complete the form accurately.

- Begin by writing the date of your donation at the top of the form.

- Next, list the items you are donating. Be specific about each item, including its condition (new, used, etc.).

- Indicate the estimated value of each item. This can be a rough estimate based on what you believe each item is worth.

- If you have donated a large number of items, you may summarize them in a general statement, such as "various clothing items" and provide an overall estimated value.

- Sign the form to confirm that the information you provided is accurate.

- Keep a copy of the completed form for your records. This will be useful when you file your taxes.

After completing the form, you can submit it to Goodwill along with your donations. Make sure to keep your copy safe, as it serves as proof of your charitable contribution.

More PDF Templates

What Is Immunization Records - Health departments may refer to this record during community health evaluations.

Coloumn Graph - Strategic Planning: Useful in outlining long-term goals and objectives.

Odometer Disclosure Statement Ca - The buyer's contact information is required on the form for records.

Documents used along the form

The Goodwill donation receipt form serves as a crucial document for individuals who wish to claim tax deductions for their charitable contributions. Alongside this form, several other documents are commonly utilized to ensure proper record-keeping and compliance with tax regulations. Below are four such forms and documents that often accompany the Goodwill donation receipt.

- IRS Form 8283: This form is used for reporting non-cash charitable contributions valued over $500. It provides details about the donated items and their fair market value, ensuring that donors comply with IRS requirements.

- Donation Inventory List: This document outlines all items donated, including descriptions and estimated values. It helps donors keep track of their contributions and can be referenced when completing tax forms.

- Appraisal Report: For valuable items such as artwork or collectibles, an appraisal report may be necessary. This document provides a professional valuation of the donated items, supporting the claimed value on tax returns.

- Charity Letter of Acknowledgment: This letter, provided by the charity, confirms the donation and may include details about the items donated. It serves as additional proof for tax purposes and can enhance the donor's records.

Utilizing these documents alongside the Goodwill donation receipt form can help ensure a thorough and organized approach to charitable giving and tax deductions. Proper documentation is essential for maximizing potential benefits and maintaining compliance with tax laws.

Misconceptions

Many people have misunderstandings about the Goodwill donation receipt form. Here are eight common misconceptions and clarifications to help clear things up.

- Misconception 1: The receipt is only for tax purposes.

- Misconception 2: You can only receive a receipt for large donations.

- Misconception 3: The receipt must be filled out by Goodwill staff.

- Misconception 4: You must provide a detailed list of items to receive a receipt.

- Misconception 5: The value of donated items must be appraised.

- Misconception 6: You cannot donate items without a receipt.

- Misconception 7: The receipt guarantees a specific tax deduction amount.

- Misconception 8: You can only donate items to Goodwill during business hours.

While the receipt can be used for tax deductions, it also serves as proof of your charitable contribution. Goodwill uses it to track donations and provide acknowledgment to donors.

Goodwill issues receipts for all donations, regardless of size. Every contribution counts and deserves acknowledgment.

Donors can fill out the receipt themselves. Goodwill provides a blank form for you to list your items and their estimated values.

A general description of the items is sufficient. You don’t need to list every single item in detail, but a summary is helpful.

Donors are responsible for estimating the value of their items. Goodwill does not appraise items, but they do provide guidelines on how to determine fair market value.

You can donate items without a receipt, but having one is beneficial for record-keeping and tax purposes.

The receipt does not guarantee a specific deduction. The IRS requires that donors determine the fair market value of their items, which may vary.

Goodwill has drop-off locations that may be accessible outside of regular business hours. Check with your local Goodwill for specific drop-off options.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | A Goodwill donation receipt serves as proof of your charitable contribution for tax purposes. |

| Tax Deduction | You may be eligible for a tax deduction for the value of your donated items. |

| Itemization | The receipt should list the items donated, including their condition and estimated value. |

| Non-Cash Donations | Goodwill receipts are typically used for non-cash donations, such as clothing or furniture. |

| State-Specific Forms | Some states may have specific requirements for donation receipts; check local laws. |

| IRS Guidelines | The IRS requires that donations over a certain value be documented with a receipt. |

| Record Keeping | Keep your receipt for at least three years in case of an audit. |

| Contact Information | The receipt should include Goodwill's name, address, and contact details for verification. |

Key takeaways

When utilizing the Goodwill donation receipt form, there are several important points to consider. These takeaways can help ensure a smooth donation process and proper record-keeping for tax purposes.

- Always complete the receipt form at the time of donation. This helps maintain accurate records.

- List all items donated. Providing a detailed description can aid in valuation and tax deductions.

- Assign a fair market value to each item. This is essential for tax purposes and should reflect what you would expect to receive if you sold the item.

- Keep a copy of the receipt for your records. This is important for tax documentation and future reference.

- Understand that Goodwill does not assign values to donations. The donor is responsible for determining the value of their items.

- Be aware of the tax deduction limits. Familiarize yourself with IRS guidelines to ensure compliance when claiming deductions.

Following these guidelines can enhance the donation experience and ensure compliance with tax regulations.