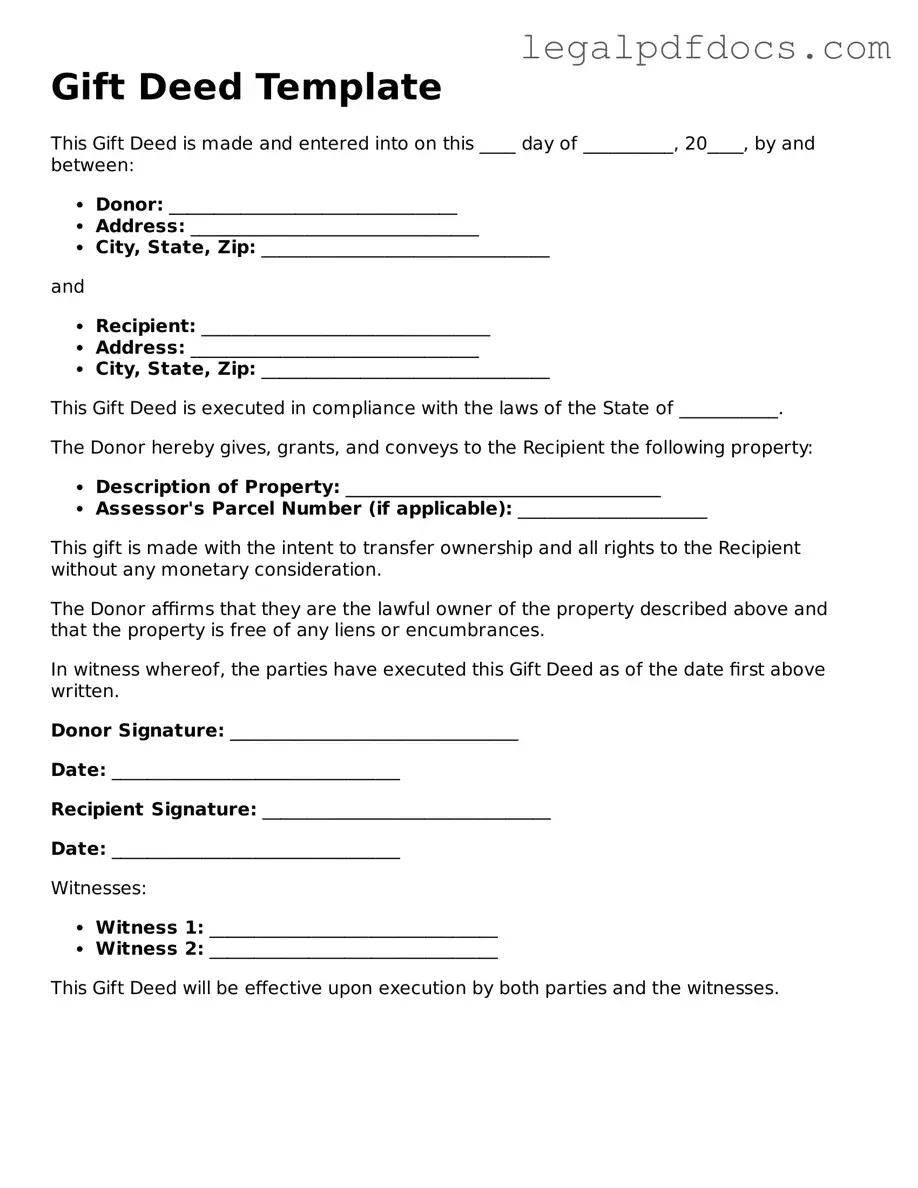

Gift Deed Template

The Gift Deed form serves as a crucial legal instrument in the transfer of property or assets without any exchange of monetary compensation. This form is often utilized when an individual wishes to donate property to another person, typically a family member or a friend, as a gesture of goodwill. Key components of the Gift Deed include the identification of the donor and the recipient, a detailed description of the property being gifted, and the explicit intention to make the gift without any conditions. Additionally, the form may require the signatures of witnesses to validate the transaction. Understanding the nuances of this form is essential, as it outlines the rights and responsibilities of both parties involved. Proper execution of a Gift Deed can help prevent future disputes and ensure that the transfer is legally recognized. As such, it is important for individuals to be aware of the implications and requirements associated with this type of deed.

State-specific Guidelines for Gift Deed Documents

Dos and Don'ts

When filling out a Gift Deed form, it's important to approach the process carefully. Here are some guidelines to help you navigate this task effectively.

- Do: Clearly identify the donor and the recipient. Make sure their full names and addresses are accurately listed.

- Do: Specify the property being gifted. Include detailed descriptions to avoid any confusion later.

- Do: Sign the document in the presence of a notary public. This adds credibility and ensures the deed is legally binding.

- Do: Keep copies of the signed Gift Deed for your records. This can be useful for future reference or legal purposes.

- Don't: Rush through the form. Take your time to ensure all information is correct and complete.

- Don't: Leave out important details. Omitting information can lead to complications or disputes down the line.

Following these guidelines can help ensure that the Gift Deed is filled out properly and meets legal requirements.

How to Use Gift Deed

After obtaining the Gift Deed form, it is essential to complete it accurately to ensure the transfer of property is valid. Follow these steps carefully to fill out the form correctly.

- Read the form thoroughly. Understand each section before filling it out.

- Provide the date. Write the date on which the gift is being made at the top of the form.

- Fill in the donor's information. Include the full name, address, and any other required details of the person giving the gift.

- Enter the recipient's information. Include the full name, address, and any other required details of the person receiving the gift.

- Describe the property. Clearly describe the property being gifted, including any relevant details such as address, type of property, and legal description if applicable.

- State the intention. Write a statement indicating that the donor intends to give the property as a gift without any consideration.

- Sign the form. The donor must sign the form to validate the gift. If required, a witness may also need to sign.

- Notarize the document. If necessary, take the form to a notary public to have it notarized, which adds an extra layer of authenticity.

- Make copies. Keep copies of the completed and signed form for both the donor and the recipient for their records.

Check out Popular Types of Gift Deed Templates

California Corrective Deed - This form helps clarify property descriptions that may have inaccuracies.

Problems With Transfer on Death Deeds California - With a Transfer-on-Death Deed, property ownership is automatically transferred to the beneficiary upon death, bypassing lengthy legal procedures.

Documents used along the form

When executing a Gift Deed, several other forms and documents may be necessary to ensure the transfer of property is legally sound and properly recorded. Understanding these documents can help streamline the gifting process and protect the interests of both the giver and the recipient.

- Title Deed: This document proves ownership of the property being gifted. It details the legal description of the property and is essential for the transfer process.

- Affidavit of Gift: A sworn statement that confirms the intent of the giver to gift the property without any expectation of compensation. This document helps clarify the nature of the transaction.

- Property Tax Records: These records provide information about the property’s assessed value and any outstanding taxes. They are important for ensuring that the property is free of liens.

- Identification Documents: Both the giver and the recipient should provide valid identification, such as a driver’s license or passport, to verify their identities during the transfer.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit, the giver may need to file this form with the IRS to report the gift for tax purposes.

- Beneficiary Designation Forms: If the gift involves financial accounts or insurance policies, these forms may need to be updated to reflect the new beneficiary.

- Power of Attorney (if applicable): If the giver cannot be present to sign the Gift Deed, a Power of Attorney may be necessary to authorize another person to act on their behalf.

- Real Estate Transfer Tax Affidavit: Some states require this affidavit to ensure that any applicable transfer taxes are paid during the gifting process.

- Disclosure Statement: This document outlines any known issues or defects with the property. It protects the recipient by ensuring they are fully informed about the property’s condition.

These documents work together with the Gift Deed to facilitate a smooth and legally binding transfer of property. Being aware of these additional forms can help both parties navigate the gifting process more effectively.

Misconceptions

Understanding the Gift Deed form can be challenging, and several misconceptions often arise. Here are five common misunderstandings about this important document:

-

Gift Deeds are only for real estate transfers.

This is not true. While Gift Deeds are frequently used to transfer property, they can also be utilized for various types of personal property, such as vehicles, jewelry, or other valuable items.

-

A Gift Deed does not require any formalities.

Some people believe that a Gift Deed can be created informally, but this is misleading. A valid Gift Deed typically requires written documentation, the signature of the donor, and sometimes witnesses, depending on state laws.

-

Gift Deeds are irrevocable and cannot be changed.

This misconception overlooks certain circumstances. While a Gift Deed is generally considered irrevocable, there are specific situations where the donor may retain some rights or conditions, allowing for changes under certain conditions.

-

Gift Deeds are only necessary for large gifts.

Many people think that Gift Deeds are only needed for substantial gifts, but this is not the case. Even smaller gifts can benefit from a Gift Deed to clarify ownership and intent, especially when it comes to potential disputes.

-

There are no tax implications with a Gift Deed.

This is a common misunderstanding. Depending on the value of the gift, there may be tax implications for both the donor and the recipient. It's important to consult with a tax professional to understand any potential tax liabilities.

By clearing up these misconceptions, individuals can better navigate the process of creating and executing a Gift Deed, ensuring that their intentions are clearly communicated and legally recognized.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Intent | The donor must have a clear intention to give the property as a gift, which must be documented in the deed. |

| Consideration | Unlike a sale, a Gift Deed does not require any consideration or payment in return for the property. |

| State-Specific Forms | Each state may have its own specific form for a Gift Deed. For example, California requires compliance with California Civil Code § 11911. |

| Execution | The deed must be signed by the donor and, in some states, witnessed or notarized to be valid. |

| Tax Implications | Gift Deeds may have tax implications, including potential gift taxes. Donors should consult tax professionals for guidance. |

| Revocation | Once executed, a Gift Deed generally cannot be revoked unless specific conditions are met or if the deed includes a revocation clause. |

| Recordation | To protect the interests of the donee, it is advisable to record the Gift Deed with the local property records office. |

Key takeaways

When it comes to filling out and using a Gift Deed form, there are several important points to keep in mind. Here are some key takeaways to ensure a smooth process:

- Understand the Purpose: A Gift Deed is a legal document that transfers ownership of property or assets from one person to another without any exchange of money.

- Identify the Parties: Clearly state the names and addresses of both the giver (donor) and the receiver (donee) to avoid any confusion.

- Describe the Gift: Provide a detailed description of the property or asset being gifted. This includes its location, value, and any relevant identifiers.

- Consider Tax Implications: Be aware that gifting may have tax consequences. Consulting a tax professional can help clarify any potential liabilities.

- Signatures Matter: Ensure that both parties sign the Gift Deed. Witness signatures may also be required, depending on state laws.

- Record the Deed: After completing the form, consider recording it with the appropriate local government office. This can help protect the new owner’s rights.

- Keep Copies: Retain copies of the signed Gift Deed for your records. This can be useful for future reference or in case of disputes.

- Consult Legal Advice: If you have any questions or concerns, it’s wise to seek legal counsel to ensure everything is handled correctly.

By following these key points, you can navigate the process of completing and using a Gift Deed with confidence.