Official Transfer-on-Death Deed Form for Georgia

In the state of Georgia, individuals seeking to simplify the transfer of real estate upon their passing may find the Transfer-on-Death Deed (TODD) to be a valuable tool. This legal document allows property owners to designate beneficiaries who will automatically receive ownership of the property without the need for probate, streamlining the process and reducing potential complications for loved ones. The form must be completed with specific information, including the property description and the names of the beneficiaries, and it requires proper execution and recording with the county clerk’s office to be effective. Additionally, the TODD can be revoked or modified at any time during the owner’s lifetime, offering flexibility to adapt to changing circumstances. Understanding the nuances of this deed can empower property owners to make informed decisions about their estate planning, ensuring that their wishes are honored while minimizing the burden on their heirs.

Dos and Don'ts

When filling out the Georgia Transfer-on-Death Deed form, there are important steps to follow and common mistakes to avoid. Here’s a straightforward list to guide you.

- Do ensure you have the correct legal description of the property.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the form in front of a notary public.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the county clerk's office where the property is located.

- Don't forget to check for any state-specific requirements.

- Don't leave any sections blank; complete all required fields.

- Don't use vague terms when describing the property.

- Don't delay in filing the deed, as timing can be crucial.

Following these guidelines will help ensure that your Transfer-on-Death Deed is filled out correctly and is effective when needed.

How to Use Georgia Transfer-on-Death Deed

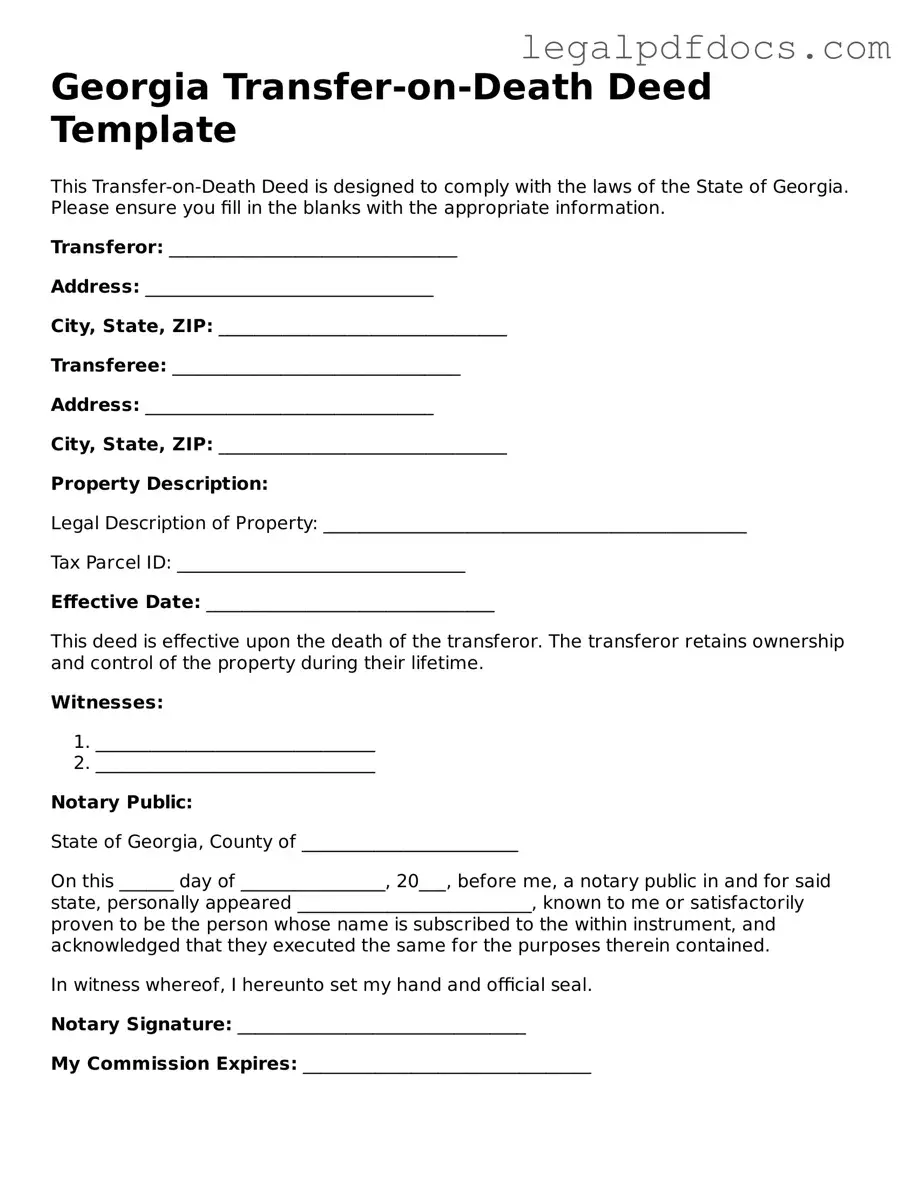

After obtaining the Georgia Transfer-on-Death Deed form, it’s important to fill it out accurately to ensure your intentions are clearly documented. Follow these steps to complete the form correctly.

- Start by entering your name and address in the designated section for the grantor.

- Provide the name and address of the beneficiary or beneficiaries who will receive the property upon your passing.

- Clearly describe the property being transferred. Include the address and any other identifying information necessary.

- Indicate whether the transfer is to multiple beneficiaries and specify how the property will be divided, if applicable.

- Sign the form in front of a notary public. Ensure that the notary also signs and seals the document.

- File the completed deed with the county clerk’s office in the county where the property is located. This step is crucial for the deed to be effective.

Once the form is filled out and filed, it will be recorded in public records. This ensures that your wishes regarding the property transfer are legally recognized after your passing.

Find Popular Transfer-on-Death Deed Forms for US States

Deed on Death - This form is an easy way to leave real estate to a loved one without the delays of probate.

Illinois Transfer on Death Instrument - Legal requirements for the deed vary by state, so consultation with a professional is advisable.

Transfer on Death Deed Idaho - The property must be specifically identified in the deed for the transfer to be valid.

Documents used along the form

The Georgia Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon their death. This deed is an important estate planning tool, but it is often used in conjunction with other forms and documents to ensure a comprehensive approach to property transfer and estate management. Below is a list of documents commonly associated with the Transfer-on-Death Deed in Georgia.

- Last Will and Testament: A legal document that outlines how a person's assets will be distributed after their death. It may include instructions for guardianship of minor children.

- Durable Power of Attorney: This document allows an individual to appoint someone to make financial or medical decisions on their behalf if they become incapacitated.

- Living Will: A type of advance directive that specifies a person's wishes regarding medical treatment and end-of-life care.

- Affidavit of Heirship: A sworn statement that establishes the heirs of a deceased person, often used when a will is not available.

- Quitclaim Deed: A legal instrument that allows a property owner to transfer their interest in a property to another party without guaranteeing that the title is clear.

- Deed of Gift: This document transfers property ownership as a gift, without any exchange of money or consideration.

- Estate Inventory: A detailed list of all assets owned by a deceased person, which is often required for probate proceedings.

- Probate Petition: A formal request filed with the court to initiate the probate process, which includes validating a will and administering the estate.

- Trust Agreement: A legal document that establishes a trust, outlining how assets will be managed and distributed during and after a person's lifetime.

Understanding these documents can help individuals and families navigate the complexities of estate planning and property transfer. Each document serves a specific purpose and can play a crucial role in ensuring that a person's wishes are honored and that their loved ones are taken care of after their passing.

Misconceptions

Understanding the Georgia Transfer-on-Death Deed (TOD) can be challenging. Here are nine common misconceptions about this important legal tool:

- It only applies to real estate. Many people believe the TOD deed can only be used for real property. In reality, it is specifically designed for transferring real estate upon death, not personal property or other assets.

- It eliminates the need for a will. Some think that by using a TOD deed, they no longer need a will. However, a TOD deed only addresses the transfer of specific property. A will is still essential for other assets and to express your overall wishes.

- It automatically transfers property without any action. There is a misconception that property will transfer automatically upon death. In fact, the beneficiary must still take steps to record the deed in the county where the property is located.

- It can be changed or revoked easily. While it is true that a TOD deed can be revoked or modified, it must be done in writing and properly executed. Many assume it’s as simple as verbal communication, which is not legally binding.

- All beneficiaries must agree to the transfer. Some believe that if there are multiple beneficiaries, they must all consent to the transfer. However, the designated beneficiary can receive the property without needing agreement from others.

- It affects the property during the owner's lifetime. A common myth is that the TOD deed impacts the owner’s ability to sell or manage the property while they are alive. In fact, the owner retains full control until death.

- It is only for married couples. Many think that only married couples can use a TOD deed. In reality, anyone can create one, regardless of their marital status.

- It is a complicated process. Some people view the TOD deed as a complex legal instrument. In truth, it is relatively straightforward and can be completed without extensive legal knowledge.

- It is not recognized in other states. There is a belief that a TOD deed created in Georgia has no validity outside the state. While laws vary, many states have similar provisions, and a Georgia TOD deed may still be recognized elsewhere.

Clearing up these misconceptions can help individuals make informed decisions about estate planning and ensure their wishes are honored after they pass away.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Georgia Code § 44-6-31. |

| Eligibility | Any individual who owns real estate in Georgia can create a Transfer-on-Death Deed. |

| Beneficiary Designation | The deed allows the owner to designate one or more beneficiaries to receive the property. |

| Revocation | The property owner can revoke the Transfer-on-Death Deed at any time before their death. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals or notarized. |

| Filing | The Transfer-on-Death Deed must be recorded with the county clerk's office where the property is located. |

| Tax Implications | Transferring property through a Transfer-on-Death Deed does not trigger gift taxes during the owner's lifetime. |

| Limitations | The deed cannot be used for transferring property that is subject to a mortgage or liens without addressing those obligations. |

| Effect on Creditors | Creditors may still claim against the estate for debts owed by the deceased, even if the property was transferred via the deed. |

Key takeaways

Filling out and using the Georgia Transfer-on-Death Deed form can be a straightforward process, but there are important considerations to keep in mind. Here are some key takeaways:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property upon their death, avoiding the probate process.

- It is essential to complete the form accurately, including the legal description of the property and the names of the beneficiaries, to ensure its validity.

- The deed must be signed and notarized to be legally effective. It should then be recorded with the county clerk's office where the property is located.

- Beneficiaries can be changed or revoked at any time before the property owner's death, providing flexibility in estate planning.

Understanding these points can help individuals make informed decisions about their estate planning in Georgia.