Fill Out a Valid Gift Letter Template

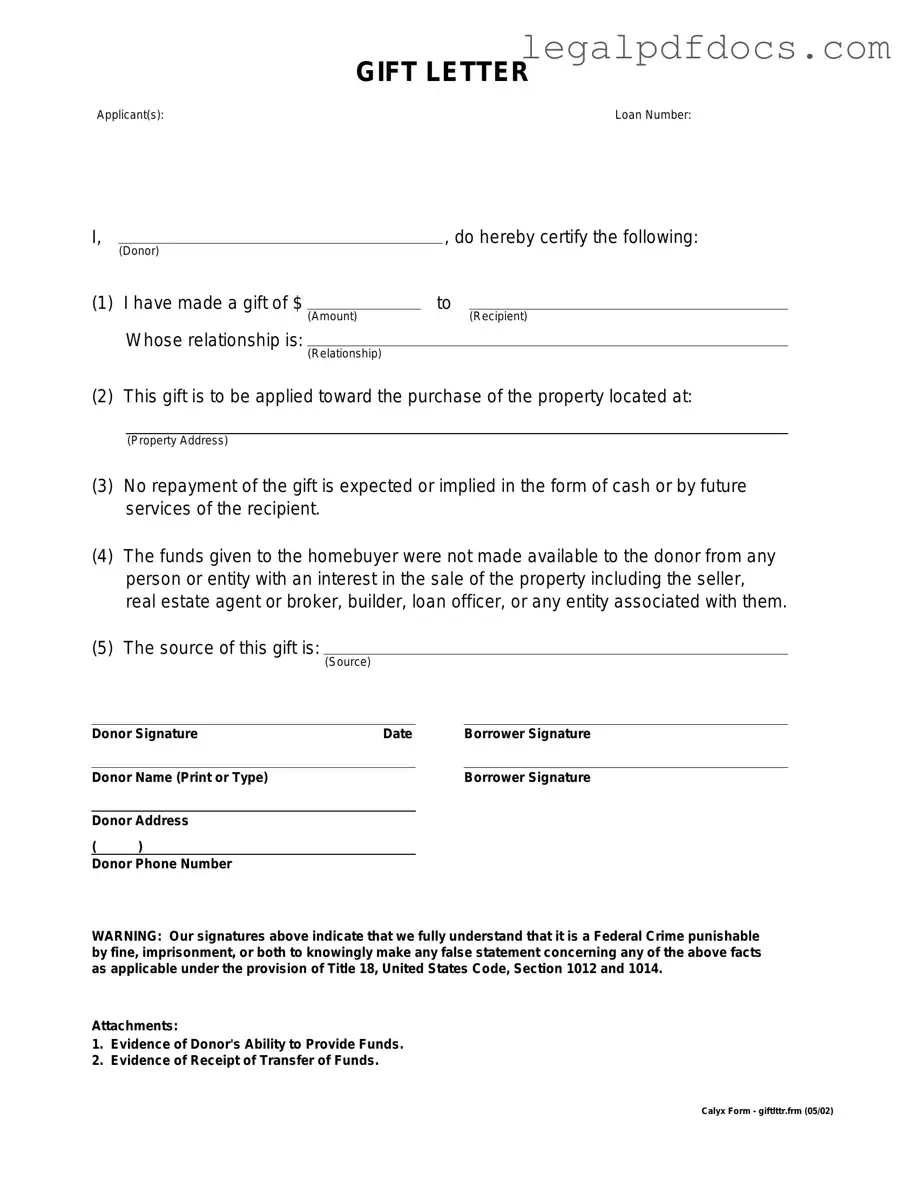

When navigating the world of real estate transactions, understanding the nuances of financial support can be crucial. One important document that often comes into play is the Gift Letter form. This form serves as a formal acknowledgment that funds received by a homebuyer are indeed a gift, rather than a loan that must be repaid. By clearly stating the donor's intention, the Gift Letter helps to establish the legitimacy of the financial assistance, which can be vital for securing a mortgage. Typically, it includes essential details such as the names of both the donor and the recipient, the amount of the gift, and a declaration that the funds are a gift with no expectation of repayment. Moreover, lenders may require this document to ensure compliance with their underwriting guidelines, as it provides clarity on the source of the down payment. Understanding how to properly complete and submit this form can significantly impact the homebuying process, making it a key component for many individuals looking to purchase a home.

Dos and Don'ts

When filling out a Gift Letter form, it's important to approach the task with care. This document is often required in financial transactions, particularly in real estate. Here are some essential do's and don'ts to keep in mind:

- Do clearly state the relationship between the giver and the recipient. This helps establish the legitimacy of the gift.

- Do specify the amount of the gift. Transparency is crucial in avoiding misunderstandings.

- Do sign and date the form. A signature validates the information provided.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Don't leave any sections blank. Incomplete forms can lead to delays or rejection.

- Don't use vague language. Be precise in your wording to ensure clarity.

By following these guidelines, you can ensure that your Gift Letter form is completed correctly and effectively. Taking the time to fill it out properly will help facilitate the process and provide peace of mind for all parties involved.

How to Use Gift Letter

Filling out a Gift Letter form is a straightforward process that helps clarify the nature of the financial gift being provided. Once you've completed the form, it will serve as a formal declaration of the gift, which can be important for both the giver and the recipient, especially in financial transactions like home purchases.

- Begin by entering the date at the top of the form. This marks when the gift was given.

- Fill in the name of the donor, the person giving the gift. Make sure to include their full name as it appears on official documents.

- Provide the donor's address. This should be their current residential address.

- Next, enter the recipient's name, the individual receiving the gift. Again, use their full name for clarity.

- Include the recipient's address. This should be the address where they currently reside.

- Indicate the amount of the gift. Be clear and precise with the dollar amount.

- In the designated section, specify the relationship between the donor and the recipient. This could be parent, sibling, friend, etc.

- Sign the form where indicated. The donor must sign to validate the gift.

- Finally, provide the date of the signature. This is typically the same as the date at the top of the form.

More PDF Templates

How Many Cells in 96 Well Plate - Plates are often designed for easy stacking during workflows.

Dd Form 2870 - This form helps individuals formally request an exemption from certain fees or requirements.

Free Printable Puppy Shot Record - Important for pet insurance claims related to health issues.

Documents used along the form

When applying for a mortgage or financial assistance, a Gift Letter is often required to verify that funds received from family or friends are indeed a gift and not a loan. Alongside the Gift Letter, several other forms and documents may be necessary to ensure a smooth transaction. Below is a list of commonly used documents that complement the Gift Letter.

- Bank Statements: These documents provide proof of the donor's ability to give the gift. They show the source of the funds and confirm that the money is available for the recipient.

- Proof of Relationship: This may include documents such as birth certificates or marriage licenses to establish the relationship between the donor and the recipient. This helps verify that the gift is genuine and not a disguised loan.

- Gift Tax Return (Form 709): If the gift exceeds a certain amount, the donor may need to file this form with the IRS. It helps ensure that any tax implications are addressed and recorded appropriately.

- Loan Application: This is the primary document submitted to the lender. It outlines the borrower’s financial status and is crucial for assessing eligibility for a mortgage or loan.

- Income Verification Documents: These may include pay stubs, W-2 forms, or tax returns. Lenders use these documents to confirm the borrower’s income and ability to repay the loan.

- Purchase Agreement: This document outlines the terms of the property sale and is essential for the lender to understand the transaction details. It ensures that all parties are on the same page regarding the purchase.

In summary, while the Gift Letter is a key component in the mortgage application process, it is often accompanied by other important documents. Each of these forms plays a vital role in verifying financial transactions and ensuring compliance with lending requirements. Collecting and preparing these documents in advance can facilitate a smoother process for all parties involved.

Misconceptions

When it comes to the Gift Letter form, there are several misconceptions that can lead to confusion. Here are four common misunderstandings:

-

Gift Letters are only for first-time homebuyers.

This is not true. While first-time homebuyers often use gift letters to help with down payments, anyone can use them when receiving a financial gift for a home purchase.

-

Gift Letters need to be notarized.

In most cases, notarization is not required. A simple signed letter from the giver stating the gift's intent is usually sufficient for lenders.

-

All gifts require a Gift Letter.

This is a misconception. Not all gifts need a formal letter. However, if the gift is significant enough to impact a mortgage application, a letter may be necessary.

-

Gift Letters are only for cash gifts.

This is misleading. Gift letters can apply to various forms of gifts, including property or assets, as long as the intent is clear.

File Specs

| Fact Name | Description |

|---|---|

| Purpose of the Gift Letter | A gift letter is used to document a monetary gift, typically for a home purchase, ensuring that the funds are not a loan. |

| Required Information | The letter should include the donor's name, the recipient's name, the amount of the gift, and a statement that the funds are a gift. |

| State-Specific Requirements | Some states may have specific requirements regarding gift letters. For example, California requires the donor's signature and may require additional documentation. |

| Tax Implications | Gift amounts over a certain threshold may have tax implications for the donor. It's important to consult IRS guidelines or a tax professional. |

Key takeaways

- Purpose of the Gift Letter: This document serves to confirm that a monetary gift is being provided without any expectation of repayment.

- Donor Information: Include the full name, address, and contact information of the person giving the gift.

- Recipient Information: Clearly state the full name and address of the individual receiving the gift.

- Gift Amount: Specify the exact dollar amount being gifted. This should be clear and precise.

- Relationship: Indicate the relationship between the donor and the recipient. This helps lenders understand the context of the gift.

- Signature Requirement: Both the donor and recipient must sign the letter to validate the agreement.

- Submission: Provide the completed gift letter to the lender as part of the mortgage application process.

- Documentation: Keep a copy of the gift letter for personal records. It may be needed for future reference.